In the cryptocurrency space, you can trade Tesla stock (TSLA) without owning the actual stock itself. But how is this possible? The solution lies in synthetic assets designed to mimic TSLA stock, and you can make such trades via Synthetix! So, what exactly is Synthetix, and how does it function in the creation of synthetic assets? Dive into the following article to find out.

Article Summary

- 📊 Synthetix is a DeFi protocol that enables that allows users to create and trade synthetic assets, called Synths. Synths are digital tokens that track the price of real-world assets, such as currencies, commodities, and stocks. This allows users to gain exposure to different types of assets without having to own the underlying asset.

- 📈 In addition to Synths, Synthetix also supports crypto derivatives markets, such as futures and options. This allows users to trade a variety of derivative instruments

- 🤑 Synthetix operates through users staking SNX tokens to generate Synths. SNX is the native token of the Synthetix platform and functions as a utility and governance token. SNX stakers earn rewards in the form of fees generated from the use of Synths and other Synthetix products.

What is Synthetix (SNX)?

Synthetix is a DeFi protocol that issues synthetic assets. Its users can create synthetic crypto assets that mimic the original assets, such as currencies, commodities, and stocks. These synthetic assets are called Synths.

Synthetix is built on the Ethereum network. In January 2021, it also built its system on the Optimism mainnet to reduce the high gas fees in the SNX staking and Synths trading process.

This platform’s purpose is to expose crypto investors to assets not available on the blockchain.

Some of the assets available on Synthetix include cryptocurrencies, commodities (gold, silver, oil), fiat currencies, Indices (NIKKEI, CEX, FTSE), and stocks (TSLA). These synthetic assets (Synths) become sTokens, such as sBTC, sXAU, sUSD, sTSLA, etc.

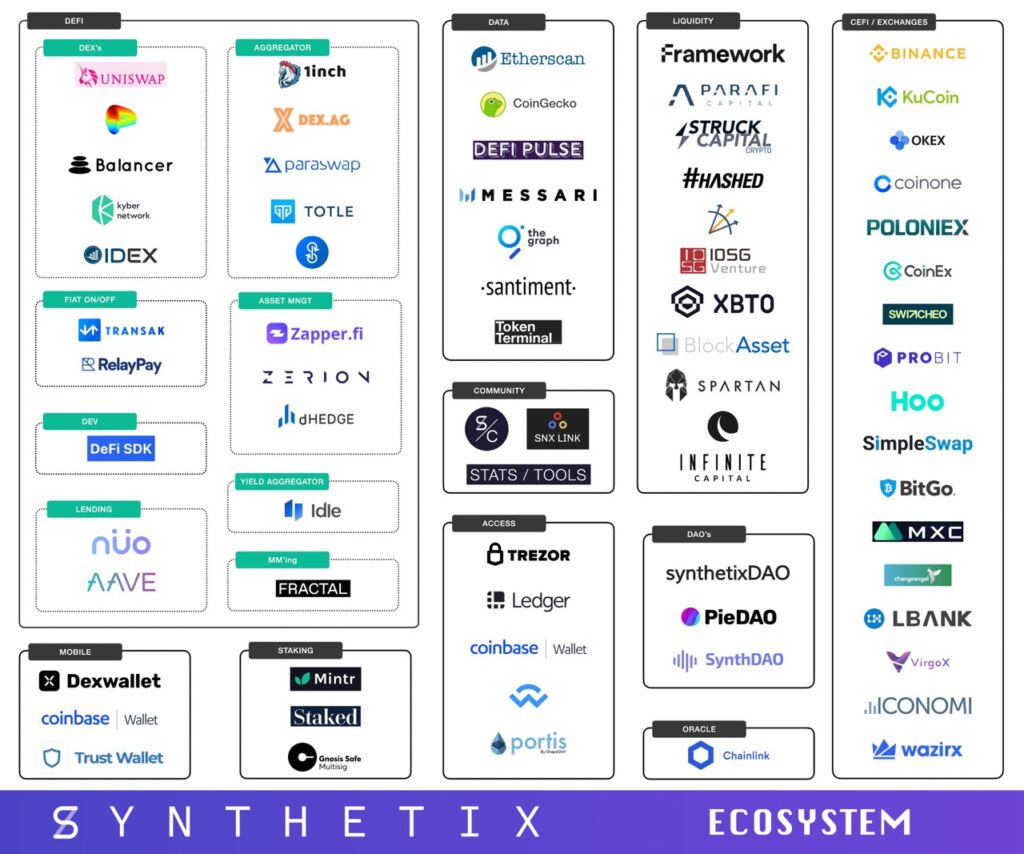

By owning synthetic assets or Synths, users can own equivalent assets without owning them. Users can use Synths, which are ERC-20 tokens for trading, investing, paying transactions, and other purposes within the Synthetix ecosystem, such as 1Inch, Curve, Uniswap, Aave, Lido, etc.

Owning synthetic assets such as sXAU (gold synthetic asset) means that users do not own real gold but only tokenized contracts that offer exposure to the gold price.

Synthetix in the Derivatives Market

Synthetix supports crypto derivatives markets such as futures and options trading. In addition, this platform also provides the back-end financial infrastructure and liquidity required to run them, although it does not provide a derivatives platform that users can access. It is why this platform is also called a “derivatives liquidity protocol.”

Some of the applications that integrate Synthetix include Kwenta (perpetual futures trading), Lyra (DeFi options trading), dHedge (investment management and automated strategies), and others.

Synthetix also supports 'Inverse Synths', which allows users to profit against price depreciation (short) on certain crypto assets, such as iBTC, iETH, and iBNB.

Who is the Team Behind Synthetix?

Kain Warwick, an entrepreneur and crypto enthusiast, founded Synthetix. Before establishing it, he built Blueshyft, a payment gateway for online services based in Australia. He is also an Advisory Council Member at Blockchain Australia and an Advisory Board Member & Investor at The Burger Collective.

In 2018, Kain Warwick launched Havven, a stablecoin project that secured 30 million US dollars in funding through an ICO in March 2018. Then, in December 2018, Havven changed its name to Synthetix.

The Synthetix team members are prominent individuals in their respective fields. Justin Moses, the CTO, has been involved in the Synthetix project since its inception. Previously, he was the Director of Engineering at MongoDB, a developer data platform.

Jordan Momtazi serves as VP of Partnership, and Clinton Ennis as Senior Architect. Before joining Synthetix, Jordan Momtazi had experience in business and development at PayPal, while Clinton Ennis was an Architect Lead at JPMorgan Chase, specializing in trading technology.

How Does Synthetix Work?

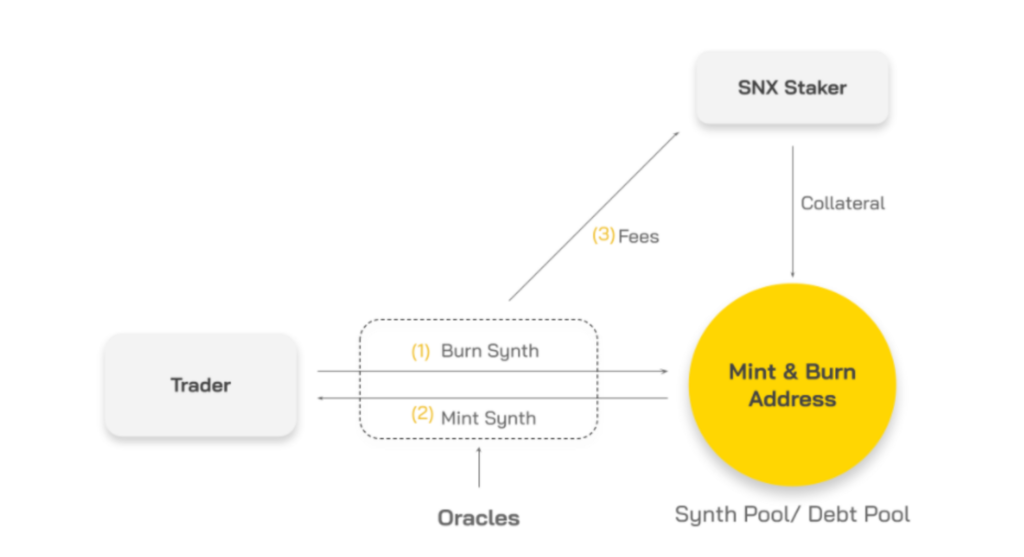

To track the prices represented by synthetic assets, this platform uses oracles provided by Chainlink. Oracles are smart contracts that track the prices of assets on real-world or other blockchains and send them to the Synthetix network.

Read more about Chainlink here.

The mechanism used by Synthetix is similar to that used by stablecoins to maintain a fixed value. However, the difference is that it allows anyone to create synthetic assets backed by SNX tokens instead of a single stablecoin.

Synthetix involves two types of tokens in its system:

- SNX: The utility token used in the creation of synthetic assets.

- Synths tokens (sToken): Synthetic asset tokens such as sBTC and sUSD that are created using the Synthetix platform.

To the user, the interface of the Synthetix system seems quite simple. However, it actually runs a complicated system. In general, Synthetix operates through users staking SNX tokens to generate Synths. Moreover, these Synths can be utilized to optimize potential gains within the Synthetix ecosystem. There are two ways to generate Synths on this platform:

- Users can purchase ETH on CEX or DEX. Then, swap it for sUSD on the Synthetix DEX such as Kwenta. sUSD then can be exchanged for other Synths, such as sBTC, sETH, and others.

In addition, users can also generate Synth through the following ways:

- Users can buy SNX on CEX or DEX. Then, stake SNX in Synthetix or Mintr (dApp in Synthetix). By staking SNX, users can get the Synths they want. These Synths can be traded on Kwenta and dApps in the Synthetix ecosystem.

On Synthetix, all Synths created by staking SNX tokens are backed by a 600% collateral ratio (ratio subject to change by community agreement). It means that if you want to borrow 100 sUSD, you must stake 600 US dollars worth of SNX.

SNX Staking

When you stake SNX and mint sUSD, you take on a debt that reflects the amount of sUSD that must be burned to unstake your SNX. As such, stakers act as the pooled counterparty or liquidity provider of SNX.

This system eliminates the need for a counterparty as the protocol converts Synths at oracle prices through smart contracts. So, you pay or receive the oracle price without any spreads and slippage.

As an SNX token staker, you are eligible for two types of rewards: staking rewards in SNX and Synths trading fees in sUSD. As of September 12, 2023, the amount of rewards plus trading fees that stakers will receive is 20.53%.

Also, read the article What is Staking? An Easy Way to Generate Passive Income.

What Benefits Does Synthetix Offer?

- Access to Real-World Assets: Synthetix allows users to gain exposure to various real-world assets such as gold, silver, fiat currencies, and stock indices without physically purchasing these assets.

- Collaboration with Chainlink: Synthetix partners with Chainlink to ensure accurate and reliable user pricing. It is important in determining the accurate pricing for Synths.

- Low gas fees: Synthetix operates on Ethereum’s Layer 2, Optimism, which reduces transaction gas fees by 50 times compared to the Ethereum mainnet network.

- Participation in DeFi: Synths can be used in various DeFi applications such as liquidity providing, lending, and others, which allows users to maximize their profit potential.

- Liquidity Without Slippage: Through Synthetix DEX, like Kwenta, users can trade without the risk of slippage, which is a common issue on some other platforms.

Conclusion

Synthetix is a DeFi protocol that provides exposure to various crypto and non-crypto assets in a decentralized and permissionless manner. It allows users to participate in the DeFi ecosystem without the need to own physical assets, bringing significant flexibility and freedom in managing their financial portfolio.

Buying SNX on the Pintu App

You can invest in SNX tokens and other crypto assets, such as BTC, ETH, SOL, etc., on Pintu without worrying about fraud. In addition, all crypto assets on Pintu have undergone a rigorous assessment process and prioritized the precautionary principle.

The Pintu app is compatible with various popular digital wallets, such as Metamask, to facilitate transactions. Download the Pintu app on the Play Store and App Store! Your safety is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

In addition to making transactions on the Pintu app, you can learn more about crypto through various Pintu Academy articles that are updated weekly! All Pintu Academy articles are created for educational and knowledge purposes, not as financial advice.

References

- Synthetix Team, Welcome to Synthetix, Docs, accessed 12 September 2023.

- Kain Warwick, What Is Synthetix and How Does It Work? Cryptopedia, accessed 12 September 2023.

- Rahul Nambiampurath, What Is Synthetix? The Defiant, accessed 12 September 2023.

- Steve Walters, Synthetix Review: Decentralised Synthetic Asset Protocol, Coinbureau, accessed 12 September 2023.

- Nguyen Thu Hieu dan Nguyen Minh Tuan, Introduction of Synthetix, TechFi, accessed 12 September 2023.