Imagine you can customize Automated Market Maker’s parameters to market conditions. It would certainly open up opportunities for traders to identify profit opportunities. This is precisely what Osmosis offers with its AMM. Furthermore, Osmosis also allows cross-chain transactions through Inter-Blockchain Communication (IBC) Protocols. What exactly is Osmosis? How does it work? Find out the answer in the following article.

Article Summary

- 🧪 Osmosis is an Automated Market Maker on the Cosmos network that enables cross-chain transactions. It has a unique AMM, as its parameters can be customized based on real-time market conditions.

- 🔧 Osmosis has a customizable AMM, allowing users to adjust the bonding curve value function to create a more efficient market.

- ⭐ Two key features of Osmosis are Liquidity Pool Customization for trading and Superfluid Staking for network security by staking OSMO tokens.

- OSMO tokens are used for transaction fees in the Osmosis ecosystem and as governance tokens.

What is Osmosis?

Most Automated Market Makers (AMMs) already have their liquidity pools, allowing users to join them. Then, the tokens in the liquidity pool are locked in smart contracts. With the AMM model, the features of the liquidity pool are more limited.

However, with the development of the DeFi industry, user needs are becoming more diverse. They need a customizable AMM. Customizable AMM means transaction fees can be changed. Its liquidity pool can be adjusted to market conditions in real-time. Osmosis comes up with a solution to these problems.

So, what is Osmosis? Osmosis is an AMM built on the Cosmos network that enables cross-chain transactions through Inter-Blockchain Communication (IBC). Osmosis has a unique AMM. It has various features and tools that allow users to search for opportunities and customize their parameters. As a result, users can customize swap fees, token weights, and curve algorithms and explore different strategies for providing liquidity.

Furthermore, Osmosis is designed for the Cosmos ecosystem, offering greater flexibility and composability. Osmosis enables the seamless exchange of assets between different Cosmos chains by incorporating the IBC protocol.

Deepen your knowledge about AMMs and how they work in the following article.

How Does Osmosis Work?

As a customizable AMM, Osmosis allows the creation and management of a non-custodial, self-balancing, interchain token index. Osmosis envisions their AMM to be used for more than just token swaps. Through the custom-curve AMMs, dynamic adjustments of spread factors, and multi-token liquidity pools, the AMM can offer decentralized formation of token fundraisers, interchain staking, options market, and more for the Cosmos ecosystem.

Osmosis calls their AMM an infrastructure service. This means the pool creator defines the bonding curve value function and reuses most of the key AMM infrastructure. In this way, users can create tailor-made and efficient AMM.

Customizing Osmosis AMM is an essential concept behind the decentralized AMM framework. In addition, Osmosis’ AMM mechanism also allows users to determine the most optimal equilibrium point between fees and liquidity. Instead of being predetermined by the protocol as in other AMMs.

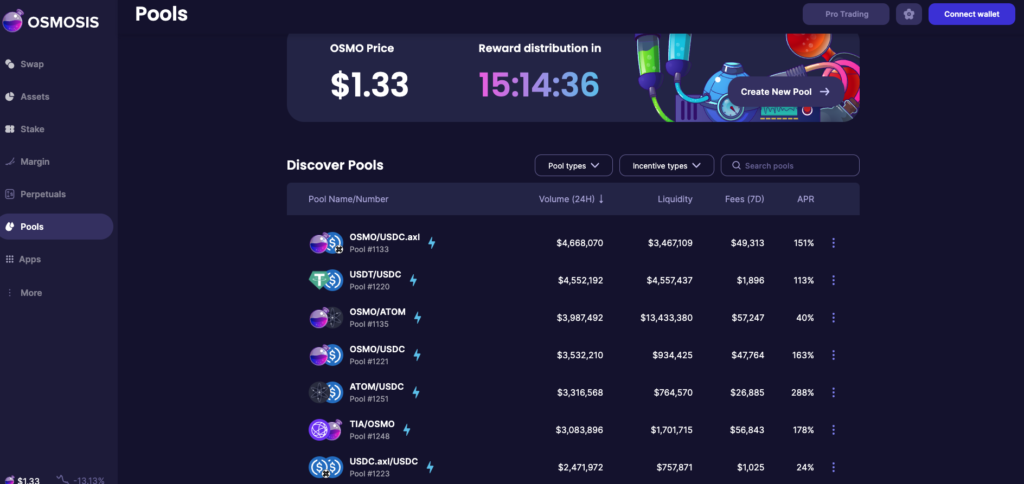

Osmosis separates the AMM curve logic and math from the core swapping functionality through the Cosmos SDK. This makes their AMM capable of incorporating any number of swap curves and liquidity pool types. Some liquidity pool types include traditional pools with a 50/50 ratio, customized ratios such as 80/20 for controlled exposure, Solidly-style Stableswap curves, concentrated liquidity pools, and CosmWasm pools.

Osmosis Features

The following are Osmosis’ key features:

Liquidity Pool Customization

Most major AMMs limit the changeable parameters of liquidity pools. For example, Uniswap only allows the creation of a two-token pool of equal ratio with a swap fee of 0.3%. The simplicity of Uniswap protocol allowed quick onboarding of the average user who previously had little to no experience in market making.

However, as the DeFi market size grows and market participants such as arbitrageurs and liquidity providers mature, the need for liquidity pools to react to market conditions becomes apparent. The optimal swap fee for an AMM trade may depend on various factors such as block times, slippage, transaction fee, market volatility, and more. As a result, there is no one-size-fits-all solution. Therefore, Osmosis provides liquidity pool customization.

The tools Osmosis provides allow the market participants to self-identify opportunities and allow them to react by adjusting the various parameters. An optimal equilibrium between fee and liquidity can be reached through autonomous experiments and iterations, rather than setting a centrally planned ‘most acceptable compromise’ value.

With these various levels of customization, Osmosis’ role is no longer a place to trade spot-priced assets. Now, it also supports options markets, interchain staking, and more.

Superfluid Staking

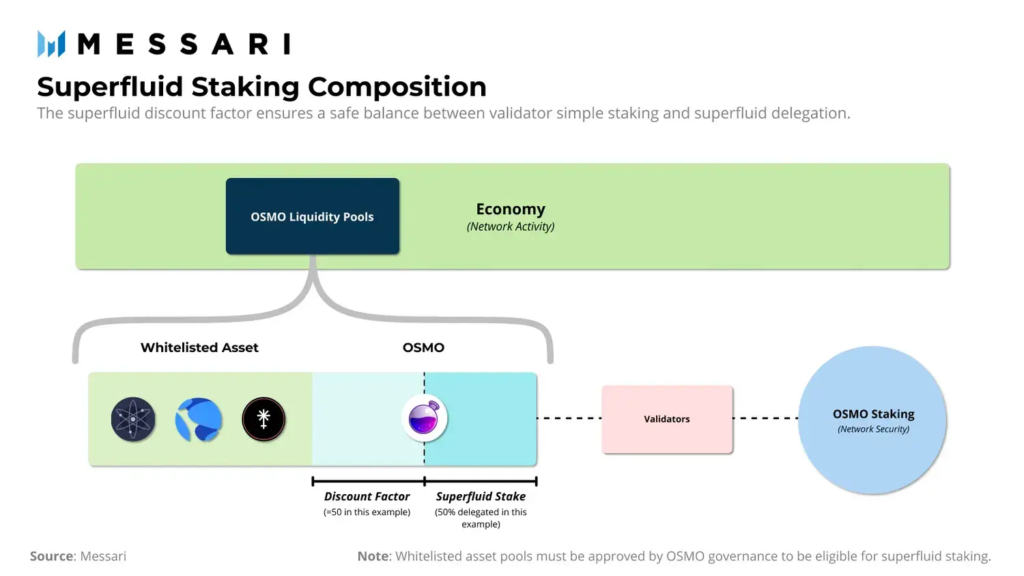

Compared to a rollup-centric ecosystem like Ethereum’s, the Cosmos ecosystem faces the challenge of bootstrapping its security. Osmosis introduces Superfluid Staking as a solution to provide additional security aspects to the consensus layer.

Using this method, liquidity providers will provide liquidity through OSMO tokens. At the same time, the OSMO token also provides a security aspect to the Osmosis network.

The superfluid staking model flips existing liquid staking solutions upside down. Superfluid staking stakes bonded liquidity from an asset to the network instead of providing liquidity to a bonded asset. As the assets are already bonded to a local liquidity pool, the network balance between economic liquidity and security will be simplified. In the process, OSMO tokens will be burned and minted to ensure the balance.

Through superfluid staking, liquidity providers double their rewards. First, through the yield generated from trading fees. The second is through staking rewards for ensuring network security.

However, only allowed liquidity pools are eligible for superfluid staking. Osmosis wants to limit the minting of risky assets by malicious actors who can drain staked liquidity pools for the underlying OSMO token.

Pintu Academy has provided an article that covers staking and how it works here.

Osmosis’s Advantages

- 🛠️ Customizable AMM. Osmosis allows the creation and management of a non-custodial, self-balancing, interchain token index. This allows Osmosis’ AMMs to be customized based on custom-curve AMMs, dynamic adjustments of spread factors, and multi-token liquidity pools.

- ⚡ Adaptive. Osmosis provides tools that allow users to find opportunities and react by adjusting various parameters. This will enable users to determine the optimal equilibrium between fees and liquidity through autonomous experimentation and iteration.

- 🌐 Interchain Transactions. As Cosmos’ main liquidity center and trading venue, Osmosis is the access point to the Cosmos ecosystem. IBC allows Osmosis to work with various blockchains, making it a multi-chain DEX.

- 🌟 Integrated Ecosystem. Apart from being a DEX, Osmosis also has various ecosystems connected to it. Some of these include margin trading through Mars and perpetual trading through Levana.

- 💲 Attractive Rewards. With the Superfluid Staking mechanism, Osmosis users can increase their return.

OSMO Token as Investment

OSMO is the native token on the Osmosis network. All transaction fees in the Osmosis ecosystem are paid in OSMO. It also plays an essential role in the governance of the Osmosis DAO. By owning OSMO, users can participate in voting and staking.

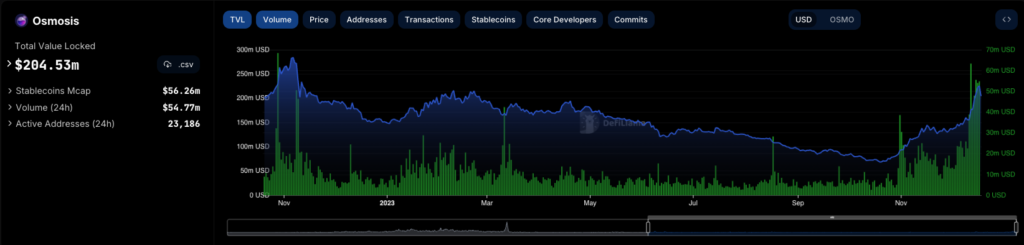

The maximum supply of OSMO is set at 1 billion with a distribution schedule of 9 years. Currently, 633.38 million OSMO tokens are circulating in the market. In the past year, the price of OSMO has managed to strengthen 84.41% and is at the level of US$ 1.42.

Based on Defi Llama data, Osmosis’ total value locked (TVL) as of December 18, 2023 stood at US$ 204.53 million. After experiencing a decline, the figure has improved and is on an upward trend.

One of the supporting factors is that Osmosis has expanded its network. They integrated Celestia’s data availability layer. As a DEX that acts as a liquidity hub, the integration will bridge the Cosmos ecosystem and Celestia’s rollups. As such, Osmosis is now a DEX and cross-rollup communication protocol.

Celestia’s modular blockchain narrative and the development of the Cosmos SDK could positively impact Osmosis’ future growth.

Pintu Academy has prepared an article that dives deep into modular blockchains and Celestia.

Conclusion

With its customized AMM concept, Osmosis can be an alternative for traders unsatisfied with conventional AMMs. Through Osmosis, traders can change the parameters of the liquidity pool to suit dynamic market conditions. Furthermore, Osmosis’ partnership with Celestia also qualifies it as a DEX protocol with cross-rollup communication. This opens up opportunities for Osmosis to continue to improve its technology and take advantage of the modular blockchain narrative..

How to Buy OSMO on Pintu

After knowing what Osmosis is, you can start investing in OSMO by buying it on Pintu app. Here is how to buy crypto on Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for OSMO.

- Click buy and fill in the amount you want.

- Now you have OSMO!

In addition to OSMO, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily on Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice

References

- Osmosis Docs, What is Osmosis? accessed on 18 December 2023.

- Osmosis Labs, Vision for Osmosis, Medium, accessed on 18 December 2023.

- Jerry Sun, Osmosis: Diffusing Liquidity Across the Cosmos Ecosystem, Messari, accessed on 18 December 2023.

- Messari Team Research, Osmosis is Bringing Cross-Rollup Liquidity to the Celestia Ecosystem, Messari, accessed on 18 December 2023.

- Consensys, Osmosis, A Fully Customizable, Cross-Chain AMM, accessed on 18 December 2023.