In the DeFi ecosystem, beyond swap and crypto lending services, there are also opportunities to participate as a Liquidity Provider (LP). As an LP, you can deposit two types of tokens into a single pool, which subsequently serves as liquidity to facilitate crypto trading on decentralized exchanges (DEX). Uniswap V3, for instance, has introduced concentrated liquidity pools, boasting higher interest rates than traditional pools. This article will explore how to become an LP in concentrated liquidity and the associated benefits and risks.

Article Summary

- 🧠 Concentrated liquidity is the liquidity that is allocated within a custom price range.

- 🤑 Concentrated Liquidity has the potential to give liquidity providers higher interest, flexibility, and control over liquidity provision and risk management.

- 🚨 When you become a Liquidity Provider (LP) in concentrated liquidity, you can earn bigger interest. But there’s a big risk called impermanent loss (IL). Unlike in traditional pools, where IL remains impermanent unless you withdraw the liquidity. In concentrated liquidity, the impermanent loss becomes permanent when the prices go out of your custom range.

What is Concentrated Liquidity in DeFi?

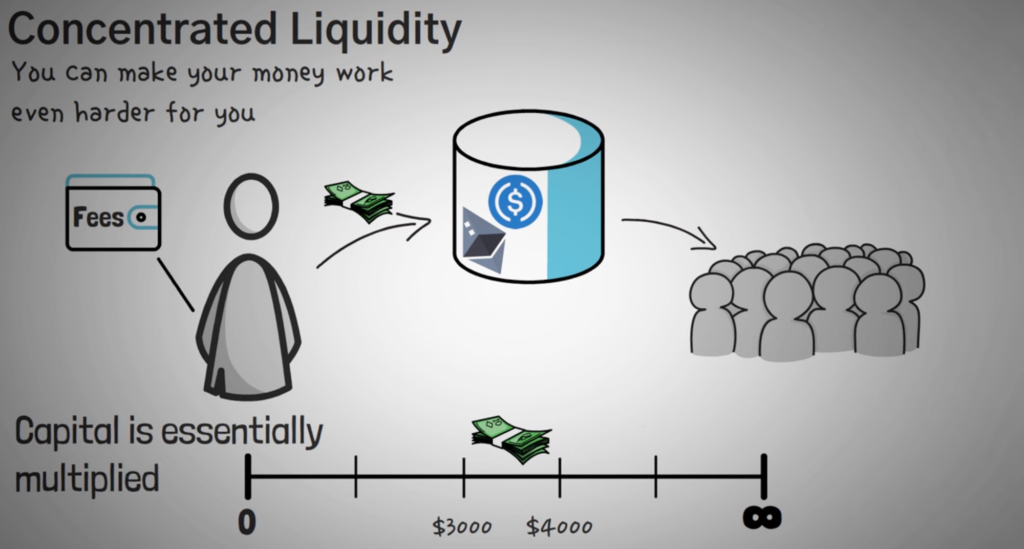

Concentrated liquidity is liquidity that is allocated within a custom price range. This feature was introduced by Uniswap V3 in 2021, which allows liquidity providers (LPs) to provide liquidity at custom price ranges rather than providing liquidity across the entire price range.

By concentrating on custom price ranges, you, as an LP, can allocate capital more efficiently and have more control over the positions you open. In addition, you can also reduce slippage in crypto trading.

As an illustration, let’s say you opt for the concentrated liquidity option in the WETH/USDC pool, where the price of ETH is $3,000. In this setup, you decide to invest capital only within the range of $2,800 to $3,200 (equivalent to $3,000 USDC + 1 ETH). You’ll receive a portion of the trading fee for every transaction conducted within this specified price range using the WETH/USDC pool.

Concentrated liquidity benefits both traders and LPs. Traders are offered deeper liquidity around the mid-price, and LPs get more share of the trading fee with their capital.

In traditional liquidity pools using the Automated Market Maker (AMM) model, liquidity is evenly distributed across the entire price range for each trading pair. However, in Concentrated Liquidity, Liquidity Providers (LPs) can focus on specific price ranges. While this offers more control and efficient use of capital, it also brings new challenges in managing risks and handling impermanent losses.

How does Concentrated Liquidity work?

Continuing from the example above, you provide liquidity to the WETH/USDC pool in the price range of $2,800-$3,200 in a 50:50 proportion. You provide $3,000 USDC and 1 ETH, totaling $6,000.

The liquidity you provide will solely be utilized within this specific price range, and you’ll only receive fees from trades occurring within this range. If the price moves outside this range, your liquidity position stays open but doesn’t actively participate, meaning you won’t earn any profits from trading fees.

What if the ETH price drops?

When the ETH price drops from $3,000 to below $2,800, this changes the token ratio from 50:50 to 100:0. USDC will be automatically sold into ETH, leaving you with less than 2 ETH and 0 USDC in your LP position (as the ratio changes along the way). If the ETH price continues to fall and you don’t adjust your position, you are fully exposed to the ETH price and experience a permanent loss.

What if the ETH price goes up?

The same applies when the price goes up but in the opposite direction. If the ETH price rises above $3,200, ETH will be sold into USDC, leaving you with approximately $6,100 USDC in an LP position (as the ratio changes along the way). If the price continues to rise to $3,500, you don’t get any additional benefit from the ETH price as you only own USDC.

In summary, if the price moves outside the specified range, you'll receive only one type of cryptocurrency. By engaging in concentrated liquidity like ETH/USDC, you essentially create a sell order for ETH as its price goes up and a buy order as it goes down, triggered when it reaches the designated point.

What are the benefits of yield farming in Concentrated Liquidity?

- Lower Slippage: By providing liquidity within a more specific price range, slippage is lower as liquidity concentrates within a narrower range.

- Higher Yield Potential: Narrower ranges mean more assets available for trading and less competition within those ranges. This could lead to increased fees and possibly higher profits.

- Flexible Risk Management: Liquidity providers can manage risk more efficiently by setting ranges that match risk tolerance and market outlook.

What are the drawbacks and risks of yield farming in Concentrated Liquidity?

- Impermanent Loss and Price Risk: Despite the potential for a high APR, there’s a significant risk of impermanent loss and vulnerability to price fluctuations when the price moves outside the set range. In a traditional liquidity pool, impermanent losses remain impermanent unless liquidity is withdrawn. However, in concentrated liquidity, temporary losses become permanent once the price is out of the range.

- Increased Complexity: The concentrated liquidity mechanism creates more entry barriers for new liquidity providers, as they need to understand the price range and the risks behind it.

- Active Management: Requires constant monitoring and adjustment of ranges to make liquidity provision efficient.

How to become a Liquidity Provider on Uniswap V3 (concentrated liquidity) on the Base network using Pintu Web3 Wallet

Some DEXs, such as Uniswap, Osmosis, and Aerodrome, offer concentrated liquidity pools with high annualized interest rates. For instance, Aerodrome’s WETH/USDC pool, the largest DEX in Base, offers an APR of 776%!

Uniswap has established a percentage rate that you earn for each transaction involving your liquidity pool. By supplying liquidity, you’ll receive a portion of the collected fees, distributed evenly among all liquidity providers in the pool. These rates vary from 0.01%, 0.05%, 0.3%, to 1%.

To see the amount of APR you get at Uniswap, you can use other tools such as BuildMetrics.

Here are the steps to become a Liquidity Provider on Uniswap V3 using the Pintu Web3 Wallet:

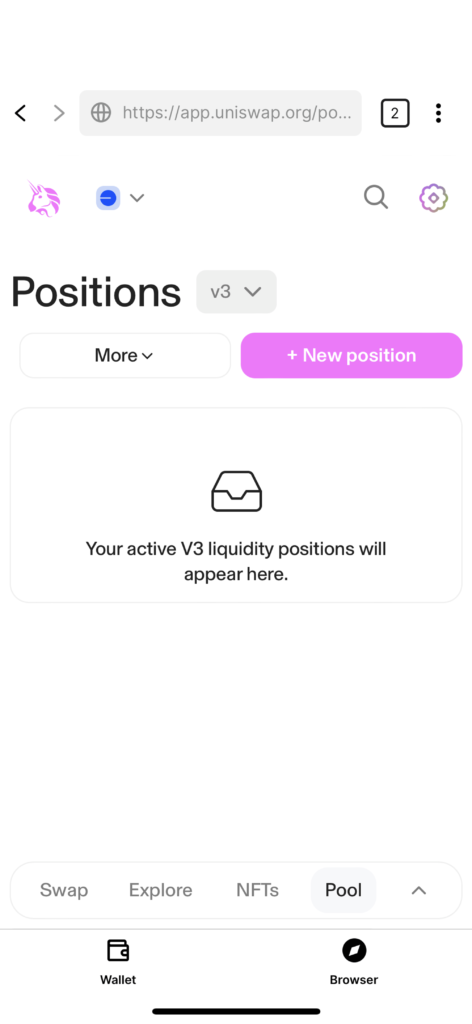

- Connect Pintu Web3 Wallet to Uniswap V3 via the in-app browser, then click ‘New Position’.

- Select the tokens you want to add to the liquidity pool.

- Consider the Total Value Locked (TVL), trading volume, and token price when selecting tokens. You can see the information in the Uniswap Base pool info.

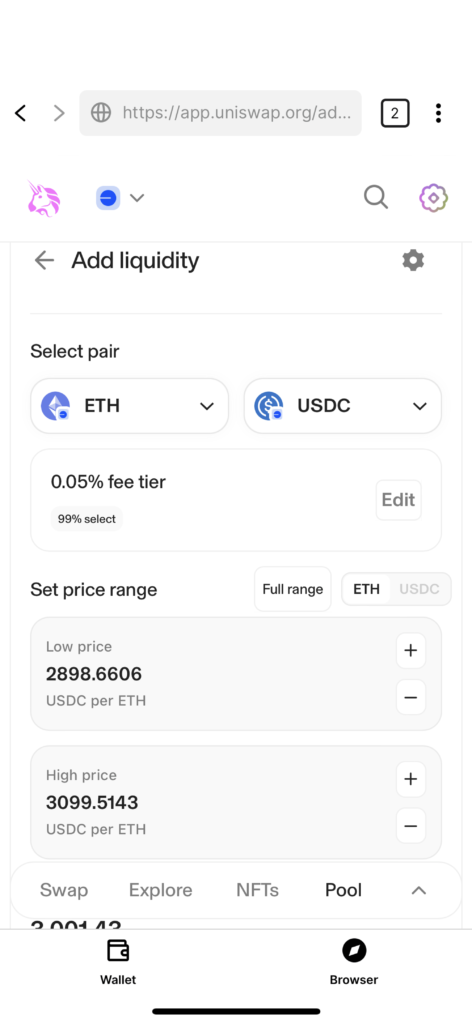

- Choose the amount of the fee tier. This number indicates the fee you get from each transaction that uses your liquidity pool. Uniswap suggests 0.05% for stable pairs.

- Set the price range to provide liquidity.

- You can enter a specific range, or provide liquidity for the full price range.

When you set a wider price range, you will receive a smaller portion of the trading fee revenue

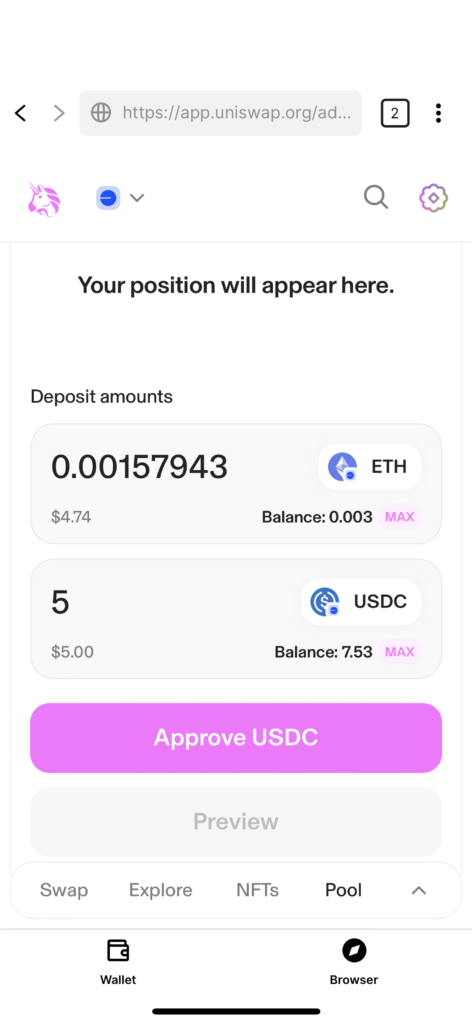

- Enter the amount of crypto available on your Pintu Web3 Wallet.

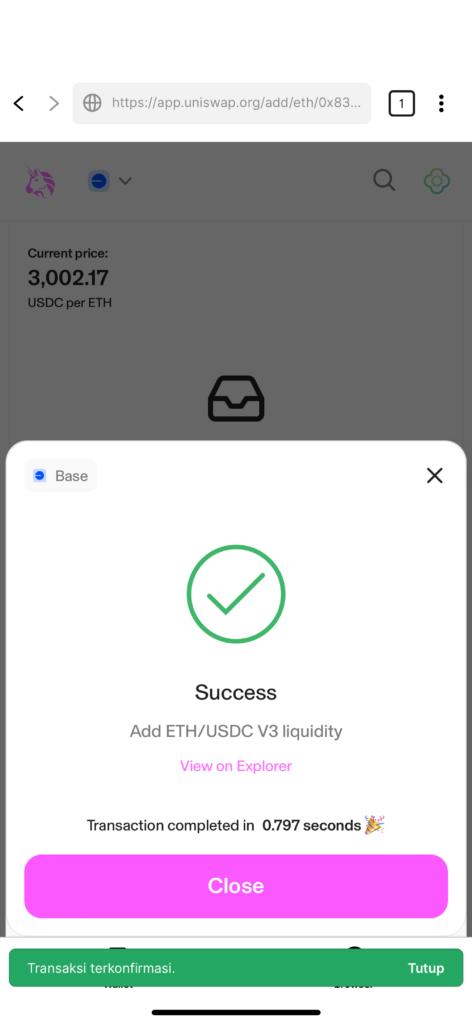

- Click ‘Approve’ and confirm the transactions.

After a successful transaction, your position will immediately appear on the Uniswap Pool main page. You can manage or adjust it by clicking on the open position.

Conclusion

Concentrated liquidity, introduced by Uniswap V3, is a DeFi concept where liquidity is focused within a specific price range. In contrast to traditional AMM models such as Uniswap V2, Concentrated Liquidity offers liquidity providers (LPs) greater interest, flexibility, and control over liquidity provision and risk management.

However, while LPs can earn high interest, they are also at risk of impermanent loss which can become permanent if the price goes out of the specified price range. Therefore, it is important for LPs to understand the risks involved and not just be tempted by the high APR without checking the actual yield.

How to transact on dApps using Pintu Web3 Wallet

To make various transactions on dApps, including swaps, buying and selling, and staking tokens, you simply need to connect your Pintu Web3 Wallet with dApps via WalletConnect.

To connect your wallet with the dApp, follow these steps:

- Visit the dApp website on your laptop or mobile browser, for example Pancakeswap.

- On the top right of the site, click ‘Connect Wallet’.

- Choose ‘WalletConnect,’ and a QR code will be displayed.

- Open the Web3 page on your Pintu account and scan the QR code using ‘WalletConnect’.

- As an alternative, you can use your smartphone to copy the dApp URL on the top right of the QR code and then paste it into the WalletConnect camera on the Pintu Web3 Wallet.

- Succes! Your Pintu Web3 Wallet is now connected to the dApp.

Once your wallet is connected to the dApp, you can transact on its available features.

References

- Bokr Finance, The Ultimate Guide To Concentrated Liquidity, Medium, accessed 7 May 2024.

- Algebra Finance, What is concentrated liquidity? Algebra Blog, accessed 7 May 2024.