While Bitcoin has long been considered the foremost “store of value” in the crypto world, it’s now becoming more than just that. Thanks to the emergence of Layer 2 solutions like Merlin Chain, BVM, and BoB, Bitcoin is now expanding its utility across diverse sectors, including DeFi, Gaming, AI, and SocialFi. This article delves deeper into the concept of Bitcoin Layer 2 and gives examples of how it enhances Bitcoin’s functionality.

Article Summary

- ✌️ Bitcoin Layer 2 is a solution to address the Bitcoin network’s limitations, such as slow block times, limited transaction capacity, and high transaction fees.

- ⛓️ Examples of Bitcoin Layer 2 solutions include Merlin Chain, BVM, and BoB. Each aims to improve the scalability, efficiency, and functionality of the Bitcoin network.

- ✨ Bitcoin Layer 2 ensures robust scalability, efficiency, low transaction fees, and fast transactions. It allows users to make transactions faster and at a lower cost.

What is Bitcoin Layer 2?

Bitcoin Layer 2 is a solution that addresses Bitcoin’s limitations and enables the development of various new applications previously incompatible with the Bitcoin network.

Traditionally, Bitcoin has been seen as a digital store of value, similar to gold, and its role in the global financial ecosystem has been largely limited to this function. The use of Bitcoin has also been limited to centralized financial institutions (CeFi) or through controlled bridging solutions such as wBTC.

Besides its limited use cases, the Bitcoin network also has limitations. Some of the limitations of the Bitcoin network include the following:

- Slow block time: Each block in Bitcoin takes about 10 minutes to mine, making transaction confirmation relatively slow compared to other blockchain networks.

- Limited transaction capacity: Bitcoin can process about 7 transactions per second (TPS), which is much less compared to networks like Solana that can handle thousands of transactions per second.

- High transaction fees: During times of high network usage, transaction fees on the Bitcoin network can increase substantially. Consequently, this can make Bitcoin less feasible for small-value daily transactions.

On the other hand, Ethereum and other blockchains supporting smart contracts are the foundation for building on-chain applications. They also provide essential services such as Data Availability, Consensus, and Settlement.

In 2023, the perception of Bitcoin solely as a “store of value” began shifting with the rising popularity of Ordinals, Inscriptions, and BRC-20 tokens. Bitcoin has demonstrated the potential to be more than just a digital store of value, highlighting the significance of Layer 2 solutions. Examples of Bitcoin Layer 2 solutions include Merlin Chain, BVM, and BoB.

Merlin Chain

Merlin Chain is a Layer 2 blockchain for Bitcoin that aims to improve the scalability, efficiency, and functionality of the Bitcoin network. It uses ZK-Rollup technology, decentralized oracle network, Data Availability mechanism, and on-chain BTC fraud-proof module. Thus, Merlin Chain enables faster transactions, lower fees, and greater innovation in the Bitcoin ecosystem.

However, unlike Ethereum’s ZK-Rollups, where proofs are verified on-chain, Merlin transaction proofs are verified off-chain by a network of decentralized oracle nodes before being aggregated and submitted to the Bitcoin blockchain via Taproot. This off-chain data and proof handling ensures scalability and security without stressing the Bitcoin mainnet with excessive data.

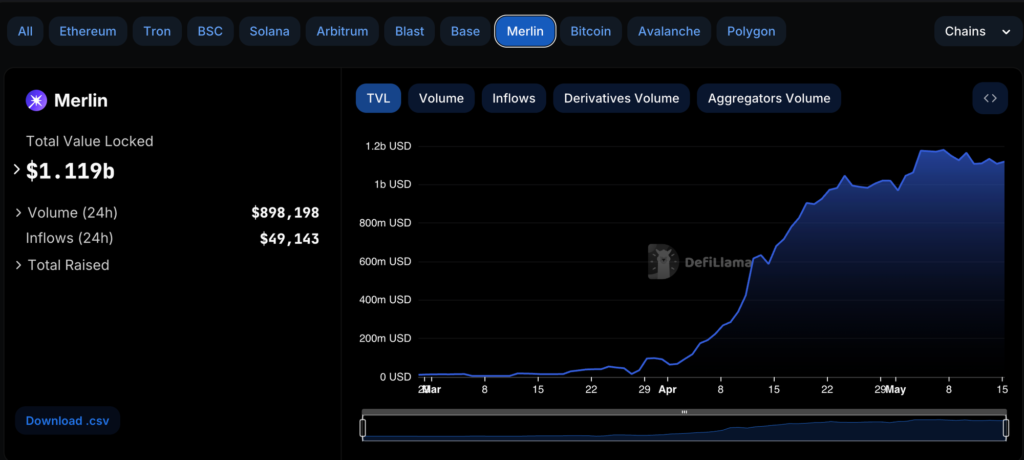

Merlin launched its mainnet in February 2024. Within a month, Merlin raised $3.6 billion and built a vibrant ecosystem with over 200 native dApps. Currently, Merlin Chain is the 8th highest TVL blockchain with over $1 billion, surpassing Bitcoin, Avalanche, and Polygon.

More than 60% of Merlin’s TVL is held in Solv Finance, a protocol that allows users to deposit WBTC and receive “Solv Points” in return. Solv and Merlin run promotions that encourage users to earn points and tokens.

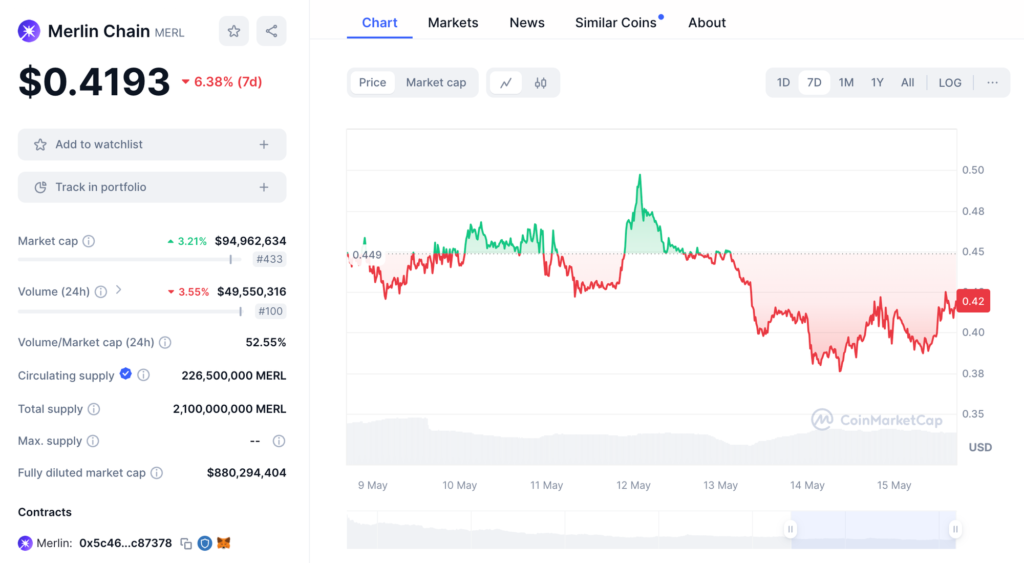

MERL is the native token of Merlin Chain ecosystem. It is used for Merlin’s governance, staking, network fees, and liquidity. The MERL token was launched on April 19, 2024 with a total supply of 2.1 billion MERL. As of May 15, 2024, the MERL price is at $0.41.

BVM – Bitcoin Virtual Machine

Bitcoin Virtual Machine (BVM) is Bitcoin’s first modular blockchain metaprotocol. This protocol allows users to create their own layer 2 network on top of the BVM.

BVM provides the tools and infrastructure needed to build or scale Bitcoin L2. Developers using BVM will get a complete infrastructure that includes smart contracts, decentralized applications (DApps), and decentralized AI modules.

Thus, BVM can increase Bitcoin’s scalability in all sectors, from DeFi, Gaming, and SocialFi to AI. Some projects that utilize BVM are as follows:

- Naka Chain – Bitcoin L2 for DeFi

- Eternal AI – Bitcoin L2 for fully on-chain AI

- Swamps – Bitcoin L2 for SRC-20 DeFi

- Rune Chain – Bitcoin L2 for Runes

- Bittendo – Bitcoin L2 for Gaming

- Bloom – Bitcoin L2 for Yield and Restaking

BVM technology is equivalent to EVM (Ethereum Virtual Machine). This means that BVM allows Ethereum developers to migrate smart contracts and dApps that use the Solidity programming language from Ethereum to Bitcoin with minimal or no modifications.

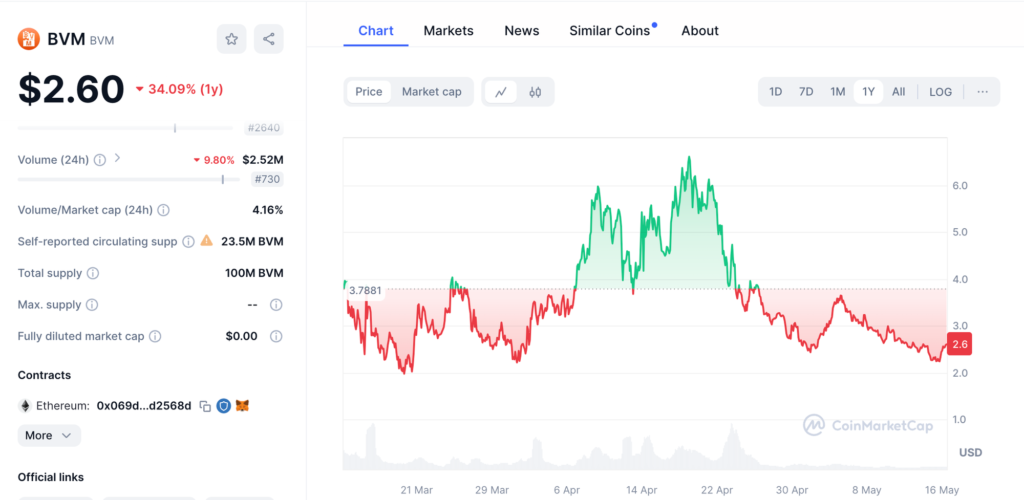

Bitcoin Virtual Machine’s native token is BVM. This token is used in the ecosystem to empower developers and users to build dApps on Bitcoin. BVM serves as a means of payment and a staking tool to earn SHARD, the BVM governance token.

BVM began trading in March 2024 with a total supply of 100 million BVM. It hit ATH on April 19, 2024, at $6.5. One influence was the airdrop of Naka Chain, a layer-2 Bitcoin built on top of BVM. Naka Chain will distribute an airdrop of 10.5 million tokens to BVM token stakers.

BOB – Build on Bitcoin

BOB is a hybrid Bitcoin L2 that combines Bitcoin’s security with Ethereum’s reliability. The combination aims to connect Bitcoin PoW’s global adoption, liquidity, and security with Ethereum’s innovation capabilities, including EVM smart contracts, UX, and access to USD stablecoins.

The BOB hybrid system is achieved through the BOB rollup ecosystem, which will use Bitcoin PoW for security. BoB also allows users to access all on- and off-ramps, dApps, stablecoins, NFTs, and DeFi provided by the Ethereum EVM.

In DeFi, BOB gets liquidity from Bitcoin and Ethereum, thus positioning BOB as one of the best solutions for the mass adoption of DeFi.

BOB launched its mainnet on May 1, 2024, with over 40 dApps and infrastructure projects running on day one. BOB also managed to raise a TVL of $300 million locked in the BOB Fusion Season 1 campaign ahead of the mainnet launch. This high amount has led to speculation that the next ‘DeFi Summer’ will be fueled by Bitcoin.

You can bridge assets from Ethereum to BOB through BOB’s native bridge at https://app.gobob.xyz/. This can connect you to the Web3 ecosystem, including DeFi projects like Sovryn, Velodrome, and LayerBank, and the growing communities in the Ordinals and Runes projects that originated in Bitcoin.

Currently, BOB does not have its platform token.

Conclusion of Bitcoin Layer 2

Bitcoin L2 is an important solution to address the Bitcoin network’s limitations. Examples of Bitcoin L2 are Merlin Chain, BVM, and BoB. Bitcoin L2 ensures strong scalability, efficiency, low transaction fees, and fast transactions.

While still in the developmental stages, numerous Bitcoin L2 projects have shown promising potential, particularly within the DeFi sector. These initiatives provide new opportunities for broader Bitcoin utilization, empowering developers to build innovative applications on top of the Bitcoin network.

How to Buy Bitcoin Layer 2 Tokens on Pintu

After learning about Bitcoin L2, you can start investing by buying MERL, and other assets like BTC, ETH, etc. on the Pintu app. Pintu carefully evaluates all its crypto assets, emphasizing the importance of caution.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download the Pintu app on the Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

References

- Nikhil Chaturvedi, Kinji Steimetz, dan Kunal Goel, Discussion: Does Bitcoin need Layer-2s? Messari, accessed 14 May 2024.

- Jack Kubinec, Points farming comes for Bitcoin as Merlin becomes 9th-largest chain, Blockworks, accessed 14 May 2024.

- BVM, BVM: THE BITCOIN L2 FACTORY, X, accessed 14 May 2024.

- BOB Team, What Is BOB? Docs, accessed 14 May 2024.

- Deswita Zela, Proyek Layer-2 Bitcoin BVM Menggoda Pengguna dengan Airdrop Menggiurkan! Pintu News, accessed 16 May 2024.