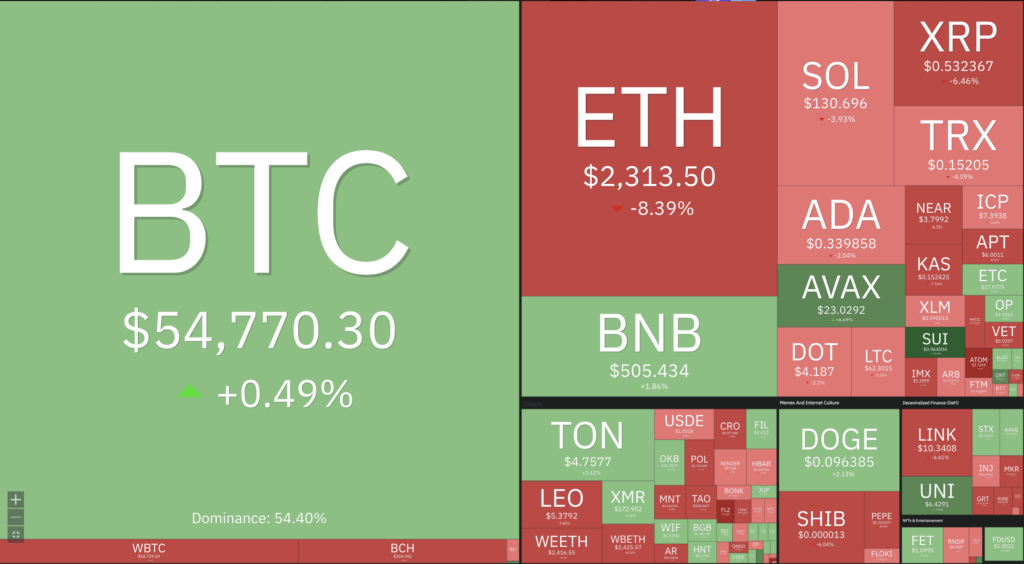

September has proven to be a challenging month for the crypto market and Bitcoin (BTC). Contrary to predictions of a surge to $60,000, BTC has experienced a significant price drop, reaching a low of $53,000. Currently, there are no clear catalysts to drive BTC’s price back up, leaving crypto investors uncertain about its future trajectory. Read the full analysis below.

As usual, the Pintu trading team has gathered critical information and analyzed the general economic situation and the crypto market’s movements over the past week. However, it should be noted that all information in this Market Analysis is intended for educational purposes, not as financial advice.

Market Analysis Summary

- 🚨 BTC has faced challenges in staying above the $57,000 mark.

- 📈 Headline PCE rose 0.2% month-over-month and 2.5% year-over-year, compared to forecasts of a 0.2% MoM rise and a 2.6% YoY increase. Core PCE increased 0.2% MoM and 2.6% YoY, slightly below the expected 0.2% MoM rise and 2.7% YoY increase.

- 🟢 The University of Michigan reported that consumer sentiment climbed to a final reading of 67.9 in August, slightly more than a point higher than July.

Macroeconomic Analysis

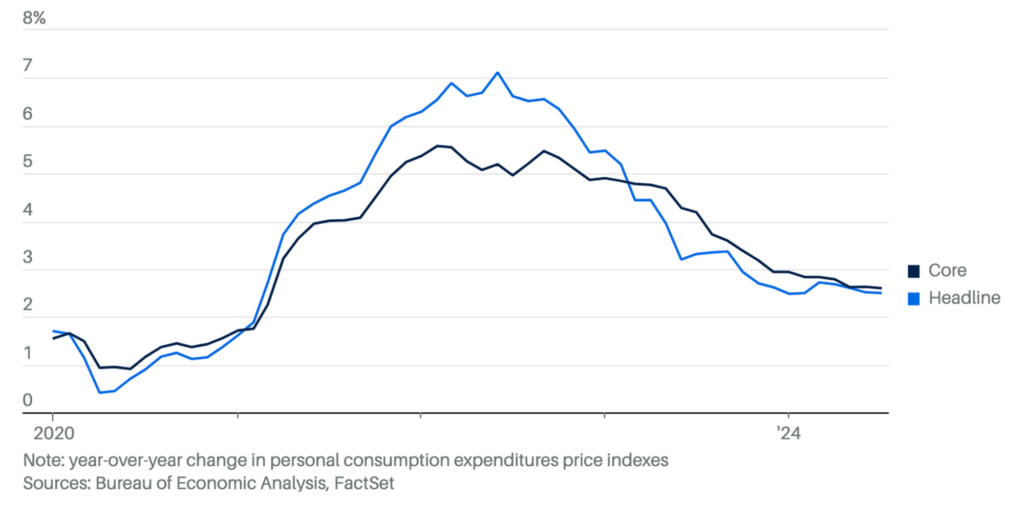

Core PCE Index

The Bureau of Economic Analysis published the Federal Reserve’s preferred inflation gauge—the personal consumption expenditures (PCE) price index

Here’s a summary of the July figures:

- Headline PCE rose 0.2% month-over-month and 2.5% year-over-year, compared to forecasts of a 0.2% MoM rise and a 2.6% YoY increase.

- Core PCE increased 0.2% MoM and 2.6% YoY, slightly below the expected 0.2% MoM rise and 2.7% YoY increase.

The July inflation data, released Friday morning, indicated that price growth is gradually returning to the Fed’s 2% target, strengthening the argument for potential interest rate cuts next month.

Both the overall PCE price index and the core reading, which excludes food and energy, rose by 0.2% in July. This softer price growth extends the recent trend of cooling inflation, aligning with the Fed’s expectations before they consider easing their restrictive monetary policy.

Year-over-year, inflation remains at approximately 2.5%, with the core rate at 2.6%. However, the three-month annualized rates for July’s PCE and core PCE dropped to 0.9% and 1.7%, respectively, inflation is well on its way back to the Fed’s target.

The continued cooling of inflation in July may give the Fed room to pursue more aggressive rate cuts at upcoming meetings, but this will likely be considered only if there’s significant deterioration in the labor market.

During his speech at the Fed’s annual Jackson Hole economic conference, Fed chair emphasized that policymakers do not want to see further weakening of the labor market, making the August jobs report a key factor in shaping future rate decisions.

The FOMC is set to meet on Sept. 17-18, with the only other critical data point before then being the August consumer price index, which will be released on Sept. 11.

Other Economic Indicators

- Personal Spending: According to the Bureau of Economic Analysis, consumer spending increased by 0.5%, or $103.8 billion, in July. This marks a rise from the 0.3% growth recorded in June.

- Personal Income: This boost in spending was likely supported by rising incomes, as personal incomes grew by 0.3% in July, up from June’s 0.2% increase.

- Michigan Consumer Sentiment: The University of Michigan reported that consumer sentiment climbed to a final reading of 67.9 in August, slightly more than a point higher than July.

- S&P Global manufacturing PMI: In August, the seasonally adjusted S&P Global US Manufacturing Purchasing Managers’ Index PMI fell to 47.9, down from 49.6 in July. This marks the lowest reading since last December and signals a second consecutive month of worsening conditions in the manufacturing sector.

- ISM Manufacturing PMI: The ISM reported that its manufacturing PMI increased to 47.2 in August, up from 46.8 in July, which had been the lowest level since November. A PMI reading below 50 signals contraction in the manufacturing sector, which represents 10.3% of the overall economy. Despite this, it has not altered expectations that the Fed will proceed with a 25 basis point rate cut as it begins its anticipated easing cycle later this month.

- JOLTS Jobs Opening: Job openings dropped to their lowest level in 3½ years in July, signaling further slack in the labor market, according to a Labor Department report released Wednesday. The closely followed Job Openings and Labor Turnover Survey (JOLTS) revealed that available positions fell to 7.67 million, a decrease of 237,000 from June’s revised figures and the lowest level since January 2021.

- ADP Employment Change: U.S. private sector employment increased by 99,000 in August, while annual pay rose 4.8% year-over-year, according to the Automatic Data Processing (ADP) report released Thursday. This follows a revised gain of 111,000 jobs in July (down from the initial 122,000) and fell significantly short of the market’s expectation of 145,000.

- Jobless Claim: The Labor Department reported on Thursday that jobless claims fell by 5,000 to 227,000 for the week ending August 31, the lowest since the week of July 6, when 223,000 claims were filed. This figure also came in below analysts’ expectations of 230,000 new filings. The four-week moving average of claims, which smooths out weekly fluctuations, declined by 1,750 to 230,000, marking the lowest level since early June.

BTC Price Analysis

Wider Crypto market

The crypto market remains heavily influenced by the current hype and fear, focusing on pivotal events such as Pavel Durov’s arrest, the surge and subsequent decline of memecoin excitement, and the ongoing debate around BTC mining. These developments have significantly impacted market sentiment and trading behavior, underscoring the ongoing influence of external factors on the crypto space.

The rapid rise and fall of several popular meme coins has sparked conversations about the risks of speculative trading and the dangers of chasing market trends driven solely by hype.

Stocks of cryptocurrency mining companies often predict Bitcoin price movements. Many traders are unaware of the close relationship between these stocks and BTC’s price direction.

The combined market capitalization of these mining companies tends to peak and dip ahead of Bitcoin’s own trend changes. This positions miners as key players in shaping price action, as their holdings and decisions are crucial to understanding BTC’s future trajectory. By recognizing these shifts early, traders can gain valuable insights into Bitcoin’s potential direction, rather than simply reacting to price changes after they occur.

BTC

The combined market capitalization of these mining companies tends to peak and dip ahead of Bitcoin’s own trend changes. This positions miners as key players in shaping price action, as their holdings and decisions are crucial to understanding BTC’s future trajectory. By recognizing these shifts early, traders can gain valuable insights into Bitcoin’s potential direction, rather than simply reacting to price changes after they occur.

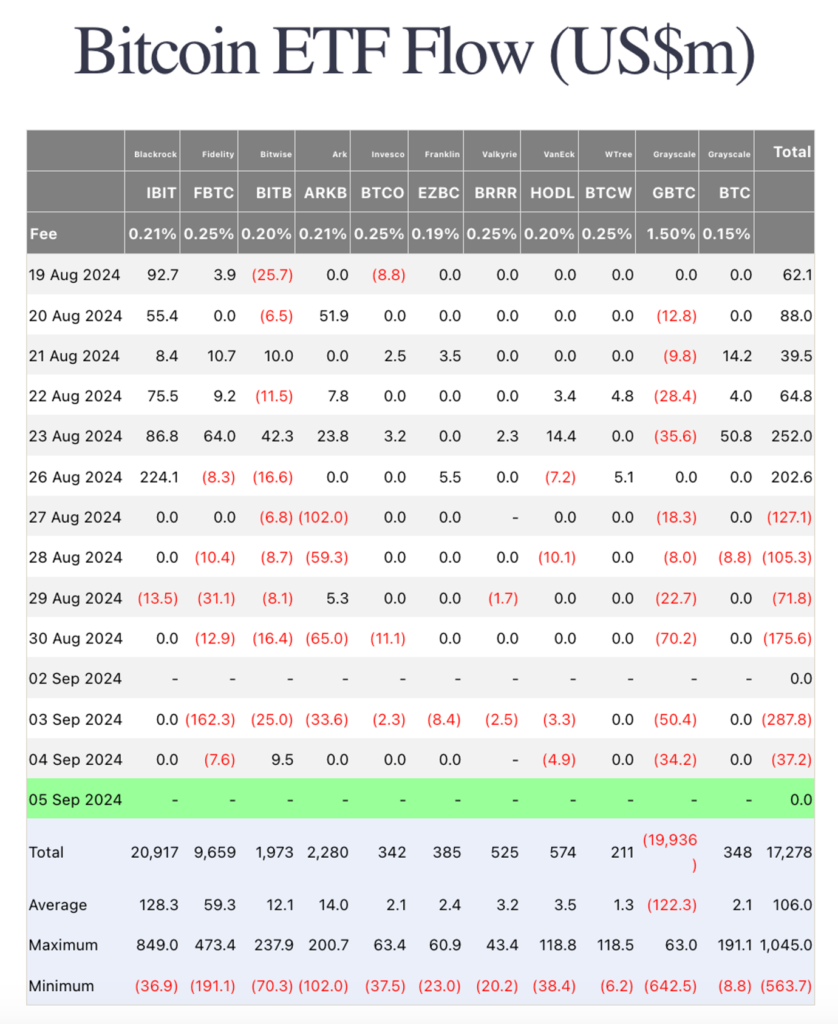

BTC ETFs experienced their largest outflows in four months, with over $287 million being withdrawn from 11 U.S.-listed bitcoin ETFs on Tuesday, according to Farside Investors data. The selling momentum persisted into Wednesday, with an additional $37 million in net outflows.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to fall, it indicates lower selling pressure. Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

- 💻 Miners: Miners’ are selling holdings in a moderate range compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- 🔗 On-Chain: More investors are selling at a loss. In the middle of a bear market, it can indicate a market bottom. Long term holders’ movement in the last 7 days was lower than the average. They have a motive to hold their coins. Investors are in a anxiety phase where they are currently in a state of moderate unrealized profits.

- 🏦 Derivatives: Long position traders are dominant and are willing to pay to short traders. Buying sentiment is dominant in the derivatives market. More buy orders are filled by takers. As open interest decreases, it indicates investors are closing futures positions and possibility of trend reversals. In turn, this might trigger the possibility of long/short-squeeze caused by sudden price movement or vice versa.

- 🔀 Technicals: RSI indicates a neutral condition. Stochastic indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

News About Altcoins

- BLUM: The Next Big Thing After the DOGS Airdrop Sensation. With over 50 million users already on board, BLUM, a Binance Labs-backed project, is poised to be the next big thing in the crypto world. Leveraging the popularity of the Telegram ecosystem and its predecessors NOT and DOGS, BLUM is set to launch a highly anticipated airdrop on September 20, 2024. By completing simple tasks, users can earn BLUM tokens. The project’s innovative features include direct wallet trading and a unique “meme-based” approach, all accessible through the Telegram mini-app. With this solid foundation and exciting roadmap, BLUM is positioned for substantial growth in the future.

News from the Crypto World in the Past Week

- Allan Lichtman’s Prediction: Kamala Harris to Win 2024 U.S. Presidential Election. Historian Allan Lichtman, known for his accuracy in predicting U.S. presidential election outcomes, has forecasted that Kamala Harris will win the 2024 presidential election. Despite the Democrats losing the advantage of incumbency after Joe Biden’s withdrawal, Lichtman believes Harris is favored by several factors, including the absence of a strong third-party candidate and the economic and legislative achievements of the Biden administration.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Starknet (STRK) +22,90%

- Sui (SUI) +21,77%

- Helium (HNT) +16,52%

- SATS (1000SATS) +12,92%

Cryptocurrencies With the Worst Performance

- DOGS (DOGS) -17,79%

- Cosmos (ATOM) -17,28%

- Beam (BEAM) -12,50%

- Bittensor (TAO) -11,27%

References

- Robert Trait, Kamala Harris will win election, predicts leading historian Allan Lichtman, theguardian, accessed on 8 September 2024.

- Sritanshu Sinha, Telegram’s Blum Could Be the Biggest Airdrop of 2024, cryptonewsz, diakses accessed on 8 September 2024.