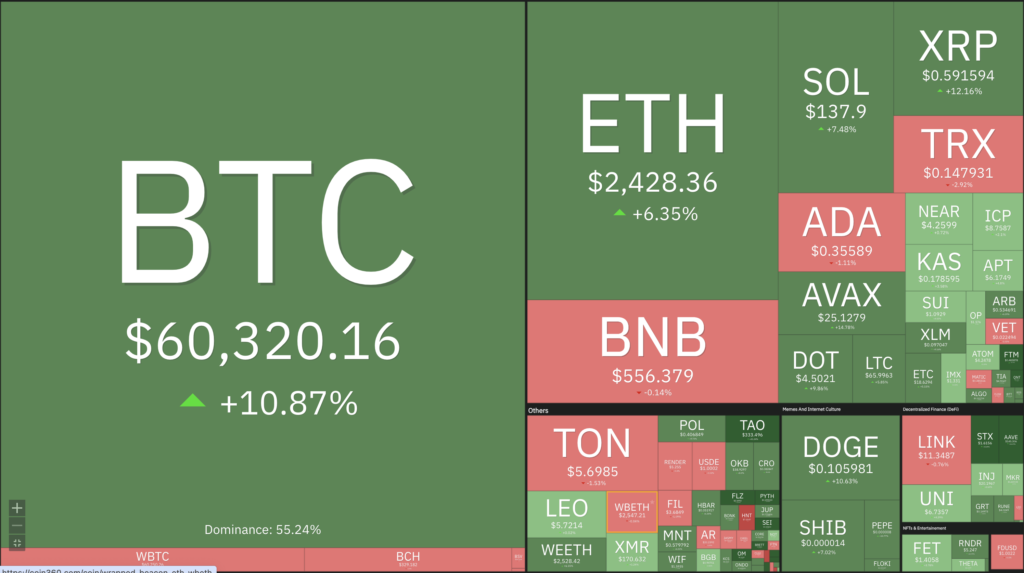

Bitcoin (BTC) has finally reached the significant price point of $60K after weeks of consolidation. While investors initially celebrated this milestone, the overall crypto market remains shrouded in negative sentiment, as evidenced by various data points.

As usual, the Pintu trading team has gathered critical information and analyzed the general economic situation and the crypto market’s movements over the past week. However, it should be noted that all information in this Market Analysis is intended for educational purposes, not as financial advice.

Market Analysis Summary

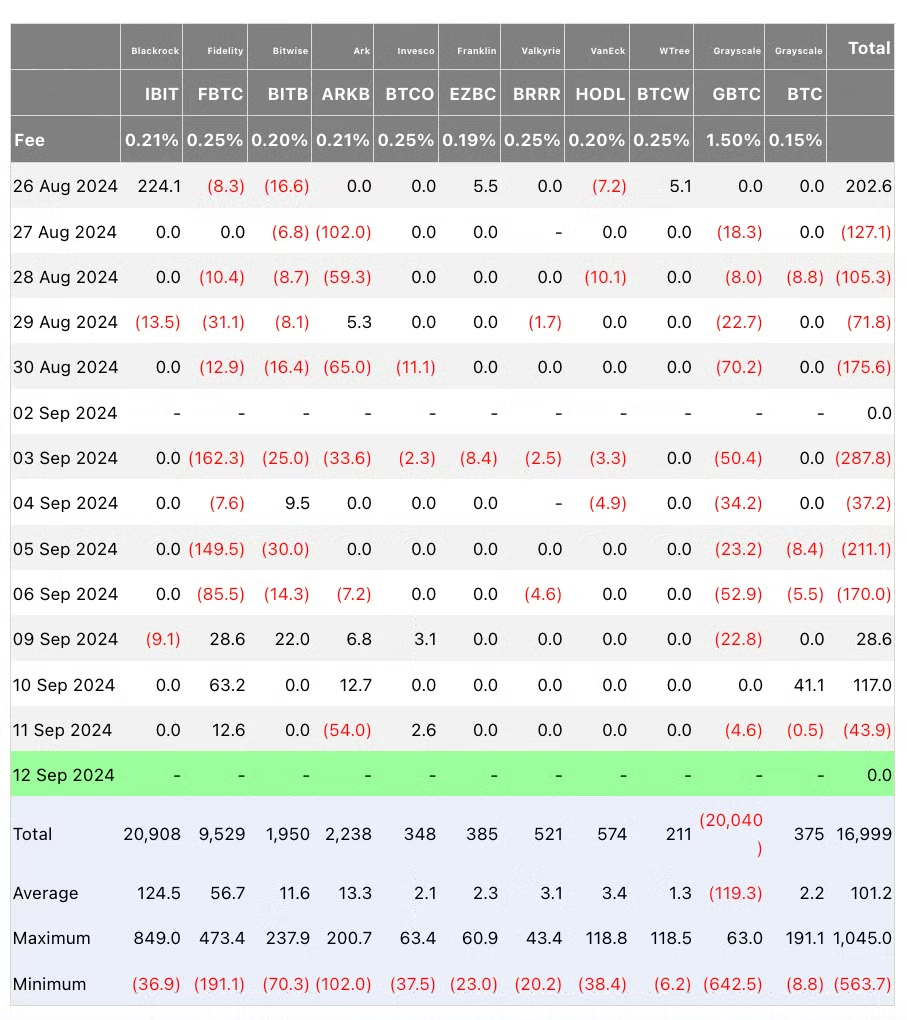

- 🔴 Two negative factors for BTC, a drop in BTC active address network activity and a $1 Billion BTC exchange-traded fund (ETF) outflow.

- 💼 August Jobs Report Falls Short of Expectations as Labor Market Remains Sluggish.

- ↔️ The core inflation rate in August was 3.2%, unchanged from July’s figure.

- 📈 The four-week moving average of claims, which helps smooth out weekly fluctuations, also edged up by 500 to a total of 230,750.

Macroeconomic Analysis

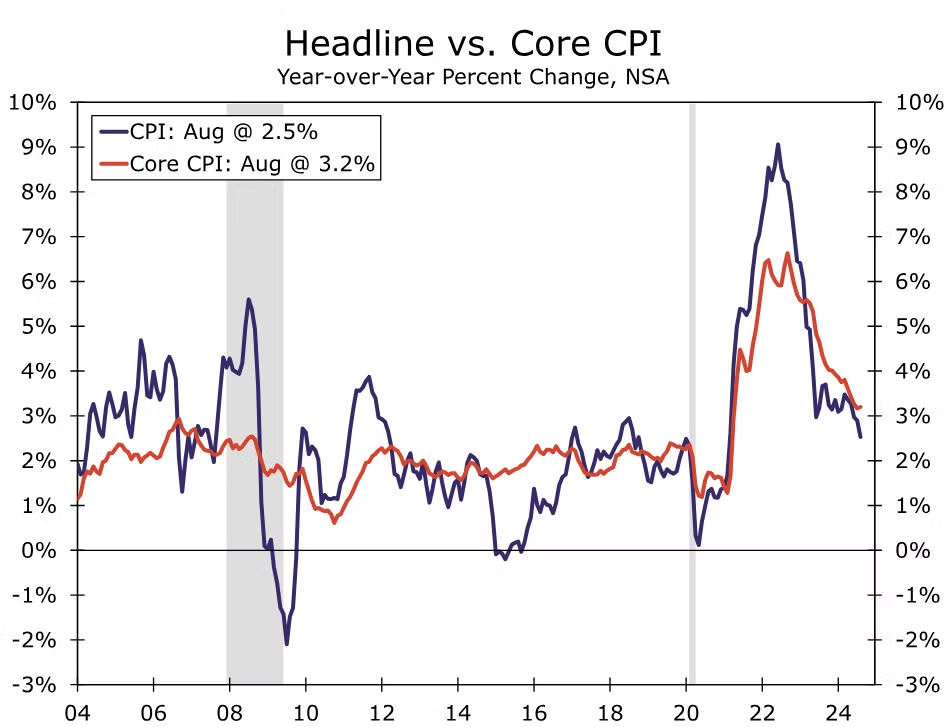

CPI

Inflation has returned to levels not seen since February 2021, marking significant progress toward the Fed’s 2% target. However, the overall data suggests that only a modest interest rate cut is likely next week.

Just over two years ago, in June 2022, U.S. inflation peaked at around 9%. But in the past month, the consumer price index (CPI) rose only 2.5% year-over-year. Declining gas prices and stable grocery costs in August offer some relief to households grappling with higher borrowing expenses.

Despite the cooler-than-expected overall CPI, core inflation—excluding food and energy prices—remained stubbornly high. The core inflation rate in August was 3.2%, unchanged from July’s figure. On a month-to-month basis, core CPI rose 0.3% in August, up from 0.2% in July, largely due to persistent shelter costs and higher prices for airfares and services.

The latest CPI data doesn’t significantly alter the outlook for the Fed’s preferred inflation measure, the PCE price index, which stood at 2.6% in July. Fed signaled that the inflation progress made so far justifies starting rate cuts.

While some economists and Fed observers had speculated that slow job growth might prompt a more aggressive 50 basis point cut, Wednesday’s inflation report points to a more cautious 25 basis point reduction.

Other Economic Indicators

- Nonfarm payroll: The Labor Department reported that U.S. employers added 142,000 nonfarm payroll jobs in August, up from July’s initially reported 114,000 but below economists’ expectations of 160,000.

- Unemployment rate: The unemployment rate dropped to 4.2% in August, slightly down from July’s 33-month high of 4.3%, and matching predictions of 4.2%. The government also revised July’s job growth downward by 114,000, bringing the total to 89,000 jobs added, while June’s figures were lowered from 179,000 to 118,000, resulting in 86,000 fewer jobs created over the two-month period.

- Jobless Claims: Jobless claims increased by 2,000 to reach 230,000 for the week ending Sept. 7, in line with economists’ expectations, according to Thursday’s report from the Labor Department. The four-week moving average of claims, which helps smooth out weekly fluctuations, also edged up by 500 to a total of 230,750. The number of Americans receiving jobless benefits increased slightly by 5,000, staying around 1.85 million for the week of Aug. 31.

BTC Price Analysis

BTC’s price has been consolidating below the $60K mark for the past few weeks. However, a shift may be on the horizon, as the asset surged to an 8-day high of nearly $58,500 earlier today.

Looking at the chart below, the price recently bounced off the $55K support level and at one point touched 58,5K, where it was met with its resistance. It has since moved back above the $57K mark. In the coming days, the market is likely to climb toward the $60K resistance level if we are able to break through the 58,500 price level.

Additionally, the RSI is rising above the 50% level, suggesting a potential short-term uptrend.

However, there are several bearish data to indicate that BTC’s price might potentially break down from its current price point.

The number of active BTC addresses has now fallen to 612,000, signaling that a large portion of users have stopped engaging with the cryptocurrency. This notable drop reflects a decrease in network activity, suggesting declining interest or involvement in recent months.

The report also pointed to $1 billion in outflows from BTC ETFs this week as a negative signal for the market. It further mentioned the weak U.S. economy and significant futures liquidations as contributing factors that could potentially drive Bitcoin’s price down.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to fall, it indicates lower selling pressure. Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

- 💻 Miners: Miners’ are selling holdings in a moderate range compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- 🔗 On-Chain: More investors are selling at a loss. In the middle of a bear market, it can indicate a market bottom. Long term holders’ movement in the last 7 days was lower than the average. They have a motive to hold their coins. Investors are in a anxiety phase where they are currently in a state of moderate unrealized profits.

- 🏦 Derivatives: Long position traders are dominant and are willing to pay to short traders. Buying sentiment is dominant in the derivatives market. More buy orders are filled by takers. As open interest increases, it indicates more liquidity, volatility, and attention are coming into the derivative market. The increasing trend in open interest could support the current ongoing price trend.

- 🔀 Technicals: RSI indicates a neutral condition. Stochastic indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

News About Altcoins

- Airdrop hunters, mark these Telegram game token launch dates in September. This year, several Telegram-based games, including Hamster Kombat, Rocky Rabbit, and WatBird, have garnered attention by offering gameplay that promises a share of upcoming crypto token airdrops. Now, these games are set to launch their tokens and enter the market. Catizen’s CATI token will be released on September 20, followed by Rocky Rabbit’s RabBitcoin (RBTC) on September 23. WatBird will also introduce its WatCoin (WAT) on September 23. Finally, Hamster Kombat will launch the HMSTR token on September 26. As the airdrops approach, players are scrambling to complete tasks and qualify for their tokens.

News from the Crypto World in the Past Week

- Presidential Candidate Trump Launches DeFi Project. World Liberty Financial, Trump’s DeFi project, is set to officially launch on September 16. While this Aave-based project has garnered attention, controversy surrounds the WLFI token allocation, with 70% allocated to insiders and only 30% available to the public. The project is led by Trump’s sons and has ties to the previously hacked Dough Finance. With Trump’s 2024 campaign ongoing, the project is expected to face strict regulatory scrutiny, especially given the risks of launching during election season.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies Market Price Over the Past Week

- Popcat (POPCAT) +45,09%

- Bittensor (TAO) +39,53%

- Artificial Superintelligence Alliance (FET) +29,90%

- MANTA (OM) +26,50%

Cryptocurrencies With the Worst Performance

- Helium (HNT) -10,34%

- SATS (1000SATS) -6,07%

- Starknet (STRK) -4,62%

- TRON (TRX) -2,93%

References

- Andrew Hayward, When Are the Next Big Telegram Game Airdrops? From ‘Hamster Kombat’ to ‘Catizen’ and ‘Rocky Rabbit’, decrypt, accessed on 15 September 2024.

- David C, World Liberty Financial Sets Launch Date, bankless, accessed on 15 September 2024.