The SUI ecosystem is experiencing explosive growth, fueled by a surge of innovative protocols and the recent memecoin frenzy. As a result, SUI has rapidly climbed the ranks to become a top 20 cryptocurrency by market capitalization. Its total value locked (TVL) has soared by nearly 5x, setting a new all-time high for the SUI token.

But what exactly is driving this unprecedented growth? What are some of the most promising protocols within the SUI ecosystem? Let’s dive in and explore.

Article Summary

- 🔥 As a new generation L1 protocol, Sui shows its potential to compete with other L1 competitors. They successfully broke into the top 20 cryptos with the largest market cap

- 🚀 Throughout 2024, Sui recorded TVL growth from $212 million to $1.19 billion, or a 461% increase.

- 🏆 Sui’s TVL growth is driven by the increasing adoption of Sui thanks to the presence of potential protocols such as NAVI Protocol, Scallops, Cetus, DeepBook, to the development of native memecoins in Sui.

- 💡 Thanks to its advanced technology, Sui is believed to have the requirements to compete with Solana if Sui’s adoption and ecosystem become more prominent.

About SUI

Sui is a layer-1 permissionless blockchain from a team of ex-Meta developers. Sui is a smart contract platform that can fulfill multiple needs in one ecosystem. One of Sui’s unique characteristics is the parallel execution of transactions through object-centric processing. This transaction model makes Sui very different from the typical blockchain.

Unlike Bitcoin, Ethereum, and Solana, which store transactions chronologically, Sui employs a fundamentally different approach.

The majority of transactions on the network are processed without any strict order. However, some transactions are organized by causality, where transactions 1, 2, and 3 are related. In this case, Sui stores the history of these interrelated transactions from genesis to the latest.

Learn more about SUI and how it works in the following article.

Sui Ecosystem Development

Launched in early 2023, the SUI mainnet saw significant growth in a short period. They consistently bring new features and updates to enhance its performance and ecosystem.

Throughout the third quarter of 2024, SUI rolled out several critical updates to boost liquidity and network efficiency. Notably, the new Mysticeti consensus engine was introduced. It reduced Sui latency to a mere 390 milliseconds, representing an 80% decrease from its predecessor. This improvement has significantly accelerated transaction finalization on the SUI network.

Additionally, Sui Bridge, a native cross-chain bridge, was launched on September 30, 2024. This bridge facilitates seamless transfers of native assets between Ethereum and SUI. Furthermore, SUI introduced DeepBook v3, a native liquidity layer, and its native token, DEEP.

Since its inception in early 2023, SUI has achieved several significant milestones. As of writing, SUI boasts a Total Value Locked (TVL) of $1.19 billion, according to DefiLlama. This represents a remarkable 461% increase from the beginning of 2024, solidifying SUI’s position as the seventh-largest blockchain by TVL.

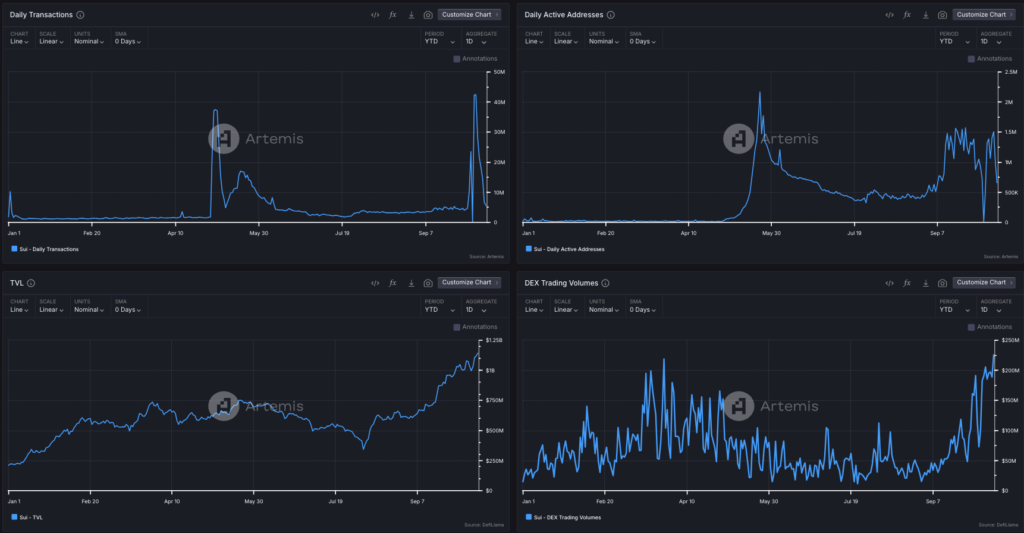

While SUI’s on-chain metrics have exhibited some volatility, the overall trend is upward, especially within the past month. Data from Artemis indicates a surge in daily transactions, active daily addresses, and DEX trading volume.

The growth of SUI’s TVL and on-chain metrics can be partly attributed to the rising popularity of memecoins on the network. The surge in the value of meme tokens like HIPPO, BLUB, and FUD, which have experienced up to 10x gains, has attracted significant market interest. Concurrently, developing native protocols such as NAVI Protocol, Cetus, Scallops, and DeepBook has contributed to the ecosystem’s expansion.

SUI Ecosystem

1. Lending Protocol

Navi Protocol is the first one-stop native liquidity protocol in the Sui ecosystem. Similar to Aave, it offers lending and borrowing services for various assets, including SUI, vSUI, NAVX, USDT, USDC, CETUS, WBTC, and WETH. Navi Protocol also features Volo, a liquid staking service for SUI that rewards users with voloSUI tokens.

Currently, Navi Protocol boasts the highest Total Value Locked (TVL) among all protocols in the Sui ecosystem. According to DefiLlama, its TVL stands at $348.37 million, reflecting a more than 30% increase over the past month, aligning with the recent rally of the SUI token.

Other lending protocols present in the Sui ecosystem include Suilend and Scallop Lend. DefiLlama data shows these platforms have TVLs of $190.5 million and $159.3 million, respectively.”

2. Decentralized Excange (DEX)

Cetus has solidified its position as the leading decentralized exchange (DEX) in the Sui ecosystem, boasting a Total Value Locked (TVL) of $247.17 million. This makes Cetus the second-largest protocol in terms of TVL on Sui. Alongside Cetus, Sui also hosts native DEXes like Aftermath Finance. However, DeepBook has recently garnered significant attention.

DeepBook is a decentralized central limit order book (CLOB) protocol built on the Sui network. Leveraging Sui’s parallel execution technology and low transaction costs, DeepBook offers a high-performance, low-latency on-chain exchange.

As a liquidity layer on Sui, users can access DeepBook’s liquidity through various DEXs on Sui, including Cetus and Aftermath Finance. By utilizing DeepBook, these DEXs can bridge the gap between what is available on Sui and centralized exchanges (CEXs).

While DeepBook is still a relatively new protocol, and its performance metrics are yet to mature fully, this is expected given the nascent stage of the Sui ecosystem. This allows Mysten Labs to build DeepBook’s functionality and features from the ground up. Moreover, DeepBook enjoys strong support from the Sui Foundation, facilitating seamless integration into the broader Sui ecosystem.

3. Hop Aggregator

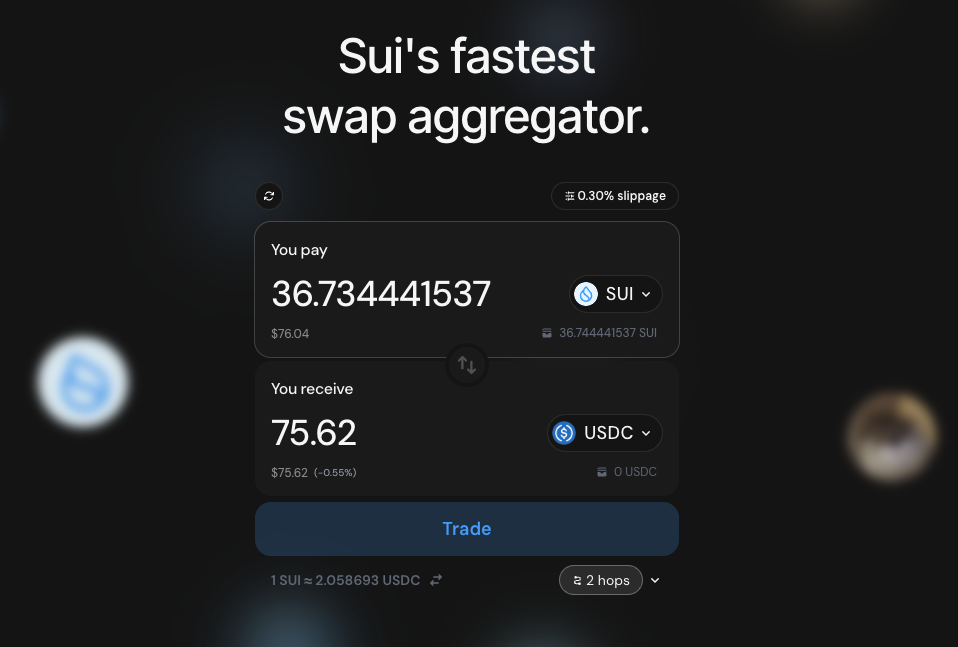

Hop Aggregator is a decentralized aggregation layer designed specifically for the Sui ecosystem. Its aggregation mechanism infrastructure provides users with direct access to the most optimal pricing and lending rates across multiple decentralized exchanges (DEXs) within the Sui ecosystem.

Currently, Hop Aggregator supports all native tokens on Sui and various wrapped versions of major tokens like WBTC, WETH, WFTM, WMATIC, and more. Notably, swaps on Hop Aggregator are completely fee-free.

Additionally, the Hop Aggregator enables cross-chain bridging. Users can directly send tokens like BTC, ETH, FTM, and others to the Sui network at the best possible rates.

Hop Aggregator is also developing Hop Fun, a token creation and bonding curve platform feature. Hop Fun empowers creators and communities to launch their memecoins. Beyond memecoin creation, users can purchase these tokens and interact with other community members. This feature is slated for launch on October 20, 2024.”

4. Memecoins

Surprisingly, the memecoin sector on Sui has seen significant growth in terms of new token launches and trading volume. Memecoins have become one of the driving forces behind the rising price of the SUI token and the influx of new users into the Sui ecosystem.

During this period, memecoin projects like HIPPO, BLUB, FUD, and AAA experienced gains of up to 10x. Remarkably, HIPPO’s market capitalization now surpasses other tokens in the Sui ecosystem, including CETUS, NAVX, and SCA.

This momentum has attracted a wave of “degens” to the Sui network. Concurrently, new memecoins continue to emerge on Sui. Notably, approximately 27% of the funds fleeing the Solana ecosystem have reportedly flowed into Sui during September. Meanwhile, CoinGecko data shows that the total market capitalization of memecoins on the Sui ecosystem has surged by 170%, reaching $296 million at the time of writing.

SUI Potential in The Future

Beyond the growth in TVL and on-chain metrics, the price of SUI has also shown a positive trend. SUI reached a new all-time high of $2.20 on October 13th. At the same time, Sui broke the top 20 cryptocurrencies by market cap, precisely at the 18th position.

One compelling narrative surrounding Sui is its potential to become the “next Solana.” This narrative is widely discussed within the crypto community, particularly on Twitter. CryptoGoos, for instance, has noted similarities between the current trajectory of SUI and Solana’s early stages before its 2023 bull run.

Beyond these price pattern comparisons, the growth of the Sui ecosystem and its strong fundamentals further support the notion of Sui as a potential Solana rival. Throughout 2024, the Sui ecosystem has expanded rapidly with the emergence of various dApps, including DEXes, lending protocols, liquid staking protocols, and the memecoin sector.

Furthermore, integrating the USDC into the Sui network will enhance liquidity, improve transaction efficiency, and elevate user experience within the Sui ecosystem. The presence of USDC will be instrumental in attracting new users and driving broader adoption of Sui.

The potential for the Sui ecosystem to continue growing is immense. One example is the planned launch of the SuiPlay0x1 gaming console, developed by Mysten Labs, the primary team behind Sui. Many speculate that SuiPlay0x1 will resemble Solana’s Saga, where buyers receive airdrops valued higher than the device’s purchase price.

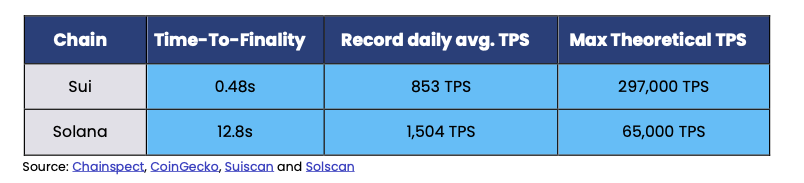

K33 DeFi analyst David Zimmerman has noted that Sui’s performance is comparable to Solana’s. He suggests that Sui could technically compete with Solana. Theoretically, Sui has a maximum TPS of 297,000, significantly higher than Solana’s 65,000.

However, Solana has achieved a peak TPS of 3,000 in practice, while Sui has only reached 864 in July 2023, according to CoinGecko data. Moreover, Solana’s average daily TPS is also higher at 1,504 compared to Sui’s 853.

“Sui has created impressive technology, but it hasn't yet surpassed Solana in practice. However, if Sui can continue to attract new users and capital inflows into its ecosystem, it could potentially rival Solana” said Zimmerman as quoted by CoinTelegraph.

Nevertheless, one potential downside for Sui’s future is its token supply. Since its launch, only 27% of the total SUI supply has been circulated, compared to 80% for SOL. This situation exposes current SUI holders to significant sell-offs when token unlocks occur.

Conclusion

Sui has emerged as one of the most promising assets, capturing the attention of the wider crypto community. With its strong fundamentals, growing adoption, and increasing utility for the SUI token, Sui has demonstrated significant potential.

The innovative technology behind Sui and the ongoing development of its ecosystem are factors that could further propel its popularity. Some even predict that Sui may rival Solana, or even Ethereum, in the future. However, it’s important to note that Sui still has a long road ahead to fully realize its potential and prove these ambitious predictions.

How to Buy SUI Token on Pintu

You can start investing in SUI by buying it on Pintu app. Here is how to buy crypto on Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for SUI.

- Click buy and fill in the amount you want.

- Now you have SUI!

In addition to SUI, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily on Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

References

- Sui Foundation, Sui Q3 2024 DeFi Roundup, Sui Blog, accessed on 14 October 2024.

- Revelo Intel, DeepBook – Sui Liquidity Layer: What You Need to Know, Substack, accessed on 14 October 2024.

- Tom Mitchelhill, SUI could soon be Solana’s fiercest competitor, CoinTelegraph, accessed on 16 October 2024.

- David Zimmerman, Speculating on SUI, k33 Research, accessed on 16 October 2024.

- Woo X Research, Does the Solana killer narrative work? An overview of the SUI ecosystem, Chain Catcher, accessed on 16 October 2024.