Bitcoin (BTC) has reached a significant milestone of $100,000, and the cryptocurrency market continues its strong performance. Positive economic signals from the United States, including the possibility of a Federal Reserve interest rate cut in late 2024, are expected to fuel further growth in BTC. Check out the macro and crypto analysis by the Pintu trader team below.

Market Analysis Summary

- 🚀 BTC has reclaimed the $100,000 price level following a healthy correction that brought it down to the 21-day EMA support line, a key technical indicator watched by traders.

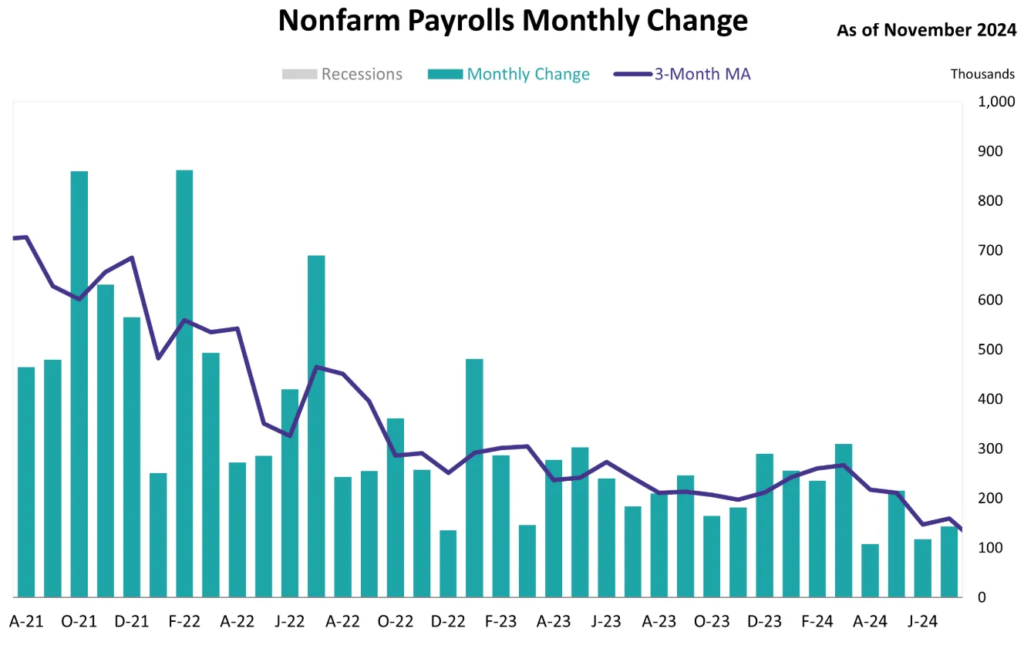

- 📈 Nonfarm payrolls increased by 227,000 in November, significantly higher than the upwardly revised 36,000 in October and exceeding the Dow Jones consensus estimate of 214,000.

- 💼 Job growth was concentrated in health care (54,000), leisure and hospitality (53,000), and government (33,000).

- 📝 The consumer price index indicate a 12-month inflation rate of 2.7% for November, a slight increase of 0.1 percentage point from October.

Macroeconomic Analysis

NonFarm Payroll

The U.S. Bureau of Labor Statistics reported that total nonfarm payroll employment increased by 227,000 in November.

Job creation in November bounced back sharply after nearly stalling in the previous month, as the impact of a major labor strike and severe storms in the Southeast subsided, the Bureau of Labor Statistics reported on Friday.

Nonfarm payrolls rose by 227,000 in November, surpassing the Dow Jones consensus estimate of 214,000 and significantly outpacing the upwardly revised October figure of 36,000. September’s payrolls were also revised upward to 255,000, an increase of 32,000 from the earlier estimate. October’s weaker numbers were largely attributed to disruptions caused by Hurricane Milton and the Boeing strike.

Other Economic Indicators

- Unemployment Rate: The unemployment rate ticked up to 4.2%, in line with expectations, as the labor force participation rate slightly declined and the overall labor force shrank. A broader measure, which includes discouraged workers and those working part-time for economic reasons, also rose modestly to 7.8%. This data likely paves the way for the Fed to proceed with an interest rate cut later this month.

- Michigan Consumer Sentiment: The University of Michigan Consumer Sentiment Index, a key measure of current and future economic conditions, surpassed expectations in its latest reading, coming in at 74.0. This figure exceeded the forecast of 73.1, reflecting greater consumer optimism than anticipated. Such a stronger-than-expected result is typically seen as positive, or bullish, for the USD, potentially indicating near-term currency strengthening.

- CPI: The CPI, a comprehensive measure of the costs of goods and services across the U.S. economy, goes up for a second consecutive month in U.S., reaching 2.7% for November, representing a slight increase of 0.1 percentage points compared to October, based on the Dow Jones consensus.

BTC Price Analysis

The crypto market is filled with excitement as the 2024 bull run dominates the spotlight, breaking records and attracting a wave of investors. BTC has shattered the $100,000 price milestone, igniting a significant rally in altcoins such as BNB, TRX, XRP, SOL, and others.

The 2024 bull run has been truly remarkable, fueled by a mix of global events, market advancements, and heightened investor confidence.

A defining feature of this bull run is the surge in institutional participation. Data from crypto exchanges shows a significant rise in average Bitcoin deposits, jumping from 0.36 BTC in 2023 to 1.65 BTC in 2024. Likewise, deposits of Tether, have soared from $19,600 to $230,000, underscoring the increasing influence of corporate players in the market.

Binance has reported a 40% growth in its corporate client base this year, signaling a substantial influx of institutional capital into the crypto market. The introduction of spot Bitcoin ETFs has further strengthened investor confidence, making cryptocurrencies more accessible to traditional financial players.

Adding to the momentum, Donald Trump’s re-election in the United States has generated waves of optimism in the crypto space. His administration’s commitments, including plans to overhaul SEC leadership and consider a strategic U.S. Bitcoin reserve, have sparked hopes for a more favorable regulatory environment. Investors are counting on these policies to provide much-needed clarity and stability, potentially sustaining the current market rally.

BTC has reclaimed the $100,000 price level following a healthy correction that brought it down to the 21-day EMA support line, a key technical indicator watched by traders. During this pullback, trading volumes spiked by 35%, signaling robust market activity and renewed buying interest at lower levels. The rebound was further supported by a 20% surge in on-chain transaction activity, reflecting growing network engagement. Additionally, BTC’s Relative Strength Index (RSI) bounced back from the neutral 50 level, reinforcing the bullish sentiment and paving the way for continued upward momentum.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to fall, it indicates lower selling pressure. Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

- 💻 Miners: Miners’ are selling more holdings compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- ⛓️ On-chain: More investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Long term holders’ movement in the last 7 days was higher than the average. If they were moved for the purpose of selling, it may have negative impact. Investors are in a belief phase where they are currently in a state of high unrealized profits.

- 🏦 Derivative: Long position traders are dominant and are willing to pay to short traders. Buying sentiment is dominent in the derivatives market. More buy orders are filled by takers. As OI decreases, it indicates investors are closing futures positions and possibility of trend reversals. In turn, this might trigger the possibility of long/short-squeeze caused by sudden price movement or vice versa.

- 🔀 Technicals: RSI indicates a neutral condition. Stochastic indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

News About Altcoins

- Ethereum Poised for Record Highs in Early 2025, Analysts Predict. Market analysts predict that Ether (ETH) will surpass its previous all-time high in the first quarter of 2025, despite currently struggling to break the $4,000 resistance level. Recent crypto market deleveraging, where investors reduced their use of borrowed funds, is seen as a potential catalyst for an ETH price rally. Technical analysis suggests an ascending triangle pattern on ETH’s daily chart, indicating a potential price target of $8,800. However, this requires overcoming the initial hurdle of $4,100 resistance. Furthermore, historical trends suggest that ETH typically experiences significant growth following a Bitcoin halving event (a pre-programmed reduction in the number of new Bitcoins generated). This time, analysts predict ETH could catch up to Bitcoin’s performance, reaching an ETH/BTC ratio of 0.39. Supporting this optimism is a surge in new Ethereum wallet creation, indicating growing investor interest. Even conservative estimates, like VanEck’s $6,000 price prediction for 2025, suggest a significant price increase for ETH.

News from the Crypto World in the Past Week

- Google’s Quantum Leap and the Implication for Bitcoin Security. Google has made significant strides in quantum computing with the launch of its “Willow” chip. This chip incorporates advancements in error correction and is nearing the development of logical qubits, a critical component for more sophisticated quantum computers. While quantum computers capable of breaking current encryption systems, like those used in Bitcoin, still require thousands of qubits and are estimated to be 5-10 years away, this technological progress serves as a timely reminder to prepare for the future. One proactive measure is to transition to post-quantum cryptography, utilizing quantum-resistant algorithms standardized by NIST. This shift will ensure the security of digital assets and systems in the age of quantum computing.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Aave (AAVE) +31.18%

- Chainlink (LINK) +17.22%

- Ethena (ENA) +8.45%

- Ondo (ONDO) +8.13%

Cryptocurrencies With the Worst Performance

- dogwifhat (WIF) -27.48%

- Bonk (BONK) -25.36%

- EOS (EOS) -23.29%

- Worldcoin (WLD) -23.09%

References

- Zoltan Vardai, Ethereum poised for record highs in Q1 2025, analysts predict, Cointelegraph, accessed on 15 Desember 2024.

- David C, Anxieties Around Quantum Computing, Bankless, accessed on15 Desember 2024.