As Christmas and New Year’s Day 2025 approach, Bitcoin (BTC) and the broader crypto market faced heightened volatility following Federal Reserve Chairman Jerome Powell’s remarks on 2025 interest rate cuts and monetary policies. Check out the macro and crypto analysis by the Pintu trader team below.

Market Analysis Summary

- 📝 Bitcoin is currently trading at its 21-day EMA, which aligns with the $100K price level.

- 📈 Retail sales climb 0.7% in November, surpassing market expectations of a 0.5% increase.

- ⬆️ Core retail sales grow 0.4%, with no revisions to October’s core sales figures

- 🏘️ Builders applied for more building permits in November, signaling optimism for future construction.

Macroeconomic Analysis

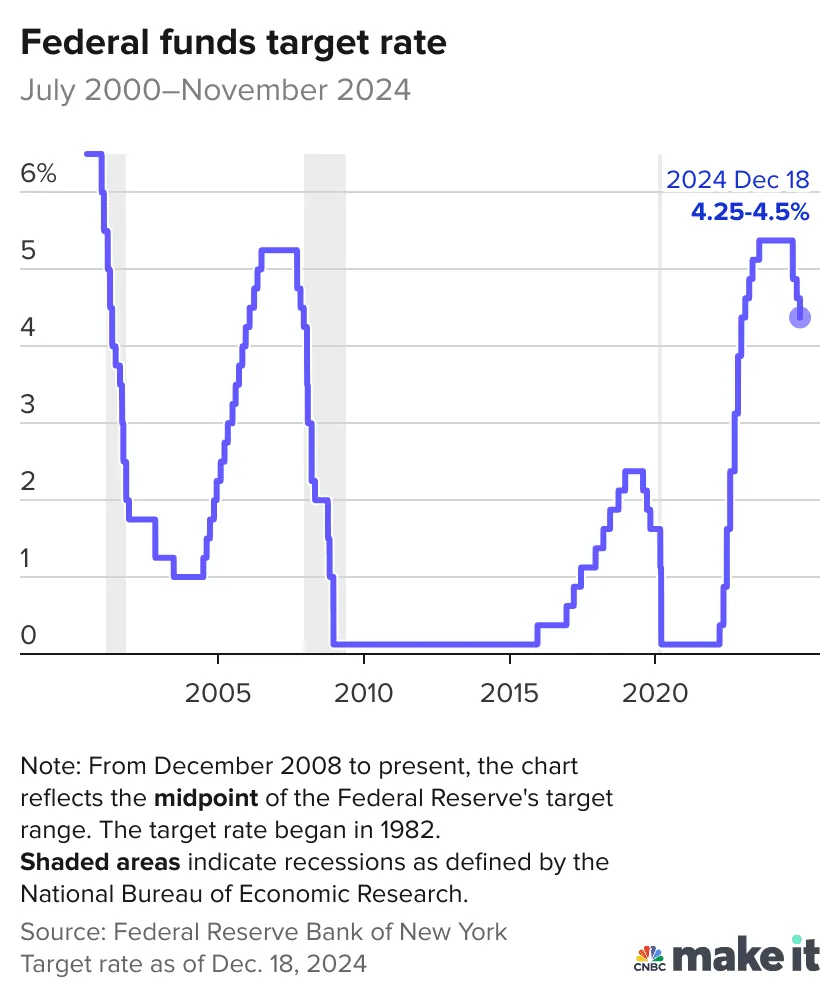

Fed Funds Rate

The Fed’s rate-cutting cycle appears to be nearing its end, and the possibility of a shift to rate hikes next year can no longer be dismissed.

On Wednesday, the Fed reduced the federal funds rate by 25 basis points, bringing it to a target range of 4.25%-4.50%, as anticipated. However, this was a “hawkish cut.” The market reaction was immediate and intense: the dollar surged to a two-year high, stocks fell sharply, and Treasury yields spiked. While markets can overreact on such days, the Fed’s statement, revised projections, and Chair Jerome Powell’s comments provided ample justification for these moves.

One key factor was the lack of unanimity in the decision, with Cleveland Fed President dissenting. Powell also described the rate cut as a “closer call” compared to recent decisions and noted that monetary policy is now “significantly less restrictive” and approaching “neutral.”

Policymakers raised their median inflation outlook for 2025 to 2.5% (up from 2.1%), increased the long-run neutral interest rate to a six-year high of 3.0%, and reduced the number of projected rate cuts next year from four to two. Despite these revisions, rates markets are skeptical, pricing in only 35 basis points of cuts next year and virtually no additional easing thereafter, essentially challenging the Fed’s projections.

This skepticism stems from an apparent inconsistency in the Fed’s outlook: it expects inflation to remain higher than previously forecast yet plans to cut rates. Powell faced tough questions on this logic during his press conference, as the stance appears harder to justify given the Fed’s relatively stable projections for economic growth and employment, which are expected to remain strong through 2026.

Just a year after Powell’s dovish pivot, markets are now entertaining the prospect of a hawkish reversal.

Interest rate markets currently anticipate an extended pause, with the next rate cut not fully priced in until September 2025. However, external factors, such as the return of President-elect Donald Trump and potential tariff-driven inflation, could complicate the Fed’s plans. Economist Phil Suttle predicts that rising inflation in the second quarter of 2025 might force the Fed to hike rates by July.

Although Powell dismissed the idea of a rate hike next year as unlikely, recent financial market movements suggest otherwise. The dollar has risen 8% since the Fed’s first rate cut in September, and Treasury yields have climbed 80 basis points, indicating that parts of the financial market are already bracing for tighter policy.

Other Economic Indicators

- NY Empire State Manufacturing Index: The New York Empire State Manufacturing Index, a key barometer of business conditions in New York state, has experienced a sharp decline. The index, derived from a survey of roughly 200 manufacturers, plummeted to just 0.2. This figure falls far below the anticipated value of 6.4, signaling that business conditions are not improving as expected.

- Retail Sales: U.S. retail sales saw a stronger-than-expected increase in November, driven by robust household spending on motor vehicles and online goods. This growth underscores solid economic momentum as the year comes to a close. Despite the upbeat report from the Commerce Department on Tuesday, it did not alter expectations that the Fed would proceed with its anticipated interest rate cut on Wednesday, marking the third reduction since the central bank began its policy easing cycle in September.

- Housing Permits: Building permits rose by 6.1% to an annual rate of 1.5 million, up from October’s revised rate of 1.42 million. In contrast, housing starts decreased by 1.8%, falling to 1.29 million from an upwardly revised 1.31 million the previous month. While the permit figures exceeded expectations, housing starts fell short of forecasts.

BTC Price Analysis

The broader cryptocurrency market remains volatile, with BTC experiencing a significant setback. The leading cryptocurrency recently dipped below the $100,000 mark amid heightened selling pressure across financial markets, including digital assets. This decline closely followed the Fed’s decision to cut interest rates and Fed Chair Jerome Powell’s subsequent remarks.

BTC had previously rallied strongly following Trump’s victory in the U.S. presidential election, with hopes of a pro-crypto regulatory environment under the new administration. Institutional interest also surged, as evidenced by substantial inflows into the BTC ETF.

However, this week’s downturn has raised concerns. BTC’s fall below $100,000 signals widespread selling pressure amid macroeconomic uncertainty and heightened financial market volatility.

The Fed recently announced a 25-basis-point rate cut, aligning with market expectations and providing short-term optimism. However, comments from Jerome Powell tempered sentiment. Powell indicated the Fed might slow the pace of rate cuts in the coming year. Moreover, the Fed halved its projected number of rate cuts for 2025, reducing them from four to two, further dampening market confidence and contributing to Bitcoin’s sell-off.

Despite this short-term pullback, analysts remain optimistic. Many believe BTC is positioned for a recovery, citing positive market developments. For instance, reports suggest the U.S. is considering establishing a Bitcoin Strategic Reserve, boosting investor confidence. Similarly, EU leaders are exploring similar initiatives, which could further support market sentiment.

Overall, while short-term volatility persists, underlying market developments and institutional support suggest potential for Bitcoin’s recovery in the near future.

Bitcoin is currently trading at its 21-day EMA, which aligns with the $100K price level. This pullback serves as a much-needed correction following its aggressive rally over the past month. The key resistance level lies at $106K; a clear breakout above this resistance could position BTC to enter a new price range.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to fall, it indicates lower selling pressure. Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

- 💻 Miners: Miners’ are selling more holdings compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- ⛓️ On-chain: More investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Long term holders’ movement in the last 7 days was higher than the average. If they were moved for the purpose of selling, it may have negative impact. Investors are in a belief phase where they are currently in a state of high unrealized profits.

- 🏦 Derivative: Long position traders are dominant and are willing to pay to short traders. Buying sentiment is dominent in the derivatives market. More buy orders are filled by takers. As OI decreases, it indicates investors are closing futures positions and possibility of trend reversals. In turn, this might trigger the possibility of long/short-squeeze caused by sudden price movement or vice versa.

- 🔀 Technicals: RSI indicates a neutral condition. Stochastic indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

News About Altcoins

- ETH Likely to Consolidate Between $3,000 and $4,000. Ethereum (ETH) is expected to consolidate between the psychological support level of $3,000 and the resistance level of $4,000 in the near term, according to crypto analysts at Rekt Capital. Following a 10% drop over the past week, ETH faces challenges in holding above $4,000. Rekt Capital highlighted the possibility of an inverse head-and-shoulders pattern if ETH establishes a bottom around $3,000, potentially signaling a trend reversal. Meanwhile, positive catalysts, such as a drop in ETH supply on exchanges to an 8.5-year low and growing fund inflows into spot Ether ETFs, could drive upward price momentum. Analysts anticipate the upward trend in spot Ether ETFs to persist into 2025, with price forecasts reaching $6,000 by the fourth quarter of 2025. 1 However, the likelihood of ETH hitting $5,000 by the end of 2024 appears increasingly slim.

News from the Crypto World in the Past Week

- Bullish: Metaplanet Raises ¥5 Billion to Increase Bitcoin Holdings. Metaplanet, a Japanese company focused on Bitcoin accumulation, announced that it has raised ¥5 billion (the equivalent of $32 million) through a bond issue to increase its Bitcoin holdings. This is the company’s fifth bond issuance, with the funds this time coming from EVO FUNDS through an interest-free loan to be repaid in June 2025. This strategy mirrors that of MicroStrategy, known as the public company with the largest Bitcoin holdings globally. Since it began adopting Bitcoin as a strategic reserve last May, Metaplanet has raised $61 million through bond sales and now owns 1,142 BTC worth $110.5 million, making it the 15th-ranked public company in terms of Bitcoin holdings. This Bitcoin strategy has brought Metaplanet closer to reporting its first operating profit in seven years.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Pudgy Penguins (PENGU) +420%

- Movement (MOVE) +30.68%

- FTX Token (FTT) +6.64%

Cryptocurrencies With the Worst Performance

- dYdX (DYDX) -36.00%

- Stacks (STX) -35.74%

- dogwifhat (WIF) -34.50%

- Aptos (APT) -34.40%

References

- Ciaran Lyons, If ETH ‘pullback continues,’ a $3K retrace remains in play — Analyst, Cointelegraph, acceseed on 22 Desember 2024.

- Elenu Benedict, Japanese MicroStrategy, Metaplanet Raises $32M to Buy More Bitcoin, thecryptobasic, accessed on 22 Desember 2024.