Leverage is a feature that allows traders to access positions larger than their available capital in futures trading. With relatively small funds, traders can gain greater exposure to market movements, but the risks they face will also scale with the size of the position.

However, traders must exercise caution when managing their capital to avoid liquidation if the market moves against their analysis. Liquidation occurs when the margin value is insufficient to cover the losses of open positions, potentially leading to the loss of all capital used.

Therefore, it is crucial to use leverage wisely, assess the risks, and always implement a risk management strategy. This includes using stop-loss orders and limiting the amount of leverage based on individual risk tolerance.

Article Summary

- 🔎 The Definition and Advantages of Leverage in Crypto Trading

- 💡 The Importance of Risk Management and the Wise Use of Leverage

- 💸 Key Components of Leverage Trading

- 🚨 How to Open a Leverage Trading Position

What Is Leverage in Crypto Trading?

Leverage is a commonly used tool in futures trading on crypto exchanges. With leverage, traders can open long or short positions with a value significantly larger than their initial capital.

For example, on Pintu Pro Futures, traders can utilize leverage for futures trading. In this system, traders borrow additional capital from regulated exchanges. As long as traders maintain sufficient margin to withstand price fluctuations, there is no time limit for holding a position.

At Pintu Pro Futures, traders can use leverage of up to 25x. This “x” represents the multiplier indicating that your capital can be increased by up to 25 times.

For illustration, if you have a margin of $100 USDT and open a BTC position with leverage of 25x, the total value of your position becomes $2,500 USDT. The calculation is: $100 USDT x 25 = $2,500 USDT.

The advantage of leverage is that with a minimal initial fund of $100 USDT, you can hold a much larger BTC position, specifically $2,500 USDT.

If BTC increases by 25% from the entry price, you will earn a profit of $625 USDT, or 525% of your initial capital, calculated as $100 USDT (margin) x 25 (leverage) x 25% (increase) = $625 USDT.

This leverage applies to both long and short positions. However, it is important to keep in mind that the greater the leverage and margin you use, the higher the potential profit and the greater the risk of loss.

Things to Consider When Using Leverage in Futures Trading

1. Margin

- Margin is the amount of funds that must be deposited by a trader in the exchange in order to open a position with leverage for futures trading. The funds deposited into futures trading serve as a guarantee against potential losses for traders.

- Margin Usage is the amount of funds or collateral used by traders. The greater the use of margin, the higher the risk.

- Maintenance Margin is the amount of funds a trader must maintain to keep an open position. It can also be referred as the minimum amount of funds a trader must have.

- Available Margin is the amount of funds a trader has available and can use to open additional positions. Basically, Available Margin is the result of subtracting the Total Maintenance Margin and Open Order Margin from the Margin Balance.

- Open Order Margin is the amount of margin reserved for open orders that have not been executed.

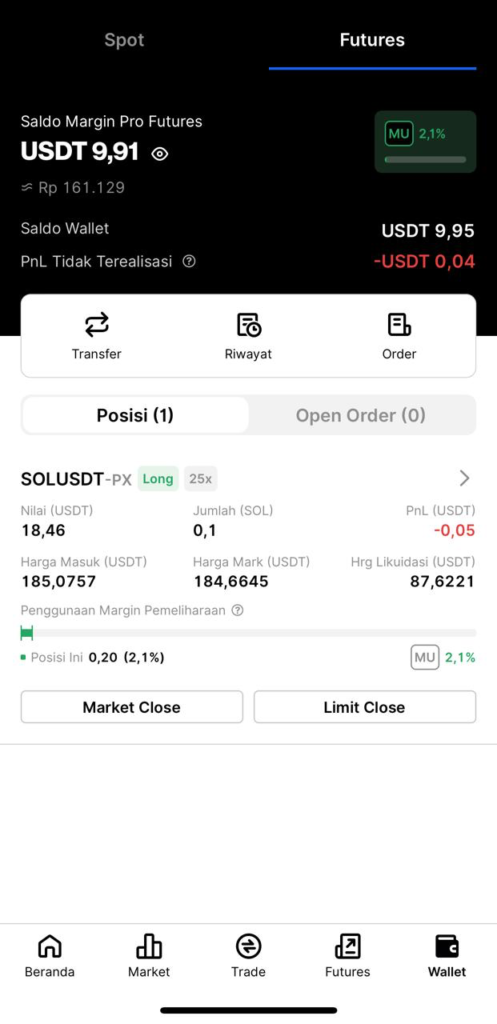

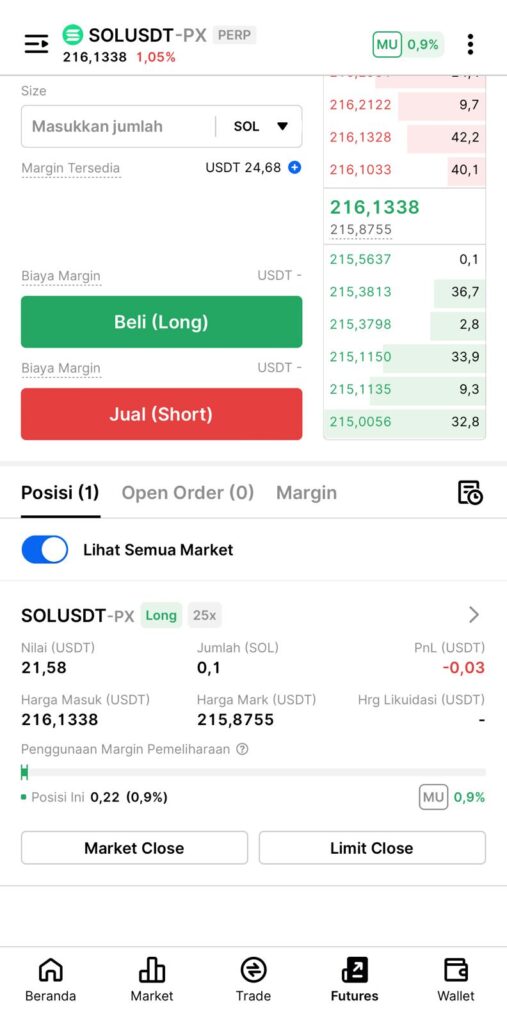

For example, if you have one open position in the SOL asset with 25x leverage worth $18.46 USDT, you need to have $0.18648 USDT as maintenance margin to keep the position open, which is rounded up to $0.2 USDT. The calculation is $18.46 USDT (initial margin) x 1% = $0.2 USDT.

For example, if you have $100 USDT in Available Margin and set aside $10 USDT to open a long position with 25x leverage, your current Available Margin will be $90 USDT. However, if the order has not been executed and you decide to cancel it, the $10 USDT will be returned to Available Margin.

2. Liquidation

Liquidation is the process in which the position you hold will be automatically closed when the usage of margin reaches 100%. Once liquidated, all the funds you have in Pintu Pro Futures will be lost.

Why can liquidation occur?

Excessive use of margin is the main factor that leads to liquidation, because when the market moves against the position taken, the losses incurred can exceed the available margin. In this situation, the system will automatically close the position to prevent further losses.

Stop Loss is a very important tool used in leverage trading because it can prevent traders from being liquidated. In general, a Stop Loss is placed at the maximum loss limit that a trader can tolerate, usually around 1-5% of total capital, with a maximum Margin Usage of 1-5% for a single open position.

3. Discipline in Trading

Discipline in leverage trading in the crypto market is crucial to avoid emotional decisions that can lead to significant losses. Therefore, pay attention to the following points to prevent this.

- Overtrading Avoid overtrading or opening many positions if you cannot manage the use of margin properly. Traders need to manage position sizes carefully and ensure that the margin used does not exceed their risk tolerance limit.

- Create a Two-Way Scenario In leverage trading, the value of assets owned by traders can fluctuate rapidly based on the use of leverage. It is important to note that in Futures Trading, traders can open long positions when the market is bullish and short positions when the market is bearish. Traders should prepare the right strategy for these two scenarios.

- Determine a Trading Plan When creating a plan for Futures Trading, avoid making decisions based on emotions. Traders must create a well-thought-out plan to avoid liquidation due to market uncertainty. Determine entry and exit positions based on analysis, and set profit targets and tolerable loss limits as the key elements to plan before opening a position.

Tutorial on Opening Leveraged Positions in Futures Trading

Interested in opening a leverage trading position but still unsure about how to do it? Don’t worry, here’s a tutorial on opening a 25x leverage trading position on Pintu Pro!

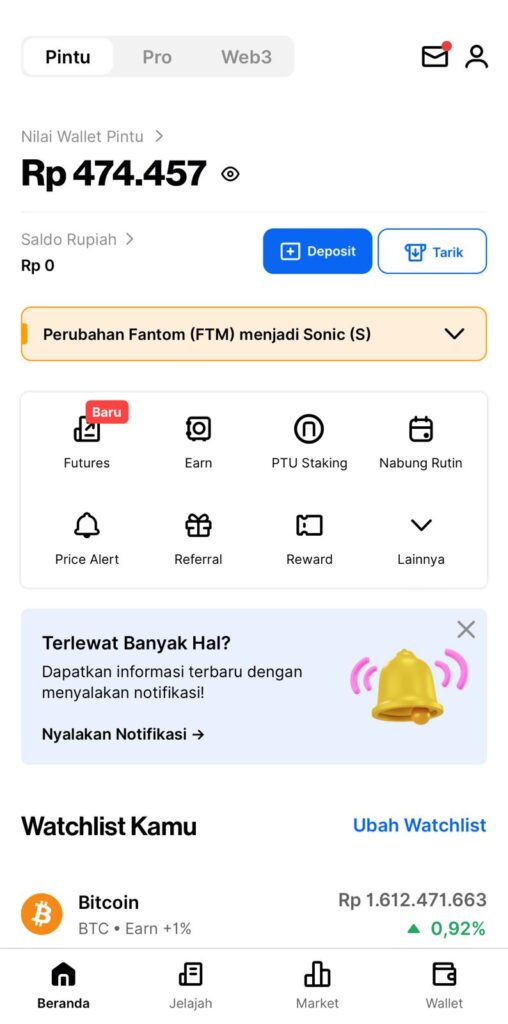

1. Open the Pintu application and select the “Futures” menu on the main page to access perpetual trading with leverage.

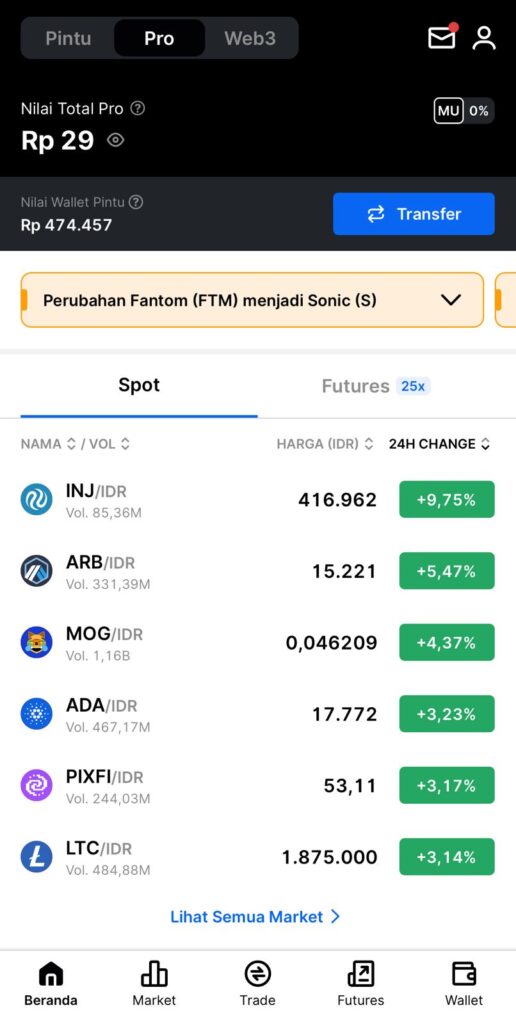

2. Click the “Transfer” menu to transfer your balance from Pintu to Pintu Pro.

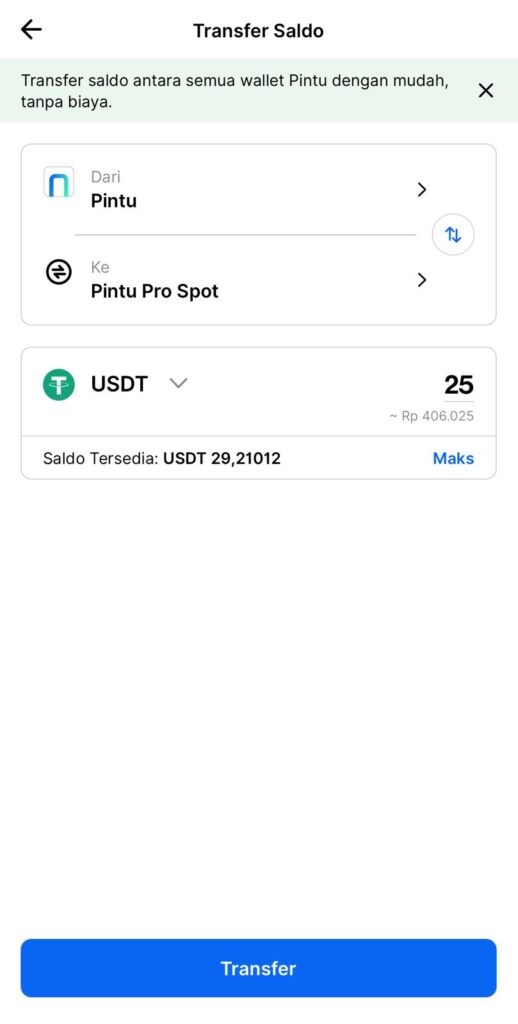

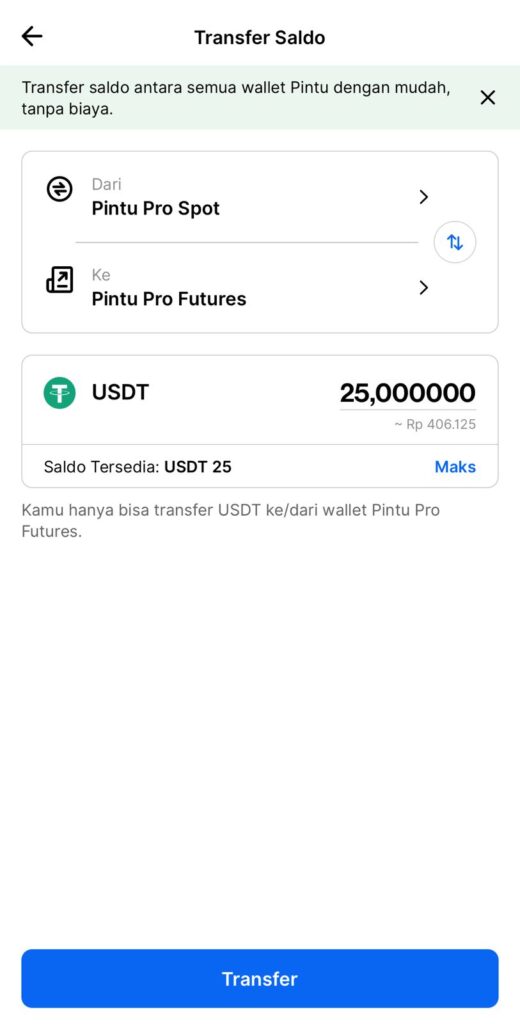

3. Transfer your USDT balance from Pintu to Pintu Pro Spot and click “Transfer.” USDT is required because it is the main pair for trading on Pintu Pro Futures.

4. After the balance has been successfully transferred to Pintu Pro Spot, transfer it to Pintu Pro Futures and select “Transfer.”

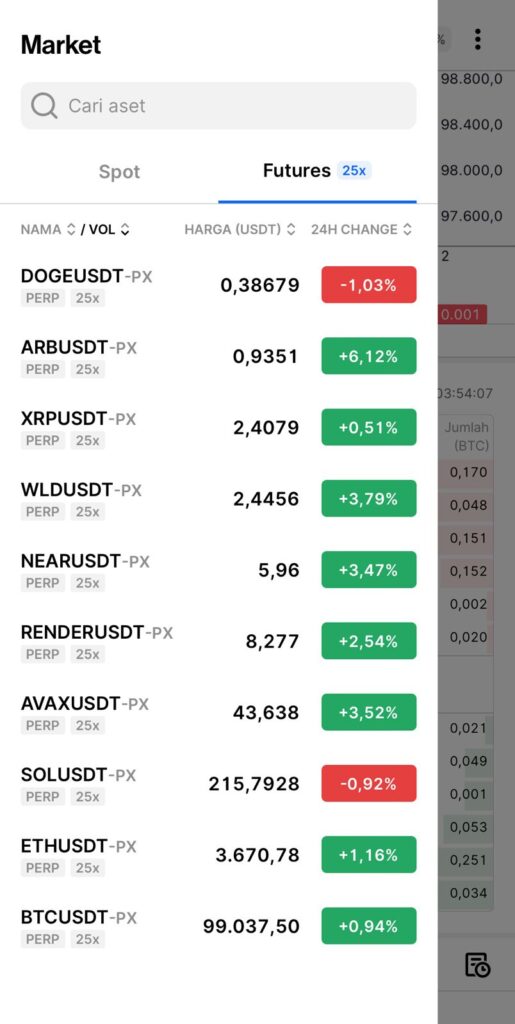

5. Select the “Futures” menu and choose the assets you want to trade with leverage on Pintu Pro Futures.

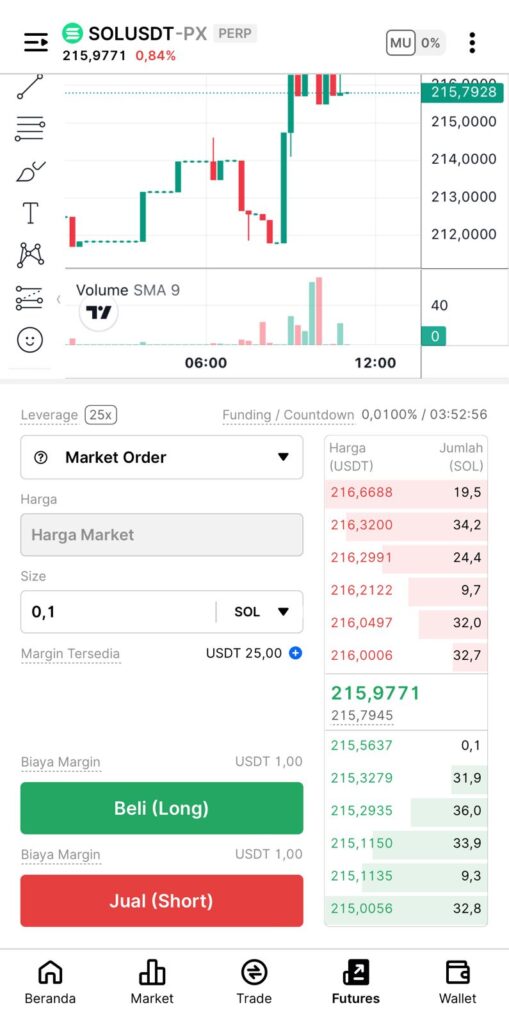

6. Determine the “Size” of the position you want to open, then select long or short.

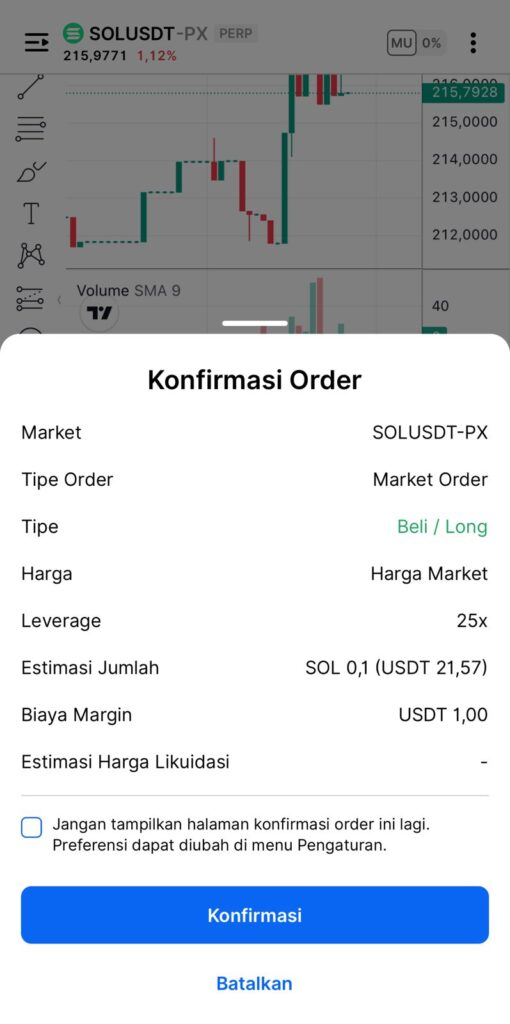

7. Click “Confirm” to approve the position opening. In this example, the margin used is only 1 USDT, and you will open a long position of 0.1 SOL / 21.57 USDT.

8. Done! You have opened a 25x leveraged trading position on Pintu Pro Futures!

Disclaimer: The examples above are for illustration purposes only and do not constitute financial advice or recommendations. Be sure to always conduct your own research when transacting crypto assets. All articles from Pintu Academy are intended for educational purposes only and do not constitute financial advice.

Conclusion

Leverage trading in the crypto market is a tool that allows traders to increase their market exposure with relatively small capital. With leverage, traders can open long or short positions that are several times larger than their initial capital, providing the potential for significant profits. However, leverage also carries a substantial risk of loss, especially if not managed properly.

To succeed in leverage trading, it is essential to understand concepts such as margin, maintenance margin, and liquidation risk. Traders must also implement disciplined risk management strategies, such as avoiding overtrading, creating two-way scenarios, and developing a well-thought-out trading plan.

FaQ

1. What is leverage in crypto trading?

Leverage is a feature that allows traders to open positions larger than their actual capital by borrowing funds from the exchange.

2. How does leverage work on crypto exchanges?

In leveraged trading, the exchange provides additional borrowed funds based on a set ratio (e.g., 10x or 50x), amplifying both potential profits and losses.

3. What is the difference between low and high leverage?

Low leverage offers better risk control and suits conservative traders, while high leverage provides greater profit potential but comes with a higher risk of liquidation.

4. What risks should traders be aware of when using leverage?

The main risks of leverage are rapid liquidation when prices move against a position and potential losses that can exceed the initial capital if risk management is not applied properly.