After reaching an all-time high (ATH) last week, Bitcoin (BTC) has returned to the $100K range following U.S. President Donald Trump’s imposition of tariffs on countries such as Canada, Mexico, and China. However, many investors took advantage of the decline to accumulate BTC and other crypto assets. Read the full analysis by the Pintu Trader Team.

Market Analysis Summary

- 📝 BTC has regained momentum after a four-day decline, supported by a weaker U.S. dollar and increasing institutional interest.

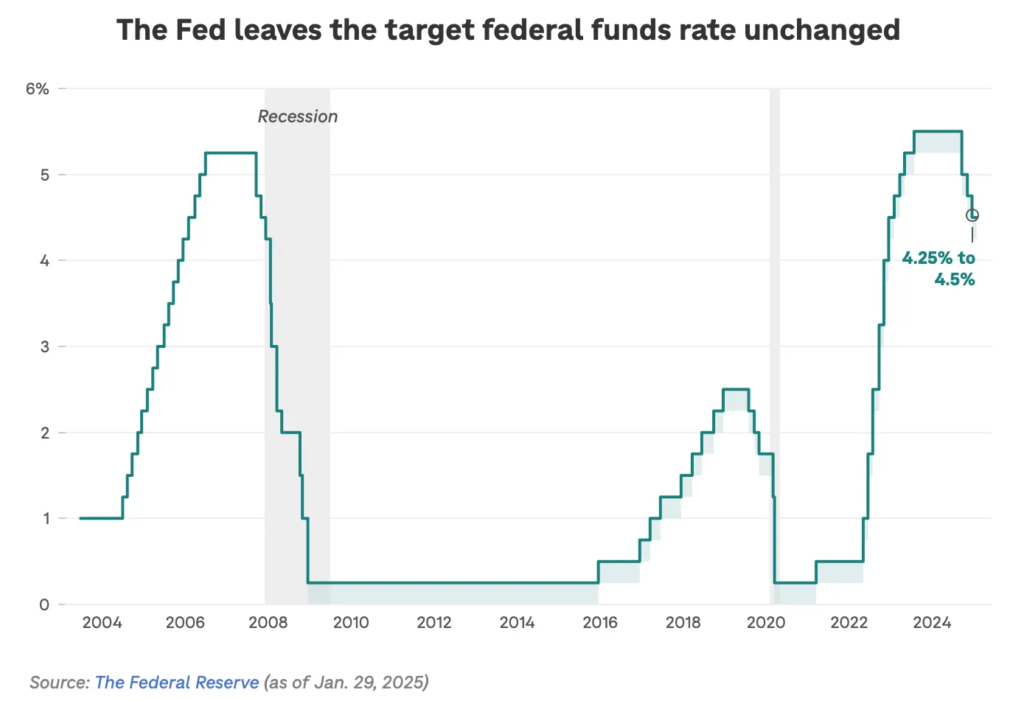

- 🔴 The Fed’s rate-setting committee unanimously voted to maintain the benchmark interest rate within the 4.25% to 4.5% range.

- 🏭 Manufacturing rebounds to expansion at 50.1, while services decline sharply to 52.8, the lowest in nine months.

- 🏠 Home sales rose 2.2% in December to a seasonally adjusted annual rate of 4.24 million units, the highest since February.

- 📉 U.S. durable goods orders fell 2.2% in December, marking the fourth decline in five months and missing market forecasts.

Macroeconomic Analysis

Fed Interest Rate Decision

The Fed kept interest rates unchanged on Wednesday as it continues efforts to control persistent inflation.

Fed policymakers have signaled a cautious approach to future rate cuts, as long as the job market remains strong and prices continue to rise.

The Fed’s rate-setting committee unanimously voted to maintain the benchmark interest rate within the 4.25% to 4.5% range, which influences borrowing costs for car loans, credit cards, and other short-term lending.

While the decision was widely anticipated, it could set up a potential conflict with President Trump, who recently stated that he believes interest rates are far too high.

Since September, the central bank has already reduced its benchmark rate by a full percentage point. However, with inflation remaining stubborn, policymakers are in no rush to implement further cuts. Consumer prices in December rose 2.9% year-over-year, marking a slightly higher increase than the previous month.

At the same time, the labor market has remained robust, with employers adding over 250,000 jobs last month. A weaker job market would likely increase pressure on the Fed to lower borrowing costs to stimulate hiring, but current conditions suggest a more measured approach.

Other Economic Indicators

- S&P Global PMI: The latest S&P Global Flash US PMI data for January reveals a mixed sectoral performance. Manufacturing expanded for the first time in six months, with the PMI climbing to 50.1 from 49.4 in December, reaching a seven-month high. Meanwhile, the services sector saw a sharp slowdown, as the Services PMI fell to 52.8 from 56.8, hitting a nine-month low.

- Michigan Consumer Sentiment: according to the final January report for the Michigan Consumer Sentiment Index, which fell to 71.1. This marks a 2.9-point drop (-3.9%) from December’s final reading of 74.0 and a 10.0% decline compared to the same period last year. The latest figure also came in below expectations of 73.2.

- Existing Home Sales: Home sales rose 2.2% in December to a seasonally adjusted annual rate of 4.24 million units, the highest since February. Since existing home sales are recorded at contract closings, December’s figures likely reflect transactions from at least three months prior, when mortgage rates were lower. Economists polled by Reuters had projected sales to rise to 4.19 million units.

- New Home Sales: New home sales increased by 3.6% in December, reaching a seasonally adjusted annual rate of 698,000 units, according to the Census Bureau. November’s sales pace was revised upward to 674,000 units from the previously reported 664,000 units. Economists surveyed by Reuters had projected sales to rise to 675,000 units.

- Durable Goods: Fresh data from the U.S. Census Bureau shows that durable goods orders declined by 2.2% in December, missing market expectations and marking the fourth drop in the past five months. Total new orders fell by $6.3 billion to $276.1 billion, following a 2.0% decline in November.

- Goods Trade Balance: The U.S. advanced goods trade deficit for December came in at -$122.1 billion, significantly exceeding the -$105.6 billion estimate. This puts the deficit near its 2022 low, which was likely influenced by port strikes. The widening gap appears to be a response to the Trump-era tariffs.

BTC Price Analysis

BTC has regained momentum after a four-day decline, supported by a weaker U.S. dollar and increasing institutional interest. The cryptocurrency’s recovery has been further fueled by discussions in multiple U.S. states about adopting Bitcoin reserves, signaling broader governmental acceptance. However, market sentiment now more cautious after Trump announced new tariffs, potentially fueling global economic uncertainty.

Following President Trump’s inauguration, market optimism surrounding crypto has remained high. The appointment of an interim SEC Chair known for advocating crypto-friendly policies and developing a regulatory framework has been well received by industry enthusiasts.

This week, several U.S. states are considering establishing Bitcoin reserves, a move that could further strengthen the appeal of the world’s largest cryptocurrency and provide price support. On Tuesday, Utah became the second state, following Arizona, to approve the Strategic Bitcoin Reserve Bill. If the bill is enacted, it could encourage other states to follow suit.

Currently, around 11 U.S. states are exploring Bitcoin’s inclusion in their strategic reserves, with many considering allocating up to 10% of their total funds. This reflects the growing recognition of Bitcoin as a viable asset in government portfolios.

In a related development, Grayscale has launched the Bitcoin Miners ETF, providing investors with a straightforward way to gain exposure to Bitcoin mining companies and the global mining industry. David LaValle, Grayscale’s Global Head of ETFs, emphasized that Bitcoin miners are essential to the network and are poised for significant growth as Bitcoin adoption expands, making the ETF an attractive option for investors.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to rise, it indicates higher selling pressure. Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

- 💻 Miners: Miners’ are selling more holdings compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- ⛓️ On-chain: More investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Long term holders’ movement in the last 7 days were lower than the average. They have a motive to hold their coins. Investors are in a belief phase where they are currently in a state of high unrealized profits.

- 🏦 Derivative: Long position traders are dominant and are willing to pay to short traders. Selling sentiment is dominant in the derivatives market. More sell orders are filled by takers. As open interest decreases, it indicates investors are closing futures positions and possibility of trend reversals. In turn, this might trigger the possibility of long/short-squeeze caused by sudden price movement or vice versa.

- 🔀 Technicals: RSI indicates a neutral condition. Stochastic indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

News About Altcoins

- XRP Poised for an Uptrend with a $4 Target Amid US Regulatory Changes. XRP remains in the red, but recent market developments suggest a potential trend reversal. Ripple CEO Brad Garlinghouse has highlighted several positive advancements, including regulatory shifts in the US and growing institutional interest, such as the XRP ETF filings by WisdomTree and CoinShares. 1 Furthermore, the launch of the RLUSD stablecoin and the increasing adoption of the XRP Ledger have strengthened market optimism. 2 While XRP is currently trading around $3.04 with an RSI of 57, analyst Dark Defender emphasizes the importance of the $3.07 support level to sustain the uptrend, with a short-term target of $4 and potential growth to $5 in the near future

News from the Crypto World in the Past Week

- Global Markets Turmoil as Trump’s Tariffs Send Bitcoin Below $97K. U.S. President Donald Trump’s announcement of new tariffs on Canada, Mexico, and China has shaken global markets, causing U.S. stock futures to plummet and triggering massive liquidations in the crypto market. Dow, S&P 500, and Nasdaq futures dropped 1.2%, 1.9%, and 2.7%, respectively, while Bitcoin and Ethereum fell by 5% and 10%, with XRP and Dogecoin plunging 19%. The tariffs have sparked inflation concerns, potentially prolonging high interest rates throughout 2025, hindering economic recovery, and worsening conditions for the crypto market. Some analysts predict continued volatility, while others believe negotiations could ease trade tensions sooner than expected.

- El Salvador Continues to Increase Bitcoin Reserves Amid IMF Pressure. El Salvador once again expanded its Bitcoin holdings by purchasing two BTC on February 1, bringing the country’s total reserves to 6,055 BTC, valued at over $612 million. Despite repealing the law that required businesses to accept BTC as payment to secure a $1.4 billion loan from the IMF, the country remains committed to its Bitcoin reserve strategy. The government has even accelerated its BTC acquisitions, with plans to increase purchases in 2025. This strategy has caught the attention of the crypto community, including Fidelity Digital Assets, which sees El Salvador’s approach as a potential catalyst for broader Bitcoin adoption by other nations in the future.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- MANTRA (OM) -0.64%

Cryptocurrencies With the Worst Performance

- Virtuals Protocol (VIRTUAL) -37.10%

- Artificial Superintelligence Alliance (FET) -36.46%

- Render (RENDER) -36.14%

- Worldcoin (WLD) -34.49%

References

- Rupam Roy, XRP Price Targets $4 Rally As Ripple CEO Highlights Major Good News, Coingape, accessed on 2 February 2025.

- Vince Quill, El Salvador purchases 2 additional BTC in a single day, Cointelegraph, accessed on 2 February 2025.

- Sebastian Sinclair, Trump’s Tariffs Shake Markets: Dow Futures Slide, Crypto Liquidations Top $2B, decrypt, accessed on 3 February 2025.