The massive development of artificial intelligence (AI) technology has had a revolutionary impact on various sectors. According to data recorded by allaboutai, the AI agent market is predicted to grow exponentially, with a valuation reaching $47.1 billion by 2030.

The integration of AI and blockchain (AI x Crypto) is becoming stronger, opening up opportunities for developers to innovate in the development of AI agents—autonomous systems capable of making decisions based on data.

Although still experimental, AI agents have shown great potential in increasing efficiency, reducing human bias, and creating more accurate—data-driven solutions. This article provides an in-depth analysis of AI agents to help you understand this sector.

Article Summary

- AI Agent: A software system designed to extract data, recognize patterns, and perform logical reasoning before making decisions or taking actions based on information analysis.

- General AI Agent Adoption Trends: According to AllAboutAI data, 2025 is predicted to be a pivotal year for the adoption of AI agents across various industries.

- AI Agent Trends in the Crypto Sector: This trend has shown significant growth in 2024.

- AI Agent Framework and DeFAI Analysis: A discussion on AI agent frameworks such as Virtual and ElizaOS, each offering a distinct approach to AI agent development. Additionally, the integration of DeFAI (Decentralized Finance + AI) enables more efficient automation of investment strategies and crypto asset management.

What is an AI Agent?

An AI agent is a software system designed to extract data, identify patterns, and perform logical reasoning before making decisions or taking actions based on information analysis. This concept is fundamentally different from conventional bots, which operate solely through static instructions and are limited to pre-programmed scenarios without the ability to adapt independently. You can learn more about AI agents in the following article, click this.

According to Franklin Templeton, AI agents demonstrate significant potential and have the capability to revolutionize various industries, particularly the crypto sector. However, it is important to note that AI agent innovation extends beyond crypto and plays a crucial role in several other sectors as well.

General AI Agent Adoption Trends

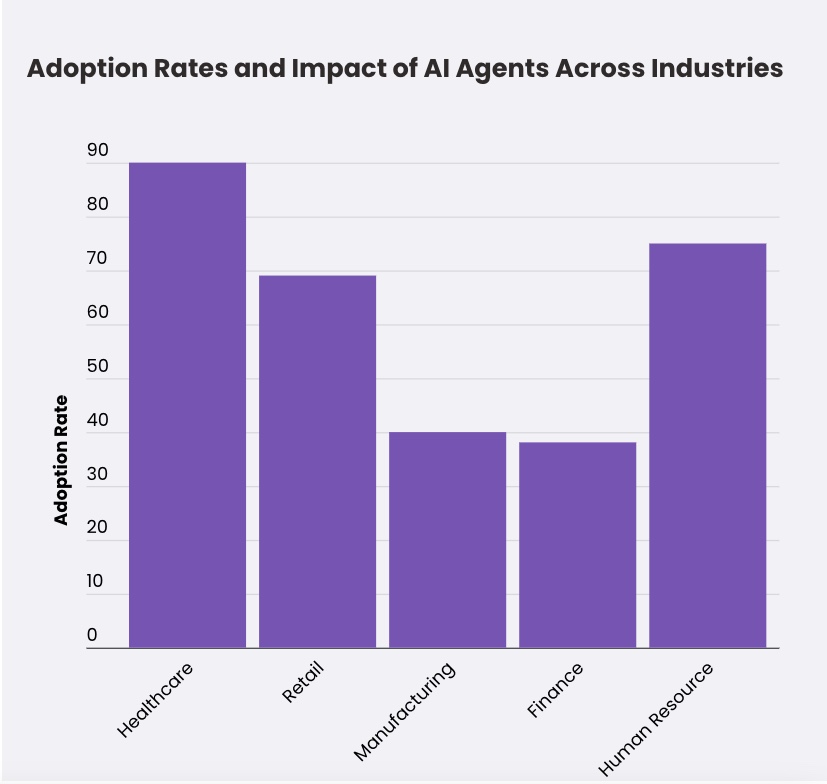

According to data from allaboutai, 2025 is predicted to be a pivotal year for the adoption of AI agents across various industries, including Healthcare, Manufacturing, Finance, Human Resources, and Retail.

- Healthcare: AI agent adoption has reached a high of 90%, enhancing patient care outcomes.

- Human Resources: Adoption has reached 75%, significantly improving the efficiency of candidate screening processes.

- Retail: 69% of retailers that have adopted AI agents have experienced significant revenue growth, driven by enhanced service personalization and predictive analytics that support their business strategies.

- Manufacturing: AI-powered predictive maintenance has reduced downtime by up to 40% in the manufacturing sector, leading to greater operational efficiency and cost savings on repairs.

- Finance: The financial industry has achieved a 38% increase in profits through AI agent adoption, primarily due to improved fraud detection and accurate risk assessment.

Trends and Developments of AI Agents in the Crypto Sector

1. AI Agent Infrastructure

- Virtual

The trend of AI agents in the crypto sector has shown significant growth in 2024, particularly in AI agent frameworks such as Virtual. Virtual is an AI agent framework project launched on the Base blockchain network, enabling anyone to create and develop AI agents tailored to their needs without requiring coding skills. Although Virtual makes it easy to create AI agents, it has limitations in customizing the AI agents that are built.

As of this writing, a total of 16,688 AI agents have been released through Virtual, with the highest number of AI agent launches reaching 1,350 on November 30, 2024.

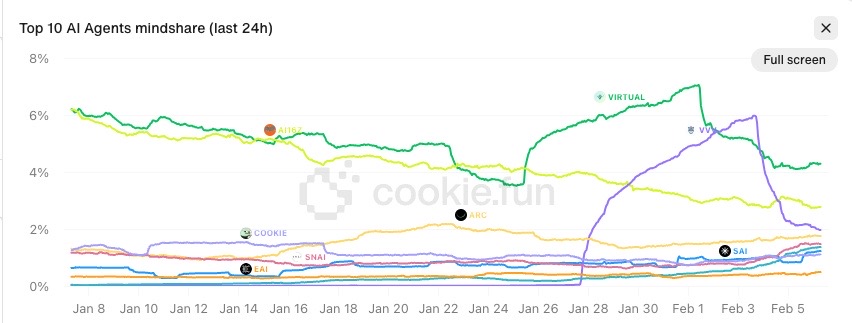

Compared to its competitors, such as ai16z—now rebranded as ElizaOS—Virtual leads in total mindshare by 4.29%. This means that discussions about Virtual remain active on social media, reflecting a high level of community engagement and growing interest in the project. This suggests that Virtual remains one of the leading AI agent projects in the blockchain ecosystem, particularly on the Base network.

- ElizaOS

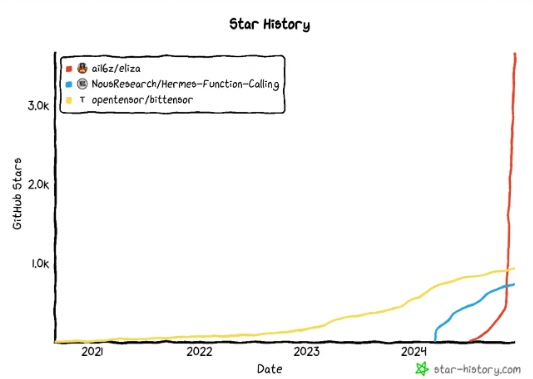

ElizaOS is an open-source AI agent framework that offers greater customization capabilities than Virtual. However, it is primarily designed for developers with programming expertise, as it allows them to customize and integrate AI agents more flexibly while benefiting from strong community support.

Additionally, the growing popularity of ElizaOS on GitHub—reaching over 13,000 stars and more than 4,000 forks—demonstrates the high level of interest and participation from developers in its ecosystem, making it one of the most actively developed AI agent frameworks today. However, as of this writing, there is no exact figure on the number of AI agents created using ElizaOS.

Market Capitalization vs Smart Engagement

- Overall Market Performance:

- The current total market cap stands at $2.2 billion, reflecting a -6.5% decline in the last 24 hours. This suggests a general market squeeze or correction.

- Smart Engagement:

- The current Smart Engagement is 1.04k, marking a -4.33% decrease in the last 24 hours. This could indicate reduced activity or waning interest from users or investors.

- Virtuals Protocol Dominance and Performance:

- Virtuals Protocol has a market cap of $840.53 million, a -6.17% in the last 24 hours. This may suggest that the asset is under selling pressure.

- Dominance and Performance of ai16z/ElizaOS and Other Ecosystems:

- The ai16z/ElizaOS ecosystem has a market capitalization of $345.04 million, reflecting -9.79%. Meanwhile, AI agents in other ecosystems have a market capitalization of $28.82 million, reflecting an -11.16% decline in the last 24 hours. This data highlights the performance gap between large and small ecosystems.

- Trend Analysis:

- Trends can be evaluated based on available data—for example, determining whether the decline is temporary or indicative of a long-term pattern. Additionally, comparing market capitalization to the number of AI agents can offer further insights into market conditions.

2. DeFAI (Decentralized Finance + AI)

DeFAI is the integration of Decentralized Finance (DeFi) and AI, enabling AI agents to autonomously interact with DeFi applications to conduct project-related analysis, execute transactions, manage portfolios, and optimize investment strategies based on real-time data. These AI agents can provide more accurate and adaptive decisions in response to market changes, making DeFi more accessible to the general public.

- The Average FDV-to-Fees Ratio (5.1x) serves as a benchmark for DeFAI, with significant variations among comparable protocols:

- Across (5.4x) and Kwenta (6.0x) have above-average multiples, indicating higher growth expectations or strong market confidence.

- Banana (3.8x) has the lowest multiple, suggesting lower perceived risk or growth potential from investors.

- Griffain and Hey Anon (5.1x) are in line with the average, reflecting stable valuations.

- Relationship Between FDV and Annualized Fees:

- While Across and Banana have the highest Annualized Fees ($72.5 million and $77.9 million), their FDVs are disproportionate, suggesting that other factors influence their valuations.

- Kwenta, despite having relatively low Annualized Fees ($2.5 million), maintains a high multiple (6.0x), indicating that its valuation is driven by unique potential or distinct advantages within its protocol.

- Implications for DeFAI:

- DeFAI’s fee estimates are based on an average multiple of 5.1x but must account for variations and qualitative factors—such as product differentiation, roadmap, and competitive risks—to ensure an accurate valuation.

DeFAI Coins Outlook

Trend Analysis:

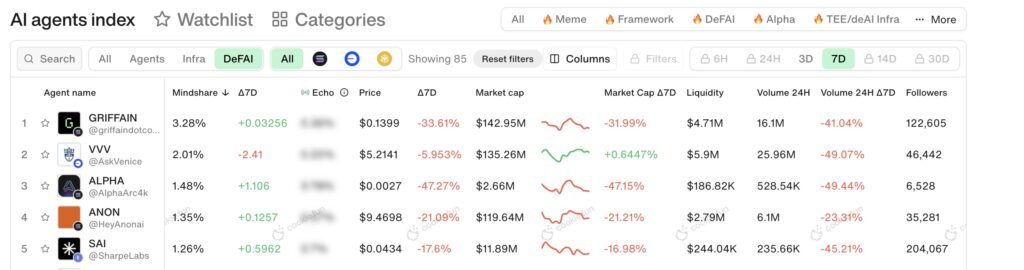

- Griffain leads in mindshare, indicating significant popularity and influence in the DeFAI market, despite a substantial decline in market capitalization, which has dropped by 31.99% over the past seven days.

- SAI has the largest follower base among the five DeFAI coins, totaling 204,067.

- The five DeFAI coins with the highest mindshare have experienced a significant decline in transaction volume over the past seven days.

- Data indicates that selling pressure and market corrections have also affected coins in this category, leading to a substantial decrease in market capitalization over the past seven days.

- Despite declining value and trading volume, interest in DeFAI projects remains high, suggesting that the ecosystem is still in its early growth stage and has the potential to recover as technology advances and adoption expands.

Disclaimer: All articles from Pintu Academy are intended for educational purposes only and do not constitute financial advice.

Conclusion

AI agents are emerging as an innovation that extends beyond the broader technology landscape and has now begun to penetrate the crypto sector with rapid development. Frameworks such as Virtual and ElizaOS demonstrate an increasing adoption trend, each offering distinct advantages in terms of ease of creation and flexibility in AI agent development.

Although the AI agent market in crypto is still in its early stages, data indicates that community interest and engagement in AI projects continue to grow. However, market fluctuations, selling pressure, and corrections within this ecosystem highlight its dynamic nature and susceptibility to change.

Additionally, the concept of DeFAI (Decentralized Finance + AI) strengthens the synergy between AI and the DeFi ecosystem, enabling AI agents to automate investment strategies and manage crypto assets more efficiently. However, challenges related to market volatility and uncertainty remain key factors to consider.

Overall, AI agents in the crypto sector hold significant potential to revolutionize how users interact with digital assets. However, broader adoption and continued development are necessary to enhance the stability, security, and reliability of this technology in the long run.

References

- Dave Andre, “AI Agents Statistics for 2025: Market Impact & Industry Insights,” All About AI, accessed February 6, 2025.

- Kinji Steimetz, Sam Ruskin, “DeFAI: The Efficiency Frontier,” Messari, accessed February 6, 2025.

- Andrew Dyer, “Framework Fortresses: How Infrastructure Secures Its Place in the AI Agent Stack,” Messari, accessed February 6, 2025.

- Franklin Templeton Digital Assets @FTDA_US, “Intersection of AI Agents & the Crypto Ecosystem,” X (formerly Twitter).