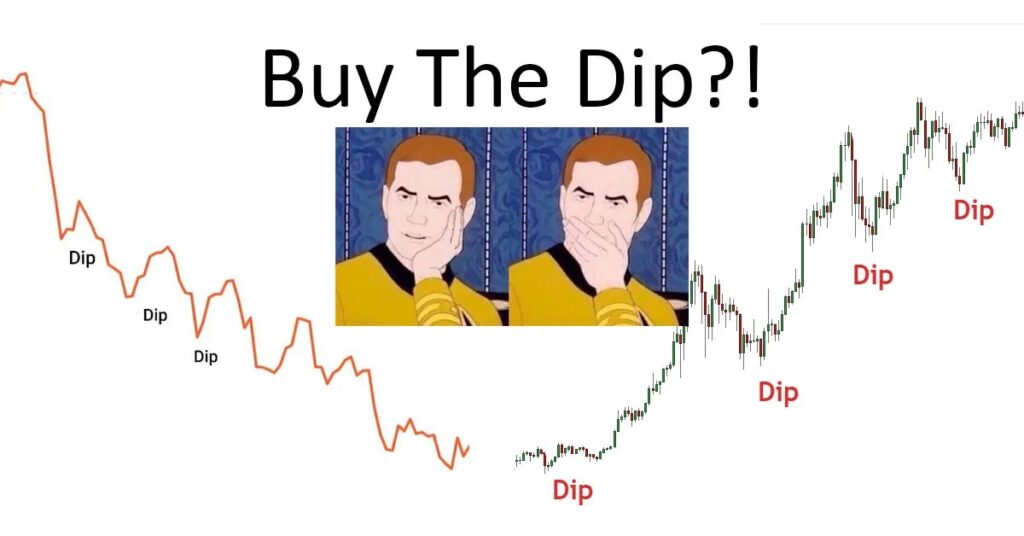

The crypto market has been in a downtrend since the middle of January 2025. A combination of bad macroeconomic conditions and Trump’s tariff war has sent the crypto market spiraling down. Investors and traders who buy the dip have been punished heavily as the market keeps crashing at every sign of negative news. We will explain how to implement the buy the dip strategy.

Key Takeaways

- How to buy the dip: The “buy the dip” strategy relies on identifying genuine market corrections within an overall uptrend. Not all dips are buying opportunities—proper analysis is needed to differentiate between temporary pullbacks and prolonged downtrends.

- Identifying patterns for buying the right dip: Effective use of chart patterns such as rounding bottoms, Wyckoff accumulation phases, and buying dips in a confirmed uptrend can signal favorable entry points. These patterns, combined with technical indicators like EMA, RSI, and Fibonacci retracement, help pinpoint when to buy.

- Risk Management when buying the dip: Successful dip buyers use techniques such as stop-loss orders, Dollar-Cost Averaging (DCA), and avoiding going all in at once. These measures help protect against severe market downturns if the dip continues longer than anticipated.

- Adapting to Market Conditions is Key: Buying the dip works best in bull markets where corrections are temporary and the overall trend is upward. In a downtrend, you need a proper strategy before buying the dip.

What is the Buy The Dip Strategy?

Buy the dip is an investing and trading strategy commonly used in cryptocurrency and equity markets. It refers to a simple strategy of buying when the price falls and the expectation that it will recover. In the volatile crypto market, ‘buy the dip’ is one of the most popular terms and investing strategies. This is especially popular among newbie investors as it is simple to execute.

When executed right, the buy the dip strategy provides investors and traders with potential entry points for high-quality assets. However, executed badly and it will net you significant losses from buying all the way into a downtrend.

A good buy-the-dip strategy buys the correction within a strong uptrend and profits before the trend breaks down. The example below shows how profitable it is to buy the SOL dip throughout 2024. It is a good example of how to buy the dip in a bull market.

Buying the dip on SOL in 2024.

When to Buy the Dip?

In order to profit from using this strategy, you need to buy the correct dip. A lot of people just blindly buy each dip without any sort of strategy or analysis. This is why people often buy into a downtrend instead of just a dip. Not every dip should be bought.

Buy the right dip. Source: Dr. wealth.

So, when to buy the dip? The simple answer will be to buy the dip in a clear uptrend momentum. You can identify strong uptrend momentum through technical analysis, looking at volume, reading general market sentiments, or simply analyzing Bitcoin’s chart. However, when you try to buy the dip in a downtrend, you need to identify clear patterns instead of blindly catching a falling knife (the left chart above).

Risk Management When Buying the Dip

- Use stop loss: Using stop loss around major support or around your risk tolerance is a good way to prevent significant losses when the market suddenly shows weakness.

- Technical analysis: Technical analysis will help you identify momentum and dictate when to buy the dip (or not). This is also useful to map out key areas of support and resistance.

- Don’t go all in: For newbie traders and investors, buying the dip should be executed gradually using DCA or other strategies. This is done to prevent significant losses if our assumption is wrong.

- Knowing when to stop: When the dip you bought keeps dipping and the market continues to show weakness, you need to reevaluate. Buying the dip in a downtrend is a recipe for disaster (unless you are a long-term investor).

3 Chart Patterns and Strategy for Buying the Dip

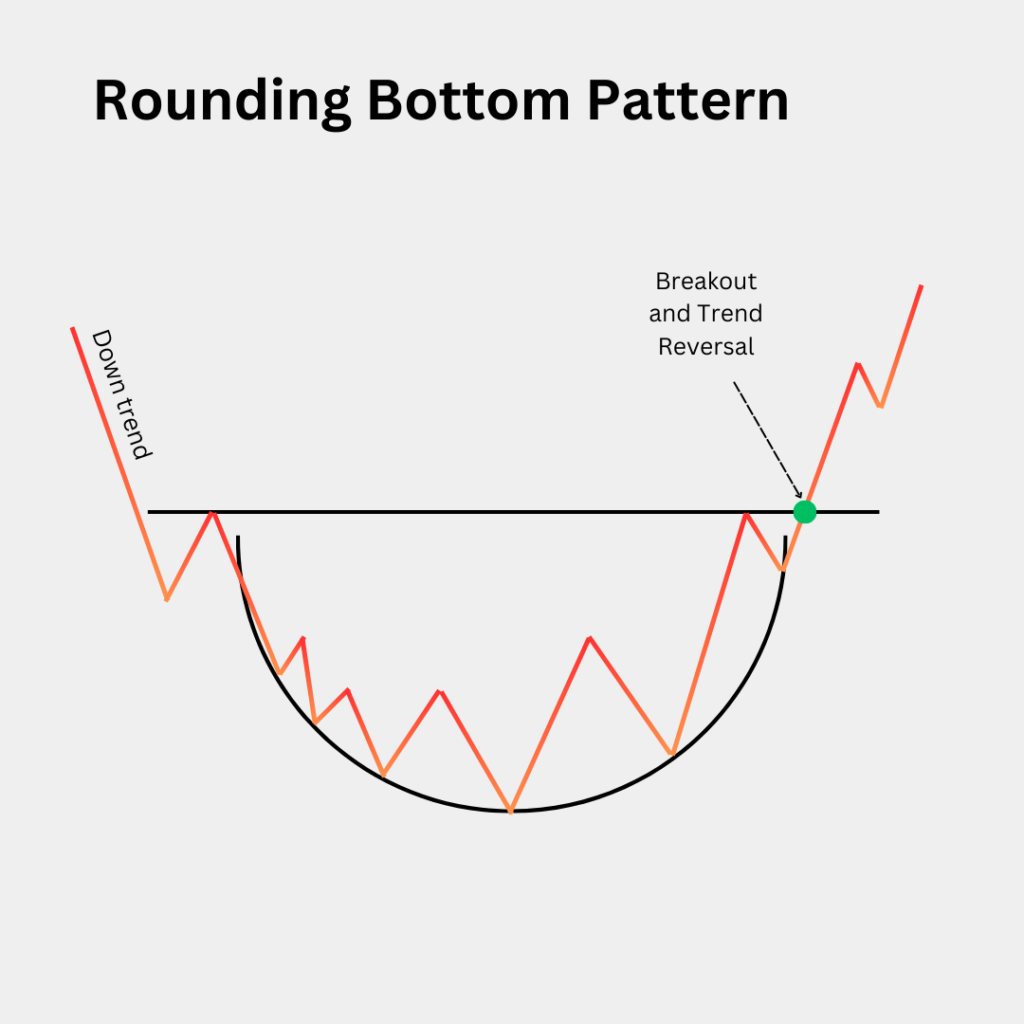

1. Rounding Bottom

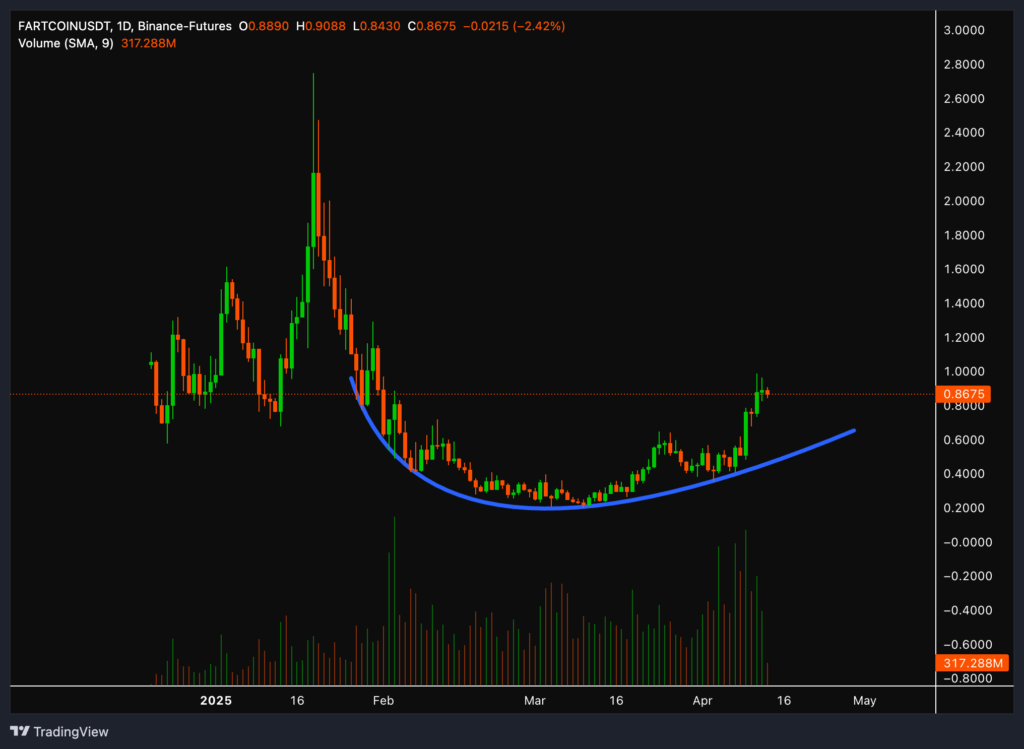

A rounding bottom is a chart pattern often formed during a downtrend. Rounding bottoms are found at the end of an extended downtrend and signal price reversal. Visually, the pattern can be seen in the shape of a “U”. It is also called a rounding bottom pattern because of the simplicity of the price movement (higher low followed by higher high).

In a rounding bottom pattern, the recovery of the asset is slow and steady. Price often fluctuates near the low of the chart, forming a higher low slowly while approaching previous resistance. Additionally, watch out for other patterns within the rounding bottom, such as a double bottom.

So, how do you trade a rounding bottom pattern? With a buy the dip strategy, all you have to do is buy the higher low within a rounding bottom. DCA-ing every time a higher low forms is also a sound strategy. Additionally, you can set your stop loss on the previous higher low or the local bottom.

Two examples of rounding bottom forming on CRV and FARTCOIN:

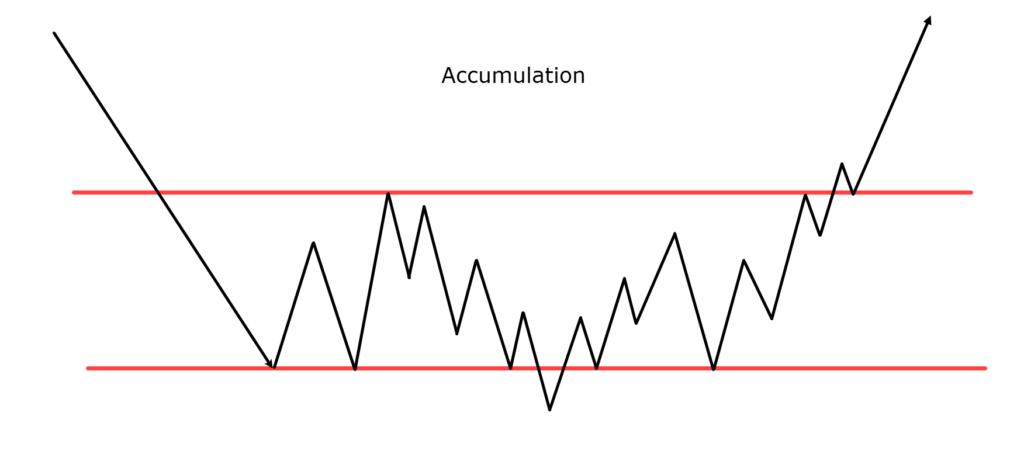

2. Buying on Wyckoff Accumulation

According to Richard Wyckoff’s theory, the accumulation phase happens after an asset suffers a prolonged downtrend and the price finally stabilizes. In an accumulation, price consolidates and settles in a range (sideways). However, Wyckoff argues that smart money traders will accumulate the asset within this phase.

The Wyckoff accumulation phase is more similar to a general phase where various patterns can emerge. In this phase, the asset can look like a rounding bottom pattern or form other patterns such as triple bottom, V-reversal, double bottom, or even cup and handle. An important aspect for the accumulation stage is that volume stabilizes and/or starts to rise again.

Trading a Wyckoff accumulation phase using the buy the dip strategy is similar to the rounding bottom pattern. Higher low on the chart is a potential buy trigger, while stop loss should be set at previous support or the local low (to anticipate potential breakdown).

Example of a potential Wyckoff accumulation phase in ENA:

3. Buying the Dip in an Uptrend

Implementing a buy the dip strategy in a strong uptrend is the ideal scenario. In an uptrend, pullbacks are usually temporary, and the price will eventually resume the trend. As seen above, buying on the big dip below $2 on SUI will give you more than 150% profit (if you sell at around $5).

You can use various tools to identify a strong uptrend, such as EMA (Exponential Moving Average), Fibonacci Retracement, or RSI (Relative Strength Index). We can say SUI is still in an uptrend despite the dip because the price pulls back into the 50-day EMA and immediately creates a higher low and higher high.

An uptrend is basically where the price always creates higher highs and higher lows. So, when price finally fails to create these, a potential trend break might occur.

So, trading an uptrend using the buy the dip strategy is fairly simple. Use EMA or Fibonacci to determine a strong support area when the correction happens. After buying the dip, you need to determine a profit-taking strategy because the trend will break at some point.

Conclusion

The “buy the dip” strategy can be a powerful method for acquiring high-quality assets at lower prices, especially during a strong uptrend. By harnessing technical analysis to identify key chart patterns and implementing risk management, investors can position themselves to benefit from market rebounds. However, success with this strategy depends on discerning the right moments to enter and maintaining a disciplined approach. Ultimately, a well-executed buy-the-dip strategy balances patience and precision, making it a viable tool for both new and experienced traders aiming to capitalize on market corrections.

Buy Cryptocurrencies on Pintu Pro Web!

Interested in investing in cryptocurrency? Through Pintu, you can buy cryptocurrencies such as BTC, ETH, and many others without the fear of scams. Furthermore, you can buy them directly in your browser through: https://pintu.co.id/pro/id/markets. In Pintu Pro web, you can trade both Futures and spot!

The Pintu app is also compatible with popular digital wallets such as MetaMask, making your transactions even more convenient. Go ahead and download the Pintu app on the Play Store or App Store today! Your security is guaranteed, as Pintu is regulated and supervised by OJK and CFX.

In addition to trading, Pintu also allows you to learn more about crypto through a wide range of articles on Pintu Academy, updated weekly!

All articles from Pintu Academy are intended for educational purposes only and do not constitute financial advice.

References

- The DeFi Investor, “When to buy the dip?”, Substack, accessed on April 7 2025.

- Kriptomat, “Should You Buy Crypto During a Market Dip?”, accessed on April 8, 2025.

- @fejau_inc, “Just a piece of advice here for people trying to buy the dip When we see liquidations of this magnitude, there’s a couple of things that often happen”, X, accessed on April 8, 2025.

- @TraderMercury, “”I bought the dip!” no, you didn’t. you bought a downtrend. know the difference”, X, accessed on April 9, 2025.

- Archana Chettiar, “Rounding Bottom Pattern: A Complete Guide,” Equentis, accessed on April 10, 2025.

- TradingwithRayner, “Wyckoff Theory For Beginners (The Definitive Guide),” accessed on April 11, 2025.

- Lenka Fetyko, “Maximizing Profits: The Strategy of Buying Dips in an Uptrend,” altFINS, accessed on April 14, 2025.