In the ever-evolving Solana ecosystem, Kamino Finance has emerged as an innovative platform that enhances the DeFi experience. Kamino offers various financial products such as lending, borrowing, and yield farming strategies with high flexibility.

So, what is Kamino, its key features, and the optimal strategies that can be used to maximize profit potential? Read on to find out.

Article Summary

🏦 Kamino Finance: Kamino is a DeFi platform on the Solana network that combines automated liquidity management, lending markets, and leverage farming into one integrated ecosystem.

⚡ Key Features of Kamino: Kamino offers features like automated liquidity provisioning, stablecoin and SOL lending, and Multiply — a leverage farming feature based on liquidity pools.

📈 Multiply Strategy on Kamino: Users can use Multiply to enlarge positions in liquidity pools through leverage, increasing yield potential, but with liquidation risks that should be carefully managed.

What is Kamino Finance?

Kamino Finance is a DeFi platform built on Solana that provides decentralized lending and investment products. The main focus of Kamino is to integrate automated yield farming, lending markets, and leverage strategies based on liquidity pools within a single platform.

Initially, Kamino was known as a concentrated liquidity management protocol for decentralized exchanges (DEX) like Orca and Raydium. Now, Kamino has evolved into a one-stop liquidity layer that combines swap, lending markets, and leverage farming. With automation, Kamino enables users to optimize liquidity and investment returns without having to manually manage their positions.

Key Features of Kamino Finance

Some key features of Kamino Finance include:

- Automated Liquidity Management Kamino automatically manages user liquidity within a concentrated liquidity-based pool, maximizing yields (APR) without the need for manual rebalancing.

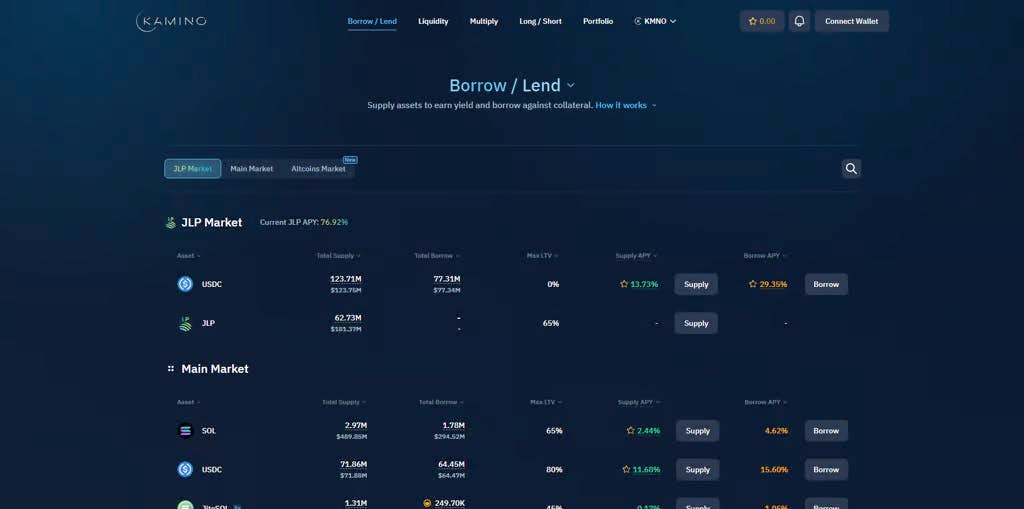

- Lending and Borrowing Market Kamino offers opportunities to earn interest from stablecoins like USDC, USDT, and other assets like SOL.

- Multiply (Leverage Farming) The Multiply feature allows users to earn higher returns through leverage farming, using looped lending methods to increase yield.

What Can You Do on Kamino?

Here are the main activities you can do on Kamino:

- Earn Interest from Stablecoins Lend USDC, USDT, and other stablecoins to earn passive interest with relatively low risk.

- Lend SOL and Other Assets Lend other crypto assets like SOL to earn additional returns.

- Use the Multiply Feature Open leverage positions in liquidity pools to increase the returns you earn.

- Provide Liquidity You can provide liquidity in Kamino for various liquidity pools and earn interest.

Optimal Strategy on Kamino: Leverage Multiply on JLP

One optimal strategy is to use Multiply on JLP (Jupiter Liquidity Provider). Multiply is Kamino’s leverage farming feature that allows users to increase exposure to their chosen liquidity pools by using borrowed funds. This boosts yield potential but also increases liquidation risk.

💡 JLP is the token liquidity pool in Jupiter Perps, which consists of combined liquidity from SOL, ETH, WBTC, USDC, and USDT. JLP has a relatively stable price because the JLP Pool in Jupiter acts as an automated market maker in Jupiter Perps.

Multiply allows users to increase positions in selected liquidity pools using borrowed funds. By utilizing the Solana Concentrated Liquidity Layer, the yield generated can be higher compared to regular pools. With the JLP pool, as of April 23, 2025, users can earn a 48% return using Kamino’s Multiply feature.

However, it is important to consider risks such as:

- Liquidation risk if there is high volatility.

- Potential losses that increase with leverage.

The Multiply strategy is suitable for experienced users who are prepared to manage risks in the DeFi ecosystem.

What Are the Risks When Using Multiply on Kamino?

The main risk of Multiply is liquidation if asset prices move sharply in the opposite direction. Additionally, high volatility in the Solana crypto market can exacerbate losses, especially when excessive leverage is used.

Can Kamino Be Accessed Only Through Solana Wallets?

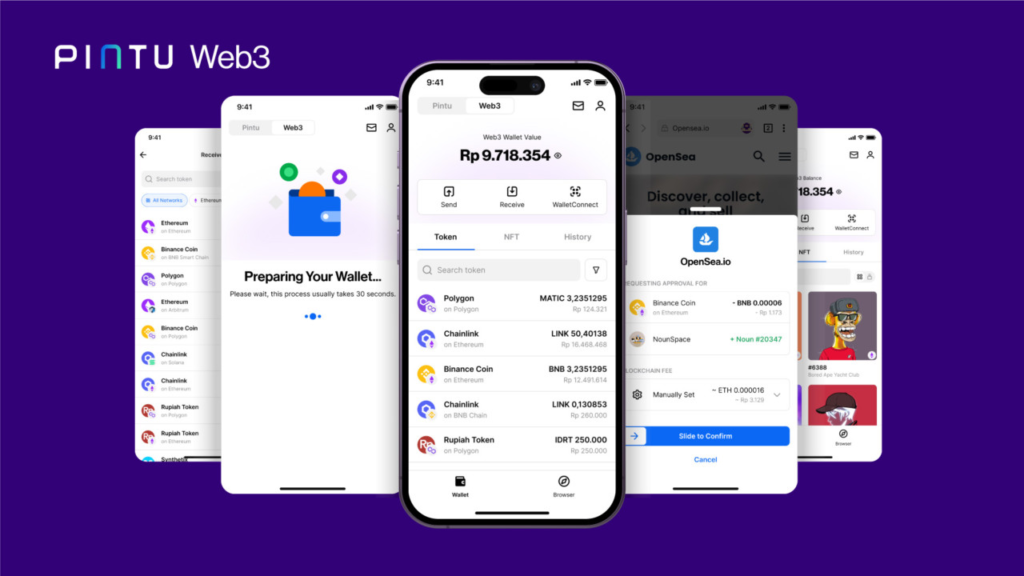

Kamino Finance is based on the Solana ecosystem, so you need to use a Solana wallet (such as Phantom, Backpack, etc.) to access it. However, you can also access Kamino Finance directly through the Pintu app via Pintu Web3.

How to Access Kamino Finance via the Pintu Web3 App

Now, users can access Kamino more easily through Pintu Web3. Here’s how:

- Open the Pintu app and go to the Pintu Web3 menu.

- Search for Kamino Finance in the list of available apps.

- Connect your Solana wallet through Pintu Web3.

- Start exploring lending, borrowing, and leverage Multiply services directly from the app.

With Pintu Web3, users can access Kamino directly and securely without the need for additional wallet extensions, while enjoying a more integrated DeFi user experience within a single app.

Conclusion

Kamino Finance offers a range of exciting features in the Solana DeFi space, from automated liquidity to leverage farming. With easy access through Pintu Web3, Kamino is an attractive option for users looking to maximize their crypto asset potential. Be sure to understand the risks before getting started, especially when using leverage.

Download the Pintu cryptocurrency app from the Play Store and App Store! Your security is guaranteed as Pintu is registered and supervised by the Financial Services Authority & CFX.

In addition to transactions, you can also learn crypto more through various articles on Pintu Academy, updated weekly! All Pintu Academy articles are for educational purposes, not financial advice.

References

- OKX Learn. What is Kamino Finance (KMNO): simplifying CLMMs on Solana. Accessed April 18, 2025.

- OSL. What Is Kamino Finance? A Concentrated Liquidity Layer on Solana. Accessed April 18, 2025.