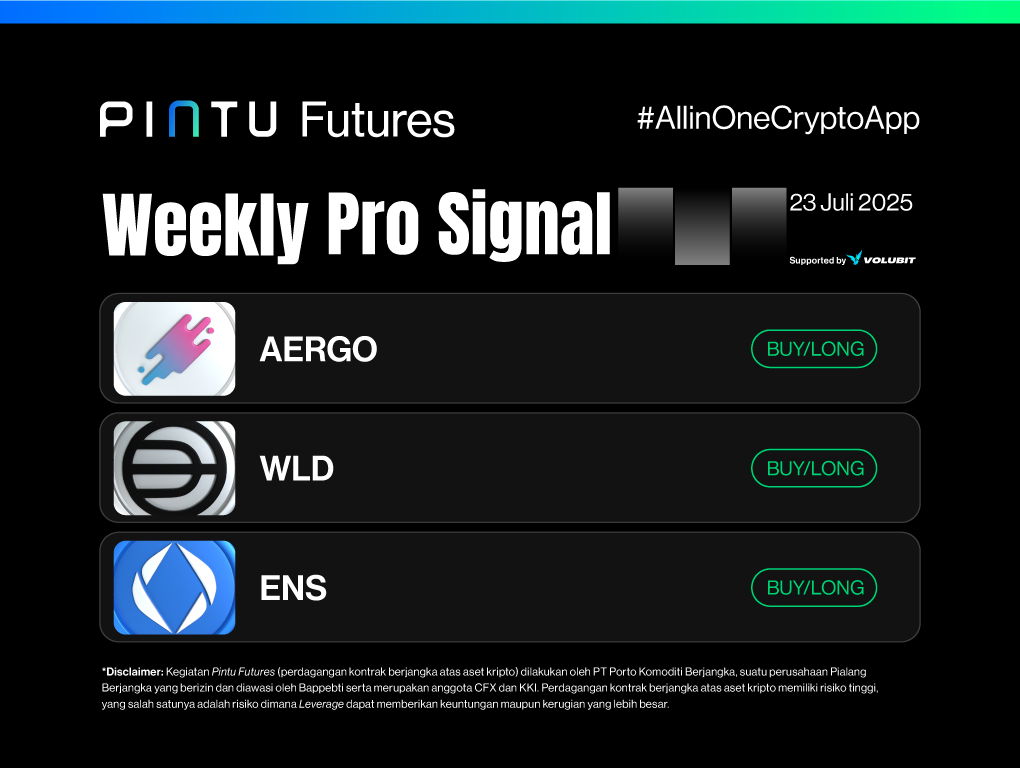

Signal Summary:

- AERGO [AERGO]:

- Entry : $0.15516

- Stop Loss [SL] : $0.13738

- Target Profit [TP] :

- TP1: $0.17272

- TP2: $0.20613

- WORLDCOIN (WLD):

- Entry : $1.3430

- Stop Loss [SL] : $1.1660

- Target Profit [TP] :

- TP1: $1.5217

- TP2: $1.8843

- ETHEREUM NAME SERVICE (ENS):

- Entry : $29.033

- Stop Loss [SL] : $24.585

- Target Profit [TP] :

- TP1: $31.034-$35.925

- TP2: $39.626

AERGO (AERGO)

AERGO [AERGO] has attracted positive market sentiment after successfully breaking out above the resistance level, which previously marked the daily candle close high on June 21 at $0.14975.

This breakout likely serves as a confirmation of the ascending triangle pattern that had been forming, acting as a solid trigger to continue the upward trend.

In the lower timeframe (4H), the next resistance zone is seen at $0.17825–$0.18237, while the primary target is projected at $0.20613.

Potential Buy Setup for AERGO:

- Entry: $0.15516

- Stop Loss [SL]: $0.13738

- Take Profit [TP]:

- TP1: $0.17272

- TP2: $0.20613

Important Note:

Always apply disciplined risk management and capital allocation. For trades, especially those using leverage, it is recommended to risk no more than 1% of your total capital per transaction.

WORLDCOIN (WLD)

Worldcoin (WLD) posted a notable price increase of 12.73%, accompanied by strong trading volume well above the 20-day moving average, confirmed during the latest daily candle close.

This bullish momentum broke through the resistance zone at $1.1853–$1.2451, which has now flipped into a key support level.

If WLD continues trading above this support, sentiment is likely to remain strong. The next price target is the May 22 daily candle high at $1.6487.

Potential Buy Setup for WLD:

- Entry: $1.3430

- Stop Loss [SL]: $1.1660

- Take Profit [TP]:

- TP1: $1.5217

- TP2: $1.8843

Important Note:

Use proper risk management and capital discipline. For leveraged trades, limit your risk per transaction to 1% of total capital.

ETHEREUM NAME SERVICE (ENS)

On July 16, Ethereum Name Service (ENS) successfully broke above the key resistance level at $25.067, which served as the neckline of a double bottom pattern visible on the weekly timeframe.

This breakout has fueled a bullish rally, supported by sustained high trading volume. The nearest price target lies between $34.034–$35.925, with a potential further move toward $39.626.

Potential Buy Setup for ENS:

- Entry: $29.033

- Stop Loss [SL]: $24.585

- Take Profit [TP]:

- TP1: $31.034–$35.925

- TP2: $39.626

Important Note:

Maintain strict risk control and capital management. Especially for trades involving leverage, keep risk limited to 1% of your total capital per position.