Margin trading is a popular strategy that allows traders to open positions larger than their available capital. On centralized exchanges (CEX), this is known as perpetual futures trading using leverage. In perpetual futures trading, margin serves as collateral to open and maintain positions.. By understanding how margin works, you can make wiser decisions when sizing your positions. This article will cover the definition of margin, how it works, and how to manage it effectively.

Key Takeaways

- 🔎 Understanding Margin: Margin is the collateral balance a trader must provide to open and maintain a position in perpetual futures trading.

- 📊 Types of Margin: Available Margin, Initial Margin, Maintenance Margin, and Margin Usage Ratio. These are the key components traders need to understand for smarter margin management.

- 📌 What is Cross Margin? Cross Margin is known for its flexibility, allowing users to share margin across multiple open positions simultaneously.

Understanding Margin

Margin is the collateral balance to open and maintain a position in futures trading. It plays a critical role in how leverage is used, how position sizes are determined, and how liquidation prices are calculated.

On crypto exchanges like Pintu, margin is deposited in USDT. Although the available leverage is fixed at 25x, traders can still control how much margin they allocate to each position. The larger the margin, the larger the size that can be opened.

On Pintu Futures, the required initial margin is 4%. This means users must provide 4% of the total position size as initial margin.

For example: a user opening a long BTC position worth $5,000 using 25x leverage would need to provide $200 (4%) as initial margin. In a scenario where the price drops by 3%, this position could be liquidated, wiping out the entire initial margin (and potentially all of the margin).

How Does Margin Work?

Before opening a position in perpetual futures, it’s crucial for traders to understand the different types of margin and how they function. By managing margin properly, traders can control the level of risk they’re willing to take and determine the appropriate position size according to their trading strategy. This helps reduce the chances of liquidation.

1. Available Margin

Available margin is the portion of your margin balance for opening new positions and support existing ones. In cross margin mode, this amount adjusts dynamically depending on the performance of your open positions, whether they’re in profit or loss, and any pending open orders.

| Margin Balance | USDT 100 | Total margin balance in the account |

| Number of Positions | 1. BTC (Filled) 2. ETH (Open Order) | Two positions: one active, one pending execution |

| Leverage | 25x | Fixed leverage in Pintu Futures |

| Open Order | USDT 500 | Position value of pending orders |

| Initial Margin for Open Order | USDT 20 | 4% of the pending order value |

| Position (Filled) | USDT 1.000 | Value of active position |

| Initial Margin (IM) | USDT 40 | 4% of the active position value |

| Maintenance Margin (MM) | USDT 10 | 1% of the active position value (locked balance) |

| Available Margin | USDT 70 | Margin Balance – IM & MM |

| Effective Leverage | 10x | Total Position Value / Account Balance |

| Margin Usage Ratio | 12,5% | Maintenance Margin / (Maintenance Margin + Available Margin) x 100% |

The table above shows that the available margin is influenced by two main components: open orders and maintenance margin.

When you place an open order, the system locks the initial margin until the order is executed. For active positions, only the maintenance margin remains locked.

In the given example, from a total margin balance of USDT 100:

- USDT 20 is locked for the open order

- USDT 10 is locked as maintenance margin

This leaves an available margin of USDT 70. The larger the total open orders and maintenance margin from active positions, the smaller the remaining margin.

2. Initial Margin

Initial margin is the amount of balance used to open a position with leverage. The required amount depends on the leverage level set by the exchange (CFX). At Pintu Futures, with a leverage of 25x, the required initial margin is 4% of the position value.

Example: If you want to open a position worth USDT 1,000, you only need to provide USDT 40 as initial margin. While the position is still an open order, this margin will be locked. However, once the position is opened, the margin will be released and returned to your available margin.

3. Maintenance Margin

Maintenance margin is the minimum amount that must remain available to keep a position open. If your margin balance falls below this level, your position may be liquidated. On Pintu Futures, with 25x leverage, the maintenance margin is set at 1% of the position value.

Example: For a position worth USDT 1,000, the required maintenance margin is USDT 10. Make sure your margin balance does not fall below this amount to keep your position safe from liquidation. This amount will remain locked as long as the position is open.

4. Margin Usage Ratio

Margin ratio is a percentage ranging from 0 to 100% that indicates how much of your margin has been used while a position is open. The higher the ratio, the closer your position is to the risk of liquidation.

| Margin Balance | USDT 100 |

| Number of Positions | 1 (BTC) |

| Leverage | 25x |

| Total Position Size | USDT 1.000 |

| Initial Margin | USDT 40 |

| Maintenance Margin | USDT 10 |

| Available Margin | USDT 90 |

| Effective Leverage | 10x |

| Margin Usage Ratio | 10% |

As shown in the example above, a margin ratio of 10% means you still have 90% of your margin available to absorb losses or open new positions. If the margin usage ratio approaches 100%, it indicates your balance is nearly depleted and your position is at risk of liquidation.

What is Cross Margin?

In futures trading, there are several types of margin modes, and one of them is cross margin. Understanding the margin mode used by an exchange is important so that traders can allocate their margin effectively.

Pintu Futures uses the cross margin system, which is known for its flexibility because it allows users to share their margin across multiple open positions at once. This means the entire margin balance is used collectively to support all active positions.

If one position incurs a loss while another gains unrealized profit, that profit will automatically increase the available margin. This leads to more efficient margin usage and helps reduce the risk of liquidation, depending on how much profit is being held.

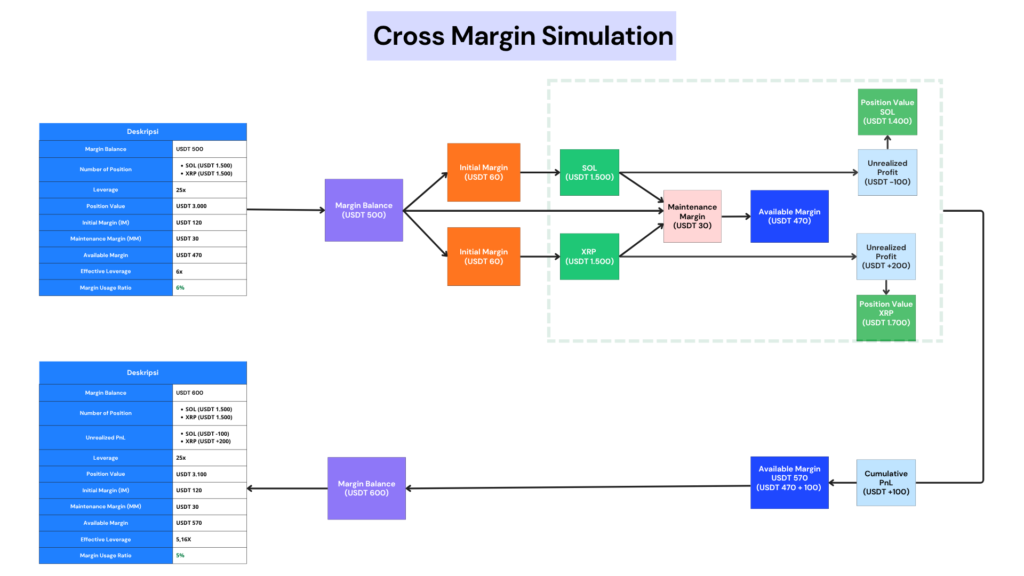

Cross Margin Simulation

- A trader opens two positions: SOL and XRP, each worth USDT 1,500 (total position value of USDT 3,000) using 25x leverage.

- Margin balance is USDT 500, with a total initial margin of USDT 120 and a maintenance margin of USDT 30.

- The remaining margin becomes the available margin of USDT 470.

- The SOL position experiences an unrealized profit of USDT -100, while the XRP position sees an unrealized profit of USDT +200.

- This results in a total cumulative P&L of USDT +100, which automatically increases the available margin to USDT 570.

Outcome:

- The profit from XRP helps cover the loss from the SOL position.

- The margin remains healthy and the risk of liquidation is reduced.

- Cross margin enables more efficient and adaptive margin usage across all open positions.

What is a Margin Call?

A margin call occurs when a trader holds an active position that incurs a floating loss, causing margin usage to rise and approach the liquidation threshold. In this situation, the trader will receive alerts to add more margin in order to prevent the position from being automatically closed by the broker (CFX).

On Pintu Futures, a margin call is triggered when the margin usage ratio reaches between 50% and 70%. Once this alerts appears, users have several options: add more margin, partially or fully close their positions, or cancel any pending open orders.

How to Manage Margin in Futures Trading

Understanding how margin works is just the beginning. You also need to know how to manage it effectively. Without proper planning, your margin can quickly deplete, increasing the risk of liquidation. Here are several strategies you can use as a reference to manage your margin more wisely when trading futures.

1. Position Sizing

The amount of initial margin you use directly determines the size of your open position. That’s why it’s important to plan carefully and set a clear margin allocation limit from the start. For example, you might decide to allocate no more than 10% of your margin balance to a single position. This allocation can also be spread across several potential positions, reducing your reliance on just one trade.

2. Build Clear Calculations and Scenarios

After determining your position size, the next step is to create calculation scenarios for both long and short positions. You can refer to the formulas discussed earlier to estimate your initial margin, maintenance margin, and available margin. With clear planning, you’ll better understand your risk limits and be able to assess your margin capacity during extreme market movements.

Example: You have a margin balance of USDT 500 and want to open a long BTC position at $100,000 with a position size of USDT 1,000. In this case, you only need to provide USDT 40 as initial margin and USDT 10 as maintenance margin. This means you are allocating 8% of your total margin. If BTC drops to $52,000, which is a 48% decline, the value of your position would be approximately USDT 520, and your available margin would be reduced to USDT 10 with a 50% margin usage ratio. In other words, your position is now highly exposed to liquidation risk.

As shown in the example above, understanding the potential price drop allows you to estimate how much of your available margin can absorb that risk. This helps you make more informed decisions before your position reaches the liquidation threshold.

3. Use Stop Loss Orders

After carefully calculating your position size, set a risk limit you’re willing to tolerate using a Stop Loss Order. This helps minimize potential losses beyond your set threshold due to sudden and volatile price movements.

4. Use Partial Take Profit Orders

Take Profit Orders allow you to secure profits at your predetermined target levels. This approach helps you stay disciplined, increases your available margin, and expands the safety buffer from your maintenance margin.

5. Monitor Your Margin Usage Ratio

Pay close attention to your margin usage ratio regularly. This ratio indicates how much of your margin is currently in use and how close your position is to liquidation risk. If the ratio starts reaching a risky level, such as 30% or more, you should take immediate action by adding margin, reducing your position size, or partially closing the trade.

6. Factor fees and funding

Maker/taker fees, funding payments, and slippage chip away at your margin and can accelerate liquidation if you forgot to factor them in when opening or closing your positions.

Conclusion

Margin plays a crucial role in perpetual futures trading, as it determines how well a trader can open and maintain positions. Understanding the types of margin, the cross margin system, and the margin usage ratio is essential for managing risk effectively.

By being disciplined in position sizing, accounting for costs, and using stop-loss and take-profit orders strategically, traders can keep their margins healthy and avoid liquidation risks. Proper margin management allows you to stay in the market longer and make decisions with greater confidence.

Disclaimer: All articles from Pintu Academy are intended for educational purposes only and do not constitute financial advice.

References

- dYdX, “How Does Crypto Margin Trading Work?” dYdX.xyz, accessed July 25, 2025.

- CryptoJelleNL, “What Is Margin Trading and How Does It Work?” Coinmarketcap, accessed July 25, 2025.

- Crypto.com, “Cross Margins, Isolated Margins, and the Advantages of Smart Cross Margins” Crypto.com, accessed July 25, 2025.

- Michelle Legge, “Crypto Margin Trading: Your Ultimate Guide | Koinly, accessed July 25, 2025.