Signal Summary:

- SUN (SUN)

- Entry : $0.020764

- Stop Loss [SL] : $0.019643

- Take Profit [TP] :

- TP1: $0.021910

- TP2: $0.023047

- CONFLUX (CFX)

- Entry: $0.1735

- Stop Loss [SL]: $0.1421

- Take Profit [TP]:

- TP1: $0.2046

- TP2: $0.2500

- NERVOS NETWORK (CKB)

- Entry : $0.005806

- Stop Loss [SL] : $0.006612

- Take Profit [TP] :

- TP1: $0.004999

- TP2: $0.004194

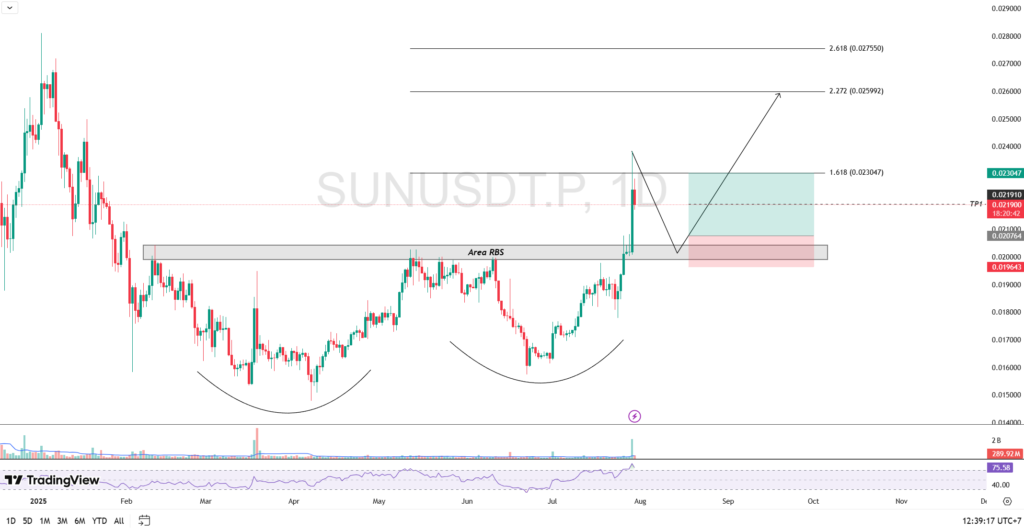

1. SUN (SUN)

SUN (SUN) caught a wave of positive market sentiment during this morning’s daily candle close. The token surged by 11.19%, hitting a high of $0.023825.

This price jump validated a breakout above the neckline of a double bottom pattern on the weekly timeframe, which now acts as a new support level (resistance-turned-support). However, SUN is currently facing rejection at a harmonic resistance level around $0.023047. If price continues to trade below this level, there’s a strong possibility of a retest toward the neckline zone.

If price pulls back and successfully rebounds at the neckline, this could serve as a strong buy signal with a favorable risk-to-reward ratio.

Potential Buy Setup for SUN:

- Entry: $0.020764

- Stop Loss (SL): $0.019643

- Take Profit (TP): TP1: $0.021910, TP2: $0.023047

Important Note:

Always apply strict risk management and capital allocation. Especially when using leverage, limit risk per trade to 1% of your total capital.

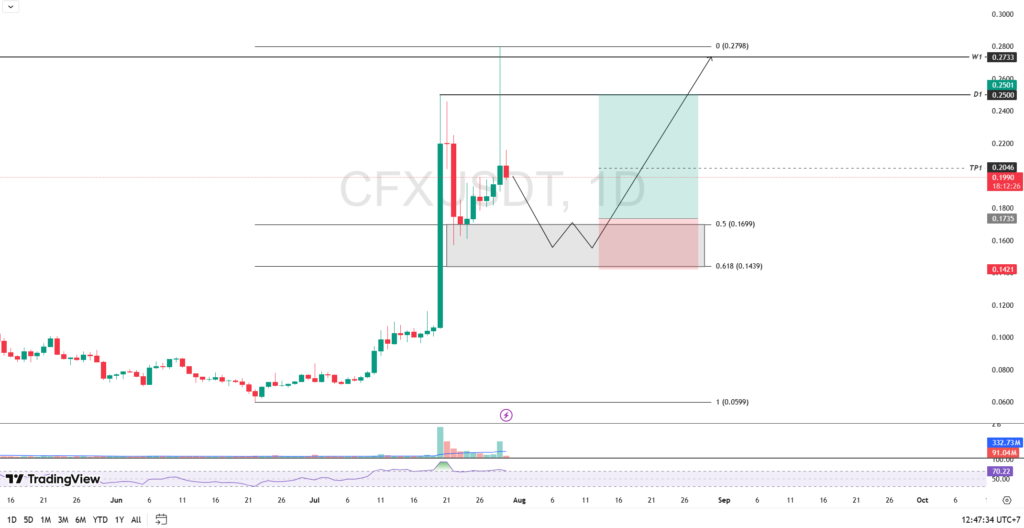

2. CONFLUX (CFX)

Despite only a 5.96% gain, CONFLUX (CFX) closed its daily candle with an impulsive structure, indicated by a large upper shadow, hinting at strong intraday price action.

The daily high touched the weekly resistance at $0.2733, showing signs of strong supply. Meanwhile, the Golden Pocket zone from $0.1439 to $0.1699 (based on the 0.5–0.618 Fibonacci Retracement levels) has acted as a solid buy zone, especially after the price rebounded from that area during the July 22 correction.

If CFX corrects again and retests the Golden Pocket, followed by a confirmed rebound, it could signal a strong entry opportunity.

Potential Buy Setup for CFX:

- Entry: $0.1735

- Stop Loss (SL): $0.1421

- Take Profit (TP): TP1: $0.2046, TP2: $0.2500

Important Note:

Stick to disciplined risk and money management. For leveraged trading, limit exposure to 1% of total capital per trade.

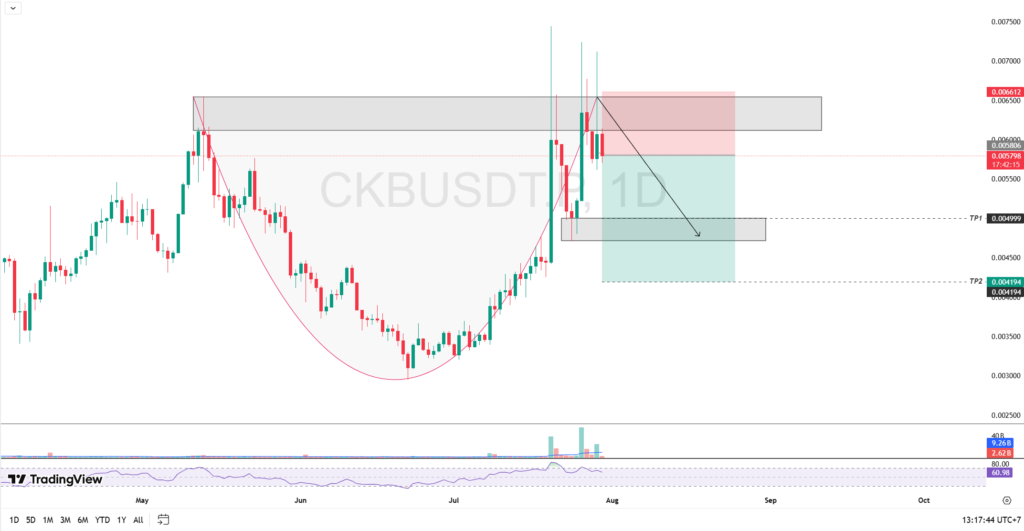

3. NERVOS NETWORK (CKB)

NERVOS NETWORK (CKB) is currently facing heavy selling pressure near the resistance zone between $0.006116 and $0.006542. This has triggered a price pullback after a previous bullish rally.

On the daily candle closes for July 20, 26, and 29, the charts showed long upper wicks, indicating liquidity grabs and distribution activity around that resistance zone. If CKB continues to trade below resistance and today’s candle closes in red, it could signal a potential continuation of the downtrend toward the support zone at $0.004717–$0.005004.

Potential Sell Setup for CKB:

- Entry: $0.005806

- Stop Loss (SL): $0.006612

- Take Profit (TP): TP1: $0.004999, TP2: $0.004194

Important Note:

Never forget to implement proper risk management and trading discipline. Keep your risk per trade to no more than 1% of your capital, especially when using leverage.