Altcoins refer to all cryptocurrencies other than Bitcoin, including Ethereum, Solana, and hundreds of others. Due to their high volatility, altcoins are often targeted by investors seeking higher profit opportunities. This article will explain what the Altcoin Season Index is, its functions, how it differs from Bitcoin Season, and the key stages leading to an altseason.

Article Summary

📊 Altcoin Season Index: A metric that measures whether altcoins collectively outperform Bitcoin over the last 90 days.

🧠 Main Function: Helps investors identify market momentum, strategize portfolio diversification, and interpret shifts in market sentiment.

🔁 Altseason Cycle: Typically occurs in four phases: Bitcoin dominance → Ethereum strengthens → major altcoins rally → smaller altcoins follow.

📌 Key Difference: The Altcoin Season Index is a quantitative indicator, while Bitcoin Season simply refers to market conditions when Bitcoin dominates.

What Is the Altcoin Season Index?

The Altcoin Season Index is a tool used to compare the performance of altcoins against Bitcoin over a specific period, typically 90 days. This index indicates whether the market is entering an altseason, a phase where altcoins collectively outperform Bitcoin.

Traders and investors often monitor this index to gauge market trends and spot opportunities in the crypto market.

💡 Read more about altcoins in this guide: Altcoin: Alternative Crypto Investments Beyond Bitcoin – Pintu Academy

Functions of the Altcoin Season Index

The Altcoin Season Index plays a vital role in helping investors and traders interpret market conditions. Beyond signaling when altcoins outperform Bitcoin, it also provides actionable insights for better investment strategies. Here are its main functions:

- Identifying Market Momentum 📊

Indicates when altcoins start to outperform Bitcoin, helping investors enter the market at the right time. - Guiding Portfolio Diversification 📈

Provides signals on when to increase allocation to promising altcoins. - Reducing Investment Risk 📁

Helps avoid entering altcoins during weak dominance phases, resulting in more strategic decision-making. - Improving Research Efficiency 👩🏻💻

Encourages investors to focus on strong fundamental projects when the index shows an emerging altseason. - Indicating Market Sentiment Shifts 💲

Reveals when investor attention is rotating from Bitcoin to alternative assets.

Reading the Altcoin Season Index Chart

The Altcoin Season Index chart provides a clear snapshot of whether Bitcoin still dominates or if altcoins are taking the lead:

- Index above 75 → Altcoin Season:

The majority of top 50 altcoins are outperforming Bitcoin, often signaling higher profit potential in alternative assets. - Index below 25 → Bitcoin Season:

Bitcoin significantly outperforms altcoins, and investors typically favor BTC for its stability and lower risk.

Altcoin Season Index vs. Bitcoin Season

Understanding these cycles is essential for effective investment planning. While the terms may sound similar, their roles differ:

- Definition

- Altcoin Season Index: Measures how many of the top 50 altcoins outperform Bitcoin over the last 90 days.

- Bitcoin Season: Describes a market phase where Bitcoin strongly outperforms most altcoins.

- How It Works

- Altseason occurs if ≥75% of altcoins outperform Bitcoin.

- Bitcoin Season occurs if ≤25% of altcoins outperform Bitcoin.

- A range of 26–74 indicates a neutral or undecided market.

- Purpose

- Altcoin Season Index: Analytical tool to spot early signs of altcoin dominance.

- Bitcoin Season: Reflects a market preference for safer, lower-risk assets.

Is It Already Altseason in 2025?

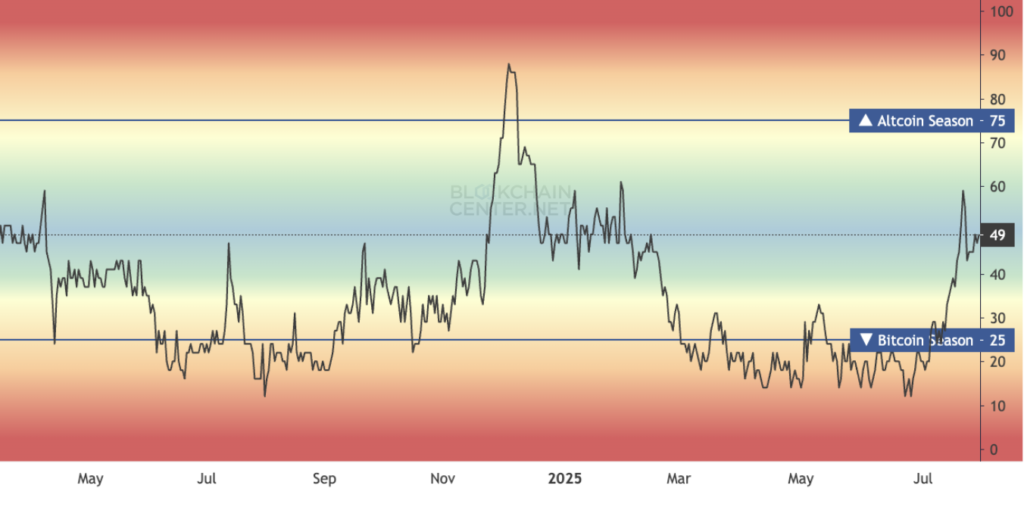

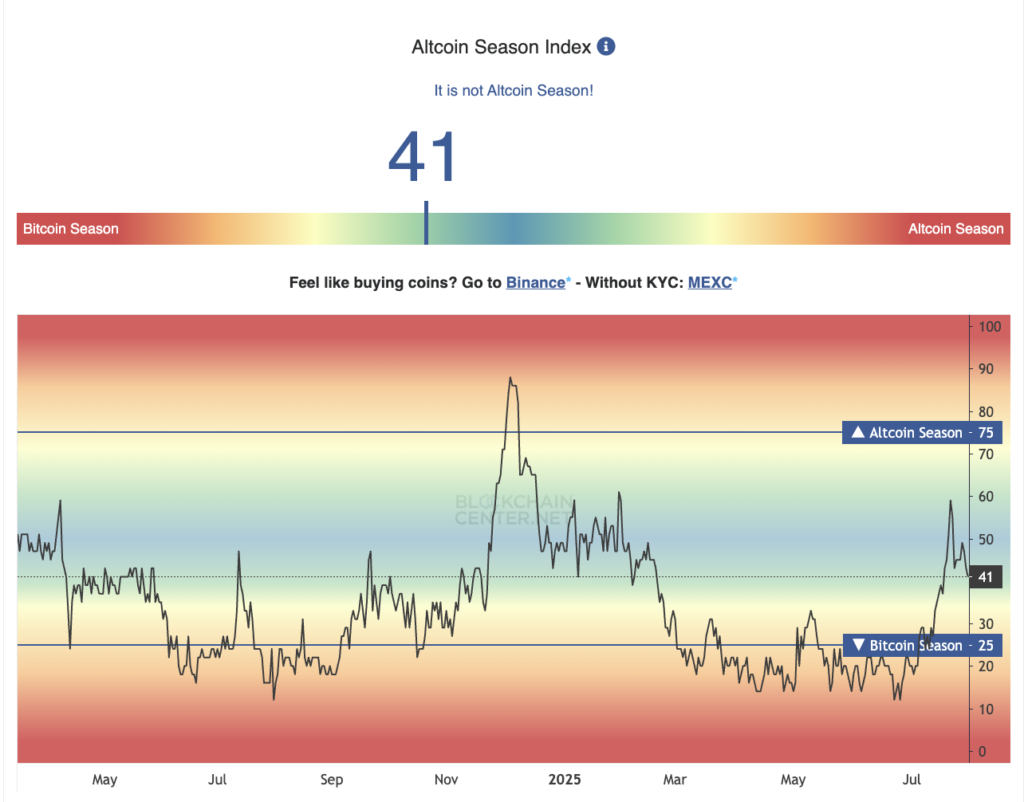

As of July 2025, the market is not in altseason yet. The current index sits at 41, within the neutral zone, indicating no clear dominance by either altcoins or Bitcoin.

Key observations:

- Color Scale:

- Red (top) = Altcoin Season (≥75)

- Blue/green (middle) = Neutral (26–74)

- Red/orange (bottom) = Bitcoin Season (≤25)

- Recent Trend:

- Late 2024 saw a brief spike above 75 (a short altseason).

- The index has since declined and only started climbing again in July 2025.

To confirm altseason, the index must remain ≥75, showing that at least 75% of altcoins outperform Bitcoin over 90 days.

The Four Phases Leading to Altseason

Altseason occurs when capital rotates from Bitcoin into altcoins, driving significant price increases. It often follows periods where Bitcoin trades sideways or consolidates.

💡 For a deeper explanation, read: Altcoin Season – Definition and How to Identify It | Pintu Academy

Today’s market is more complex than the classic BTC → ETH → Large-Cap → Small-Cap rotation. Specific narratives like AI crypto, Real World Assets (RWA), or emerging ecosystems (Base, Sui) can trigger mini-altseasons in targeted sectors.

Here are the four typical phases of an altseason:

1. Bitcoin Dominance Phase

- Investors prioritize Bitcoin as the safest asset.

- BTC.D (Bitcoin Dominance) rises and BTC trading volume increases.

- Risk-off sentiment prevails; altcoins stagnate or decline.

2. Ethereum Rotation Phase

- Bitcoin stabilizes, and funds start flowing into Ethereum.

- ETH/BTC ratio rises as ETH begins outperforming BTC.

- Ethereum-related catalysts such as DeFi activity, Layer-2 growth, or staking yield improvements emerge.

- This phase often signals the beginning of market liquidity expansion.

3. Major Altcoin Rally

- Liquidity moves into large-cap altcoins like Solana, Cardano, Avalanche, and Polygon.

- TOTAL3 (market cap excluding BTC and ETH) rises, confirming capital rotation.

- Narrative-driven sectors (AI, Gaming, RWA) attract retail attention.

💡 Note: Nowadays, TOTAL3 and BTC.D are often used together to predict liquidity shifts. When BTC.D starts to decline while TOTAL3 rises, it usually signals that the market is preparing for the early stages of altseason.

4. Small-Cap Altcoin Surge

- Mid-cap and low-cap coins experience explosive growth, marking peak altseason euphoria.

- Fast money flow targets niche narratives such as memecoins or AI crypto.

- Data from Dune Analytics, DeFiLlama, and Coinglass can confirm inflows and rising TVL.

Conclusion

The Altcoin Season Index is a valuable tool for identifying when altcoins begin to dominate the crypto market. Currently, the index sits at 41 (neutral zone), suggesting the market has yet to enter a true altseason. However, its recent rise from Bitcoin Season levels could signal the early stages of capital rotation.

By understanding the four phases—from Bitcoin dominance to small-cap rallies—investors can better prepare for market shifts and optimize their altcoin strategies. Monitoring the index regularly ensures more adaptive and timely decisions in a dynamic crypto market.

💡 Disclaimer: All content from Pintu Academy is for educational purposes only and does not constitute financial advice.

References:

- EBC Financial Group. Altcoin Season Index 2025 Explained: Are We in One Now? (Accessed July 30, 2025)

- Trust Wallet. What is the Altcoin Season Index? (Accessed July 30, 2025)

- Tangem. What is Bitcoin Season? How Long Will it Last in 2025? (Accessed July 30, 2025)