XRP (Ripple) has experienced a significant resurgence in 2025 after scoring a crucial victory against the SEC in a prolonged legal battle.

Now, XRP stands as one of the top cryptocurrencies with much greater potential in the global financial ecosystem. Many analysts set conservative price targets in the $5-8 range for year-end, as regulatory clarity and institutional adoption continue to improve its outlook.

Curious how XRP managed to rally 437% in 2025 and why many predict its price could break $10? Dive into this article — covering Ripple’s legal triumph, the potential XRP spot ETF, and the growing wave of institutional adoption!

🧾 Article Summary

📈 XRP up 437% in 2025, placing it among the world’s top 3 cryptocurrencies with a market cap exceeding $185 billion, fueled by a major legal win against the SEC.

⚖️ Ripple wins SEC lawsuit in August 2025, with the court ruling XRP is not a security for public trading, removing regulatory barriers that had long hindered its growth.

📊 XRP spot ETF expected to be approved in October 2025, with approval odds estimated at 95%, based on SEC reviews of filings from Grayscale, 21Shares, Bitwise, and WisdomTree.

🏦 RippleNet is now used by over 300 financial institutions across 40+ countries, including DBS Bank, PNC Bank, SBI Holdings, and Santander — several leveraging On-Demand Liquidity (ODL), which uses XRP as a liquidity bridge.

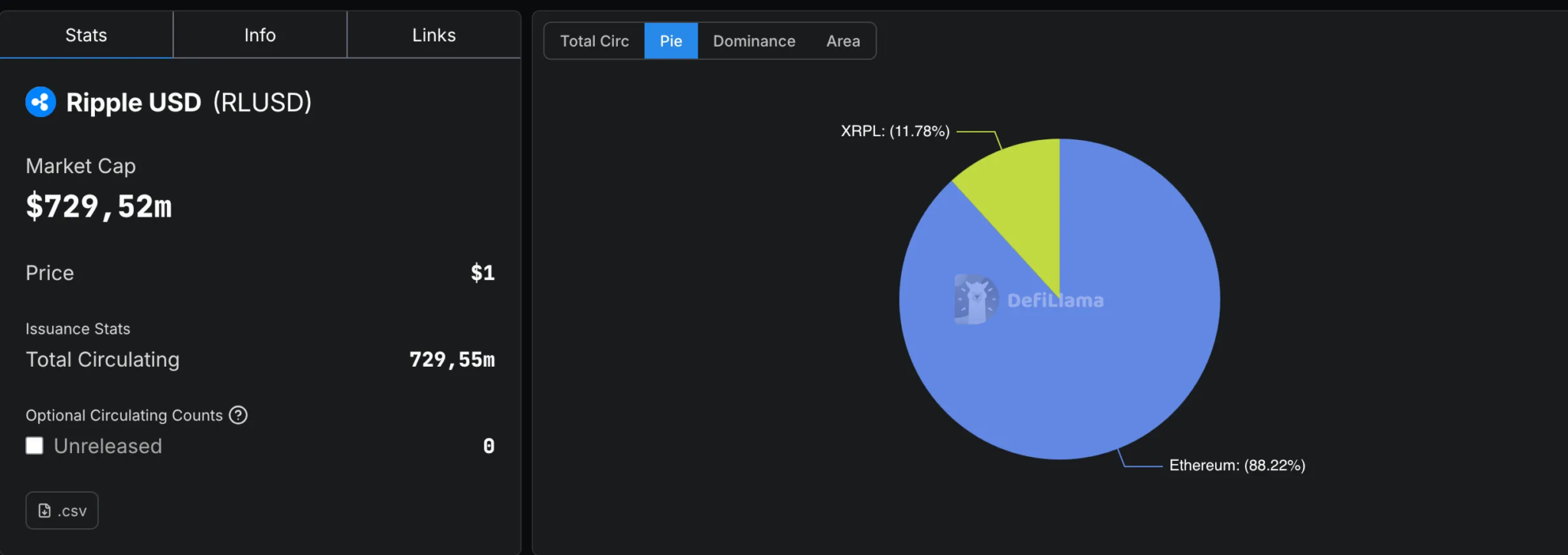

🔐 New tech such as RLUSD and real-world asset tokenization expands XRP’s utility, with RLUSD hitting a $729.52M market cap as of September 2025 (DeFiLlama). Ripple also acquired prime broker Hidden Road to scale institutional solutions.

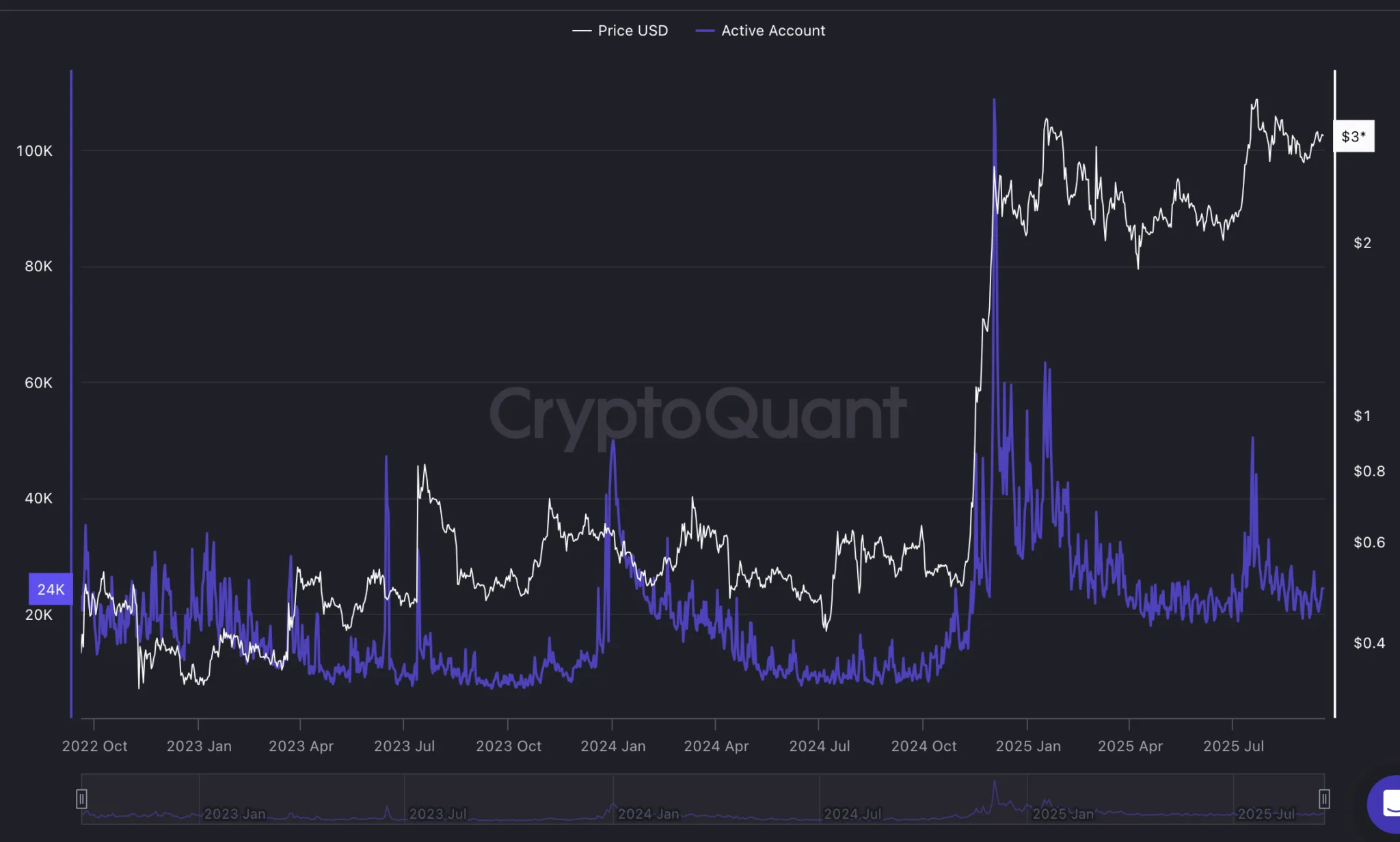

📈 On-chain data confirms strong activity, averaging 24,000–60,000 active wallets daily with steady transaction volume — proving XRP is being actively used, not just speculated on.

💬 Technical analysts and traders like Nebraskangooner, Unipcs, and Jesse Olson see XRP’s current structure as bullish, with upside potential toward $3.30–$3.50, depending on its ability to break the $3.07 resistance.

XRP Wins SEC Lawsuit ✅

- What happened: On August 8, 2025, Ripple Labs and the SEC settled the lawsuit ongoing since December 2020. Ripple agreed to pay a $125M fine, and the SEC halted appeals on some of its claims.

- Why it matters: With this settlement, XRP is no longer classified as a security when traded publicly by retail investors, though institutional sales remain regulated. This legal clarity removes the long-standing compliance risks burdening XRP as a crypto asset.

- Impact: Following the announcement, XRP’s price jumped 5-11% in the first few days, reflecting the market’s positive response to the regulatory certainty.

XRP ETF Nears Approval 📈

- Status: Multiple spot XRP ETF applications are under SEC review, with a final decision expected mid- to late October 2025.

- What’s an ETF: A spot ETF allows major investors and institutions to gain exposure to XRP via an exchange-listed product, without holding the tokens themselves — making access easier for traditional investors.

- Forecast: If approved, institutional capital could flow into XRP, boosting liquidity and demand. Analysts believe this could lift XRP’s price into the $5-8 range, or higher in a bullish scenario.

Banks & Institutions Start Adopting XRP 🏦

- Ripple, through RippleNet, has partnered with 300+ financial institutions in 40+ countries. Not all are large banks, and not all use XRP as a bridge currency.

- XRP is not deemed a security for retail sales via exchanges, but unregistered institutional sales remain subject to securities rules.

- By September 2025, Ripple partnered with DBS Bank (Singapore) and Franklin Templeton to deliver trading and lending solutions using tokenized money market funds on the XRP Ledger and the RLUSD stablecoin.

- Ripple announced the acquisition of Hidden Road, a multi-asset prime broker, for $1.25B — a strategic move to strengthen Ripple’s presence in institutional finance, especially prime brokerage services and stablecoin-based cross-asset products.

Real-World XRP Usage

- Active Wallets & Transactions: Latest CryptoQuant data shows XRP network activity remains solid as of September 2025, with 24,000–60,000 daily active addresses, signaling stable user participation despite price volatility.

- Partners & Adoption: RippleNet has partnered with over 300 financial institutions in 40+ countries, including Santander, SBI Holdings (Japan), PNC Bank (US), Tranglo (Southeast Asia), and Azimo (Europe). Many leverage On-Demand Liquidity (ODL), which uses XRP as a bridge for cross-border liquidity.

Latest Trader Analysis on XRP

1. Nebraskangooner — Breakout + Retest Support

Trader Nebraskangooner noted that XRP recently saw a solid breakout and is now retesting the breakout level. He believes that if this support level holds, XRP could rally to at least $3.30, with room for higher upside.

2. Unipcs (aka ‘Bonk Guy’) — Mixed Bearish–Bullish Outlook

Trader Unipcs stated that although he doesn’t hold or trade XRP, it’s hard to view the chart as bearish right now. If the market maintains key support levels, a “pump” could follow soon. However, weak support may lead to downside risks.

3. Jesse Olson — Weekly Technical Signal + Potential Pullback

Analyst Jesse Olson highlighted that $XRP’s daily chart shows a swift retest of the uptrend and a strong rebound after breaching the descending resistance line since August 2025. This breakout, validated by a rebound at support, suggests the uptrend may continue. As long as prices hold above $3.10, XRP’s technical structure remains bullish.

XRP Roadmap & Risks

RLUSD Stablecoin & Real-World Asset Tokenization

Ripple officially launched its Ripple USD (RLUSD) stablecoin in December 2024 as part of its strategy to expand into digital payments and asset tokenization. RLUSD is designed to maintain a stable value of $1, bridging traditional finance and the XRP Ledger (XRPL)

As of September 2025, DeFiLlama

reports RLUSD’s market cap at $729.52M, with 729.55M RLUSD in circulation. Growing transaction volume shows RLUSD gaining traction in DeFi apps and cross-border payment infrastructure built on XRPL, strengthening Ripple’s ecosystem and supporting institutional XRP adoption.

Spot ETF & Regulation

The SEC’s final decision is expected between October 18 and 25, 2025, a milestone for XRP’s role in US financial markets.

If approved, it could act as a major catalyst. Yet, delays or rejection remain possible, depending on legal, custody, and asset management requirements.

📅 XRP ETF Deadlines

- Grayscale XRP ETF – Deadline: October 18, 2025

- 21Shares XRP ETF – Deadline: October 19, 2025

- Bitwise XRP ETF – Deadline: October 20, 2025

- Canary Capital XRP ETF – Deadline: October 24, 2025

- WisdomTree, Franklin Templeton, CoinShares XRP ETFs – Deadline: October 25, 2025

- RexShares Rex-Osprey XRP ETF – Still under SEC review after a July 2025 delay.

C. Key Risks to Watch

- Regulation: Policy shifts in the US or abroad could affect XRP’s legal standing and ETF approval.

- Market Volatility: Despite strong legal wins, prices could retrace after news-driven rallies.

- Tech Competition: Other blockchains and stablecoins compete in payments and tokenization.

Conclusion: 2025 as XRP’s Turning Point

The year 2025 marks a historic turning point for XRP. With the SEC lawsuit finally resolved, XRP’s legal status is clearer and safer for retail investors, boosting market confidence and driving gains of over 437%.

Meanwhile, the looming approval of an XRP spot ETF enhances its appeal to institutional investors. Coupled with 300+ banks and fintechs leveraging Ripple’s technology for cross-border transactions, and innovations like asset tokenization and RLUSD, XRP’s utility in the crypto ecosystem continues to grow.

References:

- Barry Elad. XRP Ripple Statistics 2025: Market Insights, Adoption Data, and Future Outlook. Accessed September 18, 2025

- Bitget. Which Financial Institutions Use XRP? Accessed September 18, 2025

- CoinPedia. Full List of XRP ETFs: Filings, Dates, Deadlines, and More. Accessed September 18, 2025

- CoinDCX Blog. XRP Price Prediction 2025: XRP Forecast for 2025,2026,2027 – 2030. Accessed September 18, 2025

- DBS. DBS and Franklin Templeton to launch trading and lending solutions powered by tokenised money market funds and Ripple’s RLUSD stablecoin. Accessed September 18, 2025

- Kevin George. SEC v. Ripple: Key Court Decision and Impact on Cryptocurrency. Accessed September 18, 2025

- Kosta Gushterov. XRP ETF Countdown: SEC to Decide on 8 Filings in October. Accessed September 18, 2025

- Piyush Shukla. Make or break? Why October could be XRP’s biggest month yet. Accessed September 18, 2025

- Reuters. SEC ends lawsuit against Ripple, company to pay $125 million fine. Accessed September 18, 2025

- Reuters. Crypto firm Ripple to buy prime broker Hidden Road for $1.25 billion. Accessed September 18, 2025