The third week of September was an interesting one for the crypto market. It started with an anticipated interest rate cut that investors were hoping for and ended with the emergence of the Aster token, which is being touted as the main competitor to Hyperliquid (HYPE). Read the full analysis from Pintu’s Trader Team in the article below.

Market Analysis Summary

- 🗒️ If BTC manages to push past $117,000 and hold above that threshold, it could reinforce a bullish breakout narrative.

- 👀 A key trendline around $4,450 has acted as support.

- 💪🏻 Solana (SOL) resistance near $249.60 is acting like a ceiling; breaking above that could open a path toward $270 or even revisit highs closer to $295

Macroeconomic Analysis

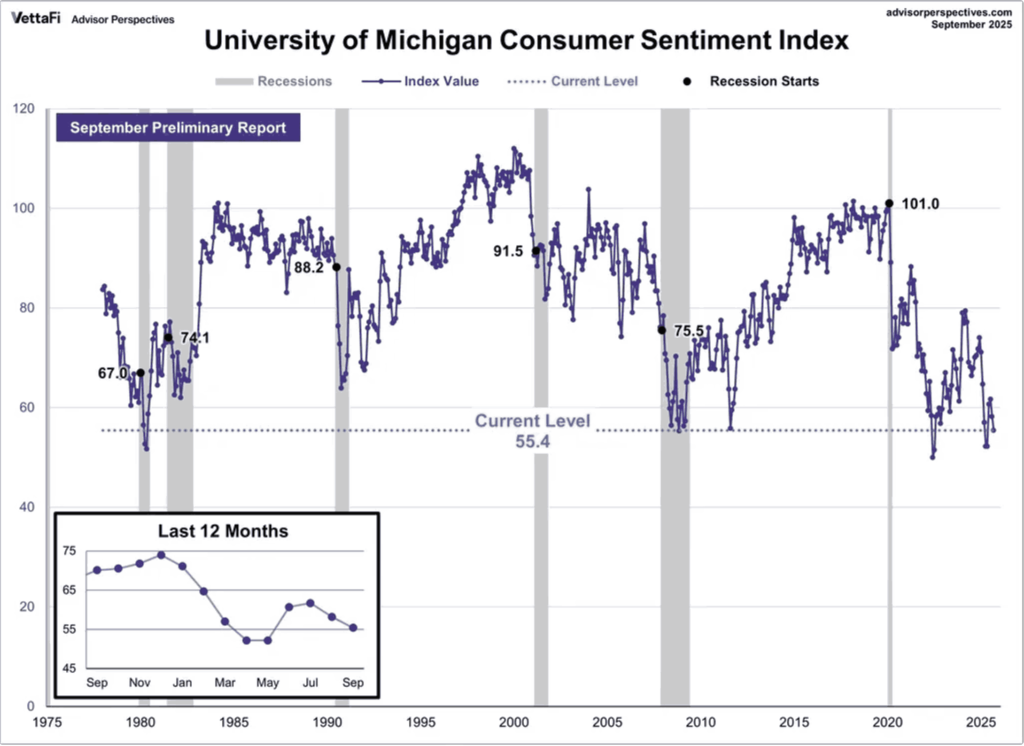

Michigan Consumer Sentiment

The University of Michigan’s September Consumer Sentiment Index fell from 58.2 in August to 55.4, signaling growing concerns about the economy and persistent inflation pressures. The meaning of this decline is as follows:

- Rising household concerns about the near-term economic outlook and their financial prospects.

- Worries include business conditions, job security, and incomes not keeping pace with the cost of living.

- Higher inflation expectations adding to pessimism, reflecting consumers’ belief that price pressures will continue.

- The decline was most pronounced among lower- and middle-income households, who feel rising prices more directly.

- This drop in sentiment may result in slower consumer spending, which could dampen overall economic growth.

A prolonged decline in sentiment risks creating a feedback loop: weaker spending reduces business revenues, which may slow hiring or investment, further eroding consumer confidence. This dynamic underscores the importance of stabilizing inflation and maintaining a strong labor market to prevent falling sentiment from triggering a broader economic slowdown.

Other Economic Indicators

- NY Empire State Manufacturing Index: In September 2025, the Empire State Manufacturing Index—a gauge of factory activity in New York State—fell sharply into negative territory for the first time since June, with the headline business conditions index dropping to −8.7 from +11.9 in August. This indicated a shift from modest expansion to contraction in the manufacturing sector. From the macroeconomic perspective, such a contraction in a key manufacturing region can weigh on overall industrial output and business investment.

- Retail Sales: In August, total retail and food services sales rose by 0.6% month over month, which was above many economists’ forecasts. On a year-over-year basis, retail sales were up about 5.0% compared to August 2024. These gains reflect solid consumer spending despite headwinds such as inflation, slower job growth, and higher interest rates.

BTC Price Analysis

Over the past week, BTC saw a fairly steady rally, supported by growing investor optimism around forthcoming central bank rate cuts in the U.S. The price has traded in a range between about $114,000 to $117,000, with resistance and support levels becoming more clearly defined. On the upside, bulls appear to be testing the $116,000-$117,000 band, while a strong floor is forming near $114,000, which seems to be absorbing much of the market’s selling pressure.

BTC Technical Analysis

Technically, the momentum indicators are mixed but tilting positive:

- Price action has reclaimed several key moving averages, including shorter ones like the 20-day and 50-day, which suggests that near-term trends are recovering.

- The Relative Strength Index (RSI) is above neutral but not overbought, implying that there’s room for further upward movement without an immediate risk of a sharp correction.

- On the downside, some analysts warn that falling below the $114,000 support with a weekly close could open the path for a pullback, possibly toward $111,000-$112,000.

- If BTC manages to push past $117,000 and hold above that threshold, it could reinforce a bullish breakout narrative.

- However, if support fails, there’s risk of a correction, which could lead to profit‐taking and possibly drag altcoins and sentiment overall.

ETH Price Analysis

ETH has shown modest gains over the week, up around 4–5% in USD terms. From charting sources, it seems to have moved from the low $4,300s into the high $4,400s, though it recently pulled back slightly from highs near $4,700. There has been volatility, largely associated with traders reacting to broader macroeconomic news and anticipation about monetary policy moves. A key trendline around $4,450 has acted as support, with buyers stepping in when price dropped toward that level.

ETH Technical Analysis

Technically, ETH is in somewhat of a consolidation phase:

- The price action has formed what some analysts are calling a pennant or continuation pattern, which suggests the possibility of another leg higher if it breaks out of its current range.

- On the flip side, losses below certain moving averages—particularly the 20-day EMA and areas closer to $4,200–$4,300—could open the door for a deeper correction.

- Some analysts point toward mid-$6,000s as possible in the medium term.

- But if it fails to hold current support levels, there is risk of retracement toward $4,200 or lower, which would test the resolve of buyers.

Analysis Altcoin

Altcoins broadly have shown renewed strength in the last week, with the TOTAL3 index rising by about 9%. This suggests rising momentum among mid‐ to small‐cap tokens and a shift in investor interest toward projects beyond just the big names. Specific tokens have drawn attention:

- ADA has been relatively stable but is building a bullish technical setup—a cup-and-handle pattern—that suggests potential upside if resistance levels are overcome.

- CPOOL is also being watched closely; large-holder accumulation appears to be increasing, exchange balances are dropping (suggesting less selling pressure), and the chart pattern (inverse head & shoulders) points to possible gains unless certain support levels fail.

- HYPE is another token seen as interesting: though its price has been range-bound over the week, indicators show that larger wallets are buying in, helping sustain the price despite retail selling and general volatility.

- SOL is now facing a crucial test. Resistance near $249.60 is acting like a ceiling; breaking above that could open a path toward $270 or even revisit highs closer to $295 if momentum and capital inflows continue.

The broader implication is that the market is showing signs of transitioning into what many call “altcoin season,” where value is shifting away from the largest, most established coins toward smaller, emerging, innovation-led projects.

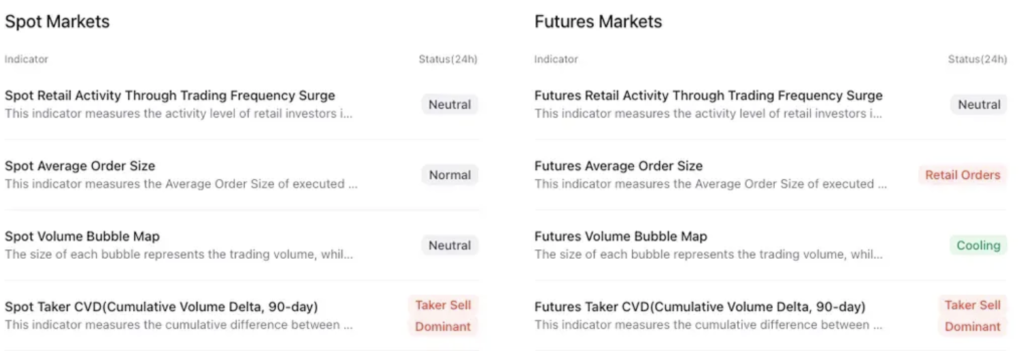

On-Chain Analysis

News About Altcoins

- CZ’s Endorsement Fuels Aster’s 1,500% Rally. Aster, a new decentralized perpetual exchange, skyrocketed after Binance founder Changpeng Zhao (CZ) publicly endorsed it, driving its token price up over 1,500% in just a week. Heavy whale accumulation and CZ’s praise for its multi-chain support and hidden order features pushed Aster’s market cap beyond $2.3 billion, with trading volume hitting $1.22 billion in 24 hours. Aster has now surpassed Hyperliquid in total value locked ($886M vs. $681M), positioning itself as a top contender in the perp-DEX space, though Hyperliquid still leads in trading volume.

News from the Crypto World in the Past Week

- Bitcoin Poised to Rise Amid Global “Fourth Turning” and Crisis of Trust. Market analyst Jordi Visser argues that Bitcoin (BTC) is set to grow in price and adoption regardless of macroeconomic outcomes, as the world enters a “Fourth Turning” reset of the financial system. He points out that people have lost trust in institutions such as governments, banks, employers, and fiat money, pushing them toward BTC — a neutral, trustless global asset. Rising inflation, geopolitical tensions, and record-high government debt are fueling this shift. With a K-shaped economy widening inequality, where asset holders thrive while others struggle, Bitcoin is increasingly seen as a necessary alternative to preserve purchasing power.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Story (IP) +30.55%

- Immutable (IMX) +19.91%

- PancakeSwap (CAKE) +16.58%

- BNB (BNB) +14.57%

Cryptocurrencies With the Worst Performance

- Fartcoin (FARTCOIN) -16.33%

- SPX6900 (SPX) -13.09%

- Raydium (RAY) -11.35%

- POL (POL) -10.69%

References

- Paul, CZ Endorses Hyperliquid Rival Aster DEX, Token Rallies 1,500%, coingape, accessed on 21 September 2025.

- Vince Quill, Bitcoin will ‘accelerate’ as world heads into the Fourth Turning — Analyst, cointelegprah, accessed on 21 September 2025.