Every four-year cycle, the development of crypto projects moves rapidly, both in terms of products and innovation. One of the most prominent trends gaining significant attention today is the tokenization of real-world assets (RWA), which has even begun to attract adoption from major institutions.

Through RWA, access to assets such as real estate, collectibles, and bonds becomes more efficient, transparent, and available through blockchain technology.

In this article, we will highlight 5 selected altcoins in the RWA sector with the largest market capitalizations that deserve close attention.

Article Summary

🚀 Ondo Finance has the potential to become a pioneer in RWA with strong institutional backing and rapid TVL growth.

🔗 Quant Network opens up major opportunities for enterprise adoption through its blockchain interoperability solutions.

💰 Maple Finance and Clearpool expand institutional financing access with more efficient lending models.

🌎 Parcl introduces on-chain innovation in the real estate market, though its main challenge lies in volume and adoption.

1. Ondo Finance

Ondo Finance is a financial services project that brings institutional-grade products to the public through blockchain. Previously, these exclusive financial products were only accessible to certain groups, but Ondo has now opened the opportunity for anyone to use them.

The project operates by purchasing securities from traditional assets such as stocks and bonds, then leveraging blockchain technology to tokenize these assets.

As one of the pioneers in the Real World Assets (RWA) sector, Ondo has sustained its presence for more than three years by delivering inclusive and innovative products.

Ondo Finance’s Core Products

- Ondo Short-Term US Government Treasuries (OUSG): A tokenized asset backed by short-term U.S. Treasury bonds, allowing holders to earn interest in line with market rates. Additionally, OUSG can be used as collateral to borrow other crypto assets, such as USDC and USDT, through Flux Finance, a DeFi platform developed by the Ondo Finance team.

- Ondo US Dollar Yield Token (USDY): A stablecoin backed by short-term U.S. Treasury bonds. USDY comes in two versions: the first is a token whose value increases as yields rise, and the second, rUSDY, is a token that remains pegged at $1.

Latest Ondo Metrics

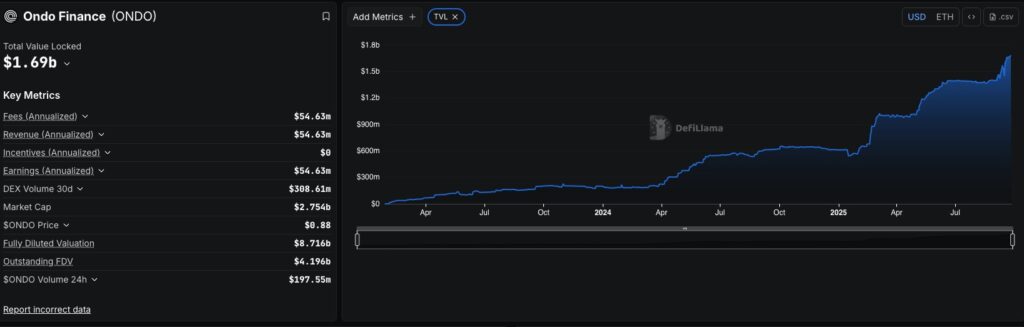

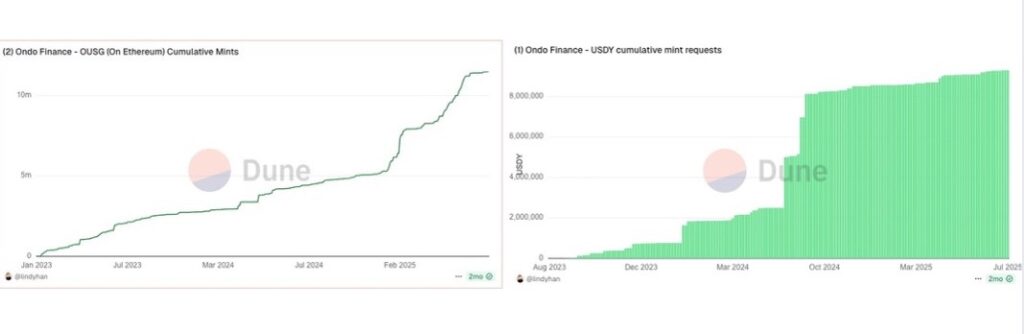

According to data from DeFiLlama, Ondo’s Total Value Locked (TVL) has continued to hit new all-time highs in recent months, reaching $1.69 billion. Among this, the Ethereum network remains the largest contributor, accounting for approximately $1.345 billion in TVL. Cumulatively, Ondo has also generated revenue of $54.63 million.

The growth in Ondo’s TVL has been largely driven by its OUSG and USDY products. Demand for both tokens has steadily increased since their launch. Cumulatively, USDY issuance has reached 9,306,896 tokens, while OUSG has recorded 11,489,922 tokens.

Latest Developments of Ondo

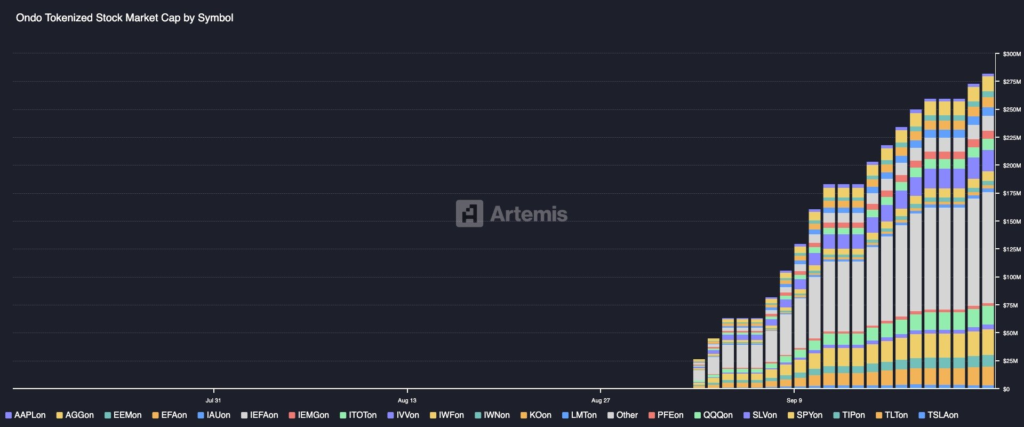

On September 3, Ondo launched its latest product called Ondo Global Markets. This platform allows users to trade over 100 tokenized stocks and ETFs at any time using the USDC stablecoin.

Unlike traditional brokers, tokenized stocks and ETFs purchased through Ondo Global Markets can be transferred to other wallets. In addition, trading can be executed instantly without concerns about liquidity issues.

Although launched less than a month ago, the adoption of tokenized stocks and ETFs through Ondo Global Markets has grown steadily, reaching a tokenized market cap of $280 million.

Ondo Finance Potential

According to Coingecko data, $ONDO has a market capitalization of around $2.8 billion. The token has a total supply of 10 billion, with approximately 3.1 billion currently in circulation.

ONDO’s monthly price movement shows multiple rejections at the 61.8% golden ratio level. The price failed to hold above it, marked by a strong red candle (highlighted in yellow), and is now moving sideways below that level. Volatility has decreased, as seen from the narrowing distance between green and red candles, while another significant rejection at the 78.6% level signals strong resistance.

A bullish scenario could unfold if the price breaks and sustains above 78.6% (around $1) with high trading volume, indicating strong buying interest. If confirmed, the price could retest the 61.8% level (around $1.1) and potentially rise to $1.3 with supportive sentiment.

However, any breakout must be validated by a monthly candle close above 61.8% to avoid a false breakout. Close attention to price reactions at both the 61.8% and 78.6% levels is crucial in this context.

Beyond current price action, Ondo demonstrates strong fundamental potential. Its core products, such as OUSG and USDY, have significantly contributed to the project’s growth by offering stable investment options in the crypto ecosystem. Additionally, continuous innovation, including the launch of Global Markets and its growing adoption, further strengthens Ondo’s long-term outlook.

2. Quant Network

Quant Network is a project focused on blockchain interoperability. Founded in 2015 by Gilbert Verdian, who has over 20 years of experience in cybersecurity, the project aims to bridge the gap between different blockchain systems.

Its target users are financial institutions and enterprises seeking solutions for cross-border payments, automated payment logic (programmable payments), and the integration of multiple blockchains for digital asset management and interoperability.

Through its Overledger platform, Quant enables both public and private blockchains such as Ethereum and other compatible networks to communicate and exchange data securely and in a structured manner.

Quant Network’s Core Products

- Overledger: Overledger is a universal API that securely and efficiently connects traditional financial systems with various blockchain networks.

- Quant Flow: An API-based digital money platform that enables banks and fintechs to automate accounts and deliver programmable payments to support the next generation of financial services.

- QuantNet: A programmable gateway that links banks with the tokenization of digital assets and money, allowing value transfer across public, private, and payment networks with full control.

- Quant Fusion: Quant Fusion is a solution that bridges traditional finance and decentralized innovation while maintaining compliance, integration, and security standards.

Latest Developments of Quant Network

On September 26, 2025, Quant issued a press release through its website, announcing that it had been selected to provide the technological infrastructure for the tokenised sterling deposits (GBTD) project in the United Kingdom.

The project is led by UK Finance in collaboration with major banks such as Barclays, HSBC, Lloyds, NatWest, Nationwide, and Santander. This initiative aims to test how token-based deposits can enhance payment efficiency, accelerate transaction settlements, and strengthen fraud protection.

Quant Network Potential

Quant Network has a native token with the ticker $QNT. In terms of tokenomics, $QNT has a relatively limited supply of around 14.6 million tokens, with approximately 12.1 million already in circulation. Its current market capitalization stands at 1.5 billion USD.

Based on technical analysis, $QNT’s price is currently moving above the 78.6% Fibonacci level and testing the 61.8% golden ratio on the monthly timeframe. To validate a bullish scenario, $QNT must close its monthly candle above the golden ratio level. Conversely, a bearish scenario may occur if the price fails to break through or sustain around $110.

In the attached price chart, although $QNT experienced a decline this month, there was a significant rebound. The price successfully reclaimed the opening level at $103.62 and rose to $104.86 at the time of writing.

The range of solutions offered by Quant Network shows great potential to accelerate integration between traditional financial systems and blockchain technology.

With a focus on interoperability, digital payment efficiency, asset tokenization, and compliance with regulatory standards, Quant Network positions itself as a relevant infrastructure amid the digital transformation of the global financial sector.

This advantage makes Quant Network not just a technology provider but also a strategic bridge for banks, fintechs, and other institutions to adapt to trends like CBDCs, RWAs, and DeFi. If these trends continue to develop, Quant Network has the potential to become a key connector, strengthening connectivity between the old financial world and the future digital ecosystem.

3. Maple Finance

Maple Finance is a crypto asset lending-borrowing platform providing on-chain financial services for institutions and retail users. Borrowers, including companies and institutions, gain access to fixed-rate funding for real-world business needs or digital activities. Meanwhile, lenders, such as retail users, can earn variable interest from assets they provide as liquidity on the platform.

Maple Finance’s Core Products

- Earn: A lending product requiring users to complete Know Your Customer (KYC) verification. Through this product, users can provide liquidity in crypto assets to various pools, such as High Yield, Blue Chip, and Bitcoin Yield. Each pool differs in interest rates, collateral types, and withdrawal periods. To access this service, users must complete several steps: submitting basic information, uploading KYC documents, awaiting review by the Maple team, and signing a lending agreement. Interest rates offered range from 4–10%.

- SyrupUSDC dan syrupUSDT Lending: A lending product accessible to all users without KYC requirements. Users provide liquidity in stablecoins (USDC or USDT), with interest rates around 6.7% as of the article’s writing. In addition to interest, users may also earn Maple’s native token, $SYRUP, when using this product.

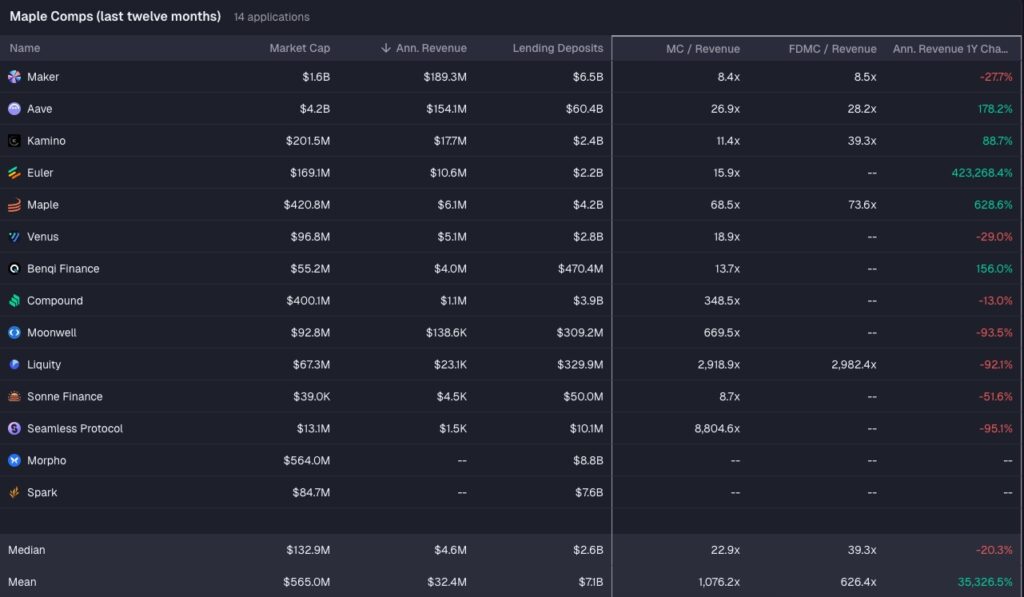

Latest Maple Metrics

Based on Artemis data, Maple Finance recorded a market capitalization of approximately $420.8 million with total loan deposits amounting to $4.2 billion.

In terms of annual revenue, Maple generated around $6.1 million, with a Market Cap to Revenue (MC/Revenue) ratio of 68.5x. This indicates that Maple’s valuation is relatively high compared to its generated revenue.

However, what sets Maple apart is its year-over-year (YoY) revenue growth, soaring by 628.6%, a significant increase signaling robust adoption of Maple’s services, particularly in its institutional lending model.

Compared to major platforms like Aave or Maker, which dominate in revenue and loan deposit size, Maple demonstrates more aggressive growth potential.

Despite its smaller business scale, Maple’s rapid growth highlights its ability to meet market needs, especially in bridging traditional financial institutions with on-chain lending services. This reinforces Maple’s position as a key project contributing to the strengthening of the RWA ecosystem in DeFi.

Latest Developments of Maple Finance

On September 15, 2025, Maple announced a partnership with Plasma, a new blockchain project. In this collaboration, Maple provided a $200 million pre-deposit vault for syrupUSDT on the Plasma network.

This strategic move is considered impressive, as Plasma is designed to expand stablecoin adoption. The presence of syrupUSDT in Plasma’s ecosystem not only enhances liquidity but also positions Maple as a key RWA project, actively expanding its product reach while strengthening its role in the growing trend of stablecoin adoption in DeFi.

Maple Finance Potential

Based on CoinGecko data, $SYRUP’s market capitalization currently stands at approximately $418 million. Out of a total supply of about 1.2 billion tokens, 1.1 billion are already circulating in the market.

The current price of $SYRUP is near a key support level at the 61.8% Fibonacci retracement, around $0.37, on the monthly timeframe. Technically, this area is often considered a strong defensive zone that could trigger a price bounce. If $SYRUP holds and closes its candle above this support, a bullish scenario opens with potential to rise toward the nearest resistance at approximately $0.50.

Conversely, if selling pressure intensifies and the price breaks below $0.37, a bearish scenario could unfold. Further declines might push the price toward the 78.6% Fibonacci level at around $0.30. With trading volume trending lower, the price reaction at this support will be critical for $SYRUP’s direction in the coming weeks.

Maple demonstrates strong fundamental potential by catering to two segments simultaneously. The Earn product offers KYC-compliant lending services, appealing to institutions.

Meanwhile, syrupUSDC and syrupUSDT Lending provide easy access for retail users without KYC. This combination highlights Maple’s flexibility in bridging institutional and retail market needs, reinforcing its position in the RWA and DeFi sectors.

4. Clearpool

Clearpool is a decentralized credit marketplace platform focused on real-world asset-based financing. Through its platform, Clearpool has facilitated hundreds of millions of dollars in stablecoin credit to reputable institutions, connecting verified borrowers with lenders.

Clearpool’s Core Products

- PayFi Vaults: Specialized financing containers providing short-term capital loans to support stablecoin-based transactions.

- Clearpool Dynamic: A permissionless lending-borrowing platform enabling users to supply liquidity to selected institutions, earning risk-adjusted yields without locking capital.

- Treasury Pool: A flexible USDX staking pool fully backed by short-term U.S. Treasury securities, offering additional incentives through FLR token rewards.

- Clearpool Prime: A credit solution designed for regulated institutions, incorporating KYC/AML procedures to ensure compliance with regulatory standards.

- cpUSD: A mintable crypto asset created by depositing stablecoins, backed by liquid stablecoin reserves and PayFi Vaults, generating ongoing yields.

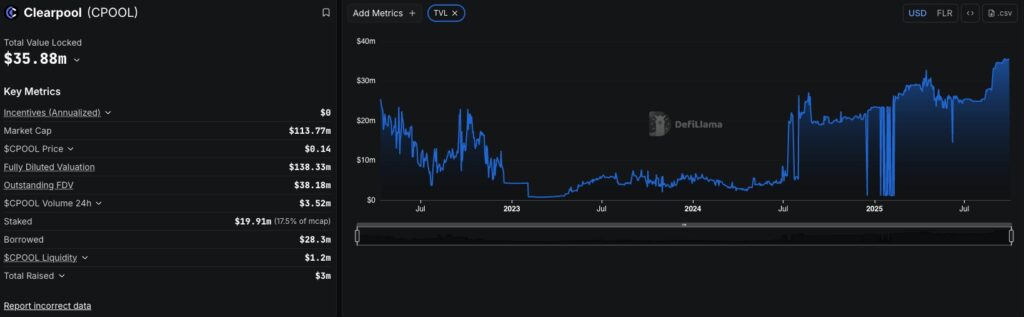

Latest Clearpool Metrics

Clearpool’s Total Value Locked (TVL) is currently recorded at approximately $35.88 million, with a $CPOOL market capitalization of $113.7 million and a token price around $0.14. Of this, about $19.9 million, or 17.5% of the market cap, is staked, while outstanding loans amount to $28.3 million.

The TVL chart shows a sharp decline in 2023, but since 2024, the trend has risen and stabilized in 2025. This surge indicates growing confidence from users and institutions in Clearpool’s ecosystem, particularly in its role as a decentralized credit marketplace.

Latest Developments of Clearpool

On August 11, 2025, Clearpool announced a strategic collaboration with Cicada, a company focused on on-chain credit risk consulting and management. Through this partnership, Cicada will be responsible for screening and monitoring borrower credibility in PayFi, ensuring lenders can confidently allocate funds with safety and precision.

Clearpool Potential

The CPOOL price chart indicates that the asset is currently at a critical juncture on the daily timeframe. After experiencing a weakening, the price is now hovering around the 61.8% Fibonacci level with strong support at approximately $0.12. This area is pivotal, as holding it could open the door to a potential upward reversal, especially supported by a previously formed consolidation pattern.

However, if the price fails to maintain this support area, a bearish scenario could drive CPOOL lower toward $0.11 or even $0.08. Conversely, a bounce followed by a breakout above the resistance zone of $0.16–$0.18 could rekindle a short-term bullish trend. Thus, the current support area is key to determining the next price direction.

Fundamentally, Clearpool offers a complementary ecosystem of products, ranging from stablecoin financing and flexible yield opportunities to access for regulated institutions. This foundation provides strong long-term growth potential for both retail and institutional markets.

5. Parcl

Parcl is a perpetual decentralized exchange (perpetual DEX) on the Solana network, focusing on the real estate market. The platform introduces innovation by enabling users to open long or short positions on global property price indices, including properties in cities like Chicago, Austin, and Brooklyn, without directly owning physical assets.

Clearpool’s Core Products

- Perpetual DEX: Parcl’s core feature, allowing users to open long or short positions on global property price indices without purchasing physical assets.

- Dealflow: An investment product that provides simpler access to global real estate markets.

- The Bank: Parcl’s liquidity mechanism, where users can deposit assets to support platform trading activities and earn up to 80% of transaction fees as a reward.

Latest Parcl Metrics

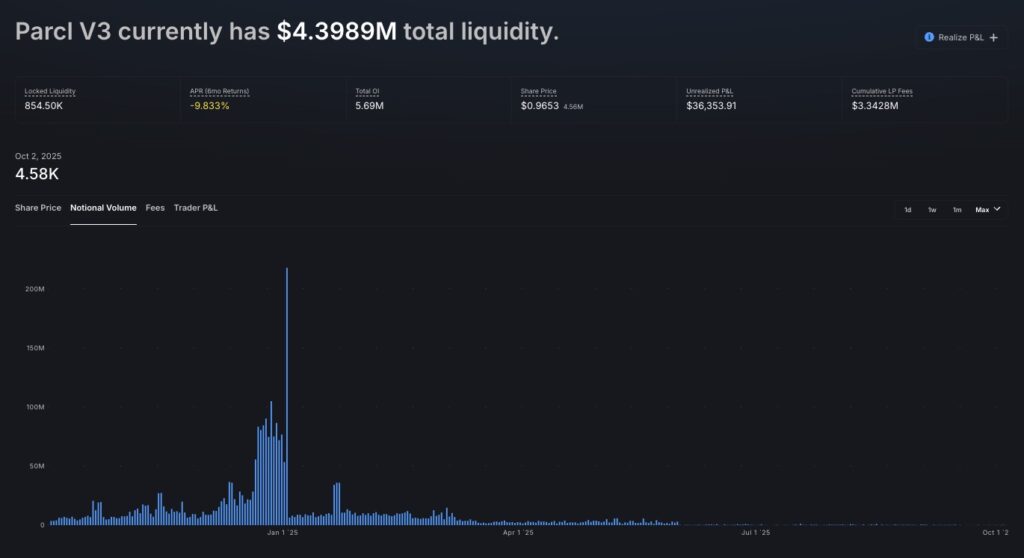

Liquidity in Parcl V3 is recorded at approximately $4.39 million, with trading activity significantly quieter compared to early 2025. A significant volume surge occurred earlier this year, but notional volume is now notably low.

This situation indicates a decline in trading interest within Parcl’s ecosystem, possibly suggesting that the real estate market is in a “wait and see” phase or that investors are exercising greater caution. Nevertheless, the sustained liquidity reflects that Parcl still maintains an active user base.

Latest Developments of Parcl

On September 17, 2025, Parcl announced via a blog post details regarding its V4 proposal. In this update, Parcl V4 introduces a significant shift by replacing the V3 AMM model with a Frequent Batch Auctions (FBA) system. This mechanism enables orders to be executed periodically at an average price, reducing loss risks for liquidity providers and lowering transaction costs. As a result, the market becomes simpler, more transparent, and efficient for all users.

Given the relatively low transaction volume on Parcl recently, V4 could serve as a pivotal moment to revitalize market activity. The streamlined trading structure and reduced barriers for liquidity providers are expected to encourage broader participation, further strengthening Parcl’s position as a bridge between real estate markets and DeFi.

Parcl Potential

Based on CoinGecko data, $PRCL has a market capitalization of approximately $32 million, a significant decline from its all-time high of $99 million.

The $PRCL price chart shows a downward trend since early 2025, with the price now at a support zone around the 78.6% Fibonacci level. This pattern indicates the price is testing a critical area, where market reaction will determine whether it holds or continues to weaken further. Technically, strong support below could be a key area for traders to anticipate a potential reversal.

Conversely, resistance around the 61.8% Fibonacci level is a crucial threshold that must be breached to confirm a potential recovery trend. If the price fails to surpass this area, selling pressure is likely to persist. This situation suggests the market remains cautious, and traders should monitor price movement confirmations before making further decisions.

Additionally, given the relatively low transaction volume on Parcl recently, V4 could serve as a pivotal moment to revitalize market activity. The streamlined trading structure and reduced barriers for liquidity providers are expected to encourage broader participation, further strengthening Parcl’s position as a bridge between real estate markets and DeFi.

Start Investing in RWA Altcoins on Pintu

After understanding the latest updates on RWA projects, you can easily invest in or trade RWA assets such as Ondo, SYRUP, QNT, CPOOL, and PRCL through the Pintu app. All of these are available in one safe, user-friendly application suitable for both beginners and experienced investors.

Here’s how to buy crypto assets on Pintu:

- Go to the Pintu homepage

- Navigate to the Market page

- Search for and select the crypto asset you’ve analyzed

- Enter the amount you’d like to purchase, and follow the next steps to complete your transaction

Conclusion

RWA trend shows significant progress with projects like Ondo Finance, Quant Network, Maple Finance, Clearpool, and Parcl, each offering distinct solutions to integrate real-world assets into the blockchain ecosystem. Ondo leads with bond tokenization and stablecoin products, Quant focuses on interoperability for institutions, Maple expands on-chain lending, Clearpool builds a decentralized credit marketplace, and Parcl provides access to real estate markets via a perpetual DEX. This diversity of innovation underscores that RWA not only strengthens the bridge between traditional finance and DeFi but also has the potential to become a cornerstone in driving global adoption of digital assets in the future.

Disclaimer: All articles from Pintu Academy are intended for educational purposes only and do not constitute financial advice.

References

- NFTevening, “What is Maple Finance? The Next DeFi Lending Protocol”, NFTevening, accesed on September 29, 2025.

- Guneet Kaur, “What is Quant Network: A beginner’s guide to QNT cryptocurrency”, Cointelegraph, accesed on September 29, 2025.

- Zac Glover, “Trade global real estate prices with Parcl” Phantom, accesed on September 30, 2025.

- Travor Bacon, “Parcl V4: Proposing a Revolutionary Architecture for Real Estate Investing”, Parcl, accesed on September 29, 2025.

- Documentation of Ondo https://docs.ondo.finance/ondo-chain

- Website of Quant Network https://quant.network/

- Documentation of Maple https://docs.maple.finance/syrupusdc-for-lenders/introduction

- Documentation of Clearpool https://docs.clearpool.finance/clearpool