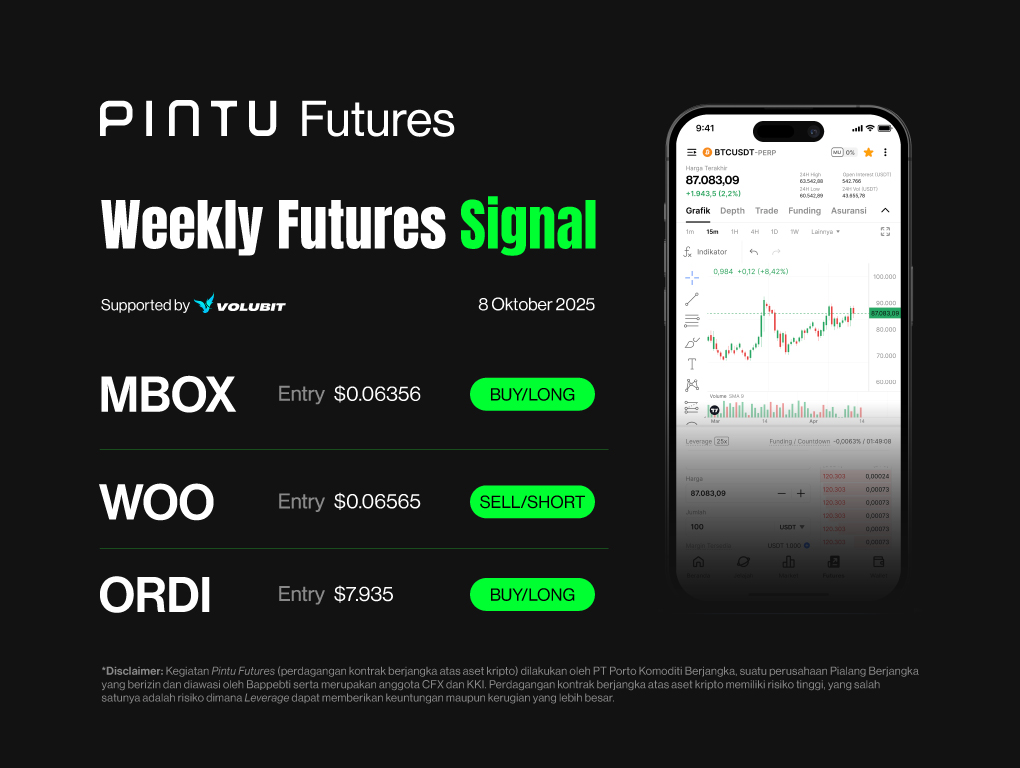

Signal Summary Futures Trading:

- MOBOX (MBOX)

- Entry (Long) : $0.06356

- Stop Loss [SL] : $0.06027

- Take Profit [TP] :

- TP1: $0.06935

- TP2: $0.07098

- WOO (WOO)

- Entry (Short) : $0.06565

- Stop Loss [SL] : $0.07031

- Take Profit [TP] :

- TP1: $0.05919

- TP2: $0.05434

- ORDI (ORDI)

- Entry (Long) : $7.935

- Stop Loss [SL] : $7.504

- Take Profit [TP] :

- TP1: $8.359

- TP2: $8.940

1. MOBOX (MBOX)

The price movement of MBOX is showing interesting technical signals after successfully breaking out from its consolidation range between $0.05202 and $0.06089.

This momentum could mark a trend reversal from a bearish phase to a bullish one. The $0.06089 level, which previously acted as the last lower high during the downtrend from September 14–25, has now turned into a key support area.

If the 4-hour candle closing at 3:00 PM WIB on October 8 closes in green, the likelihood of continued upward momentum will increase. This scenario presents an opportunity to enter a buy position with a well-measured risk-to-reward ratio.

Potential Buy/Long Setup MBOX:

- Entry (Long) : $0.06356

- Stop Loss [SL] : $0.06027

- Take Profit [TP] : TP1: $0.06935, TP2: $0.07098

2. WOO (WOO)

The price movement of WOO is showing bearish technical signals after breaking down from a rising wedge pattern, which typically indicates a potential trend reversal from bullish to bearish.

The $0.06903 level, which previously acted as both a horizontal support and the last higher low, has now been successfully breached. If the price manages to rebound and retest this area, followed by a rejection, it could present an opportunity to look for short-selling setups.

In this scenario, WOO’s downside momentum is expected to continue, with the next potential target area around $0.05919.

Potential Buy/Long Setup WOO:

- Entry : $0.06565

- Stop Loss [SL] : $0.07031

- Take Profit [TP] : TP1: $0.05919, TP2: $0.05434

3. ORDI (ORDI)

The price movement of ORDI is showing significant selling pressure after the price once again failed to break through the resistance area around $8.940. The rejection at this level has triggered an ongoing price correction.

This downward movement is expected to continue toward the support zone between $7.559 and $7.769. The price reaction within this area will be crucial in determining the next direction — if a strong rebound signal forms, ORDI could potentially regain strength and retest the $8.940 resistance level.

Potential Buy/Long Setup for ORDI:

- Entry : $7.935

- Stop Loss [SL] : $7.504

- Take Profit [TP] : TP1: $8.359, TP2: $8.940

Important Note

Always apply proper risk management and disciplined capital allocation. For trading, especially when using leverage, it is recommended to limit the risk per trade to 1% of total capital.

Disclaimer: Pintu Futures trading (crypto futures contracts) is conducted by PT Porto Komoditi Berjangka, a licensed Futures Broker supervised by Bappebti and a member of CFX and KKI. Trading cryptocurrency futures contracts carries high risk, including the risk that leverage may magnify both potential gains and potential losses.