The year 2025 has witnessed rapid growth in the blockchain ecosystem, with Layer-1 (L1) projects continuously innovating and competing to lead the foundational infrastructure of crypto technology. In an increasingly crowded landscape, several L1 altcoins have stood out, gaining significant attention from the community due to their technical performance, user adoption, and strong ecosystem support.

This article presents an analysis of the five most talked-about L1 altcoins of 2025, exploring their strengths, growth trajectories, and potential.

Article Summary

1️⃣ Ethereum (ETH) remains the dominant force with a TVL of $93.82 billion.

📈 Solana (SOL) saw a 35% spike in daily active users within just one week.

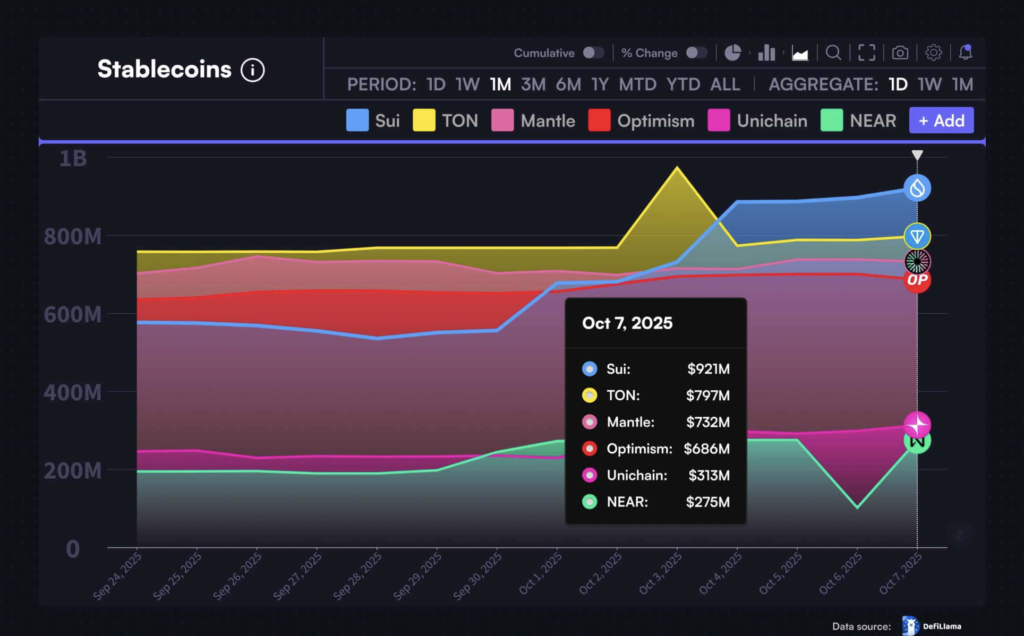

💧 Sui (SUI) surpassed Toncoin, Mantle, and Optimism in stablecoin market cap.

🎇 BNB (BNB) overtook XRP to become the 3rd largest crypto asset by market capitalization.

💸 With $1.062 billion in annualized revenue, Hyperliquid (HYPE) outperformed 4 other major blockchain platforms.

What is a Layer-1 (L1) Blockchain?

The term Layer-1 (L1) refers to the foundational layer of a blockchain network—its core protocol that forms the base infrastructure of the entire system. This layer is built on distributed ledger technology (DLT) designed to securely, transparently, and immutably record transactions without relying on third-party trust.

Layer-1 is the most fundamental form of blockchain technology, often called the “core” or “foundation” of the network. All other protocols and decentralized applications (dApps) are built on top of this layer. Only the Layer-1 layer is directly responsible for maintaining the ledger’s integrity, validating transactions, and securing the network against potential attacks.

A key component of Layer-1 is its consensus mechanism—the system used to approve and record transactions across the network. This ensures all transaction data remains permanent and trustworthy. Common consensus mechanisms include Proof of Work (PoW), Proof of Stake (PoS), and Delegated Proof of Stake (DPoS).

Many of today’s leading public blockchains—such as Bitcoin and Ethereum—are Layer-1 networks. These serve as the foundation for a wide range of decentralized applications and protocols being developed across the crypto ecosystem.

👉 Learn more about blockchain layers here.

1. Ethereum (ETH)

Launched in 2015, Ethereum is a decentralized, open-source computing platform that allows anyone to create smart contracts and decentralized applications (dApps).

Unlike Bitcoin, which was designed primarily as a form of digital money, Ethereum was built with a broader purpose in mind. Its founders envisioned a global, secure, and open computing platform that leverages blockchain technology to support a wide variety of applications — from finance and voting systems to digital asset management.

Ethereum’s Applications and Key Features

According to the Ethereum Foundation, Ethereum can be used to encode, decentralize, secure, and trade virtually anything. Some of its key use cases include:

- Crowdfunding

- Financial exchanges

- Corporate governance

- Domain name management

- Intellectual property protection

- Smart property with hardware integration

- Voting systems

- Automated contract execution

Additionally, Ethereum supports a wide range of activities such as:

- Buying and selling cryptocurrencies like ETH and ERC-20 standard tokens

- Hosting smart contracts and decentralized applications (dApps)

- Facilitating decentralized finance (DeFi) services

- Trading non-fungible tokens (NFTs)

- Running enterprise software built on Ethereum independently from the public chain

- Playing Ethereum-based games where players can earn cryptocurrency as rewards

Ethereum’s flexibility, widespread adoption, and rich ecosystem of tools and developers continue to make it one of the most influential Layer-1 blockchains in the crypto space

Latest Metrics on Ethereum

As of writing, data from DeFiLlama shows that Ethereum remains the dominant force in the DeFi sector, with a Total Value Locked (TVL) of $93.82 billion — the highest among all blockchain networks.

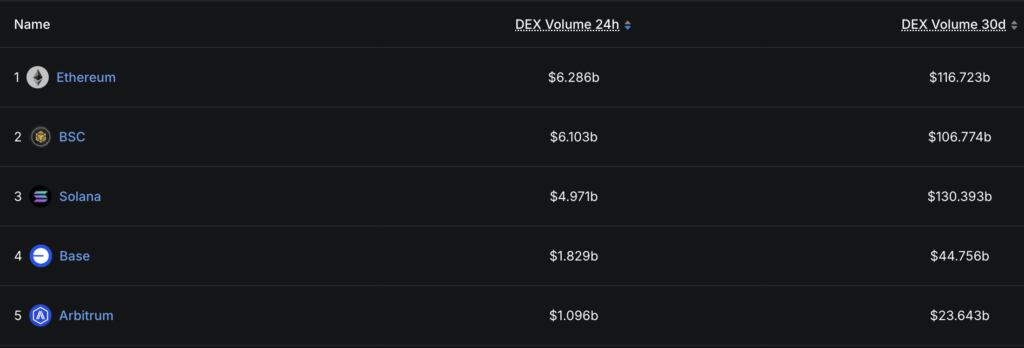

In terms of network activity, Ethereum records a daily DEX volume of $6.286 billion, slightly ahead of BNB Smart Chain (BSC) with $6.103 billion. However, over the past 30 days, Solana has taken the lead with the highest DEX volume at $130.393 billion, outperforming Ethereum at $116.723 billion and BSC at $106.774 billion.

On-chain data also reveals that large holders (whales) have accumulated nearly 870,000 ETH, increasing their total holdings from 99.34 million to 100.21 million ETH. At Ethereum’s current price of around $4,440, this accumulation is valued at nearly $4 billion, marking one of the largest single inflows by whales in recent weeks.

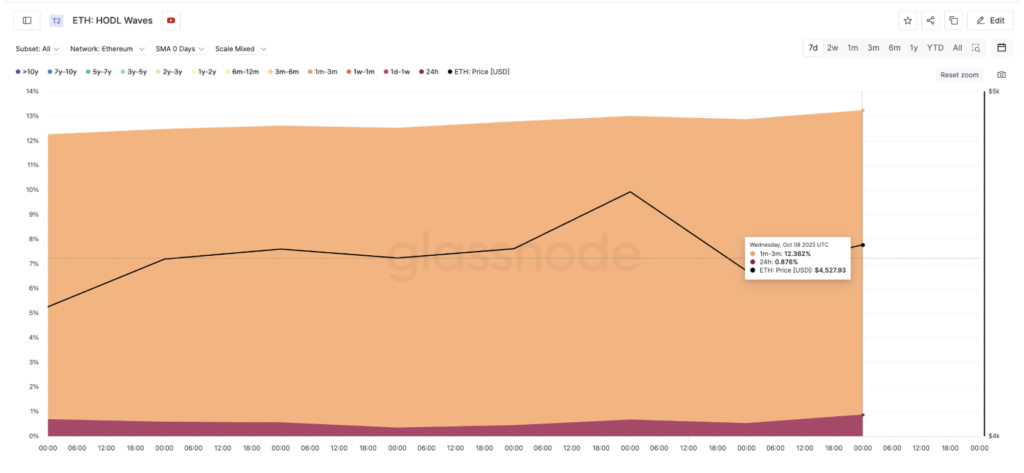

Interestingly, smaller and mid-sized investors are also becoming more active. According to Glassnode’s HODL Waves, the 24-hour holding cohort rose from 0.34% to 0.87% since October 4, while the 1–3 month cohort increased from 11.57% to 12.36% over the past week.

This rise in short-term holdings — especially during periods of sideways price movement — typically signals a reaccumulation phase, where traders are re-entering the market, adding liquidity, and setting the stage for the next potential move.

Latest Ethereum Developments

In a major update, the Ethereum Foundation has officially launched a new privacy cluster as part of its ongoing efforts to expand privacy-related initiatives within the Ethereum ecosystem. The cluster will involve 47 members, including researchers, engineers, coordinators, and cryptographers.

Notably, this privacy cluster will not operate in isolation. It will collaborate closely with other teams within the Foundation, particularly through initiatives like the Institutional Privacy Task Force (IPTF)—a group focused on ensuring all Ethereum-related projects comply with global privacy regulations.

This move reinforces Ethereum’s commitment to building a blockchain that not only upholds transparency but also respects user and institutional privacy across the globe.

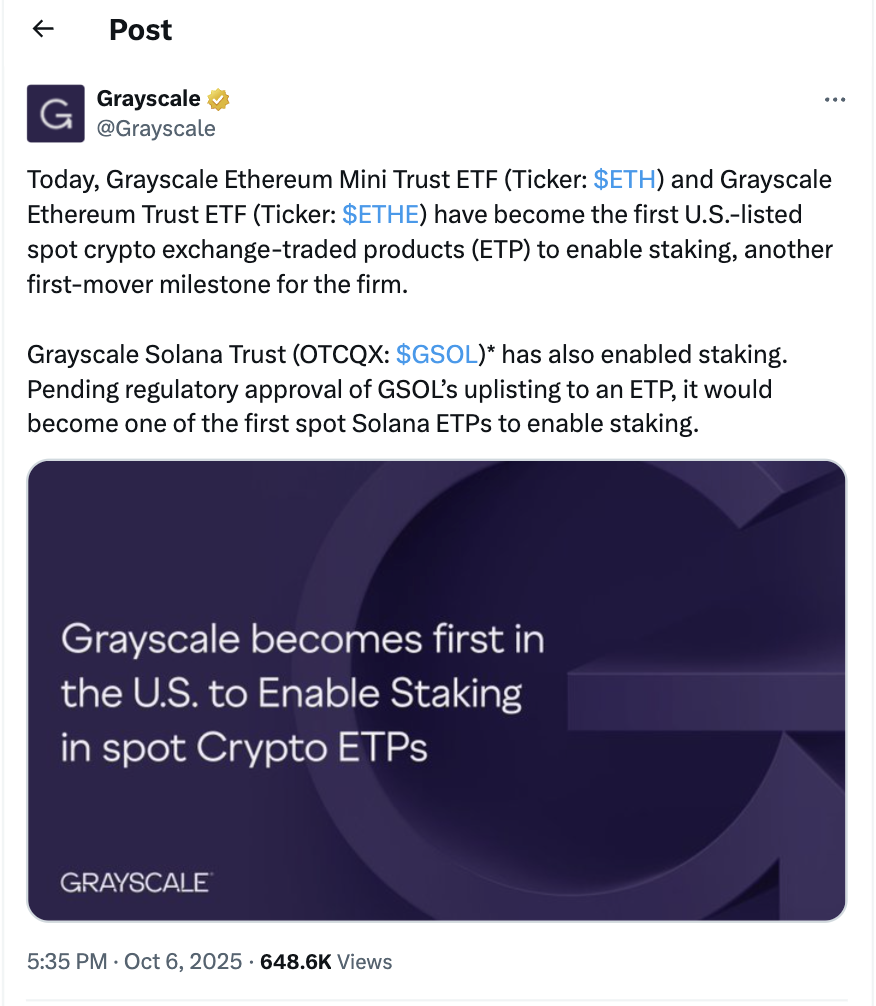

In another significant milestone for the crypto industry, digital asset manager Grayscale announced the launch of staking support for its two U.S.-listed Ethereum ETFs: the Grayscale Ethereum Trust ETF (ETHE) and the Grayscale Ethereum Mini Trust ETF (ETH).

The staking feature is designed to offer investors exposure to the long-term value growth of the Ethereum network while maintaining the core objective of both funds—spot ETH exposure.

Ethereum’s Potential

According to data from CoinGecko, Ethereum currently boasts a market capitalization of around $519 billion with a daily trading volume of $42 billion. Leading crypto analyst Michaël van de Poppe recently shared a bullish outlook on Ethereum, suggesting that the asset could reach a new all-time high [ATH] in the near future. He based this prediction on two main factors.

First, he noted that the ETH/BTC pair appears to have bottomed out after a typical correction and is now showing strong signs of recovery. On the weekly chart, ETH/BTC has rebounded sharply—up 144.29% from its 2025 low. Van de Poppe identified the 0.03250 BTC area as a prime accumulation zone, potentially serving as a launchpad for the next rally.

Second, he pointed to the parabolic surge in gold prices, which he believes is entering an exhaustion phase. Should gold correct soon, it could trigger a “risk-on” rotation, where investors move from safe-haven assets into higher-risk plays like crypto — with Ethereum likely to be one of the key beneficiaries.

A chart he posted on X (Twitter) showed ETH/BTC testing key support following a major rally, with further upside potential if the highlighted buy zone holds.

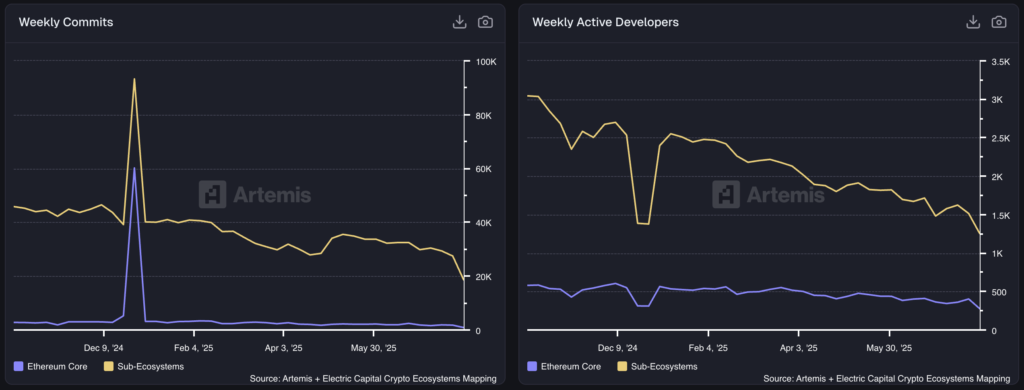

On the fundamental side, Ethereum continues to lead the crypto industry in developer activity, according to data from Artemis and Electric Capital. The Ethereum sub-ecosystem consistently records 20,000 to 40,000 code commits per week, while Ethereum Core maintains 1,500 to 2,500 commits. Weekly active developer counts remain strong, with over 1,500 developers in the sub-ecosystem and 300–500 developers working on Ethereum Core directly.

These metrics reinforce Ethereum’s appeal among developers — driven by its high compatibility, making it ideal for building a wide range of dApps. As the largest Layer-1 network in the industry, Ethereum offers a mature infrastructure and extensive ecosystem, making it the go-to platform for Web3 and DeFi project development.

2. Solana (SOL)

Solana (SOL) is a high-performance public blockchain platform that offers fast transactions and low fees for both developers and users. Compared to older public blockchains like Ethereum, Solana delivers significantly higher efficiency.

Launched in 2020, Solana quickly gained traction in the crypto community—particularly with the rise of decentralized finance (DeFi) and non-fungible tokens (NFTs). Its core mission is to achieve high scalability without sacrificing security or decentralization, setting it apart from many other blockchain projects.

Solana’s Applications and Key Features

Solana is built with several features designed to maximize performance and reduce network congestion:

1. Proof of History (PoH) Consensus Mechanism

At the heart of Solana’s speed is Proof of History, a cryptographic time-stamping mechanism that allows validators to process and sequence transactions independently, without waiting on each other. This drastically cuts down validator communication overhead and greatly improves transaction throughput.

2. Scalability and Speed

Solana is known for its ability to handle tens of thousands of transactions per second (TPS) under optimal conditions. By combining PoH with Proof of Stake (PoS), the network can scale efficiently with growing demand—making it ideal for real-time applications such as trading platforms and blockchain-based gaming.

3. Low Transaction Costs

In addition to its speed, Solana offers very low transaction fees, often remaining minimal even during periods of high network activity. This cost-efficiency makes Solana highly attractive to both developers and traders who frequently interact with the network.

Latest Metrics on Solana

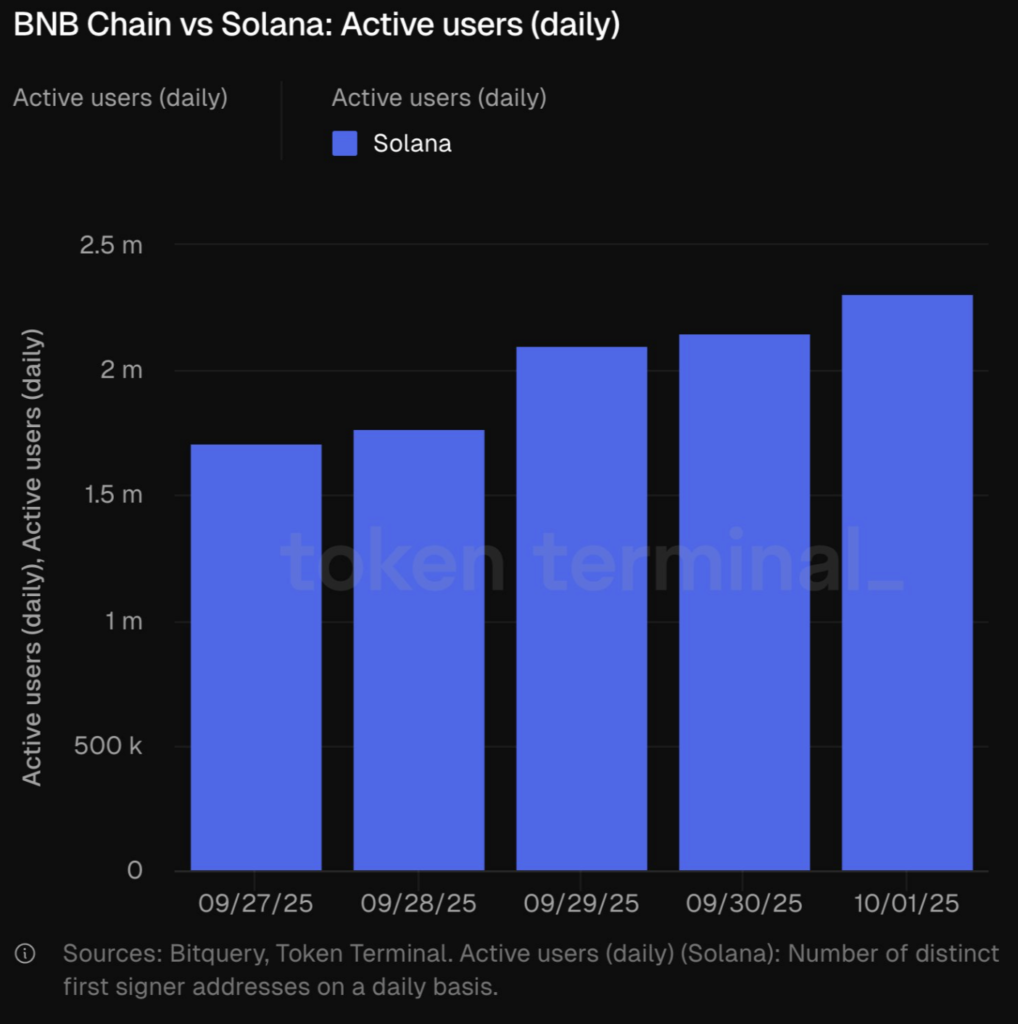

According to Token Terminal, Solana’s daily active users surged significantly in early October 2025, jumping from 1.7 million to nearly 2.4 million—a 35% increase in under a week. As reported by Coin Central, this sharp rise is believed to be driven by increased on-chain activity and the launch of several new dApps, signaling strong user engagement within the Solana ecosystem.

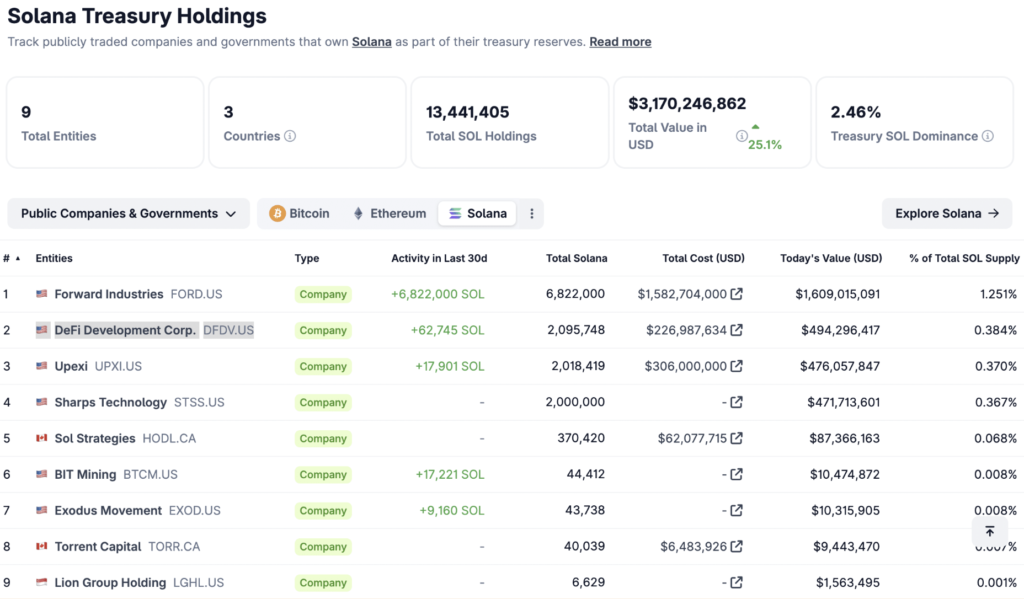

Data from CoinGecko also shows a sharp uptick in SOL accumulation by public companies throughout 2025, particularly in September. Millions of SOL tokens have been added to corporate treasuries, reflecting growing institutional interest in the asset.

Forward Industries currently holds the largest amount of SOL among corporations, with over 6.8 million tokens valued at more than $1.5 billion, all accumulated in just one month. Other companies, including DeFi Development Corp, Upexi, and Bit Mining, also made significant purchases in the past 30 days.

Meanwhile, Solana Company now ranks as the second-largest corporate holder, with 2.2 million SOL in reserve. This wave of institutional accumulation indicates that Solana is increasingly viewed as a strategic reserve asset, joining Bitcoin and Ethereum as part of a broader trend of digital asset diversification on corporate balance sheets.

Latest Solana Developments

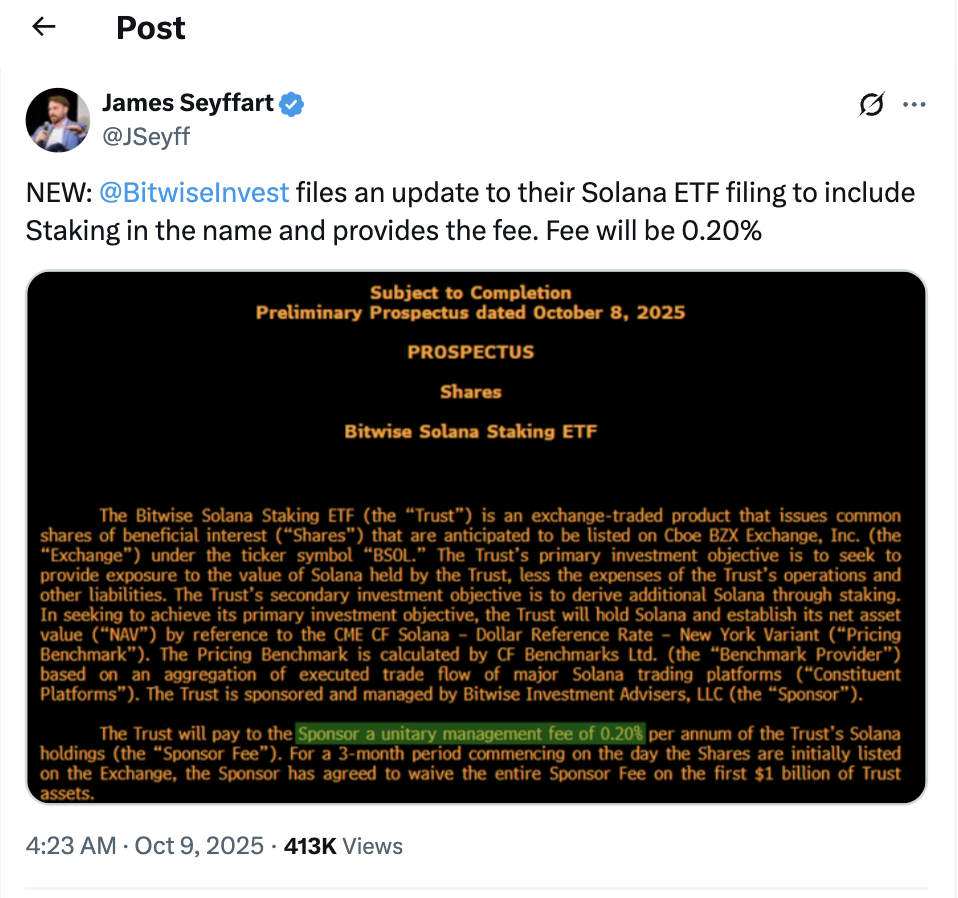

In a recent update, Bitwise amended its Solana ETF filing to include a staking feature, allowing investors to earn rewards by helping secure the Solana network. The ETF will charge an annual management fee of just 0.20%, making it more competitive than many similar products on the market.

Additionally, Matt Hougan, Chief Investment Officer at Bitwise, made a strong statement on October 2, declaring that Solana is poised to become Wall Street’s blockchain of choice for stablecoins and real-world asset tokenization.

“I believe Solana is the new Wall Street,” said Hougan in a conversation with Akshay BD from the Solana Foundation. He noted that many influential players now realize stablecoins could reinvent payments, while tokenization is set to transform the way we trade stocks, bonds, commodities, and real estate.

When institutional investors look at the blockchain landscape, Hougan explained, they are drawn to Solana’s technical strengths—particularly its speed, throughput, and transaction finality. He also highlighted the network’s performance upgrade, noting how settlement times have improved from 400 to 150 microseconds, a change that closely aligns with institutional trading preferences.

Solana’s Potential

According to CoinGecko, Solana’s market cap now stands at $122 billion, with a daily trading volume of approximately $7.9 billion. Over the past three months, SOL has gained 36.5%, highlighting its strong upward momentum.

On the technical side, Solana’s daily chart shows a hidden bullish divergence—a pattern where the price forms a higher low while the Relative Strength Index (RSI) prints a lower low. This setup typically signals that the ongoing uptrend remains strong and may continue.

A similar pattern previously formed from April 7 to June 22, resulting in a 63.63% price increase in just one month. Another divergence appeared between August 2 and September 25, of which around 24% of the projected move has already played out. If the same trajectory repeats, SOL could reach $312 by the end of October, mirroring the scale and timing of earlier rallies.

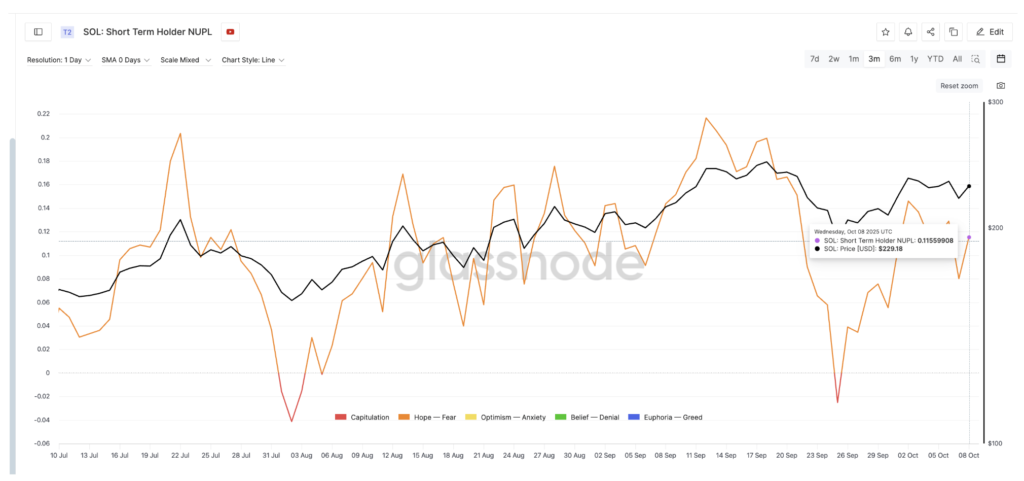

On-chain data supports this outlook. The short-term holder NUPL (Net Unrealized Profit/Loss) currently sits at 0.11, a level that suggests healthy profit-taking without signs of a panic sell-off. Historically, levels around 0.20–0.21 often mark local tops, as seen in July and September. In contrast, today’s 0.10–0.11 range is closer to the “steady accumulation zone,” similar to August, when Solana rallied after minor dips.

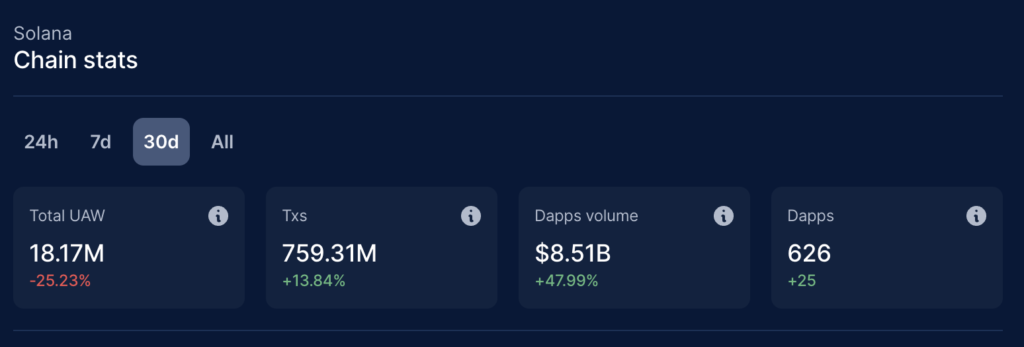

From a fundamental perspective, Solana’s ecosystem continues to expand rapidly. DappRadar reports that in the past 30 days alone, Solana recorded over 18.17 million unique active wallets (UAW), signaling high user engagement. Transaction volume was equally impressive, with 759.31 million on-chain transactions, and DApp volume reaching $8.51 billion.

Furthermore, the total number of active DApps on Solana climbed to 626, with 25 new DApps added in just one month—a strong indicator of ongoing developer activity and innovation.

This robust growth is fueled by Solana’s core strengths: its unique Proof of History consensus mechanism enables high-speed, low-cost transactions, while its scalability, interoperability, and developer-friendly tools (including support for Rust) make it a top choice for both new and experienced blockchain builders.

Taken together, these technical signals, on-chain metrics, and ecosystem fundamentals position Solana as one of the most active and promising Layer-1 blockchains in 2025.

3. Sui (SUI)

Sui is a Layer-1 blockchain designed for high-speed, low-cost transactions. Its standout features include a unique object-based data model and the use of the Move programming language, originally developed by Facebook’s Libra project. This combination allows parallel transaction execution, making Sui significantly faster and more efficient than many other blockchain networks.

The network is optimized for instant finality, large-scale parallel processing, and seamless scalability. Thanks to these capabilities, Sui has become a compelling choice for use cases such as decentralized finance (DeFi), non-fungible tokens (NFTs), and play-to-earn games.

Sui’s Applications and Key Features

Although Sui’s mainnet officially launched in 2023, several real-world use cases had already demonstrated its potential prior to that.

1. Web3 Gaming Experience

Thanks to its object-centric architecture, Sui is particularly well-suited for game developers who need to manage a high volume of in-game assets. As of May 2023, around nine game projects were already live on the Sui network.

Notable examples include:

- Abyss World, a high-fantasy action RPG that offers immersive exploration,

- Run Legends, a fitness-focused game where real-world movement translates into in-game attacks.

Other projects like Cosmocadia and Panzerdogs are also gaining traction. Additionally, Orange Comet, a leading Web3 gaming and entertainment studio, recently partnered with Sui to launch immersive games on the platform.

2. DeFi Protocols

Sui leverages the Move language, which is known for its built-in safety features, making it an ideal environment for secure DeFi protocol development. Notable DeFi projects on Sui include:

- Turbos Finance

- OmniBTC

- Cetus Protocol

- Aftermath Finance

These protocols benefit from the performance and security enhancements Move brings to blockchain-based finance.

3. Decentralized Social Applications

Sui also enables community-driven social interactions through decentralized apps (dApps). One example is Polymedia Chat, a blockchain-based messaging platform that allows users to chat without relying on centralized intermediaries or censorship.

Another notable dApp is Suia, which connects users into on-chain “families” based on shared NFT ownership, creating new forms of digital social interaction. According to a report by Hacken, Suia has grown to over 300,000 communities and 220,000+ active users.

Latest Metrics on Sui

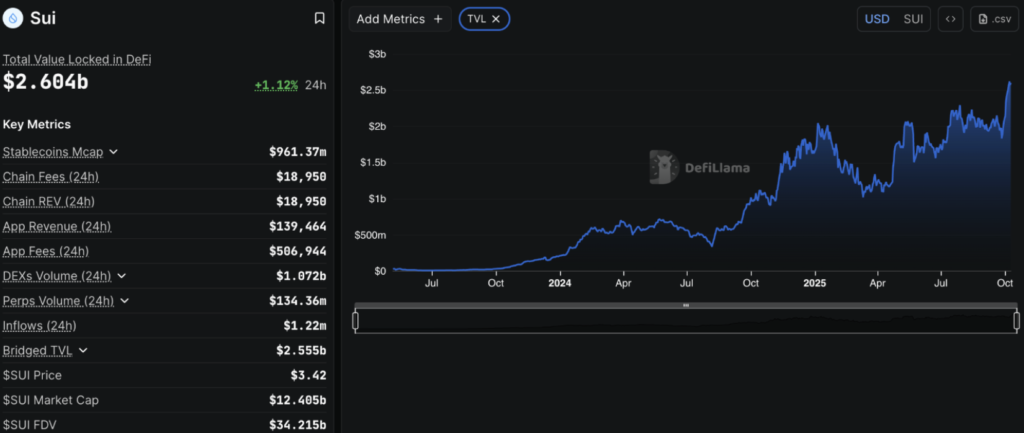

According to data from DefiLlama, Sui’s DeFi ecosystem has hit a new milestone, with its Total Value Locked (TVL) surpassing $2.6 billion this week.

This surge is more than just a reflection of market bullishness — it represents a significant shift in DeFi market share. As noted in a blog post by the Sui Foundation, Sui’s TVL stood below $250 million at the start of 2024, rose to $1.75 billion by year-end, and has now climbed more than 10x in under two years.

Sui’s momentum doesn’t stop there. It has also overtaken Toncoin (TON), Mantle (MNT), and Optimism (OP) in stablecoin market cap, reaching $921 million — over $100 million more than TON, the next closest contender. Meanwhile, total swap volume on the Sui network has crossed a major threshold of $16.25 billion, further cementing its growing presence in the DeFi space.

Latest Sui Developments

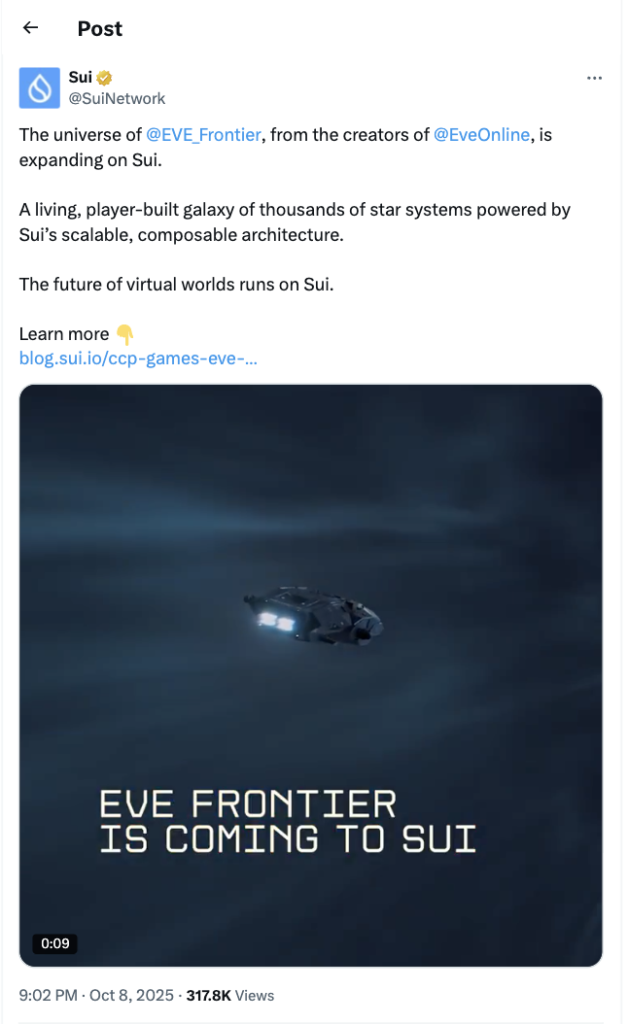

CCP Games — the developer behind the legendary EVE Online — has officially announced that its upcoming space-survival MMO, EVE Frontier, will be built on the Sui blockchain. With a vision to create a vast, player-driven economy and a continuously evolving universe, Sui’s object-based architecture was deemed the ideal foundation. This technology enables complex modeling of tens of thousands of star systems, player-built ships, and dynamic in-game infrastructure.

According to Sui’s official blog, this move reinforces Sui’s position as a leading blockchain for large-scale Web3 applications, especially in gaming — where high scalability and flexible asset logic are critical.

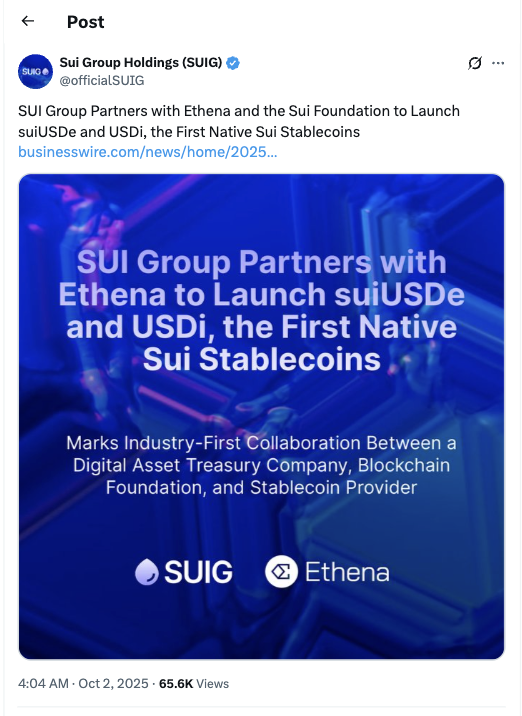

In addition, in early October, Sui and Nasdaq-listed digital asset treasury firm SUI Group Holdings Limited (NASDAQ: SUIG) announced the launch of suiUSDe, a native Sui-based synthetic dollar token powered by Ethena. This marks the first-ever collaboration in the industry between a digital asset treasury company, a blockchain foundation, and a stablecoin issuer — a significant step forward in the evolution of decentralized finance.

As detailed in their announcement, suiUSDe will be backed by a combination of digital assets and corresponding short futures positions to maintain its peg. Furthermore, another stablecoin, USDi, is also set to launch on the Sui network later this year. USDi is backed by BlackRock’s tokenized money market fund, the BUIDL Fund, adding further credibility and diversification to the growing stablecoin ecosystem on Sui.

Sui’s Potential

While the Sui network continues to demonstrate rapid ecosystem growth, the SUI token price has yet to catch up. According to CoinGecko, SUI has dropped by 3.7% over the past 7 days, currently trading at $3.42, with a market cap of approximately $12 billion.

Despite this pullback, several market analysts believe a price recovery may be near. Crypto analyst CryptoPulse notes that SUI is consolidating within an ascending triangle — a classic technical pattern often indicating a bullish breakout.

The key resistance zone lies between $4.12 and $4.45, with potential for a brief pullback to the $3.20–$3.18 support area before rebounding higher.

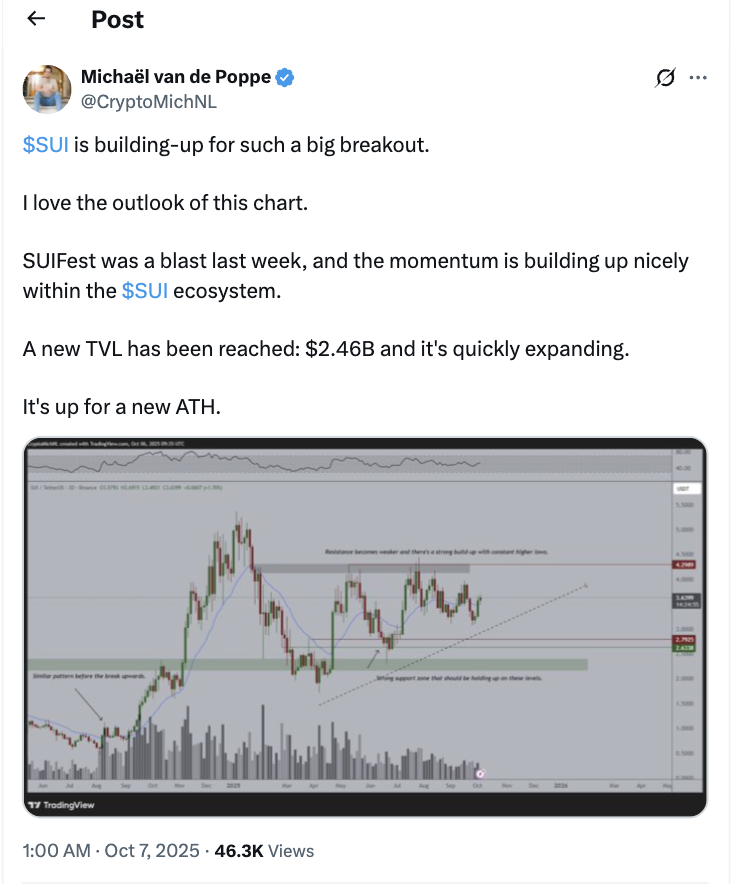

Renowned analyst Michaël van de Poppe also expressed optimism, suggesting SUI could reach a new all-time high, supported by the network’s strengthening fundamentals.

From a broader perspective, Sui’s mid-term outlook remains positive, especially with strong DeFi growth and on-chain activity. However, confirmation is still needed on whether SUI can break above resistance or if further correction is likely.

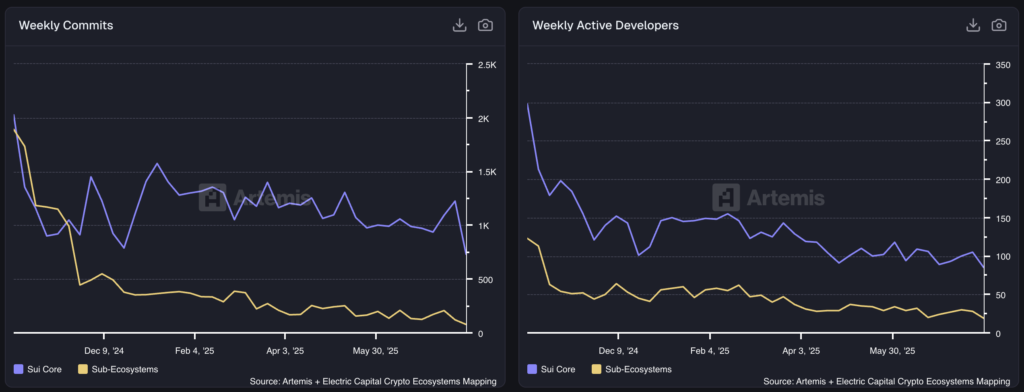

On the development side, data from Artemis and Electric Capital show that Sui remains highly active. The Sui Core averages 800–1,200 weekly commits, while its sub-ecosystems contribute 200–400 commits per week.

As for developer engagement, Sui Core consistently hosts 100–150 active weekly developers, with an additional 30–50 in its sub-ecosystem — indicating a committed and vibrant developer community.

With its Move programming language, known for secure asset management, built-in protection against vulnerabilities like reentrancy bugs, and its logical structure — Sui continues to attract developers, particularly those building complex decentralized applications (dApps).

4. BNB (BNB)

BNB Smart Chain (BSC) is a blockchain network developed by Binance, one of the largest cryptocurrency exchanges in the world. Launched in 2020, BSC was designed to run in parallel with Binance Chain, which initially focused on fast token transfers and trading.

With BSC, Binance expanded its ecosystem by enabling developers to build and deploy smart contracts and decentralized applications (dApps)—making the platform far more versatile.

BNB, the native token of Binance’s ecosystem, operates across both Binance Chain and BSC. Initially launched as an ERC-20 token on Ethereum, BNB was later migrated to Binance’s own blockchain network.

BNB’s Applications and Key Features

BNB Smart Chain is optimized for speed, efficiency, and low-cost transactions, making it attractive for both developers and everyday users.

1. Unique Consensus Mechanism

BSC uses a consensus algorithm called Proof of Staked Authority (PoSA)—a hybrid of Proof of Stake and Proof of Authority. Validators must stake BNB to participate in securing the network and are rewarded with transaction fees in BNB. This model delivers high throughput with low latency while maintaining network security.

2. Ethereum Compatibility

BSC is compatible with the Ethereum Virtual Machine (EVM), meaning developers can deploy Ethereum-based applications on BSC with little to no modification. It also supports popular Ethereum programming languages like Solidity, which has accelerated BSC’s dApp ecosystem growth.

3. Low Transaction Fees

One of BSC’s biggest advantages is its extremely low transaction fees—often just a few cents—compared to Ethereum, which can suffer from high gas fees. This cost efficiency attracts a broad range of developers and users, especially in emerging markets.

4. Robust dApp Ecosystem

BSC hosts a wide variety of decentralized applications, from DEXs, lending platforms, and yield farming protocols to NFT marketplaces. Popular dApps like PancakeSwap, Venus, and Autofarm continue to serve hundreds of thousands of active users, underlining BSC’s strong ecosystem engagement.

Latest Metrics on BNB

Recent data reveals BNB Smart Chain’s growing dominance among the top five Layer-1 blockchains, marked by strong ecosystem metrics and a sharp rise in token performance.

BNB recorded a 22.96% surge in token price, and currently leads with the highest number of dApps, totaling 5,916. User activity also showed significant growth, with daily active users (UAW) climbing to 1.77 million — up 30.65% in just a short period.

In terms of network value, Total Value Locked (TVL) on BNB Smart Chain rose 25.21%, reaching $11.79 billion. Additionally, the network saw a massive spike in NFT volume, soaring over 1,000%, and a 52.13% increase in dApp transaction volume, totaling $93.87 billion.

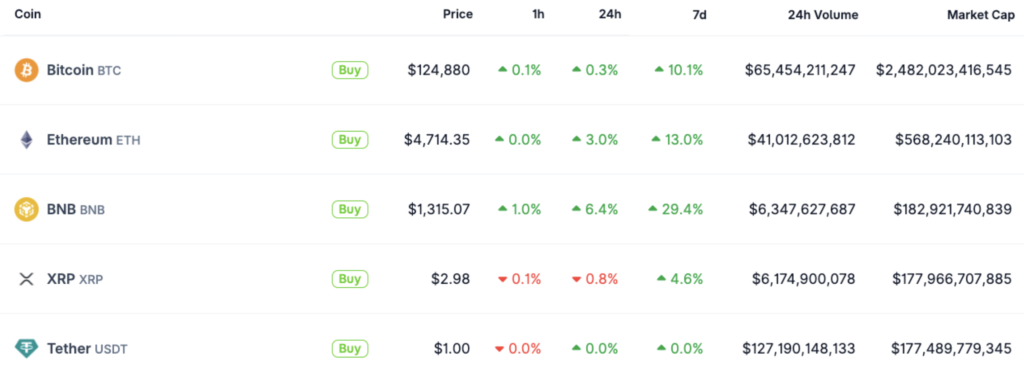

Following its price breakthrough above $1,100, BNB overtook XRP to become the third-largest cryptocurrency by market cap. According to CoinGecko, BNB traded as high as $1,326, marking nearly 30% growth in the past week, with its market cap hitting $182 billion.

This rally coincided with rising global adoption of BNB, including the launch of a state-backed BNB fund in Kazakhstan — a move that reflects growing institutional confidence in the BNB ecosystem. Ethereum still holds the lead in TVL at $190.47 billion, but BNB is solidifying its position as a major contender in the Layer-1 race.

Latest BNB Developments

BNB recently announced the launch of a $1 billion builder fund to support developers building projects on the BNB Chain. The fund targets strategic sectors such as artificial intelligence, trading, crypto wallets, and payment services, aiming to accelerate innovation within the ecosystem.

This builder fund initiative reflects BNB’s strong commitment to developer ecosystem growth. Simultaneously, a recent surge in memecoin trading activity has driven BNB Chain’s network fees and usage to record highs, signaling robust user demand.

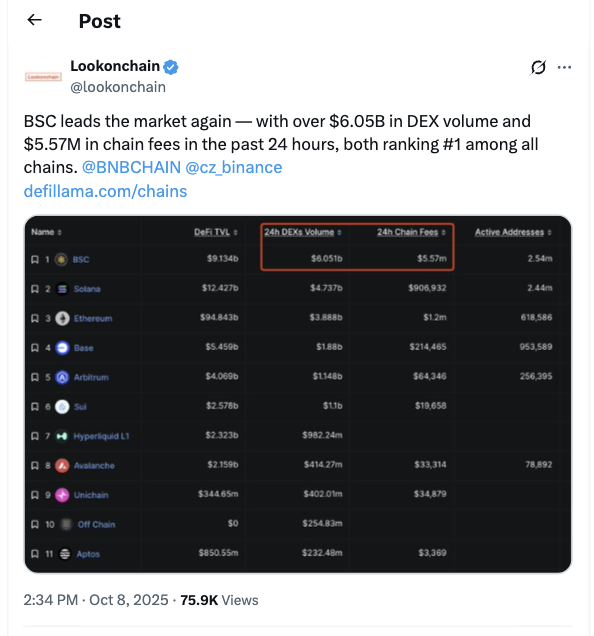

Currently, BNB Chain leads the market in DEX trading volume, with over $6 billion in transaction volume and $5.57 million in network fees, according to blockchain analytics platform Lookonchain.

On the infrastructure side, BNB continues to enhance its technical foundation with key upgrades: the Maxwell upgrade launched in June aimed at faster block production, and the Lorentz Hard Fork in April introduced shorter block times and improved validator communication — all contributing to greater scalability and performance of the BNB Chain.

BNB’s Potential

In 2021, BNB introduced its Auto-Burn mechanism, which automatically reduces the token supply based on BNB’s price and supply-demand dynamics. This deflationary system works by sending tokens to a special non-retrievable wallet, effectively removing them from circulation. Over time, this gradual reduction in supply creates upward price pressure — especially if demand remains steady or increases — offering long-term value incentives for BNB holders.

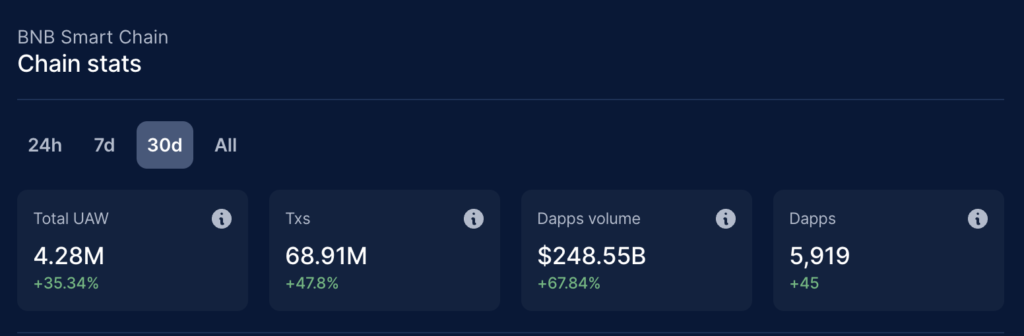

On a fundamental level, BNB Smart Chain has demonstrated strong ecosystem performance over the past 30 days. The network recorded 4.28 million unique active wallets (UAW) — up 35.34%, reflecting growing user adoption. Transaction activity also surged, with 68.91 million transactions processed, marking a 47.8% increase.

dApp activity on BNB Chain remains robust, with $248.55 billion in dApp transaction volume (+67.84%). The number of active dApps also grew, adding 45 new projects, bringing the total to 5,919 active dApps — the most among Layer-1 networks.

From a price perspective, BNB has surged 30% since early October, adding nearly $43 billion in market cap. While the bullish momentum remains strong, early signs of potential exhaustion are emerging. Bollinger Bands are widening with the price hovering near the upper band — often associated with short-term overbought conditions.

The RSI (Relative Strength Index) also shows BNB entering overbought territory, suggesting a possible pullback toward the $1,250 support zone. If broken, a correction could extend to the $1,100–$1,150 range, where strong buying interest may emerge.

Still, MACD indicators remain bullish, with a widening histogram and a positive crossover, signaling that buying pressure is still dominant. If momentum holds, BNB could retest $1,350 resistance, and potentially rally to $1,500 in the near term.

5. Hyperliquid (HYPE)

Hyperliquid is a decentralized exchange (DEX) built on its own custom Layer-1 blockchain. The platform combines ultra-fast transactions, low fees, and advanced trading features like perpetual derivatives — aiming to deliver the best of both worlds: the security and transparency of DEXs, with the speed and user experience of centralized exchanges (CEXs) like Coinbase or Kraken.

Even though Hyperliquid operates without a central authority, the user interface remains smooth, intuitive, and highly performant.

Hyperliquid’s Applications and Key Features

Hyperliquid offers a powerful and competitive trading environment that stands out in the DeFi space thanks to the following advantages:

- High-Speed Trading: Finality in under one second and up to 200,000 orders per second, rivaling top-tier CEXs in speed.

- Zero Gas Fees: No gas costs like typical DEXs, making trading significantly cheaper.

- Fully On-Chain Transparency: All order books are stored directly on-chain, ensuring a trustless and open trading system.

- One-Click Execution: Seamless trading without repetitive wallet confirmations.

- High Leverage: Offers up to 50x leverage on perpetual contracts, similar to centralized exchanges.

- HLP Vault Yield: Users can deposit USDC into the HLP (Hyperliquid Liquidity Provider) vault to earn up to 24% annualized returns via market-making.

- Cross-Chain Support: Allows deposits from 30+ blockchains, including Ethereum and Solana.

- Developer-Friendly: HyperEVM enables the building of Ethereum-compatible dApps with access to deep liquidity.

- Community-Owned Model: Hyperliquid is self-funded with 70% of HYPE tokens allocated to users, promoting fairness and decentralization.

With this architecture, Hyperliquid is emerging as a next-gen Layer-1 DEX protocol, bringing together CEX-level performance and true on-chain decentralization.

Latest Metrics on Hyperliquid

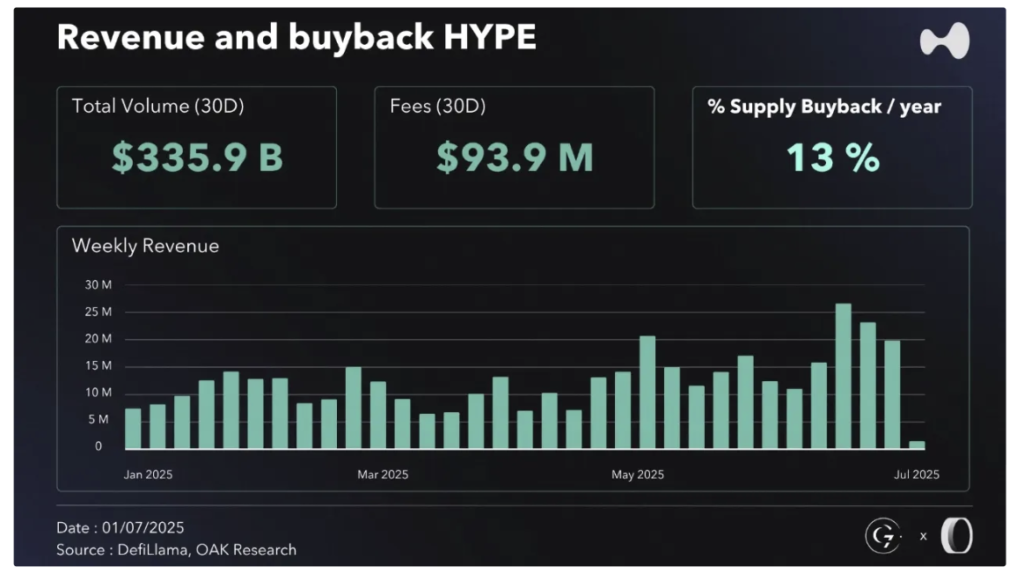

As of October 9, 2025, data from Artemis shows that Hyperliquid leads in annualized revenue among major Layer-1 blockchain platforms, generating a staggering $1.062 billion. This places it well ahead of Solana ($645M), Tron and BNB Chain (each around $476M), and even Ethereum, which posted $378M in the same period.

In addition, CryptoRank data from September ranks Hyperliquid as the third highest-earning project in the entire crypto industry, just behind stablecoin giants Tether and Circle.

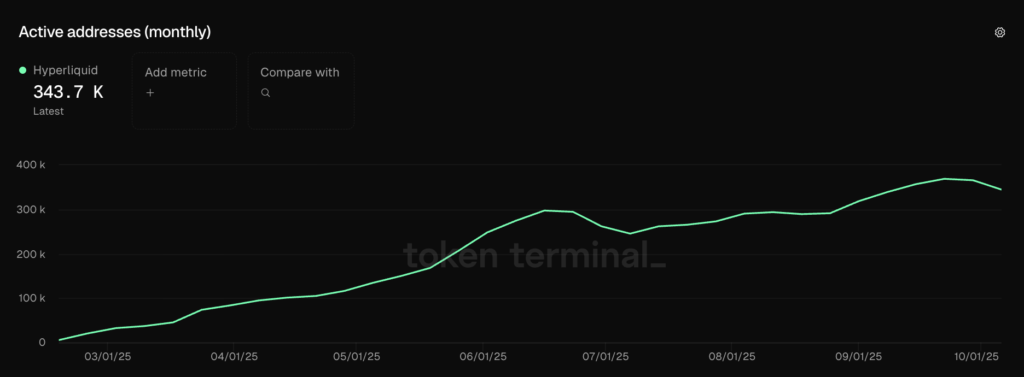

User activity is also on the rise. According to Token Terminal, monthly active addresses on Hyperliquid have grown sharply throughout 2025. From fewer than 50,000 at the beginning of the year, the number surged steadily — peaking at around 360,000 in September. As of October 2025, the figure slightly declined to 343,700 active addresses, but this still reflects a 7x increase year-to-date.

This combination of high protocol revenue and strong user growth reinforces Hyperliquid’s position as one of the most promising and fundamentally sound Layer-1 platforms in the crypto space today.

Latest Hyperliquid Developments

Hyperliquid continues to make significant strides in adoption and institutional recognition. In its latest move, MetaMask has officially launched perpetual trading integration with the Hyperliquid platform, enabling users to seamlessly access derivatives markets. Traders can now open perps positions directly via the MetaMask app using funds from any Ethereum-compatible network — a major leap forward in decentralized trading accessibility. This integration aligns with MetaMask’s broader goal of expanding its DeFi toolkit.

At the same time, S&P Dow Jones Indices announced the inclusion of $HYPE, Hyperliquid’s native token, into the S&P Digital Markets 50 Index. This index tracks the performance of 15 top crypto assets and 35 publicly traded crypto-related companies.

The inclusion of $HYPE is seen as a strong signal of growing institutional interest. It suggests that institutional players and smart money may begin accumulating the token more aggressively, positioning Hyperliquid for even greater visibility and credibility in the broader financial landscape.

Hyperliquid’s Potential

Unlike most DeFi protocols, Hyperliquid does not profit directly from user activity fees. Instead, all platform fees are funneled into two key components:

- HLP (Hyperliquid Liquidity Pool) — a community vault that allows users to participate in market making and earn yield.

- Assistance Fund — a HYPE-denominated reserve fund that acts as a liquidity buffer in times of volatility.

According to Oak Research, while the official fee split hasn’t been disclosed, on-chain data reveals that around 92% of collected fees go to the Assistance Fund, and 8% to HLP. The Assistance Fund uses its allocation to buy back HYPE tokens from the open market, distributing these purchases back to token holders. This mechanism not only supports price stability but also fuels long-term token value appreciation by gradually reducing supply — creating a deflationary pressure.

In the first half of 2025, Hyperliquid’s daily revenue surged from approximately $1 million to over $3 million, with peaks above $5 million. So far, the Assistance Fund has accumulated over $1.22 billion worth of HYPE, acquired at a cost of just $400 million, underscoring the effectiveness of the buyback model.

From a tokenomics perspective, Hyperliquid’s buyback mechanism is the centerpiece of its economic design. By committing nearly all generated fees to buybacks via the Assistance Fund, it ensures consistent demand for HYPE and cultivates investor confidence in its long-term growth potential.

Currently, HYPE’s market cap stands at approximately $12 billion, with daily trading volume around $440 million, based on data from CoinGecko. However, in the last seven days, HYPE has experienced a notable correction of around 10%.

Popular trader @NebraskaGooner recently highlighted a technical setup showing HYPE testing a key support level at $45.24. A weekly close below $47 could signal deeper downside risk. He also pointed to a developing “rounded top” pattern, often seen as a bearish reversal signal, suggesting a potential shift from bullish to bearish trend.

Should the breakdown continue, the next critical support zone lies in the $36–$38 range, marked in green on the chart. The yellow line indicates current support being tested, while the blue trajectory outlines a possible move to lower levels if selling pressure persists.

Despite short-term volatility, Hyperliquid’s fundamentals remain strong, backed by real revenue, a powerful buyback system, and increasing on-chain usage — making it a standout among newer Layer-1 crypto projects in 2025.

Start Investing in L1 Altcoins with Pintu

After exploring the growth of various Layer-1 (L1) crypto projects, you can easily invest or trade L1 assets like ETH, SOL, SUI, BNB, and HYPE directly through the Pintu app. Everything is available in one secure, user-friendly platform — perfect for both beginners and experienced investors.

How to buy crypto assets on Pintu:

- Go to the homepage of the Pintu app.

- Navigate to the Market tab.

- Search for and select the crypto asset you’ve analyzed.

- Enter the amount you want to buy, and follow the next steps to complete your transaction.

Conclusion

Layer-1 (L1) crypto projects have shown remarkable growth across adoption, technical performance, transaction volume, and institutional support. Ethereum remains dominant with its mature ecosystem, while Solana, BNB Chain, Sui, and Hyperliquid have recorded significant surges in TVL, DEX volume, and network activity — fueled by innovation, scalability, and increasing institutional interest. Overall, L1s are now at the core of crypto ecosystem growth.

<aside> 💡

Disclaimer: All Pintu Academy articles are intended for educational purposes only and should not be considered financial advice.

</aside>

References:

- Adewale Olarinde. Solana Company (HSDT) adds another 2.2M SOL to treasury holdings – Here’s why. Accessed on October 9, 2025

- BeInCrypto. Solana’s Hidden Bullish Signal Returns — Could a New All-Time High Be Imminent? Accessed on October 9, 2025

- Coinbase. What is Ethereum? Accessed on October 9, 2025

- CoinMarketCap. Layer-1 Blockchain. Accessed on October 9, 2025

- DappRadar. Hyperliquid Features and How to Get Started. Accessed on October 9, 2025

- Hacken. Sui Blockchain 101: An Overview Of The Benefits And Limitations. Accessed on October 9, 2025

- Kamina Bashir. Sui TVL Hits New All-Time High — Is a Price Breakout Next? Accessed on October 9, 2025

- Kraken. What is Sui (SUI)? A complete guide. Accessed on October 9, 2025

- Nexus. What is BNB Auto-Burn? Accessed on October 9, 2025

- Oak Research. Hyperliquid (HYPE): S1 2025 Activity Report. Accessed on October 9, 2025

- Part Dubey. BNB Reclaims $1,300 Again as Binance Japan Partners with PayPay. Accessed on October 9, 2025

- Rich. A Complete Guide to the BNB Smart Chain. Accessed on October 9, 2025

- Sean Michael Kerner. Ethereum. Accessed on October 9, 2025

- Stephen Katte. BNB mindshare spikes 251% in a week, as markets eye low-cost chains. Accessed on October 9, 2025

- Trust. A Beginner’s Guide to BNB Smart Chain. Accessed on October 9, 2025

- Zennon Kapron. What Is Solana (SOL)? How It Works And What To Know. Accessed on October 9, 2025