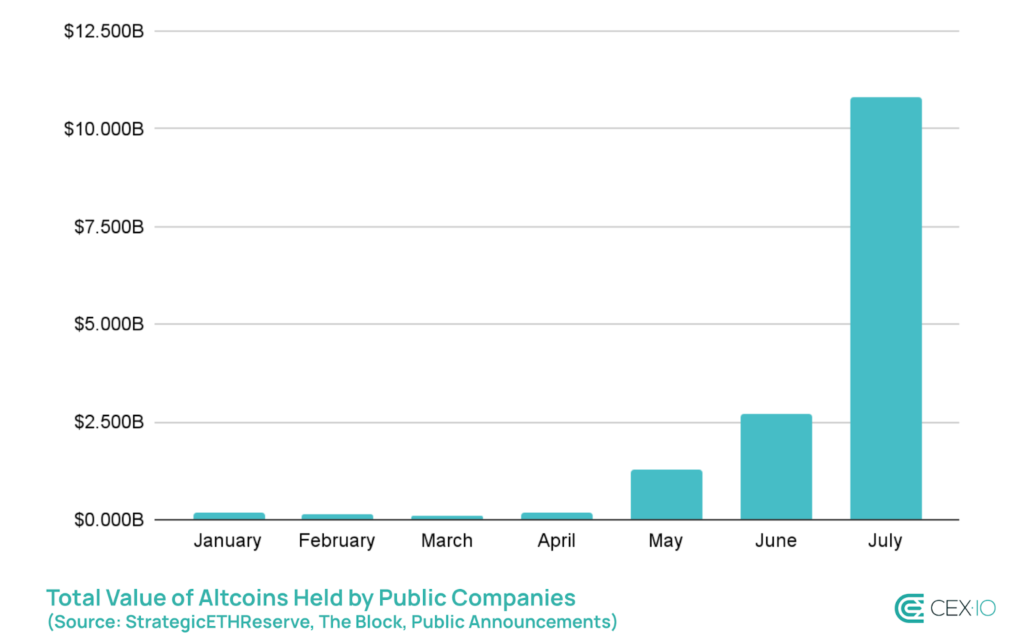

The crypto industry entered 2025 with exploding institutional interest and adoption. Many institutional investors now hold or plan to allocate funds to digital assets, especially cryptocurrencies. Many companies are planning to hold cryptocurrencies as Digital Asset Treasuries (DATs). Additionally, this extends not only to Bitcoin but also to altcoins. So, what is digital asset treasury? Why do companies plan to have altcoin treasuries? This article will dive deep into altcoin treasuries.

Key Takeaways

- Diversification Beyond BTC and ETH: Corporations are increasingly expanding their digital treasuries to include altcoins, reflecting a broader acceptance of the crypto market.

- Ecosystem-Centric Holdings: SOL, BNB, and SUI’s inclusion in the top five DATs highlights how ecosystem-driven tokens can attract institutional confidence.

- Memecoins Enter the Scene: DOGE and PUMP’s presence in corporate treasuries marks the mainstreaming of memecoins, signaling a cultural crossover between finance, entertainment, and digital identity.

- DAT Risks: In a bear market, most altcoins suffer a significant drawdown. This presents a real concern as companies holding altcoins must face this scenario, and their investors will hold them accountable.

What is a Digital Asset Treasury (DAT)?

A DAT or Digital Asset Treasury is a corporate strategy that focuses on raising capital to buy and hold cryptocurrencies as part of its treasury. Typically, institution and corporate treasuries include cash, bonds, and fiat assets. With the surging popularity and interest in crypto, companies are now shifting to having Bitcoin and even altcoins like Ethereum and Solana.

This was likely spurred by the success of Strategy (formerly MicroStrategy), which holds one of the world’s largest Bitcoin treasuries and continues to accumulate Bitcoin. Many companies try to emulate Strategy and how its Bitcoin treasury becomes a bullish catalyst for the share price.

Additionally, publicly listed companies are starting to get interested in altcoins. Helius Medical Technologies, HashKey Group, and Standard Chartered’s SC Ventures will raise hundreds of millions to fund their digital assets-focused treasuries.

Why Altoins as DATs?

The basic premise of a Digital Asset Treasury or DAT is for companies to hold highly appreciating assets in their portfolio. This especially makes sense with Bitcoin, as it has proven to outperform most assets in a higher timeframe. Additionally, a digital asset treasury also makes sense for most companies as part of a diversification strategy.

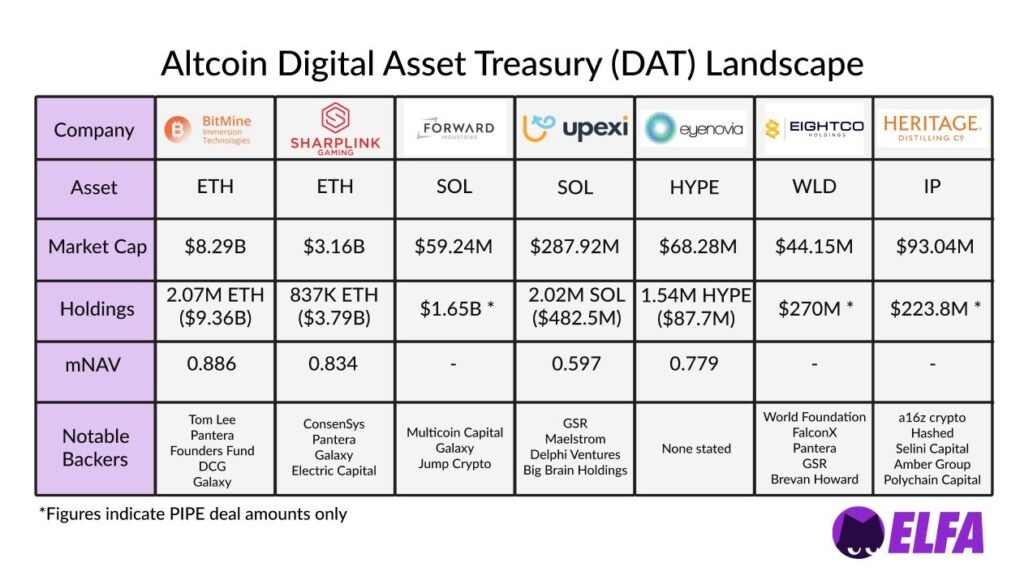

The second reason companies create a DAT is to align with their overall crypto strategies. For example, BitMine and BitDigital hold ETH as their treasuries to align with their overall Ethereum-centric focus.

Additionally, TradFi companies have realised that holding cryptocurrencies increases bullish sentiment with investors. The stock price of companies holding cryptocurrencies seems to trade with a premium compared to those without.

Prices for crypto-related companies such as Strategy, Metaplanet, Robinhood, etc, have been soaring in this bull market. TradFi companies have caught up to this, and now some of them are scrambling to buy crypto as part of their treasuries.

Lastly, raising a Digital Asset Treasury is significantly easier than buying or holding a crypto ETF product. This is because not all institutions can buy ETFs or hold crypto due to regulatory reasons. So, a Digital Asset Treasury fulfills a very specific purpose of providing companies and investors with exposure to digital assets without direct ownership.

Benefits and Risks of Altcoins DATs

Benefits of Altcoin DATs

Institutional adoption:

Proliferation of a Digital Asset Treasury by TradFi companies signals widespread institutional adoption of crypto. Besides the apparent partnership with big companies such as Visa, PayPal, etc, institutions now realise the value of crypto.

Attention:

Crypto is an attention game. With so many altcoins, liquidity is spread thin. Naturally, liquidity tends to concentrate on a few select narratives and altcoins. DATs have proven to be very successful in shifting attention. The creation of DATs was seen as a bullish institutional adoption for altcoins and signals the strong fundamentals of a project.

Quick crypto exposure:

Digital Asset Treasuries are also a type of shortcut for institutions seeking a quick exposure to crypto. Additionally, not all institutions are permitted to buy ETFs or directly own cryptocurrencies due to regulatory restrictions. A DAT can be created quickly, and if it fits a company’s investor profile, a significant sum can be raised.

Altcoin Treasuries Risks

Market volatility:

Altcoins represent a very high risk for treasuries. Altcoins’ volatility can be very extreme, even suffering a -50% drawdown within a week. So, placing altcoins in a company treasury isn’t exactly a good idea and many people are pessimistic about this. We don’t know whether DAT companies can survive the bar market volatility or not.

Forced selling:

As we know, most altcoins suffer a 70% or even 90% drawdown in the bear market. Companies holding altcoins must face this scenario, and their investors will hold them accountable when the worst comes to pass. The worst scenario is that in a bear market, companies will be forced to sell altcoins in their DATs.

Regulatory uncertainty:

The last uncertain point of a DAT is regulatory uncertainty. Currently, the US government has passed several crypto-friendly bills and listed several crypto ETFs. Things can reverse very quickly if and when a new anti-crypto government comes into power. This represents an external risk to all altcoins held in institutions.

3 Altcoins as Digital Asset Treasuries

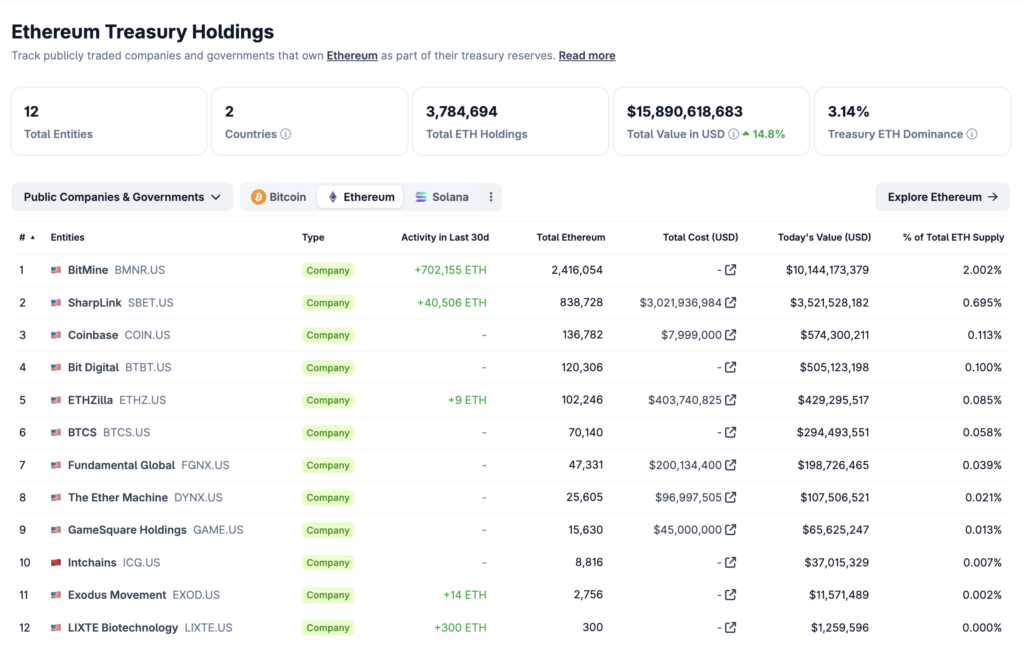

1. ETH

As the 2nd biggest cryptocurrency in the world, ETH also has the 2nd biggest DAT by total value. Fourteen entities from three different countries hold 4.4 million ETHs (around 3.5% supply) with a total value of $17.7 billion. The top three companies holding ETH are BitMine Immersion, Sharplink, and Bit Digital. Additionally, out of all three, BitMine holds 2.5% of ETH supply or around $12.1 billion.

SharpLink Gaming kickstarted the Ethereum DATs frenzy, becoming the first company to adopt Ethereum as its primary treasury asset. Then, BitMine, despite not being the first, currently holds the biggest ETH supply among other companies. BitMine’s chairman, Tom Lee, even promotes Ethereum wherever he goes.

2. SOL

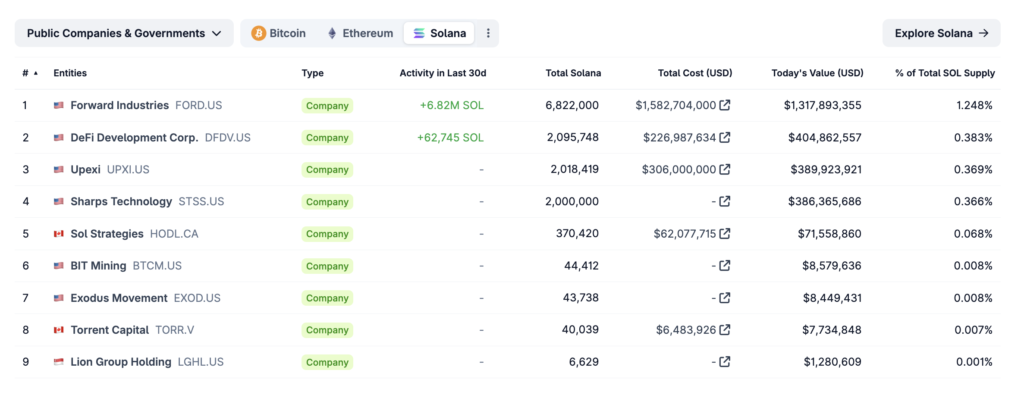

After Bitcoin and Ethereum, Solana is the third-largest DAT held by companies. However, SOL DATs haven’t even reached 20% of Ethereum’s DATs. There are currently around 2% SOL in DATs with a total value of around $2.6 billion. So, similar to Ethereum, the supply held by the top DAT (Forward Industries) pales compared to the rest of the entities.

The biggest news when it comes to SOL DAT is the Forward Industries deal. Multicoin Capital, Jump Crypto, and Galaxy led a $1.65B PIPE into Forward Industries to initiate a Solana treasury company strategy. Additionally, Multicoin Capital’s Kyle Samani committed an additional $25M on top of Multicoin’s commitment toward the DAT.

3. DOGECOIN, SUI, and other Altcoin DATs

Besides the obvious top two, there are now countless other altcoin DATs. WLFI is the surprise third-largest DAT because of its Trump family support (around $1b in value). The next is BNB as the obvious fourth-largest DAT because of its Binance ecosystem support ($722 million in value). Lastly, SUI makes up the last top five DAT altcoins held by SUI Group Holdings ($290 million in value).

Besides the obvious L1 coins, DOGECOIN becomes the first memecoin officially held by publicly-listed companies in a DAT. CleanCore Solutions currently holds 710 million DOGE with a value of $145 million. Other unique altcoin DAT is Pumpfun or PUMP, held by Fitell Corporation ($880k in value).

How to Buy Cryptocurrencies on Pintu

- Open the Pintu app.

- Go to the Market section.

- Search for altcoins such as SOL, ETH, XPL, etc.

- Enter the amount you wish to purchase and confirm your transaction.

Conclusion

The rise of altcoin-based Digital Asset Treasuries (DATs) signals a broader diversification among institutional and corporate investors beyond Bitcoin and Ethereum. So, what began as a niche strategy has now evolved into a growing trend across traditional finance companies. This shift underscores how companies are beginning to view crypto not just as speculative tools but as strategic treasury components tied to innovation and brand identity.

References

- Krix, “Solana DATs: Taking a Page Out of Saylor’s Strategy | Solana DATs Overview”, Blocmates, accessed on October 13, 2025.

- @AleaResearch, “We explored the rise of DATs, their risks and opportunities, and what they mean for institutional adoption this cycle & much more”, X, accessed on October 14, 2025.

- @tx0zz, “The Alt DAT Cheatsheet”, X, accessed on October 14, 2025.

- @Elfa_AI, “DATs have been one of the hottest narratives for the year. Several DATs have done exceedingly well, with several outperforming their underlying assets“, X, accessed on October 15, 2025.