In 2025, Decentralized Finance (DeFi) technology has grown rapidly and is being adopted by various business sectors globally. No longer limited to the crypto community, DeFi is now used by various companies as a faster, more transparent, and middleman-free financial solution. By utilizing blockchain and smart contracts, DeFi enables efficient transaction automation and more inclusive financial access.

The following are the 5 business sectors that will adopt DeFi the fastest in 2025, complete with examples, statistical data, and the latest technology trends.

Article Summary

🏦 Financial Services – Tokenization of Real Assets Goes Massive

Financial services is a pioneering sector in DeFi through the integration of real asset tokenization (RWA) such as government bonds. Protocols like MakerDAO have tokenized up to US$1 billion in US debt securities, with RWA exposure touching US$948 million or 14% of their total reserves.

💼 Investment Management – Traditional Institutions Enter DeFi

Investment giants like BlackRock and Grayscale are expanding their exposure to crypto assets. BlackRock’s crypto portfolio crossed US$100 billion, while its iShares Bitcoin Trust (IBIT ) product manages US$93 billion in AUM. Grayscale through GBTC manages US$18.47 billion and its “Crypto Sectors” index is worth US$3 trillion.

💸 Payments – Stablecoins Invaded for Global Transactions

Cross-border transactions with stablecoins are soaring. Annual global volume reached US$15.6 trillion, with Nigeria recording US$22 billion in a year. In Argentina, 61.8% of crypto transactions use stablecoins to hedge inflation. In Sub-Saharan Africa, it contributes 43% of crypto transaction volume.

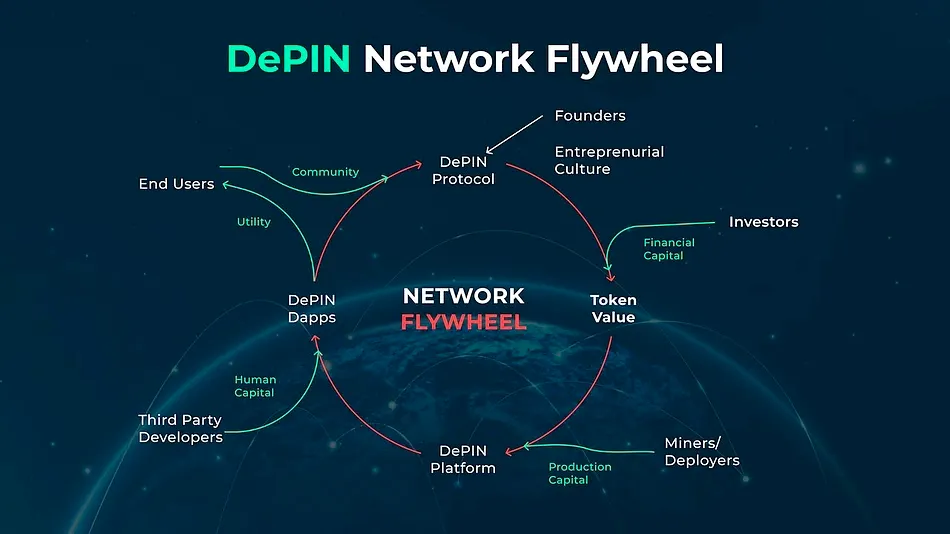

🖥️ Technology Providers – DePIN & EigenCloud Record Capitalization of IDR829 Trillion

DePIN projects such as EigenCloud recorded a capitalization of US$417 million and daily volume of US$114 million. Investors such as a16z injected US$70 million for expansion. DePIN’s total market capitalization exceeded US$50 billion and is expected to reach US$3.5 trillion by 2028.

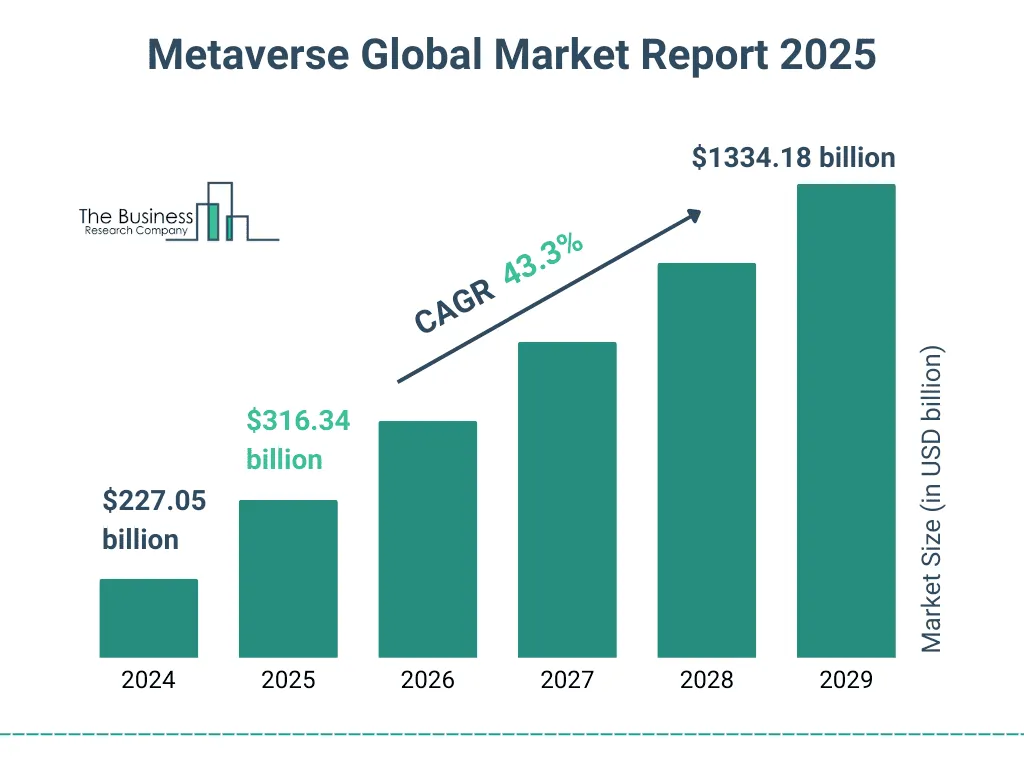

GameFi & Metaverse🎮 – Digital Game Economy Explodes 32%

The play-to-earn ecosystem through NFTs and DeFi is growing rapidly. GameFi transaction volume reached US$4.7 billion in Q3 2025, up 32% from the previous quarter. Projects like Axie Infinity, The Sandbox, and Illuvium allow players to earn crypto from gaming activities.

1. Financial Services: Financial Transformation Through DeFi and RWA

The financial sector is at the forefront of DeFi adoption, with platforms like Aave, Compound, and MakerDAO providing decentralized lending, savings, and stablecoin services. Data from DeFiLlama shows that the Total Value Locked(TVL) across DeFi protocols – although not yet verified in full detail – is significant, reflecting its increasing adoption in the new financial ecosystem.

More specifically, real asset tokenization (RWA) is becoming a concrete bridge between traditional finance and DeFi. MakerDAO itself announced a program to tokenize up to US$1 billion in US debt securities as part of its reserve strategy, according to a report from CoinDesk. In another report, it was noted that MakerDAO has an RWA exposure of around US$948 million, which accounts for around 14% of its total reserve assets as of June 2025.

With these steps, the financial sector is demonstrating that DeFi is not just hype, but an operational model that is starting to take hold at the institutional scale. The tokenization of bonds, debentures, commercial and government events, allows traditional assets to enter the crypto network safely and more affordably for various parties.

This integration also opens up space for financial institutions and investors who were once reluctant to enter the crypto world, to now start considering the DeFi model in collaboration with regulation and real asset futures as one of the pillars of portfolio diversification. The financial services sector, through collaboration with DeFi protocols and RWA tokenization, is becoming a gateway to major changes in the way we view digital assets and finance.

2. Investment Management: BlackRock & Grayscale Become Institutional Crypto Adoption Engines

In 2025, the traditional investment management sector showed significant changes by starting to actively adopt decentralized finance (DeFi) technology. Not only startups or pure crypto projects, now giant institutions such as BlackRock and Grayscale are also jumping into the digital asset ecosystem. This combination of conventional fund management and blockchain technology is one of the main drivers of global financial transformation.

According to a report by The Economic Times, in the third quarter of 2025, BlackRock reportedly held a crypto portfolio worth more than US$22.46 billion in just three months. Their total exposure to crypto assets has crossed the US$100 billion mark as of mid-2025. Their flagship product, iShares Bitcoin Trust (IBIT), even managed US$93 billion as of October 2025 according to official data from BlackRock.

Meanwhile, Grayscale Investments also continues to strengthen its position as a major player in the digital asset investment market. Grayscale Bitcoin Trust (GBTC) is recorded to manage US$18.47 billion in funds as of October 17, 2025 according to YCharts data. In addition, Grayscale released its “Crypto Sectors” index framework covering more than 260 tokens with a total collective market capitalization of approximately US$3 trillion, according to Grayscale Research‘s internal research.

This data shows that institutional players are no longer on the periphery of the crypto ecosystem, but are already a core part of the mainstream of adoption. With the influx of large funds into cryptocurrency-linked ETFs, tokenized funds, and trust products, institutions like BlackRock and Grayscale are expanding crypto’s reach to high-end investors globally. This phenomenon indicates the blurring of boundaries between traditional finance and decentralized systems.

3. Payments

The payments sector is one of the fastest to feel the transformational impact of DeFi adoption. Payment systems no longer have to pass through intermediaries such as banks or remittance institutions. Thanks to DeFi, cross-border transactions can be done directly wallet-to-wallet, with near-zero fees and instant settlement.

Projects like Celo, xMoney (formerly Utrust), and Ramp Network deliver blockchain-based global payment solutions that are increasingly popular among businesses and individuals in developing countries. They offer crypto-based payment gateways that cut remittance costs and speed up the settlement process to seconds.

According to a recent report from Yellow Card, the adoption of stablecoins as a means of payment is increasing dramatically globally:

- The annual transaction value of stablecoins reaches US$15.6 trillion globally.

- In South Asia, Africa and Latin America, stablecoins are becoming the backbone of crypto transactions – with Nigeria processing nearly US$22 billion in stablecoin transactions between July 2023 – June 2024.

- In Argentina, more than 61.8% of crypto transactions were made using stablecoins in response to extreme inflation.

- In Sub-Saharan Africa, stablecoins account for 43% of total crypto transaction volume.

- In fact, 99% of business activity on the Yellow Card platform is now driven by stablecoins, with key use cases including corporate cash management, cross-border payments, and purchasing goods.

This trend indicates that DeFi-based payments-particularly with stablecoins-are notonly more efficient, but also a real solution for regions with suboptimal financial systems.

4. Technology Providers DePIN Gains Dominance: Market Capitalization Hits IDR829 Trillion!

In the first quarter of 2025, the DePIN (Decentralized Physical Infrastructure Networks) sector recorded significant growth with market capitalization surpassing US$50 billion, according to a report by Messari . Long-term projections suggest that the sector could reach a value of up to US$3.5 trillion by 2028. Adoption continues to expand with more than 13 million devices actively supporting the DePIN network every day.

Projects like EigenCloud are in the spotlight thanks to services like EigenDA, EigenCompute, and EigenVerify that support Web3 scalability, AI, and data availability. The EIGEN token itself has recorded a market capitalization of around US$417 million (Rp6.9 trillion) with daily trading volume reaching US$114 million (Rp1.8 trillion). Investor funding is also pouring in, with a16z injecting US$70 million to fuel EigenCloud’s expansion.

In terms of revenue, DePIN projects experienced mixed dynamics. Render experienced an 80% drop in revenue in three months, while XNET and Nosana showed growth in the number of active contributors. This trend shows that while still in the early phase, experimentation and iteration of business models is ongoing in this sector.

The potential of the global public cloud market, which is expected to reach US$1 trillion by 2026, is a great opportunity for DePIN to take market share from giants such as AWS or Google Cloud. Currently, DePIN still accounts for <0.1% of the total market, indicating vast room for growth – especially in the adoption of blockchain-based technologies, AI, and decentralization of physical resources such as storage, energy, and bandwidth.

5. Gaming and the Metaverse

DeFi is now also revolutionizing the gaming sector and the Metaverse through the concept of GameFi – a hybrid of gaming and decentralized finance – which features a play-to-earn model and NFT-based digital asset ownership.

Projects like Axie Infinity, The Sandbox, and Illuvium show how players can generate crypto or NFT revenue directly from gameplay, and have full control over their virtual assets thanks to blockchain technology.

GameFi leverages decentralized ledgers to create a transparent and secure ecosystem, allowing players to:

- Owning in-game assets on-chain

- Trade NFTs as a unique form of digital asset

- Earn token incentives based on their activity

According to data from Coinlaw (2025), the GameFi and Metaverse sectors recorded a total transaction volume of US$4.7 billion in the third quarter of 2025, up 32% from the previous quarter. This growth is driven by growing interest from casual gamers to crypto investors who see new opportunities in the virtual economy.

Metaverse itself serves as a shared virtual space where GameFi thrives – from immersive social worlds to interactive gaming platforms – which opens up huge opportunities for asset trading, digital work, to decentralized financing(DeFi-powered microeconomy).

With the boundaries between gaming and finance becoming increasingly thin, the metaverse is now not only an entertainment space, but also an investment arena and digital economy that promises a new future for players, developers, and global institutions.

Conclusion: DeFi is the Future Across Industries

The five sectors above show that DeFi is not just a trend, but a fundamental transformation in the global financial system. With its ability to provide efficiency, open access, and user control, DeFi is expected to continue to penetrate more industries in the coming years.

However, this adoption also brings challenges such as regulation, security risks, and the need for user education. Therefore, it is important for industry players and regulators to work together to develop a healthy and sustainable ecosystem.

Want to better understand blockchain technology, crypto, and innovations like DeFi? Visit Pintu Academy to read educational articles on AI agents, investment strategies, and crypto market analysis that are updated weekly.

All content is intended for educational purposes, not financial advice. For a more complete experience, download the Pintu app on the App Store/PlayStore-an appthat is compatible with popular digital wallets and is regulated and supervised by OJK.

Through Pintu application, crypto transactions can be done easily and safely, while learning more about it through Pintu Academy. Don’t forget to join Pintu’s Telegram Channel and Telegram Group for the latest updates and discussions about the crypto world.

Disclaimer: Semua artikel dari Pintu Academy ditujukan untuk tujuan edukasi dan bukan merupakan nasihat keuangan.

Reference:

- Binance Research. Liquid Staking: A Growing Trend in DeFi. Accessed October 17, 2025

- Chainalysis. 2025 Crypto Adoption Index. Accessed October 17, 2025

- Coinlaw. Metaverse Finance Statistics. Accessed October 17, 2025

- CryptoRank. “MakerDAO has opened a program to tokenize up to $1 B in assets.” Accessed October 20, 2025.

- DappRadar. Q3 2025 Blockchain Gaming Report. Accessed October 17, 2025

- DeFiLlama. DeFi data dashboard. Accessed October 20, 2025.

- DeFi Llama. Total Value Locked (TVL) in DeFi. Accessed October 17, 2025

- Messari. DePIN Sector: Key Updates and Trends for Q1 2025. Accessed October 20, 2025

- Gate Learn. Unveiling MakerDAO RWA: Governance Systems and Trading Architecture. Accessed October 20, 2025.

- L2Beat. Layer 2 Ethereum TVL Tracker. Accessed October 17, 2025

- Singapore Management University. 6 Key Trends Shaping the Future of Financial Services. Accessed October 17, 2025

- Surbhi Khanna. BlackRock adds $22.46 billion in cryptocurrencies in Q3 2025: Report. Accessed October 20, 2025

- Yellow Card. Yellow Card Announces Expansion into Emerging Markets, Backed by Landmark Stablecoin Report. Accessed October 17, 2025

- The Block. “MakerDAO secures Chronicle launching RWA oracle…” Accessed October 20, 2025.

- Phemex Academy. “How RWAs Bring Stabililty and Diversity to DeFi.” Accessed October 20, 2025.