In 2025, the DeFi world will no longer focus on replicating the traditional financial system, but instead seek to create a new version that is more open and efficient. Today, perpetual DEXs are gaining attention thanks to their transparency, low fees, and ability to give users control of their assets. Among new players, Avantis stands out with an innovative approach that combines on-chain derivatives trading and real-world assets (RWAs), offering a fresh perspective in DeFi developments.

What is Avantis (AVNT)?

Avantis is a DEX platform that delivers decentralized perpetual trading, while also providing access to real-world assets (RWAs) such as gold, forex, and stocks. Unlike most DeFi platforms that still focus on crypto assets, Avantis expands opportunities for retail and institutional traders to trade a wide range of assets with up to 500x leverage.

To open a position, users simply deposit USDC stablecoin as collateral, and can then go long or short on a synthetic asset that reflects the real market price. All trading takes place in a decentralized manner without intermediaries.

Furthermore, Avantis leverages the advantages of the Base network ecosystem, is backed by major investors such as Pantera and Founders Fund, and relies on high-precision data feeds from leading oracles such as Pyth and Chainlink. This combination enables Avantis to deliver a secure, efficient and reliable trading environment for its users.

By bringing together crypto and real-world assets on a single platform, Avantis is building the foundation for the “Universal Leverage Layer”, a new approach in the evolution of DeFi.

How does Avantis Work?

Avantis adopts a hybrid liquidity model to combine capital efficiency with on-chain transparency. The foundation of Avantis lies in its capital-efficient synthetic engine. Through a protocol interface, traders can open positions on a variety of supported assets.

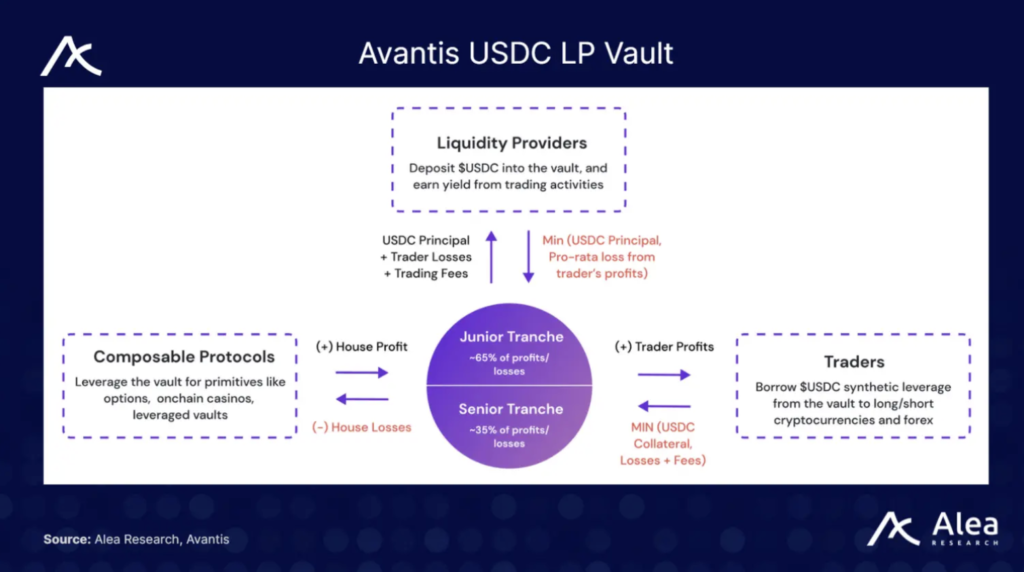

Unlike traditional exchanges that use order books, Avantis does not match orders between users. Instead, each trader is automatically paired with a USDC vault that acts as the counterparty to the trade. This vault is a pool of funds from thousands of liquidity providers (LPs), and acts as a single entity that holds all of a trader’s counter positions.

With this approach, Avantis is able to provide deep and efficient liquidity for multiple markets without the need to create separate liquidity pools for each asset pair. As a result, the protocol is able to support more than 80 markets, including 22 real-world assets (RWAs), in one integrated platform.

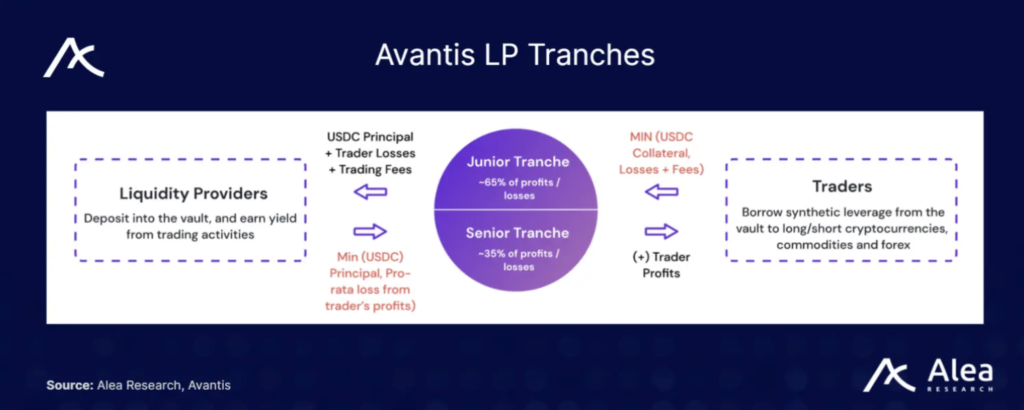

Furthermore, Avantis introduced risk tranches and time-lock parameters that allow liquidity providers (LPs) to choose the level of risk exposure according to their preference. LPs can choose to passively deposit funds into:

- Senior Tranche (Low Risk)

Covering about 35% of total losses and gains, this tranche is suitable for liquidity providers who prioritize stable returns and minimal risk.

- Junior Tranche (High Risk)

Covering about 65% of total losses and gains, this tranche is designed for LPs who are prepared to face higher volatility for potentially greater returns.

In addition, LPs can also choose the duration of the fund lock, such as 30 days or 90 days, to regulate how long their capital will be locked up. The longer the lock-up period, the more fees they can generate. This design resembles the Uniswap v3 concentrated liquidity model, but is applied for risk management in perpetual trades (perps) on Avantis.

Avantis Key Features

Avantis features a number of innovative features designed to make the trading experience fairer and more efficient, including:

Zero Trading Fees:

Avantis introduced a revolutionary feature where traders are not charged for opening, closing or borrowing positions. Instead, they only pay a percentage of the profits when closing a profitable position. This feature is available for assets such as $BTC, $SOL, and $ETH, with leverage of up to 250x, making it popular among arbitrage and high-frequency traders.

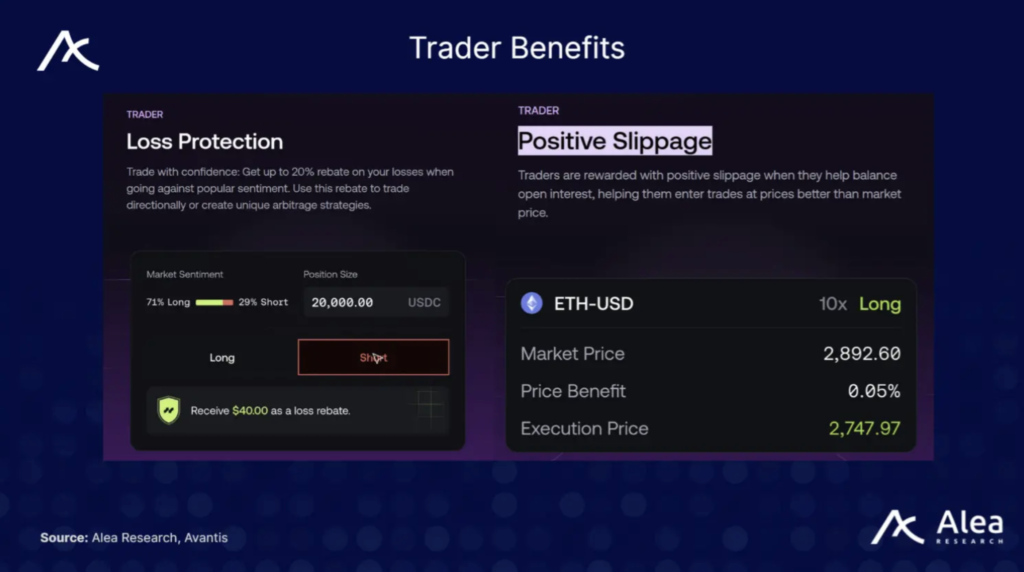

Loss Rebates

Traders who take the opposite position of an open contract-thereby helping to balance the long/short bias on the platform-have the opportunity to receive up to 20% of their losses back. This mechanism encourages traders to arbitrage existing positions, while helping to stabilize liquidity providers’ exposure.

Positive Slippage

If a trader’s order reduces risk to the vault-for example, by closing a large long position-Avantis will provide an execution price above the market price. This “better-than-market” execution is a form of incentive for traders that helps keep theflow in balance.

Risk Tranches for LP

Liquidity providers have the freedom to act as passive lenders or active market makers, by choosing the risk tranche and lock-up period of the funds. Each tranche has a different fee structure and risk sharing, allowing liquidity providers to customize their strategy based on their risk tolerance and return targets.

AVNT Token: Utilities & Tokenomics

AVNT is the main token in the Avantis ecosystem, serving as both a utility and governance token. Based on ERC20 running on the Base network, AVNT tokens play an important role in securing protocol operations, aligning incentives, and supporting decentralized governance. The total amount of AVNT is limited to 1 billion tokens and has various functions as follows:

AVNT Token Function:

- Governance: Token holders can participate in protocol decision-making and parameter customization.

- Incentives: Used for community airdrops, user rewards, as well as protocol marketing activities.

- Security: Used for staking and as collateral to strengthen the security of the protocol.

- Protocol Growth: Supports developer initiatives and ecosystem expansion.

AVNT Token Allocation:

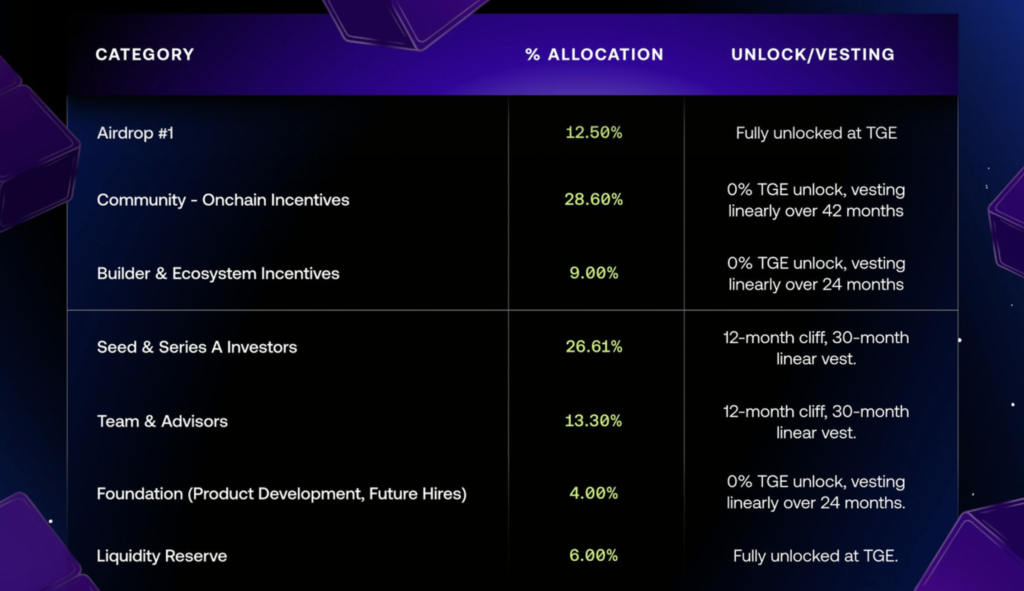

AVNT token distribution is focused on ecosystem development, community engagement, and long-term commitment:

- Early Airdrop (12.5%): Fully available during the TGE (Token Generation Event), as a token of appreciation for early backers.

- Community Incentive (28.6%): Allocated linearly over 42 months, for on-chain participation and promotion.

- Developer & Ecosystem Rewards (9%): Allocated linearly over 24 months, supporting project development and strategic cooperation.

- Seed & Series A investors (26.61%): Undergoes a waiting period(cliff) of 12 months, then allocated linearly over 30 months.

- Team & Advisors (13.3%): 12-month waiting period, then vesting linearly in 30 months.

- Foundation(4%): Used for future product development and recruitment, with linear vesting over 24 months.

- Liquidity Reserve (6%): Fully available during TGE, to maintain market stability.

Avantis Ecosystem & Adoption

Avantis Latest Metrics

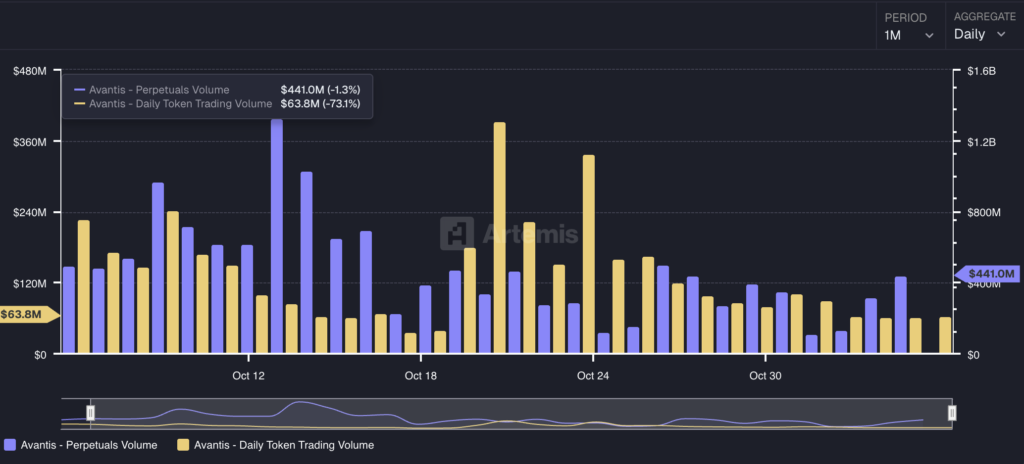

Data charts from Artemis show that perpetual trading volumes exhibited significant fluctuations, with the highest peak recorded on October 13 at $441 million, despite a small decline of approximately 1.3%. Overall, Avantis’ volumes remained stable in the range of $120 million to $240 million during the month.

On the other hand, the daily token trading volume showed a more varied trend, with a big spike on October 12, but a sharp drop to $63.8 million on October 18, which is a 73.1% decrease compared to the previous period.

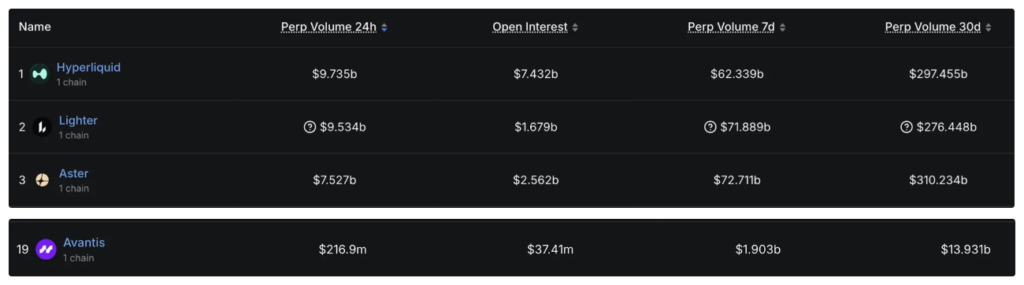

Recent data from DeFiLlama shows that the top three DEX platforms-Hyperliquid, Lighter, and Aster-are dominating the market with massive volumes. Hyperliquid recorded 24-hour trading volume of $9.735 billion, with open interest reaching $7.432 billion, and 30-day total volume of $297.455 billion.

Lighter follows with a 24-hour volume of $9.534 billion, and a 30-day total of $276.448 billion. Meanwhile, Aster took third place with a 24-hour volume of $7.527 billion and a 30-day total of $310.234 billion, making it the leader in the monthly timeframe.

Meanwhile, Avantis, which is in 19th place, is showing growth although it is still far below the big three. With a 24-hour trading volume of $216.9 million, open interest of $37.41 million, and a total 30-day volume of $13.931 billion, Avantis is starting to show its presence amidst the dominance of the big players.

Avantis Officially Launches $AVNT Buy-Back Dashboard

On November 4, 2025, Avantis officially announced the launch of the AVNT token buy-back dashboard, which is now publicly accessible through their official portal. The dashboard allows stakeholders to monitor the progress and target milestones that have been set to initiate the AVNT token buy-back program.

Based on the latest information displayed on the dashboard, Avantis has now reached $128,619 in average daily revenue over the last 30 days. This figure is close to the Milestone 1 target of $200,000, which will trigger the buy-back activation. If this target is reached, Avantis will allocate 30% of the total fees to the token buy-back, with a projected annualized buyback value of$21.9 million.

In addition, there is a Milestone 2 set at a higher target of $500,000 in average daily fees, which will trigger the allocation of 50% of the fees to buy-backs, with an estimated annual buy-back value of $91.25 million.

AVNT Token Roadmap

According to the Avantis team, the roadmap for the AVNT token through the end of 2025 and 2026 is:

- XP Boosts for Long-Term Stakers

Up to 3x point boost for long-term stakers of AVNT. This feature links user participation (liquidity, trading, referrals) with token utility. XP Boosts are now active.

- Expansion to Additional Exchanges

AVNT has listed on OKX and will continue to have a presence on various other regional and international exchanges.

- Discounted Fees for AVNT Stakers

AVNT stakers who are also actively trading will get fee discounts as a form of added value and real utility. This feature is currently under development.

- Token Buyback Based on Achievements

AVNT has experienced very rapid growth since launch. All protocol metrics show an exponential increase. This opens up the potential for a token buyback program to support the sustainability of the AVNT token price in the market.

Meanwhile, the main goal in 2026 is to continue developing the utility and value accrual of the AVNT token. Avantis will use community input to regularly update the roadmap. As a long-term token owner, all decisions will be focused on increasing long-term value for the Avantis ecosystem and AVNT supporters.

AVNT Potential According to Crypto Traders at X

- AVNT approaches critical support zone

Recently, account X with the username Finora shared the latest technical analysis for the AVNT token in the 6-hour time frame (5/11/25), which depicts increasingly strong bearish pressure pushing the price near the critical support zone around $0.4698. According to the analysis, the price is currently moving close to the support zone, which could potentially trigger a short-term reaction from buyers.

However, the dominance of selling pressure(bearish gravity) is still very strong, and if the price breaks the $0.4698 level downwards, it could pave the way for a further decline towards the psychological level around $0.25. Conversely, a bullish reversal scenario will only occur if the price manages to reclaim and hold above $0.5974, which is the so-called trigger point for uptrend recovery.

- AVNT forms a higher lows pattern

Meanwhile, a crypto market analyst with the MoneyTingz account also shared his latest technical analysis for the AVNT token, which shows signs of a potential reversal. In his post (6/11/25), he highlighted that the AVNT price has formed a pattern of higher lows, which is a positive signal in technical analysis-signaling a potential downtrend reversal towards an uptrend.

From the shared chart, it can be seen that the price of AVNT is hovering around $0.5478, with a strong support level around $0.4700, and an ascending trendline underlying the recent price movement. The trader has his eyes on the 0.236 Fibonacci level at $0.7052, as his short-term target – which represents a potential upside of about 30% from the current price.

This analysis suggests that if the price manages to bounce off the current zone and break the resistance, then the next Fibonacci levels such as $0.9103 (0.382) to $1.1190 (0.5) could be further targets. On the contrary, if the price breaks the support below $0.47, then this technical structure could be invalidated.

How to Buy Avantis (AVNT) on the Pintu

Avantis (AVNT) is available for trading on Pintu. Here are the steps on how to purchase AVNT on Pintu:

- Enter the Pintu homepage.

- Go to the Market page.

- Search and select Avantis (AVNT)

- Enter the amount of AVNT you wish to purchase, and follow the steps.

Conclusion

As a DEX perpetual platform, Avantis offers an innovative approach to address the evolving needs of the DeFi market. Amidst the dominance of protocols that still focus on crypto assets, Avantis stands apart by opening up access to real-world assets (RWAs) such as gold, forex, and stocks. This move not only expands the scope of trading, but also bridges the DeFi world with traditional finance (TradFi), creating the potential for wider adoption in the future.

With up to 500x leverage, a USDC-based collateral system, and a single liquidity structure through the “Universal Leverage Layer”, Avantis manages to increase capital efficiency without compromising transparency and user control.

Want to better understand blockchain technology, crypto, and innovations like Avantis? Visit Pintu Academy to read educational articles on AI agents, investment strategies, and crypto market analysis that are updated weekly.

All content is intended for educational purposes, not financial advice. For a more complete experience, download the Pintu app on the App Store/PlayStore-an appthat is compatible with popular digital wallets and is regulated and supervised by OJK.

Through Pintu application, crypto transactions can be done easily and safely, while learning more about it through Pintu Academy. Don’t forget to join Pintu’s Telegram Channel and Telegram Group for the latest updates and discussions about the crypto world.

Disclaimer: All articles from Pintu Academy are intended for educational purposes and do not constitute financial advice.

Reference:

- Avantis. Docs. Accessed on November 6, 2025

- CoinEx. What Is Avantis (AVNT): A Next-Generation Decentralized Derivatives Platform. Accessed on November 6, 2025

- Gate. What is Avantis (AVNT)? Accessed on November 6, 2025

- MEXC. What is Avantis (AVNT)? An Introduction to Digital Assets. Accessed on November 6, 2025

- Zhou. Detailed Explanation of Avantis: The Largest Derivatives Exchange on Base. Accessed on November 6, 2025