Signal Trading Summary:

- Bitcoin (BTC)

- Entry (Buy/Long): $87.000 – $87.500

- Stop Loss [SL]: $86.162

- Take Profit [TP]: $95.000

- Ethereum (ETH)

- Entry (Buy/Long): $2.900 – $2.950

- Stop Loss [SL]: $2.880

- Take Profit [TP]: $3.250

- Solana (SOL)

- Entry (Buy/Long): $137 – $139

- Stop Loss [SL]: $131

- Take Profit [TP]

:Polylang placeholder do not modify

1. Bitcoin (BTC)

Bitcoin is seen holding above the trendline and 21 EMA of its 4-hour timeframe. With the current structure, it appears that on the 4-hour timeframe, Bitcoin is experiencing an uptrend.

If Bitcoin can breakout from the important level of $88,760, it could go up to $94,000 – $95,000.

BTC Buy/Long Potential Setup:

Entry: $87,000 – $87,500

Stop Loss [SL]: $86.162

Take Profit [TP]: $95.000

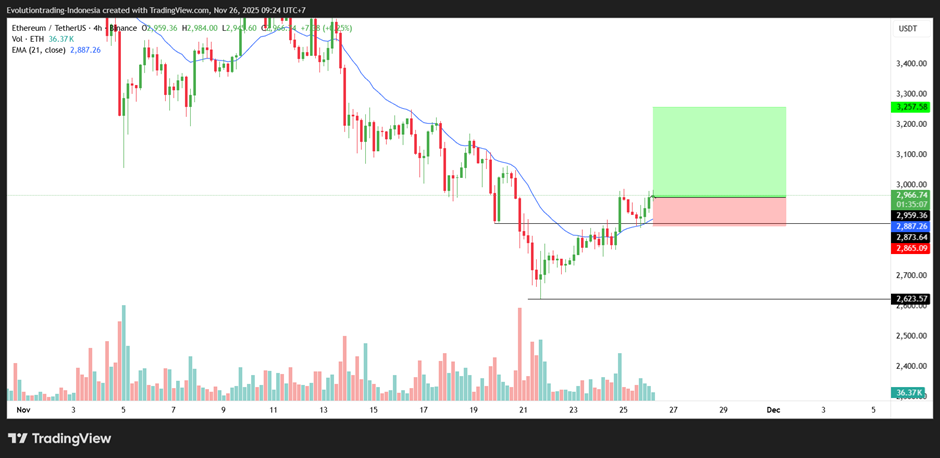

2. Ethereum (ETH)

Ethereum managed to breakout from the $2873 level which acted as resistance and has also made a retest of the level. There is a possibility that ETH could continue its rise.

The level to watch for ETH is the $3250 area which is a support become resistance area.

ETH Buy/Long Potential Setup:

Entry: $2,900 – $2,950

Stop Loss [SL]: $2.880

Take Profit [TP]: $3.250

3. Solana (SOL)

Solana managed to breakout from the 21 EMA on its 4-hour timeframe and formed a bullish structure from the formation of a higher high and higher low. This makes Solana’s bias bullish.

The levels to watch for SOL are the $151 area which is a support become resistance area and $170.

Potential Buy/Long SOL Setup:

Entry: $137 – $139

Stop Loss [SL]: $131

Take Profit [TP]: TP1: $151, TP2: $170

Important Notes:

Always apply risk management and capital management with discipline. For trading, especially those using leverage, we recommend using a risk per transaction of: 1% of total capital.

*Disclaimer: Pintu Futures activities (trading futures contracts on crypto assets) are carried out by PT Porto Komoditi Berjangka, a Futures Brokerage company licensed and supervised by Bappebti and is a member of CFX and KKI. Trading futures contracts on crypto assets has high risks, one of which is the risk that Leverage can provide greater profits or losses.