Signal Trading Summary:

1. Quant (QNT)

- Entry: IDR1,516,424 ($94)

- Cut Loss (CL): IDR1,449,618 ($86.99)

- Target Profit [TP]:

- TP1 = IDR1,685,147 ($101.12)

- TP2 = IDR1,854,386 ($111.28)

2. Liquity (LQTY)

- Entry: IDR8,781 ($0.527)

- Cut Loss (CL): IDR6,782 ($0.407)

- Target Profit [TP]:

- TP1 = IDR10,448 – IDR10,731 ($0.627 – $0.644)

- TP2 = IDR12,981 ($0.779)

3. Tensor (TNSR)

- Entry: IDR1,861 ($0.1117)

- Cut Loss (CL): IDR1.351 ($0.0811)

- Target Profit [TP]:

- TP1 = IDR2,366 ($0.1420)

- TP2 = IDR2,894 ($0.1737)

1. Quant (QNT)

QNT’s price movement showed a positive development after successfully breaking out of the consolidation phase through a breakout of the resistance area which has now turned into support in the range of IDR1,516,424 – IDR1,566,416 ($91 – $94) on November 29.

The bullish momentum continued until November 30 before finally experiencing a correction as we entered the new week. This correction is still relatively healthy as long as the price is able to stay in the support area.

If QNT retests to the support zone and bounces back up, this has the potential to be a strong accumulation momentum in line with the bullish structure that is maintained.

QNT Potential Buy Setup:

Entry: IDR1,516,424 ($94)

Cut Loss (CL): IDR1,449,618 ($86.99)

Take Profit [TP]:

- TP1 = IDR1,685,147 ($101.12)

- TP2 = IDR1,854,386 ($111.28)

2. Liquity (LQTY)

LQTY’s price started to show significant gains after successfully making a breakout against the 20-Day EMA on November 29. This increase is increasingly valid as it is supported by a surge in trading volume that moves above the 20-Day MA, signaling increased buying interest from market participants.

As long as the price is able to stay above the 20-Day EMA, the bullish momentum has the potential to continue. In this scenario, the area of IDR10,448 ($0.627)-which was the highest closing level on October 13-is the nearest upside target.

On the other hand, weekly support at IDR7,182 ($0.431) remains a strong resistance zone to limit selling pressure in case of a deeper correction.

Potential Buy LQTY Setup:

Entry: IDR8,781 ($0.527)

Cut Loss (CL): IDR6,782 ($0.407)

Take Profit [TP]:

- TP1 = IDR10,448 – IDR10,731 ($0.627 – $0.644)

- TP2 = IDR12,981 ($0.779)

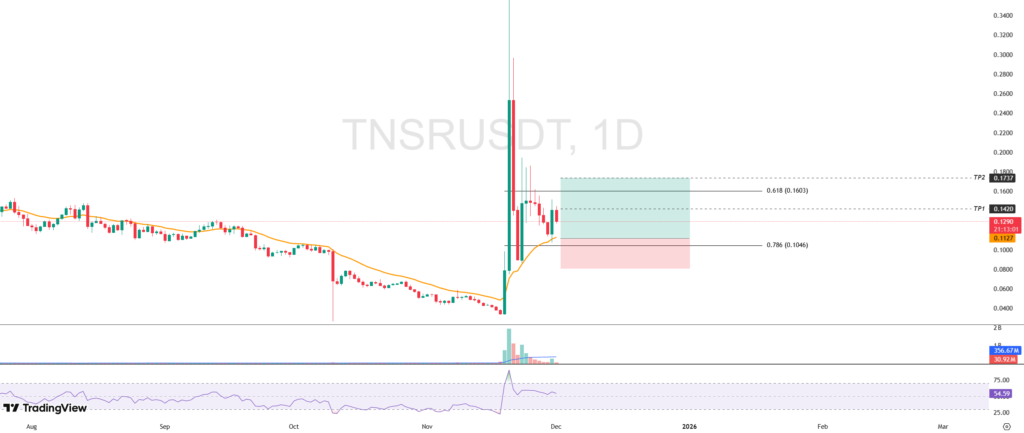

3. Tensor (TNSR)

TNSR price retested the 20-Day EMA as dynamic support after a sharp rally on November 19-20. Strengthening buying pressure in this area successfully reversed the price direction, signaling that market participants still maintain bullish sentiment in the short term.

If the upside momentum continues, the harmonic resistance at IDR2,671 ($0.1603) is the nearest target to watch.

Conversely, the support cluster at IDR1,878 – IDR1,743 ($0.1127 – $0.1046) serves as a key defense zone to keep the technical structure constructive.

TNSR Potential Buy Setup

Entry: IDR1,861 ($0.1117)

Cut Loss (CL): IDR1.351 ($0.0811)

Take Profit [TP]:

- TP1 = IDR2,366 ($0.1420)

- TP2 = Rp2,894 ($0.1737)

Important Notes:

Always apply risk management and capital management with discipline. For trading, especially those using leverage, we recommend using a risk per transaction of: 1% of total capital.