Bitcoin has delivered returns of more than 600% for investors since the bottom in late 2022. It peaked at around $125k and has been dumping for almost two months. Some traders argue that this is just a normal correction, similar to what happened in Q1 2025, while others say it marks the start of a bear market. As we approach the end of 2025, many start to ask what will happen in 2026. In this article, we will explore various crypto market forecasts and Bitcoin predictions for 2026.

Key Takeaways

- ⚖️ Divergent Market Forecasts for 2026: The Bull Case for 2026 predicts a surge to $200k driven by falling interest rates, government adoption (strategic reserves), and institutional buying. Conversely, the Bear Case suggests the 4-year cycle remains intact, predicting a macro downtrend as Bitcoin falls below key technical indicators, such as the 100-week EMA.

- 🧠 A Shift from Hype to Fundamentals: The market is maturing, moving away from speculative trends with high valuations of projects without a product. Investors are now prioritizing “sticky” narratives with genuine Product-Market Fit (PMF), revenue, and active user bases, such as stablecoin payments and perpetual DEXs like Hyperliquid.

- 💥 Explosive Growth in Utility Sectors: Prediction markets (e.g., Polymarket, Kalshi) and Crypto Neobanks (e.g., Revolut, Reddotpay) are identified as high-growth areas. Prediction markets are gaining mainstream media partnerships and volume, while neobanks are driving the adoption of stablecoins and crypto payments in daily life.

- 📉 Underwhelming 2025 Performance: The context for these predictions is a lackluster 2025, with Bitcoin down 7% YTD (lagging Gold and the S&P 500) and the altcoin market suffering a massive 33% capitalization wipeout since October, signaling a decoupling of asset performance.

The Crypto Market in 2025

2025 is a relatively underwhelming year for Bitcoin, especially compared to 2024 and 2023. As of December 1, Bitcoin’s YTD performance is -7%. For comparison, gold YTD is +62%, the S&P 500 is around 16%, and the NASDAQ is around 20%. For the first time since 2023, Bitcoin is lagging significantly behind other major assets.

The fabled Q4 rally did not happen for Bitcoin. In fact, this is the worst quarter for Bitcoin since Q2 2022. Additionally, a red November for Bitcoin usually means a flat or red December.

Meanwhile, altcoins are absolutely devastated by the Bitcoin dump. The TOTAL2 chart shows that the total market cap of altcoins fell by 33.64% since October. So, almost $600 billion in market cap is wiped off the chart. This is reflected in the charts of many altcoins, such as EIGEN, which is down around 75% since early October.

5 Crypto Predictions for 2026

1. Bull Case: Bitcoin Rebounds Into a Bullish Q1 as QE Intensifies

Source: Fidelity.

The bull case for the crypto industry and Bitcoin in 2026 essentially hinges on invalidating the four-year cycle theory. The idea is that bullish tailwinds from the macro environment will push crypto and other risk-on assets into an extended bull market.

BitWise CEO Matthew Hougan said his view that the cycle theory is dead is reinforced by two factors: falling interest rates and governments willing to engage with crypto. Echoing the same sentiment, analysts at Bernstein, led by Gautam Chhugani, expect Bitcoin to hit $200k by 2026 and an extended bull market because “the Trump admin is in mission-critical mode (incl. SEC/CFTC) to build the US into the crypto capital of the world”.

Additionally, more and more countries around the world are building a Bitcoin strategic reserve. Norway’s sovereign wealth fund is now holding 11,400 BTC, worth around $1.2 billion. Brazil is weighing a strategic Bitcoin reserve. Combined with key institutional players such as Vanguard opening access to buy Bitcoin, the buying pressure for Bitcoin will only increase over time.

On December 2, The Bank of America endorses a 1 to 4% crypto in its model portfolio.

2. Bear Case: 2026 Will Be the Start of the Next Bear Market

Source: X.

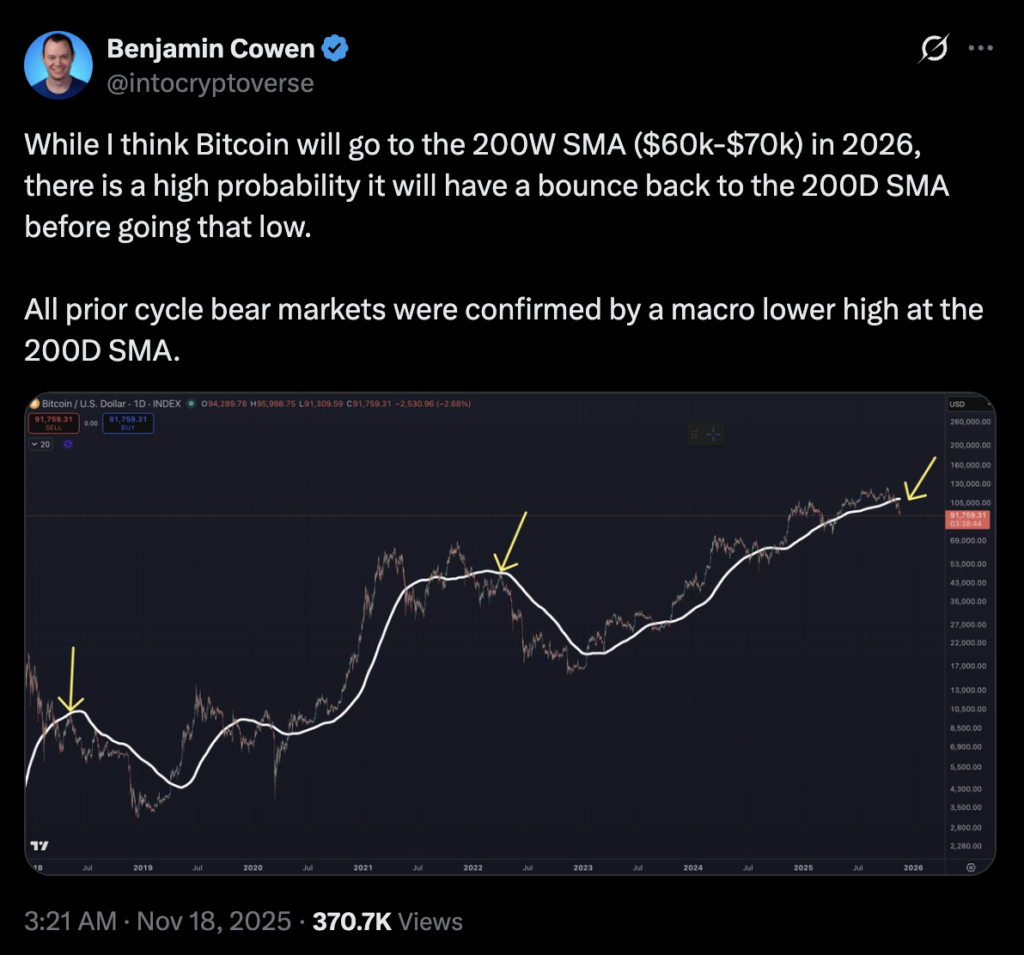

While many are optimistic about 2026, the fact is that Bitcoin has already retraced by more than 30% over the past few weeks. Many traders, like Benjamin Cowen above, have expressed their bearish bias for Bitcoin. His analysis suggests that Bitcoin will eventually fall back below the 200 Week SMA in 2026. Consequently, he believes that in the short term, Bitcoin will put in a macro lower high around the $105k price range.

The bearish view holds that the 4-year cycle is intact. Furthermore, for the first time since the 2024 halving, Bitcoin has gone under the 100 Week EMA. This also happened in 2022, when Bitcoin eventually fell below the 100 Week EMA after the November 2021 top.

Onchain indicators such as the Puell Multiple, MVRV-Z, and NUPL are already making lower highs compared to the 2021 bull market. One of the most popular market cycle indicators, the Pi Cycle Top, indicates Bitcoin is very far off the top of the cycle. To follow the Pi cycle Top, Bitcoin needs to rise to $200k.

3. Fundamentals Will Matter Once Again

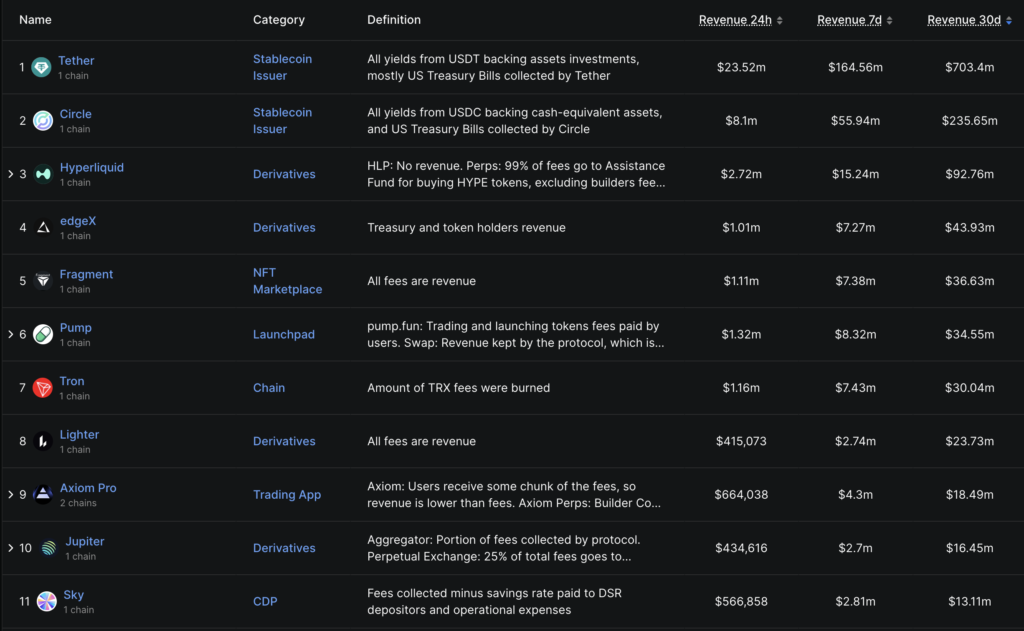

Source: DeFiLlama.

There are many prevalent trends in the current bull market. Since 2023, the market has seen ZK tech experiments, modular blockchains, AI and AI agents, prediction markets, perpetual DEX, ICM, and other narratives. However, most of what is mentioned here is already dead.

Most crypto narratives are only passing trends, and very few are sticky. Why? Simply because not all of these trends are needed by users and therefore have no real demand.

However, some narratives generated genuine demand and retained their users. The innovative yield-trading Pendle is still retaining $3b in TVL, stablecoin-focused protocols have been in an up-only mode since launch, and Hyperliquid carved out its own path in the Perp Dex sector.

As the market became bearish over the last few months, fundamentals once again became the talk of the town. Revenues, PMF (product-market fit), and users are becoming increasingly important to investors and traders. The market and its participants are maturing.

In the last few months, altcoins launching with high FDV and no usable products have been dumping hard. Cases such as XPL and MON are signs that market participants will no longer tolerate projects that hinge on futures promises.

4. Prediction Market Will Keep Expanding

Source: Dune @datadashboards.

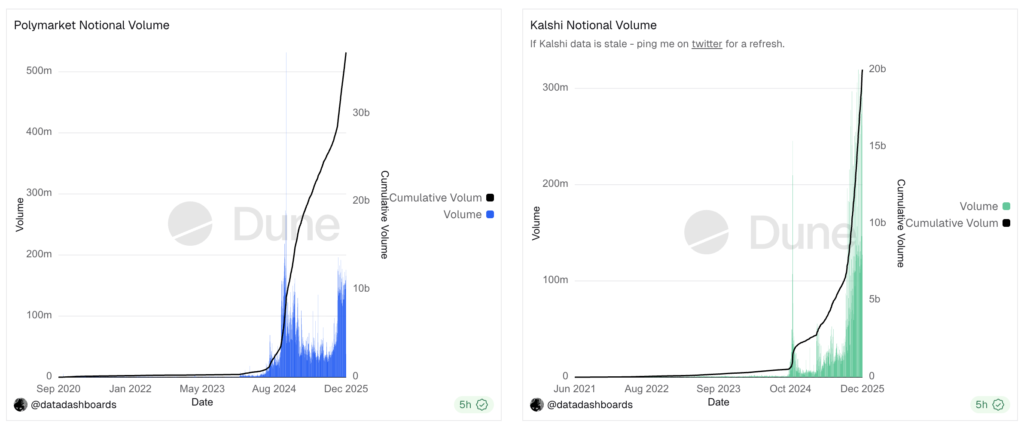

One of the most innovative and successful products to emerge from this bull market is the prediction market. Two prominent players in this sector are Kalshi and Polymarket. Both are currently valued around $11b to $15b, with Kalshi just raising $1b at a $11 billion valuation.

Prediction markets have been getting attention from the broader tech sector. The CEO of Polymarket went on TV to say that the prediction market is one of the most accurate ways to predict an event. Additionally, Kalshi has just secured a strategic partnership with CNN, one of the world’s most prominent news media outlets. Kalshi will become CNN’s official prediction market partner.

Despite launching only in late 2024, Kalshi is rivaling Polymarket in both volume and popularity. Kalshi has racked up around $20 billion in volume, while Polymarket’s total volume is around $36 billion. What sets Polymarket apart from Kalshi is that Polymarket has already confirmed it will launch its POLY token and do an airdrop.

With the FIFA World Cup looming, the prediction market sector will grow even more in 2026. Polymarket is now preparing to re-enter the US market. Meanwhile, other prediction market projects, such as Opinion, Myriad, and Limitless, will look to take away market share from the leading two.

5. Crypto Integrates Into Daily Lives Through Neobanks

Source: Dune @obchakevich.

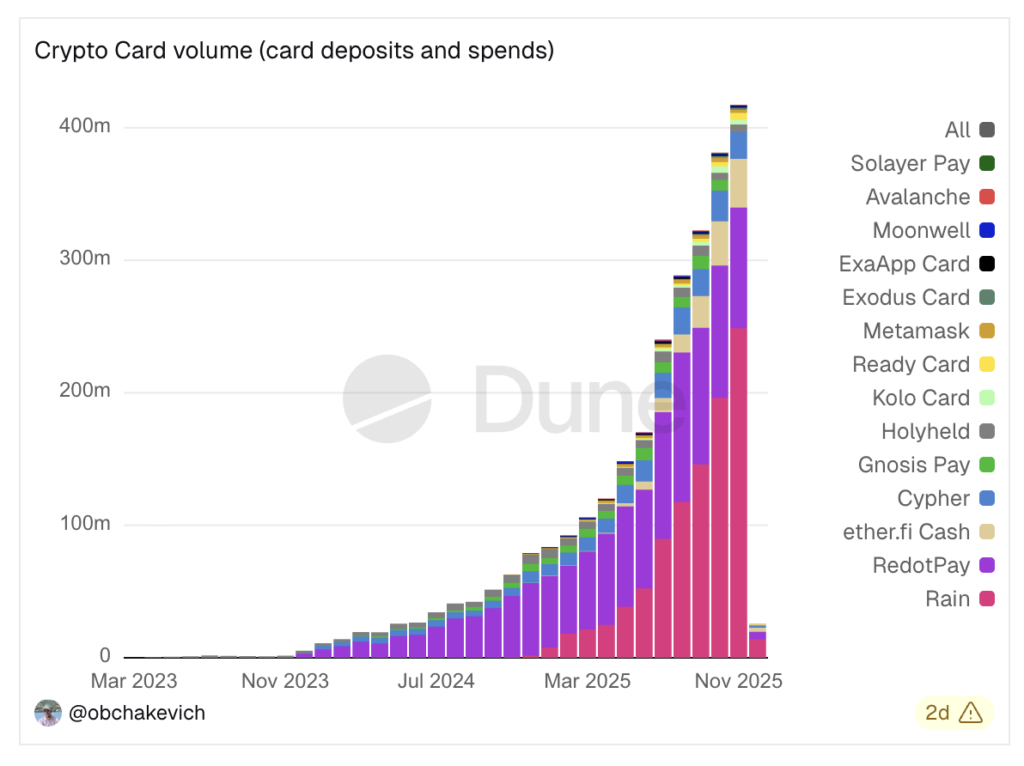

Stablecoins and crypto payments are another advancement in the crypto industry that are finding their product-market fit. While stablecoin-based projects are already popular among crypto users, crypto payments (neobanks) are gaining mainstream attention. Within a year, we can expect neobanks’ transaction volume to reach exponential levels as more people use digital assets.

Currently, there are more than five big players in the crypto neobanks sector. Revolut, Kast, Ether.fi, Rain, Tria, and Reddotpay are some of them. Collectively, the neobanks sector reached around $400 million in monthly volume in November (excluding data from Revolut and Kast).

As stablecoins usage continues to increase, payments using crypto neobanks will likely follow. Additionally, many crypto neobanks are looking at adding features such as crypto loans and credits, native stablecoin yield, and easy fiat onramp/offramp.

Potential Outperforming Sectors

Whether we enter a bear market or an extended bull run into 2026, what is certain is that some narratives or sectors will outperform others. As we’ve discussed multiple times above, projects with real users and usable products will stand head and shoulders above the rest.

With this in mind, we can narrow down several potential sectors: perpetual DEX, prediction market, tokenization, and payments or stablecoins. All of these narratives already have the potential to outperform in the upcoming year because of their strong fundamentals. The only doubt is tokenization, as it has yet to find a large user base in crypto.

One of the most popular stock tokenization platforms is xStocks. Since its launch in July, it has amassed $12 billion in combined CEX and DEX volume. For comparison, Hyperliquid has $250 billion of volume in the last 30 days. The ultimate goal of tokenization is to enable trading across all assets in the crypto ecosystem.

Source: DeFiLlama.

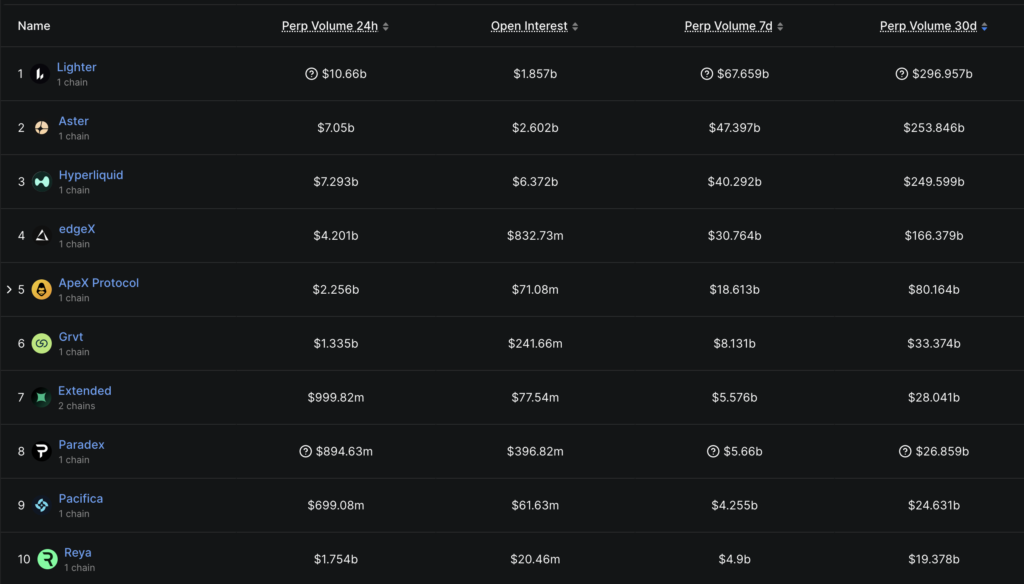

On the side of the perpetual DEX platform, Hyperliquid remains the undisputed king. The perpetual DEX market is one of the most profitable sectors in crypto besides stablecoins. Naturally, many competitors have risen to challenge Hyperliquid. Most notably, Lighter and Aster.

Lastly, as previously explained, the prediction market and stablecoin/payments sector will experience significant growth in 2026. Polymarket will launch its POLY token probably next year, and Kalshi is slowly overtaking Polymarket in mindshare.

On the other side, crypto payment volumes are increasing every month. Revolut is expanding to Solana, smaller neobank projects such as Avici and Cypher are garnering attention, and regulatory clarity in the US is helping stablecoin adoption.

Regardless of the market conditions in 2026, these narratives will still have a chance to shock the market. Even if Bitcoin continues to grind down, as it did in 2022, some altcoins will move on their own and go against the general trend.

Conclusion

As the crypto industry approaches 2026, the market stands at a decisive crossroads between a potential extended bull market driven by macro-economic tailwinds and a traditional cyclical bear market. Regardless of Bitcoin’s price action, the prevailing theme for the upcoming year is a “flight to quality.” Capital is rapidly consolidating into sectors that offer tangible utility, such as prediction markets, perpetual DEXs, and payment solutions. Consequently, investors who focus on projects demonstrating genuine product-market fit and revenue generation are most likely to outperform, even if the broader market faces headwinds.

How to Buy Crypto on Pintu

- Open the Pintu app.

- On the homepage, click the deposit button and top up your Pintu balance using your preferred payment method.

- Go to the Market section.

- Search for altcoins such as SOL, ETH, XPL, etc.

- Enter the amount you wish to purchase and confirm your transaction.

In addition, you can also invest in other crypto assets such as BTC, ETH, and others without having to worry about fraud through Pintu. In addition, all crypto holdings on Pintu have gone through a rigorous assessment process and prioritize the principle of prudence.

Download the Pintu crypto app on the Play Store and App Store! Your safety is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

In addition to making transactions, on the Pintu app, you can also learn more about crypto through Pintu Academy articles that are updated weekly! All Pintu Academy articles are not financial advice and are intended solely for educational purposes.

References

- Alexander S Blume, “5 Crypto Predictions For 2026: Breaking Cycles And Crossing Borders”, Forbes, accessed on December 1, 2025.

- Mario Lagos, “Is Bitcoin a Good Investment in 2026?”, deVere Group, accessed on December 2, 2025.

- “2026 crypto market outlook”, Fidelity, accessed on December 2, 2025.

- Patrick Scott, “The Day of Reckoning for Tokens & Stonkification of DeFi”, Substack, accessed on December 3, 2025.