From a humble meeting in a restaurant in 1993, Nvidia has grown into a global technology giant that dominates the computer graphics, artificial intelligence (AI), and semiconductor industries. Founded by Jensen Huang, Chris Malachowsky, and Curtis Priem, Nvidia started out as a graphics company, but over time evolved into a key driver of the world’s digital transformation. This article will take a deep dive into Nvidia’s early history, the milestones that shaped its journey, to a financial analysis and future outlook of a company that is now one of the most valuable in the world.

Article summary:

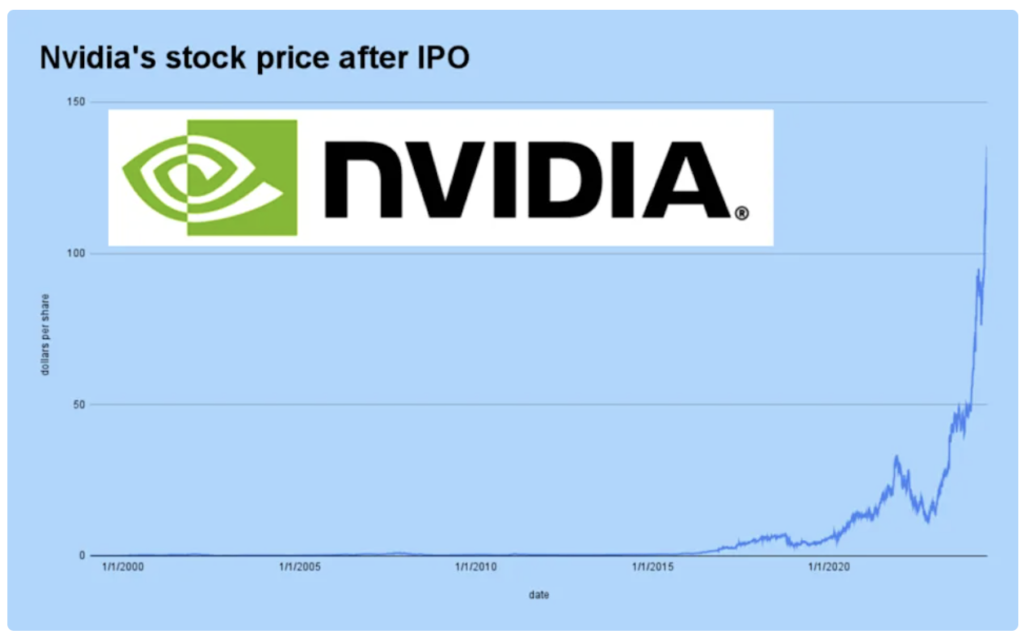

⏰ Nvidia officially became a public company with an initial stock price of $12 and began trading on the Nasdaq Exchange in 1999.

🖥️ Nvidia donated the DGX-1 supercomputer to OpenAI to support AI research in 2016.

📊 Surpassing Microsoft and Apple, Nvidia’s market capitalization will reach $3.3 trillion by 2024.

📈 Based on the November 19, 2025 report, Nvidia’s total sales increased by 62%.

History of Nvidia

Founded in 1993, Nvidia’s early history began in a Denny’s restaurant, in a meeting between Jensen Huang along with Chris Malachowsky and Curtis Priem. At that time, the personal computer (PC) era was in its infancy, and the trio had a vision to bring 3D graphics to the gaming and multimedia markets.

One year later, Nvidia established a partnership with semiconductor supplier SGS-Thomson (now known as STMicroelectronics). In the next few years, Nvidia also established other important partnerships, including with Sega and Silicon Graphics. From 1995 to 1998, Nvidia secured its first external funding and released several products such as :

- NV1, a single-slot PCI multimedia card manufactured by SGS-Thomson. This chip is a microprocessor used forrendering 3D images and can also be connected to a joystick.

- RIVA 128, the first high-performance 128-bit Direct3D processor capable ofrendering 2D and 3D images.

- RIVA TNT, the industry’s first 3D processor that supports multi-texturing.

In 1999, Nvidia officially became a public company with an initial stock price of $12 and began trading on the Nasdaq Exchange on January 22 under the stock code “NVDA”. In the same year, Nvidia released the GeForce 256, the industry’s first GPU (Graphics Processing Unit), which marked the beginning of a new way of computing. Nvidia also entered the commercial desktop PC market with the Nvidia Vanta 3D graphics processor.

A few years later, in 2006, Nvidia released CUDA, a technology that opened up the parallel processing capabilities of GPUs to the world of science and research. This technology allowed software developers to use Nvidia GPUs forgeneral-purpose computing, known as GPGPUs.

Fast forward to 2012, Nvidia released the AlexNet neural network, which the company said was a major breakthrough in the modern artificial intelligence (AI) era. Then in 2016, Nvidia donated the DGX-1 supercomputer to startup OpenAI to support AI research on the most complex problems.

This donation proved to be very beneficial because 6 years later, in 2022, OpenAI publicly released ChatGPT, which made AI more widely known and used.

Nvidia Products

Nvidia’s growth and success comes from the innovative range of products and services they offer. Here are some of the key offerings from NVIDIA’s core business:

1. Graphics Processing Units (GPU)

GPUs or Graphics Processing Units are the core of NVIDIA’s business. The company develops high-powered GPUs for various needs, from gaming graphics to high-performance computing (HPC) and artificial intelligence (AI) research.

Their GPU products include:

- Consumer graphics cards for gaming and content creativity

- High-end GPUs for data centers, AI, and machine learning

Newer architectures like Ampere and Hopper are designed to handle highly complex AI workloads, making NVIDIA GPU technology essential not only for gamers, but also for researchers and professionals in deep learning andmachine learning.

2. Cloud and Data Center Solutions

Nvidia also offers various solutions forcloud and data center computing needs. They have systems such as DGX, which is a supercomputer specifically designed to run AI models. For large-scale needs, there is also the HGX platform, which supports efficient processing of large amounts of data.

In order for AI processes to run smoothly and quickly, NVIDIA also develops high-speed networking technologies such as Mellanox InfiniBand and Ethernet solutions. These technologies allow data to move quickly and with low latency – very important in the world of AI and HPC(High-Performance Computing).

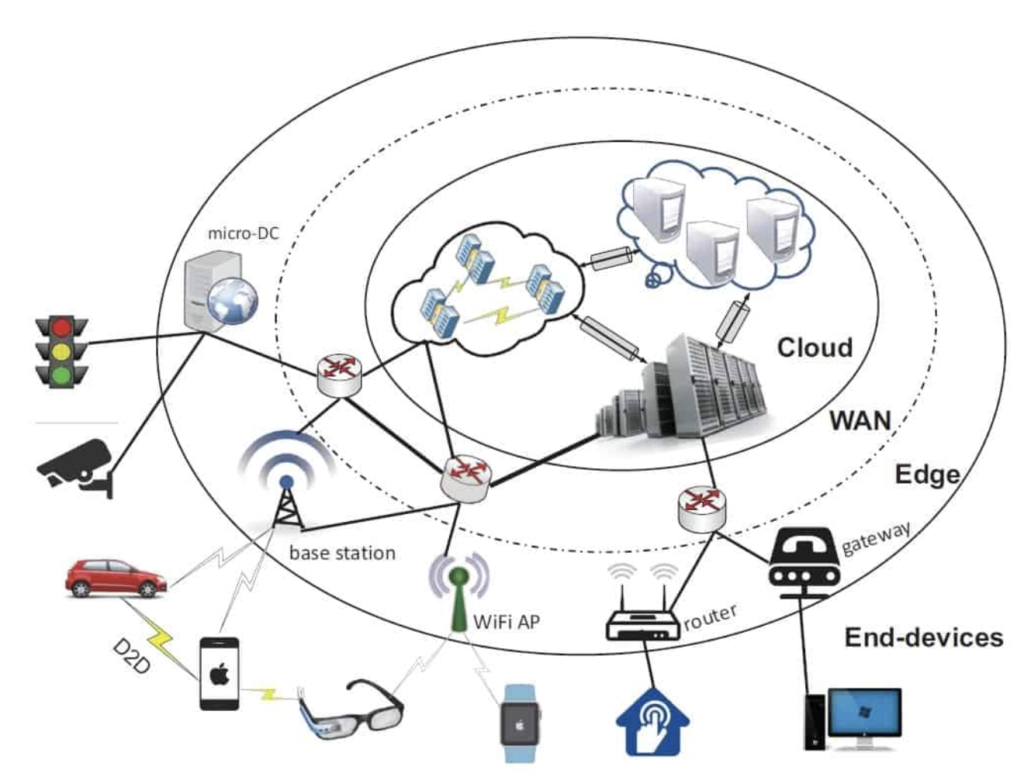

3. Automotive Solutions and Edge Computing

Nvidia developed an advanced platform for autonomous cars called DRIVE AGX. The platform is a complete package that includes the hardware, software, and AItoolkit needed to create automated driving features and a more interactive and intelligent in-cabin experience.

In addition, Nvidia also offers Jetson modules – high-performance mini-computers designed for robotics applications, Internet of Things (IoT) devices, and various systems that run AI at the edge of computing, which is data processing done directly on the device, rather than in a data center.

4. Software and Supporting Ecosystem

Nvidia not only makes hardware, but also builds a complete software ecosystem to support their technology. Here are some examples of the software and tools they provide:

- For Developers

CUDA is a programming toolkit that allows developers to write code that can run much faster on Nvidia’s GPUs. This technology is especially useful for demanding tasks such as scientific computing, video processing, and simulation.

- For Deep Learning Experts:

cuDNN is a softwarelibrary specifically designed for building and training deep learning-based AI systems.

- For Certain Industries:

Nvidia also provides ready-made frameworks and libraries for various industry sectors. For example:

- Clara assists healthcare professionals in analyzing medical images and patient data.

- Metropolis provides tools for building smart city applications, such as AI-based traffic monitoring or security systems.

Nvidia Performance and Shares (NVDA)

NVIDIA Corporation is a leading technology company based in Santa Clara, California, United States. The company specializes in semiconductors, computer graphics, and artificial intelligence (AI). It was founded in 1993 by three key figures: Jensen Huang, Chris Malachowsky, and Curtis Priem.

Many people ask, “Who is the current CEO of Nvidia?” The answer is Jensen Huang, who is also one of the founders of the company. Under his leadership, Nvidia grew rapidly and became one of the most valuable tech companies in the world. So, what makes Nvidia so valuable?

Nvidia surpasses Microsoft and Apple in 2024

By 2024, Nvidia’s market capitalization will reach $3.3 trillion and surpass Microsoft and Apple, making it the highest-valued public company in the world. Not only that, Jensen Huang’s 3.8% shareholding brings his wealth to at least $126 billion, putting him close to the top 10 richest people in the world.

According to Yahoo Finance, Nvidia’s stock price has outperformed most other tech companies. If someone invested $10,000 on the first day Nvidia went public in 1999, it would have risen to about $33.9 million by mid-June 2024. The drastic rise in Nvidia’s stock price occurred mainly after the pandemic, starting late 2022, when a massive wave of investment flowed into the artificial intelligence (AI) sector.

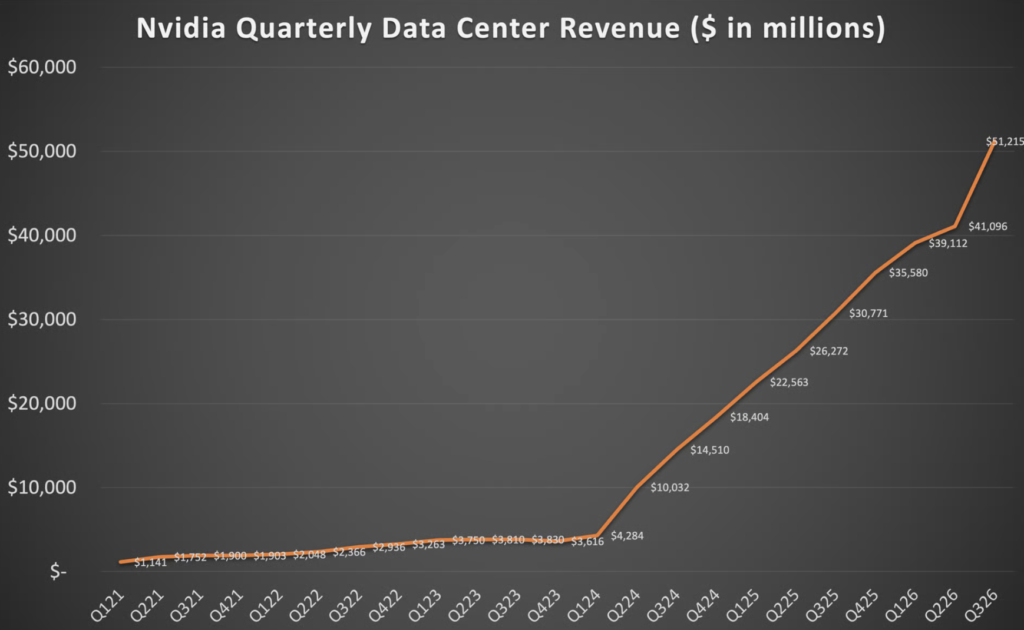

Nvidia’s Total Sales to Rise 62% by 2025

With an impressive growth chart, many people are curious about Nvidia’s latest revenue. On November 19, 2025, Nvidia reported that its total sales grew by 62% compared to the same period the previous year. This is a remarkable achievement, especially considering the sheer scale of Nvidia’s business.

In the third quarter of fiscal year 2026, Nvidia’s latest revenue reached $57 billion, of which $51.2 billion came from the data center segment – a sector that is now the company’s main source of growth. Previously, growth in this segment had slowed down as businesses scaled up.

However, that trend changed in the third quarter. Sales from data centers rose 66% compared to the same period last year, and increased 25% compared to the previous quarter. The available charts clearly show this re-acceleration of revenue growth.

Interestingly, this quarter also ended the previous trend of slowing quarter-on-quarter growth. While it is uncertain whether this trend of high growth will continue, there are some positive indications that it might.

Nvidia (NVDA) Stock Performance in the Last 1 Year

In the past 1-year period, Nvidia (NVDA) stock has performed quite significantly with a growth of +24%, even amid market fluctuations. The chart shows that Nvidia’s share price reached $179.58 or equivalent to Rp2,989,441 ($1 = Rp16,646), with the latest EPS (Earnings Per Share) of $4.05 (Rp67,419), which was released in November 2025 – the highest during this year.

Nvidia’s EPS shows a consistent upward trend throughout 2025:

- January 2025: EPS $2.94

- May 2025: EPS rises to $3.10

- July 2025: EPS increased again to $3.51

- November 2025: EPS peaks at $4.05

Overall, this increase in EPS reflects the company’s strong revenue growth and profitability, which have been the main drivers of its rising share price. Despite some short-term dips in the stock price, the long-term trend remains upward, signaling high investor confidence in Nvidia’s future. With a market capitalization of $4.4 trillion, Nvidia continues to maintain its position as one of the most valuable technology companies in the world.

NVDA Stock Analysis

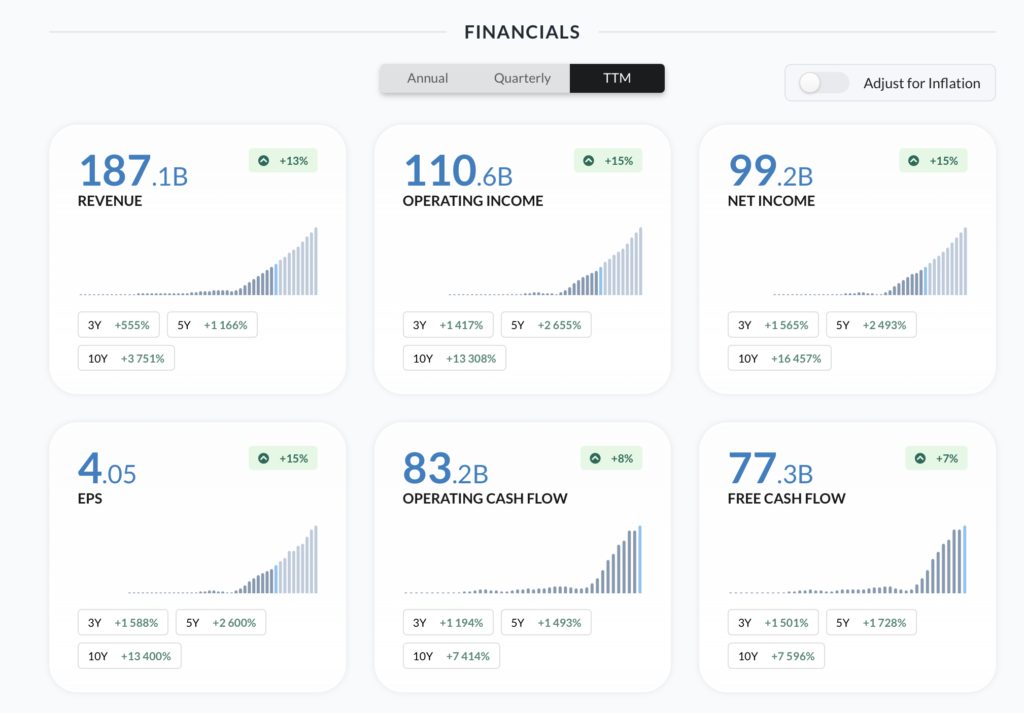

Nvidia Financial Performance (TTM)

Based on the data displayed on Alphaspread, Nvidia recorded remarkable financial growth in the past 12 months (TTM), with positive trends across all key metrics:

- Revenue: Reached $187.1 billion, up +13% from the previous period. In the last 3 years, revenue grew +555%, and remarkably surged +3,751% in the last 10 years.

- Operating Income: Recorded at $110.6 billion, up +15%. This performance reflects improved efficiency and profitability, with growth of +2,655% in 5 years and +13,308% in the last 10 years.

- Net Income: Touched $99.2 billion, up +15%. This figure shows a remarkable increase, with growth of +2,493% in 5 years and +16,457% in the last decade.

- EPS (Earnings Per Share): Reached $4.05, growing +15% in the TTM period. EPS also recorded a sharp jump of +2,600% in 5 years and +13,400% in the last 10 years.

- Operating Cash Flow: $83.2 billion, an increase of +8%, with significant long-term growth: +1,493% (5 years) and +7,414% (10 years).

- Free Cash Flow: Recorded at $77.3 billion, up +7%, reflecting a strong financial position for expansion and innovation. In the last 10 years, FCF grew +7,596%.

Nvidia Growth Projection Based on DCF Method

Meanwhile, the chart above shows Nvidia’s projected revenue and net income growth used in the DCF (Discounted Cash Flow) valuation calculation.

In terms of revenue, Nvidia is expected to grow significantly, from $268.7 billion to approximately $945.3 billion in the next few years. This growth reflects the increasing demand for Nvidia’s products and solutions, especially in sectors such as AI, data center, and high-performance computing.

Meanwhile, net income is also projected to increase sharply, from $147.3 billion to $519.9 billion. This increase reflects not only revenue growth, but also improved efficiency and profitability.

The line on the graph shows the transition from historical financial data (2021-2025) to future financial projections (2026-2030). The trend shows consistent and sustainable growth, which is the main basis for analyzing the fair value of Nvidia shares through the DCF method.

DCF is a valuation method used to calculate the fair value (intrinsic value) of a business, stock, or investment based on projected future cash flows that are then discounted to present value.

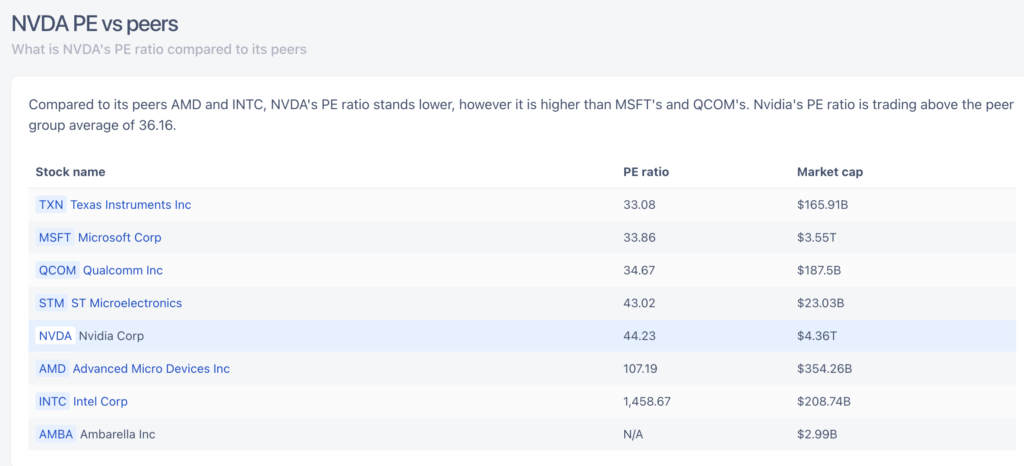

Nvidia Stock P/E Ratio Reaches 44.23

As of December 3, 2025, the P/E (Price to Earnings) ratio of Nvidia (NVDA) stock stood at 44.23. This is higher than some tech giants like Microsoft (33.86) and Qualcomm (34.67), but lower than semiconductor competitors like AMD (107.19) and Intel (1,458.67).

When compared to the average P/E of its peer group at 36.16, Nvidia’s P/E is still above average, reflecting the market’s high expectations for Nvidia’s future growth.

In terms of market capitalization:

- Nvidia is the largest company on this list, with a market cap of $4.36 trillion

- Outperforming Microsoft ($3.55 trillion) and far ahead of AMD ($354.26 billion) and Intel ($208.74 billion)

Meanwhile, Texas Instruments (TXN) and STMicroelectronics (STM) have lower P/E ratios of 33.08 and 43.02.

PEG Ratio Analysis and Projected Valuation of Nvidia

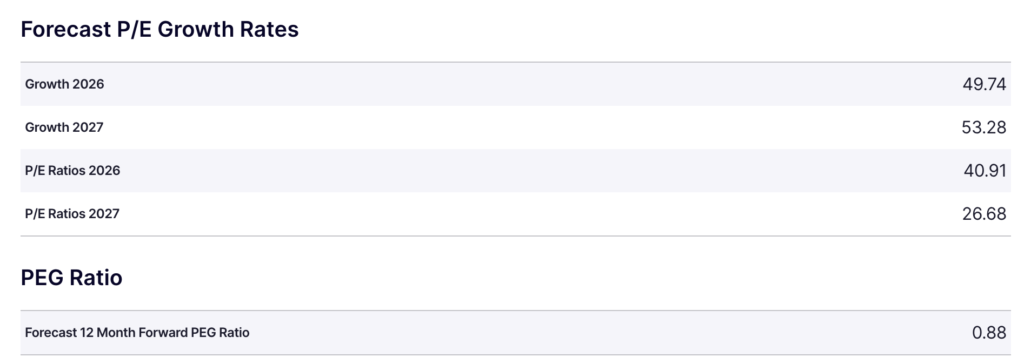

Based on data from the NASDAQ website, Nvidia is projected to record solid revenue growth in the next two years. For 2026, the estimated growth reaches 49.74%, and increases to 53.28% in 2027.

At the same time, the P/E(Price to Earnings) ratio is expected to decline from 40.91 in 2026 to 26.68 in 2027. This decline in P/E, while accompanied by high growth, reflects the potential for increased efficiency and more rational valuations.

Interestingly, the PEG ratio (Price/Earnings to Growth) for the next 12 months is estimated at 0.88, which is generally considered an undervalued signal (as it is below 1). This suggests that although Nvidia’s P/E valuation looks high, its strong earnings growth makes its valuation still attractive for medium to long-term investors.

Technical Analysis of NVDA Stock Based on Trader X

Technical analyst at X, Donald Dean, identified that Nvidia (NVDA) stock is currently in a consolidation phase in an area called a“volume shelf“, which is a price zone where there is a high accumulation of trading volume. This area is often a potentiallaunch area for the next price move.

Dean mentioned that as long as the price stays above the volume shelf area, there is a strong potential for NVDA stock to continue its uptrend and challenge the previous high. Furthermore, Dean explained that the next price target is set at $212, which is above the previous resistance level.

If the price manages to break this consolidation area with strong volume, then a move towards $212 is considered very likely.

Meanwhile, the analyst team from Xtrades reported that they have made profits in the last 4 trades for Nvidia stock from both calls and puts strategies. Currently, the 4-hour chart shows a pattern of higher highs and higher lows, indicating that the short-term bullish momentum is still strong.

In the analysis, they see an opportunity to BTD(Buy The Dip) in the buy zone between $179.44 and $177.95. This level is supported by the Fibonacci retracement line and the short-term uptrend (marked by the purple line on the chart).

Buy Tokenized Nvidia Shares at the Door

As interest in blockchain-based real-world assets increases, popular US stocks such as Nvidia, Tesla, Apple, and Meta are now available in tokenized stocks in the crypto ecosystem. Tokenized stocks are digital versions of public company stocks represented on the blockchain. Each token reflects the value of one real share and is backed 1:1 by real assets held by licensed custodians.

The good news is that you can start investing in tokenized stocks like Nvidia right on the Pintu app with ease. Here are the steps:

- Open the Doors app.

- Go to the Market section and search for Nvidia (NVDAX).

- Enter the amount you wish to purchase after logging in.

- You can follow the same steps to buy other tokenized stocks in the Pintu app.

In addition to trading, Pintu also allows you to learn more about crypto through various educational articles on Pintu Academy which are updated weekly. All articles published on Pintu Academy are for educational purposes only and are not financial advice.

Conclusion

Nvidia is no longer just a GPU manufacturer, but is now a key player in the artificial intelligence (AI), cloud computing and data center industries. From its ambition to transform the graphics industry, Nvidia is now driving a global technology revolution. With growing revenues, soaring EPS, and a trillion-dollar market valuation, Nvidia proves that continuous innovation is its core strength. In terms of products, market strategy, and stock performance, Nvidia symbolizes the dominance of future technology.

Reference:

- CNA. CNA Explains: The story of Nvidia’s rise to become the world’s No. 1 company. Accessed on December 4, 2025

- Dominic Diongson. Nvidia company history & timeline: From GPU maker to AI leader. Accessed on December 4, 2025

- Howard Smith. Nvidia Just Delivered Another Blowout Quarter. Is the Stock Still a Buy? Accessed on December 4, 2025

- Lakshmi Varanasi. Nvidia: A complete guide to the hardware company behind the AI boom. Accessed on December 4, 2025

- Nathan Reiff. How Nvidia Makes Money. Accessed on December 4, 2025

- Nico Klingler. How NVIDIA Became The World’s Most Valuable Company. Accessed on December 4, 2025