Article Summary

- Bitcoin experienced significant volatility, starting in December with a drop that wiped out gains in 2025.

- Ethereum is looking to reverse its momentum after the Fusaka upgrade, with resistance at $3100.

- Solana is consolidating in the $126- $144 range. Solana needs to break out of this consolidation zone before any further breakout or breakdown is confirmed.

MicroStrategy, one of the largest BTC holders, cut its 2025 revenue forecast due to Bitcoin’s decline. This has made corporate-level adopters wary.

Bitcoin experienced significant volatility last week, kicking off December with a drop that wiped out its 2025 gains. This massive volatility led to over $2.8 billion in liquidated futures positions in the crypto market.

However, according to some popular analyst accounts on social media X, the volatility that occurred last week is not a cause for concern.

- According to @BullTheoryio, the significant increase in Google searches for “Bitcoin bear market” suggests this is the bottom of the crypto market.

- According to the @cryptofergani account, what is currently happening is a bear trap that could lead to new highs.

In general, quite a few accounts remain optimistic that Bitcoin can reach a new high, expected to be 150,000 US dollars.

Some of the macroeconomic signals this week could affect the price movements of the crypto market, including:

- The potential for the Bank of Japan to raise interest rates could create global liquidity concerns.

- FOMC and interest rate decision. The Federal Reserve’s interest rate decision is scheduled for December 9-10.

Bitcoin (BTC) Analysis

A Week of Volatility

Bitcoin experienced significant market volatility, including a “pump and dump” in the early hours of Monday (December 8, 2025). BTC dropped to the $87K area, then suddenly rose by 4.6% to around $91K.

Bitcoin volatility in the early hours of Monday.

Technically, Bitcoin could be in a bear flag chart pattern, which suggests the potential for continued bearish movement. If this pattern holds, Bitcoin could fall further to 80,000 or 75,000 US dollars.

Bear Flag pattern on Bitcoin.

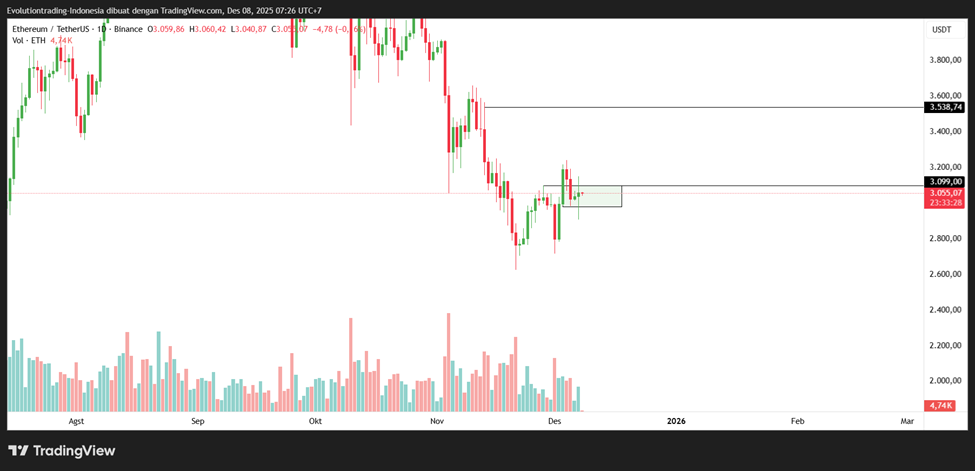

Ethereum (ETH) Analysis

Positive Sentiment After Fusaka Upgrade

Ethereum followed Bitcoin’s downward movement, dropping below US$3,000 and liquidating over US$140 million. However, Ethereum experienced positive sentiment with the launch of the Fusaka upgrade on December 3, 2025. Analyst and investor Tom Lee suggested that Ethereum could reach $62,000.

Technically, Ethereum is looking to reverse momentum, with resistance at $3100. If broken, it could take Ethereum further up to a potential $3500.

Solana Analysis (SOL)

Solana experienced a gravestone doji candle formation, indicating market uncertainty: both bullish and bearish momentum were trying to move, but neither prevailed.

This price movement is still occurring within Solana’s consolidation range around $126-$144. Solana needs to break out of this consolidation zone before any further increase/decrease is confirmed.

Ethereum On-Chain Analysis: Potentially Bullish

Ethereum on-chain metrics. Source: Defillama.com

Netflow for Bitcoin and Ethereum looks relatively stable, with the number of incoming and outgoing assets not differing much, indicating stability.

Meanwhile, for Ethereum, on-chain activity looks relatively stable with some metrics starting to rise. Transaction volume on the decentralized exchange (DEX) decreased by 6% last week, but in the last 24 hours, 64,000 new addresses were created, with 1.12 million transactions completed.

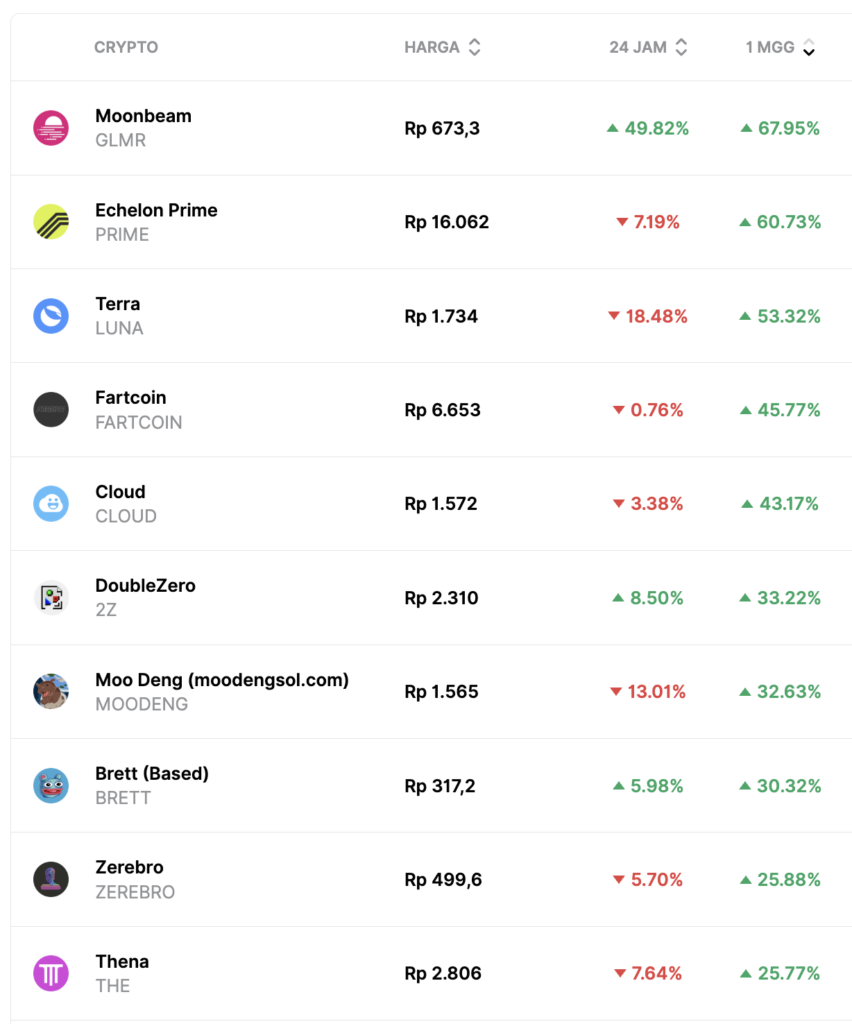

Crypto Performance in the Last Week

Top Performing Cryptocurrencies

- Moonbeam ($GLMR) +67.9%

- Echelon Prime ($PRIME) +60.7%

- Terra ($LUNA) +53.3%

- Fartcoin ($FARTCOIN +45.7%

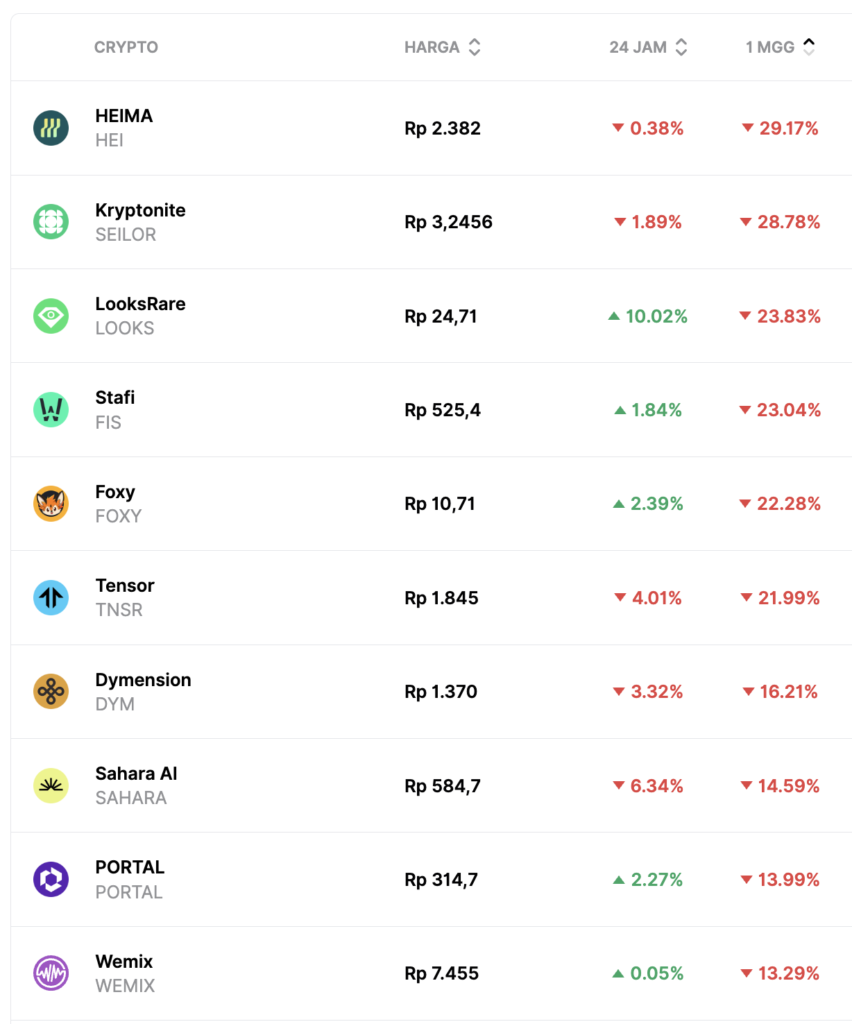

Worst Performing Cryptocurrencies

- Heima ($HEI) -29.1%

- Kryptonite ($SEILOR) -28.7%

- Looksrare ($LOOKS) -23.8%

- Staffing ($FIS) -23%

Disclaimer: All articles from Pintu Academy are intended for educational purposes and do not constitute financial advice.