Signal Trading Summary:

- Santos FC Fan Token [SANTOS]

- Entry [Long]: $1.529

- Stop Loss [SL]: $1.395

- Take Profit [TP]:

- TP1: $1.660

- TP2: $1.759-$1.858

- Filecoin (FIL)

- Entry [Long]: $1.298

- Stop Loss [SL]: $1.241

- Take Profit [TP]:

- TP1: $1.360

- TP2: $1.427

- Basic Attention Token [BAT]

- Entry [Short]: $0.2273

- Stop Loss [SL]: $0.2455

- Take Profit [TP]:

- TP1: $0.2090

- TP2: $0.1898

1. Santos FC Fan Token (SANTOS)

The selling pressure on SANTOS that lasted from November 29 to December 16 finally showed signs of weakening after the price touched a crucial support area at the level of $1,423. This level managed to withstand the price decline, while triggering a significant influx of buying pressure that prompted a reversal.

Technically, the price holding above the support area is a key factor in maintaining the ongoing rebound structure. As long as SANTOS is able to move stably above the $1,423 level, the opportunity for further strengthening is still open.

The potential price increase is projected to lead to the resistance area in the range of $1,759-$1,858 as the main target. Previously, the minor resistance area has the potential to be an area of price reaction in the short term as the consolidation process before continuing to rise.

Potential Buy/Long Setup SANTOS:

- Entry [Long]: $1.529

- Stop Loss [SL]: $1.395

- Take Profit [TP]:

- TP1: $1.660

- TP2: $1.759-$1.858

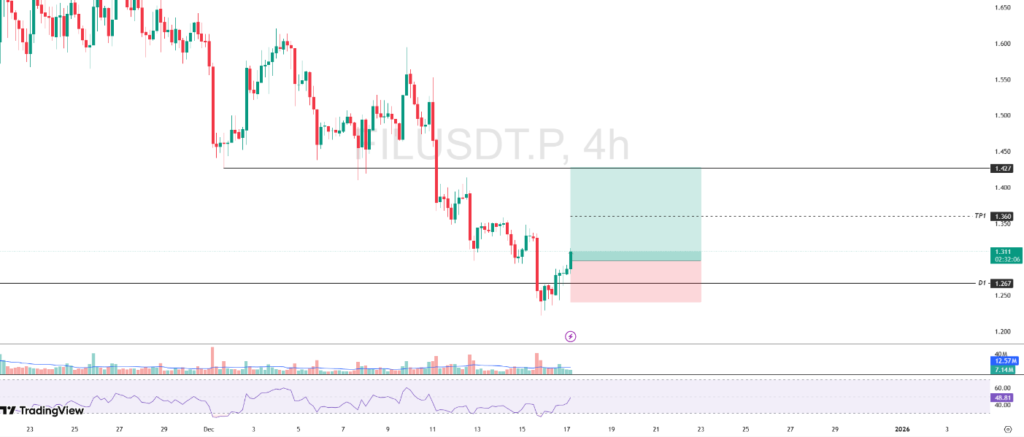

2. Filecoin (FIL)

FIL’s price movement showed recovery signals after successfully moving back above the crucial support zone at the $1,267 level. Previously, the price had experienced a false break that pushed the decline to touch the level of $1,222, but the selling pressure did not continue and instead responded with an influx of buying interest.

The return of prices above the support area indicates that FIL’s technical structure is still maintained. As long as the price is able to survive and move stably above the $1,267 level, the potential for a rebound continuation is still open.

The SBR (Support Become Resistance) area at $1,427 is the main upside target as well as a crucial area that could potentially trigger a price reaction. Before reaching this level, the minor resistance area is likely to be a short-term consolidation point.

Potential Buy/Long FIL Setup:

- Entry [Long]: $1.298

- Stop Loss [SL]: $1.241

- Take Pro

- TP1: $1.360

- TP2: $1.427

3. Basic Attention Token (BAT)

Market sentiment towards BAT tends to weaken after the price broke the crucial support area at $0.2395. The breakdown triggered increased selling pressure and changed the technical structure to bearish in the short term.

The subsequent rebound attempt was only able to bring the price to retest the broken support area. However, the weak buying pressure in the zone caused the price to fail to continue to strengthen and resume weakness. This condition confirms the $0.2395 area as new resistance.

With the price structure still below the resistance, the BAT movement has the potential to continue its decline. The main weakening target is projected towards the RBS (Resistance Become Support) area at $0.1898, which has the potential to be the next price reaction area.

Potential Sell/Short BAT Setup:

- Entry [Short]: $0.2273

- Stop Loss [SL]: $0.2455

- Take Profit

- TP1: $0.2090

- TP2: $0.1898

Important Notes:

Always apply risk management and capital management with discipline. For trading, especially those using leverage, we recommend using a risk per transaction of: 1% of total capital.

*Disclaimer: Pintu Futures activities (trading futures contracts on crypto assets) are carried out by PT Porto Komoditi Berjangka, a Futures Brokerage company licensed and supervised by Bappebti and is a member of CFX and KKI. Trading futures contracts on crypto assets has high risks, one of which is the risk that Leverage can provide greater profits or losses.