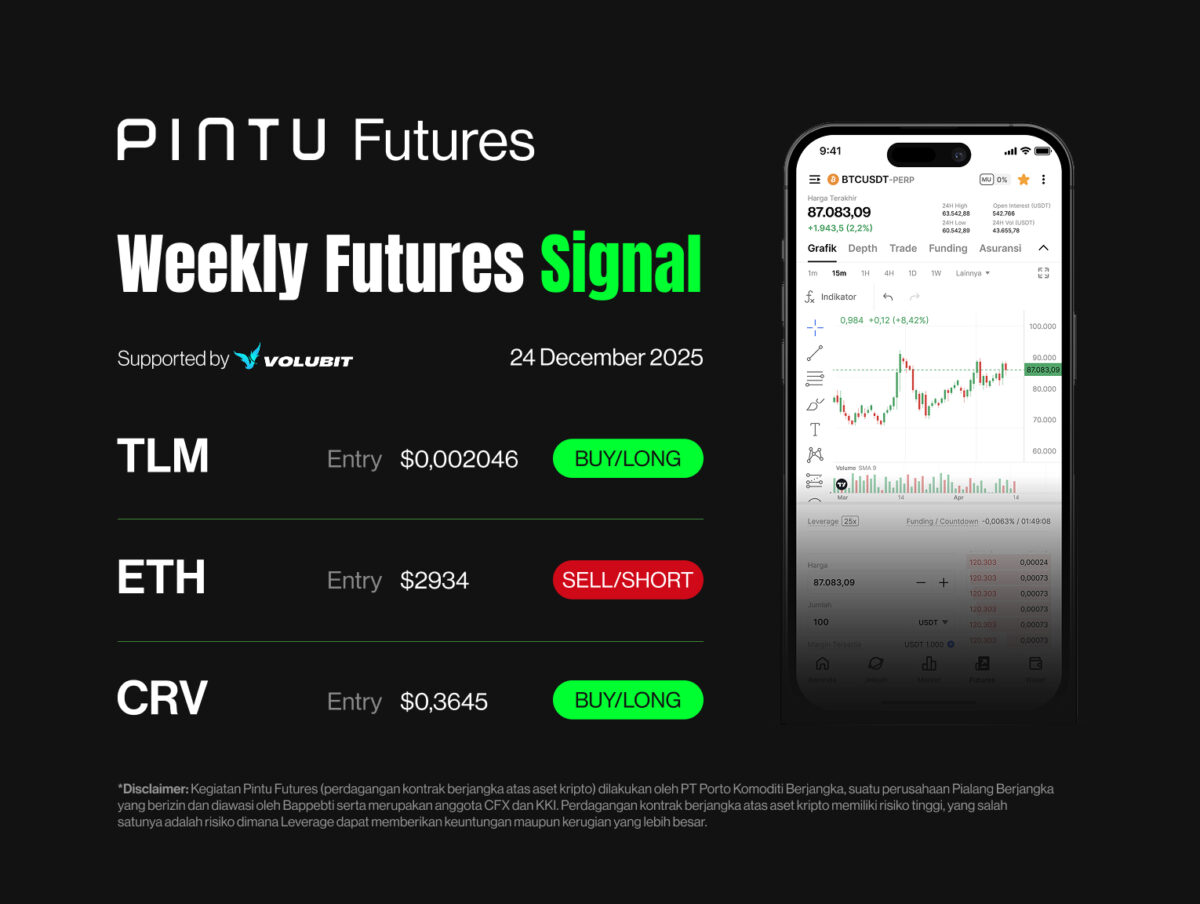

Signal Trading Summary:

- TLM

- Entry [Long]: $0.002046 – $0.002095

- Stop Loss [SL]: $0.001906

- Take Profit [TP]:

- TP1: $0.002450

- TP2: $0.002804

- Ethereum (ETH)

- Entry [Short]: $2.934 – $2.986

- Stop Loss [SL]: $3.058

- Take Profit [TP]:

- TP1: $2.779

- TP2: $2.623

- Curve Dao (CRV)

- Entry [Long]: $0.3645 – $0.3614

- Stop Loss [SL]: $0.3338

- Take Profit [TP]:

- TP1: $0.4

- TP2: $0.415

1. TLM

TLM showed an impulsive movement and broke the 21 EMA on the 4-hour timeframe. This shows the potential for TLM to experience an upward trend .

To look for a more probable buy position, we can wait for TLM to test its 21 EMA or at the resistance become support area around the $0.02046-$0.002095 area and target the high formed in the impulsive move that just formed.

TLM Potential Buy/Long Setup:

Entry: $0.002046 – $0.002095

Stop Loss [SL]: $0.001906

Take Profit [TP]:

- TP1: $0.002450

- TP2: $0.002804

2. Ethereum (ETH)

ETH is currently experiencing a breakdown of the 21 EMA on the 4-hour timeframe accompanied by the formation of a bearish candlestick, indicating a strong downside.

We can expect a correction to at least the $2779 area as long as ETH can’t breakout from the 21 EMA on the 4-hour timeframe.

ETH Sell/Short Potential Setup:

Entry: $2,934 – $2,986

Stop Loss [SL]: $3.058

Take Profit [TP]:

- TP1: $2,779

- TP2: $2,623

3. CRV

CRV looks to have a bullish structure change as seen by the higher high and breakout of the 21 EMA on the 1-day timeframe.

We can expect CRV to increase up to the $0.4 and $0.45 area as long as it does not break the 21 EMA on the 4-hour timeframe.

CRV Potential Buy/Long Setup:

Entry: $0.3645 – $0.3614

Stop Loss [SL]: $0.3338

Take Profit [TP]:

- TP1: $0.4

- TP2: $0.415

Important Notes:

Always apply risk management and capital management with discipline. For trading, especially those using leverage, we recommend using a risk per transaction of: 1% of total capital.

*Disclaimer: Pintu Futures activities (trading futures contracts on crypto assets) are carried out by PT Porto Komoditi Berjangka, a Futures Brokerage company licensed and supervised by Bappebti and is a member of CFX and KKI. Trading futures contracts on crypto assets has high risks, one of which is the risk that Leverage can provide greater profits or losses.