Coinbase Global, Inc. is a US-based cryptocurrency services company that provides the infrastructure to buy, sell, custody, and use cryptocurrencies for retail and institutional use. In general, Coinbase evolved from a crypto “exchange” to a digital asset-based financial services platform. Coinbase is now getting stronger in non-trading revenues such as stablecoins, staking, and institutional services.

Article Summary

- 📌 Coinbase evolved from a crypto exchange to a crypto infrastructure provider, with a strong focus on non-trading revenue such as stablecoins, staking, and institutional services.

- 📊 Coinbase’s business model is increasingly diversified, with subscriptions & services expected to account for around 41% of revenue by 2025.

- 🔗 COINx is a tokenized stock of Coinbase shares, providing on-chain COIN price exposure without traditional shareholder rights.

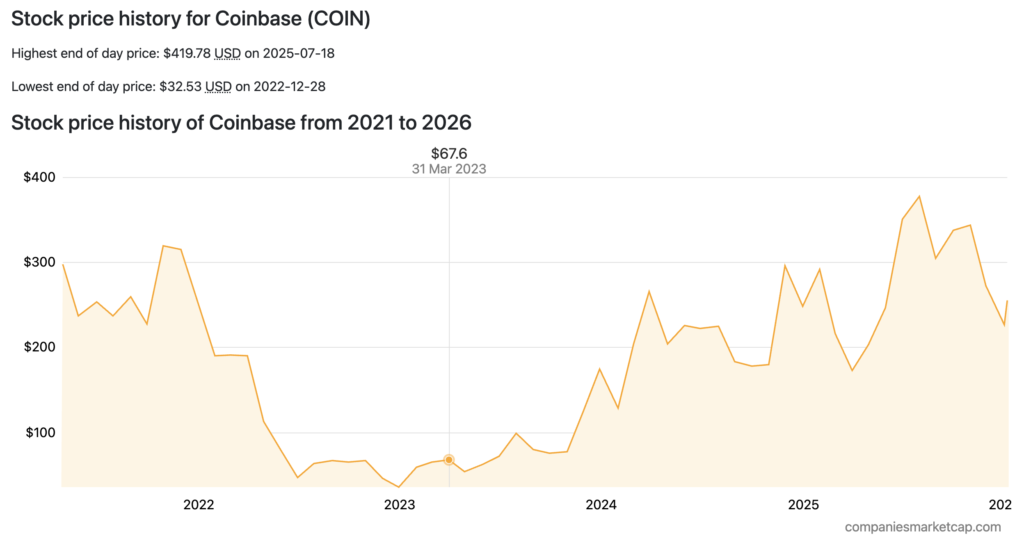

- 📈 COIN stock performance is very cyclical, falling sharply in 2022 and then rebounding strongly in 2023-2024, before entering a consolidation phase in 2025-2026.

- 🏦 Goldman Sachs upgraded COIN to Buy with a US$303 price target, highlighting the long-term opportunity while warning of competition and regulatory risks.

History of Coinbase

Coinbase was founded in 2012 by Brian Armstrong and Fred Ehrsam in San Francisco as a Bitcoin buying and selling platform targeting retail users. From the beginning, Coinbase positioned itself as a key entry point into the crypto ecosystem with a focus on convenience, security, and regulatory compliance. This strategy has led to rapid growth in its user base as adoption of cryptocurrencies increases globally.

An important milestone occurred in 2021 when Coinbase listed on Nasdaq through a direct listing mechanism with the ticker COIN. On the day of its debut, the Nasdaq reference price was set at $250, the stock opened at $381 and closed at $328.28. This event marked the legitimization of the crypto industry in traditional capital markets at the height of the bull cycle at that time.

Entering the 2022-2023 period, the crypto bear market suppressed transaction volumes and profitability so Coinbase made cost efficiencies and operational adjustments. Conditions began to improve in 2024 as the crypto market recovered, with financial performance and net profit returning to strength. In 2025, the company’s strategic focus shifted to business diversification through strengthening derivatives, developing infrastructure, and exploring tokenization and on-chain equity products.

Direct listing is a method of listing shares on the stock exchange where the company directly trades its existing shares without issuing new shares and without involving an underwriter as in an IPO.

Coinbase Business Model

Coinbase Global, Inc.’s business model is rooted in a revenue structure designed to capture value from various activities in the crypto ecosystem, not just trading fees. The company integrates consumer and institutional services through three main revenue pillars:

1. Transaction Revenue

Transaction revenue has been Coinbase’s main source of revenue since its inception and comes from crypto spot trading fees from both retail and institutional users. The size of this revenue is highly dependent on the volume and trading activity in the crypto market. In the early phase of the business, around 2020, transaction revenue accounted for approximately 96% of Coinbase’s total revenue before the company diversified its services.

2. Subscription & Services Revenue

Over time, Coinbase developed more recurring revenue pillars through non-trading services:

- Stablecoin income (including interest from USDC reserves and stablecoin-related activities).

- Staking rewards and other staking services.

- Custody services for large institutions.

- Subscription services such as Coinbase One Premium, Coinbase Cloud, and other products that offer additional benefits for a fee.

This segment is experiencing significant growth and by 2025 is expected to account for around 41% of Coinbase’s total revenue, a sharp increase from its meager contribution five years earlier. Revenue from subscriptions & services is projected to reach around US$2.9 billion, with USDC contributing around US$1.4 billion and staking rewards around US$723 million based on analyst estimates.

3. Infrastructure/Institutional and Other Revenue

In addition to trading and subscription services, Coinbase is also exploring revenue sources from crypto infrastructure activities:

- Institutional custody services such as custody of digital assets for third parties.

- Prime brokerage, derivatives and on-chain solutions.

- Other income such as interest from corporate cash and certain assets.

This segment strengthens Coinbase’s position as a technical “plumbing” provider to the broader crypto ecosystem, as well as adding revenue stability beyond the volatility of the trading market.

What is COINx?

COINx generally refers to “Coinbase xStock”, which is a token that represents the price of Coinbase shares (COIN) in an on-chain asset format. Conceptually, tokenized stock like COINx aims to provide more flexible access (e.g. integration with crypto ecosystems, fractional potential, and cross-infrastructure trading), but not “common stock” in a securities account.

COINx Structure and Main Characteristics

- In general, COINx is designed as an instrument that claims to be fully backed (1:1) by an underlying asset in the form of Coinbase (COIN) shares held through a specific custodian or issuing structure.

- This instrument provides exposure to the price movements of COIN shares, but does not include conventional shareholder rights, such as voting rights or participation in corporate decisions.

- The compliance framework, jurisdictional restrictions, and redemption and settlement mechanisms are determined by each issuer or platform where COINx is issued and traded.

COINx is a different instrument from COIN shares on exchanges. Product risks include issuer risk, legal structure, jurisdictional restrictions, as well as potential liquidity/market microstructure differences compared to the original shares.

COINx Publisher and Publishing Structure

COINx is not created directly by Coinbase as a stock issuer, but rather issued by a third party engaged in asset tokenization.

COINx is issued by Backed Assets AG, a Swiss-based tokenization company that developed the xStocks product, a token that represents public shares on-chain. In this structure, Backed acts as the token issuer, while the underlying Coinbase (COIN) shares are held through a designated custodian within the local legal framework.

Meanwhile, Coinbase acts as a party that supports the ecosystem and product distribution, not as a direct issuer of COINx. In other words, COINx is a tokenized stock of Coinbase shares issued by Backed Assets AG, not official shares issued by Coinbase Global, Inc.

COIN Stock Performance from 2021 – 2026

Coinbase’s (COIN) share price movement throughout 2021-2022 reflected the sharp correction phase after the initial euphoria of the crypto market. After the IPO in 2021, it plummeted further in 2022 with an annualized decline reaching 85.90%. This pressure was triggered by the crypto bear market, declining trading volumes, and negative sentiment towards risk assets globally.

The turning point came in 2023 when COIN stock recorded a very strong rebound. From a low of around $32.53 in December 2022, the share price surged significantly and closed 2023 with an annualized gain of around 417.62%. This recovery was driven by the stabilization of the crypto market, expectations of interest rate cuts, as well as an improved perception of Coinbase’s business sustainability.

In 2025, COIN stock recorded its highest closing price in history at around $419.78, although on an annualized basis it ended up corrected by around 12.08%. Entering 2026, COIN stock returned to positive performance with an increase of about 12.73%, reflecting a consolidation phase after high volatility in the previous cycle.

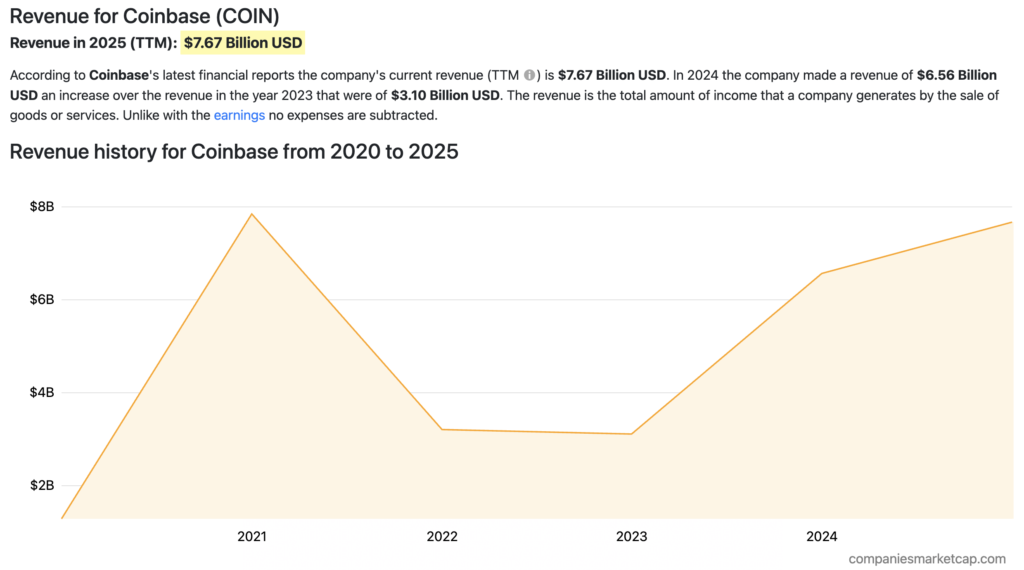

Coinbase (COIN) Revenue Development

The revenue chart shows that Coinbase’s financial performance is heavily influenced by the crypto market cycle. Revenue jumps sharply in 2021 to close to US$8 billion with the bull market, then drops significantly in 2022-2023 to around US$3 billion due to declining trading volumes and weakening market sentiment.

The recovery is evident from 2024, when revenues increase again to around US$6.56 billion, and continue in 2025 with trailing twelve months (TTM) revenues reaching around US$7.67 billion. This increase reflects a combination of recovering crypto market activity and a growing contribution from non-trading revenues such as subscriptions, stablecoins and institutional services.

Revenue is the total revenue generated by a company from the activity of selling products or services in a certain period before deducting costs.

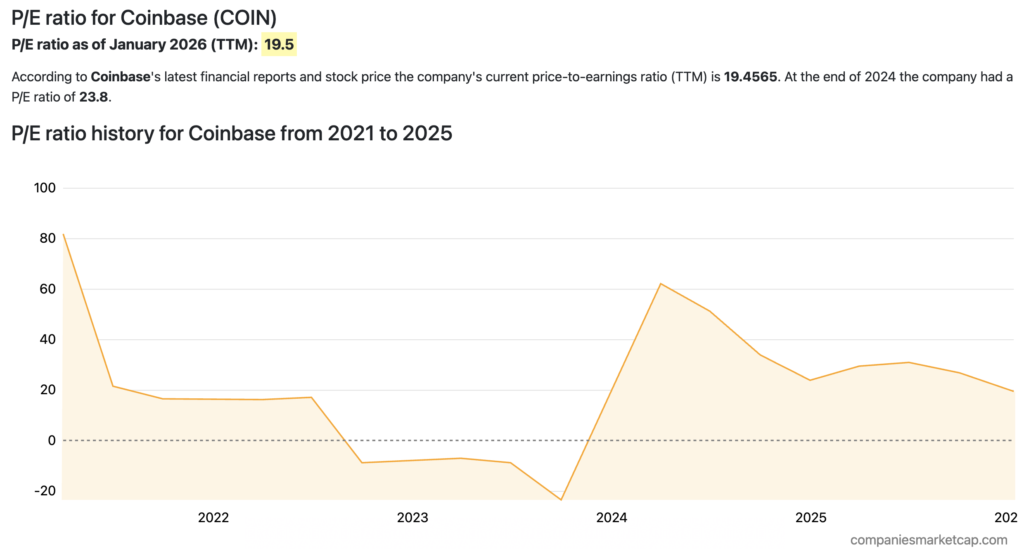

Coinbase (COIN) Stock P/E Ratio Development

The price-to-earnings (P/E) ratio chart reflects the volatility of Coinbase’s profitability throughout 2021-2023. After recording a very high P/E in 2021, this ratio dropped dramatically and even went negative in 2023, reflecting a period of net losses during the crypto bear market.

As earnings recovered in 2024, the P/E ratio returned to positive and reached levels above 60 before normalizing. As of January 2026, Coinbase’s TTM P/E is around 19.5, lower than the end of 2024, indicating a relatively more moderate valuation as financial performance stabilizes and more rational growth expectations from the market.

P/E Ratio is a ratio that compares the share price to earnings per share to assess the valuation of the company.

Goldman Sachs Predicts COIN’s Target Share Price to Touch $303

In its 2026 crypto sector outlook report released on January 5, 2026, Goldman Sachs upgraded its Coinbase (COIN) stock rating from Neutral to Buy. This decision was driven by the assessment that new product launches as well as an increasing share of non-trading revenue strengthen Coinbase’s long-term growth prospects. Goldman set a price target of $303, or about 34% above the recent low around $225, emphasizing that this view is selective and does not reflect optimism for the entire crypto sector.

According to Goldman Sachs, about 40% of Coinbase’s revenue now comes from more structural businesses such as custody, staking, and subscription-based services, up from less than 5% five years ago. This source of revenue is considered more stable than spot trading. However, Goldman expects profit margins to be relatively flat by 2026 due to intensified competition and sensitivity to falling interest rates.

Goldman also highlighted Coinbase’s expansion into new products such as US stock trading, prediction markets, derivatives and banking services. Prediction markets and tokenization are seen as having great long-term potential, although monetization is highly dependent on scale and liquidity.

COIN Stock Analysis According to Crypto Experts at X

- COIN Approaches Bottom Area, Potential to Test US$190 Support

Technical analysis of Coinbase (COIN) stock shows price movement is still within the medium-term ascending channel pattern. The price is seen undergoing repeated corrections from the resistance area, with the orange boxed zone serving as historical support-resistance that previously held the decline. In the current phase, COIN is again moving near the lower boundary of the channel, which technically is often seen as an important support test area.

According to analyst X@_Con, this indicates that COIN is getting closer to a short-term bottom. He forecasts a potential further decline towards the US$190 area by the end of January, especially if Bitcoin experiences a deeper correction. This view confirms the strong correlation between Coinbase stock movements and Bitcoin price, with pressure on BTC potentially triggering further weakness on COIN.

- COIN Bullish Structure Still Intact on Monthly Timeframe

The movement of Coinbase (COIN) shares on the monthly timeframe shows a correction phase that remains within the long-term uptrend structure. The current price area is in the Fibonacci log confluence zone of 0.707-0.786, which technically is often seen as an area of higher low formation. This zone also intersects with a buy order block, so it has the potential to be an area of resistance to selling pressure.

According to X analyst @chad_ventures, COIN’s overall bullish structure is still maintained despite high volatility. He emphasized that the monthly supertrend indicator is still in the green zone, which indicates that the long-term uptrend has not been broken. However, COIN is still categorized as an aggressive moving stock, so sharp fluctuations should be anticipated in the short term.

How to Buy Coinbase xStocks (COINx) on Door?

At Pintu, COINx purchases can start as low as Rp11,000, allowing users to gain exposure to Alphabet’s valuation without a large capital outlay.

In addition to COINx Pintu also provides various other tokenized stocks such as CRCLX, HOODX, QQQX, and other similar assets through the Market Tokenized Stocks page, allowing users to easily access various global stocks in on-chain form.

Here’s an easy way to buy COINx on Pintu:

- Enter the Pintu homepage.

- Go to the Market page .

- Search and select Coinbase xStocks (COINx) crypto assets

- Enter the amount you wish to purchase, and follow the rest of the steps.

Conclusion

Coinbase is showing significant structural transformation from a crypto trading platform to a blockchain-based financial infrastructure provider with increasingly diversified revenue sources. COIN stock performance reflects high sensitivity to crypto market cycles, but is supported by improving fundamentals and long-term product expansion. The presence of COINx confirms the direction of asset tokenization as a major industry theme, although it carries its own structural risks. With institutional analyst support and a still constructive technical structure, COIN is in a crucial phase between short-term consolidation and long-term growth potential.

Disclaimer: All articles from Pintu Academy are intended for educational purposes and do not constitute financial advice.

Reference:

- Yahoo Finance. Coinbase shares close 14% below opening price after trading debut. Accessed January 8, 2026

- Reuters. Coinbase valued at $86 bln in choppy Nasdaq debut. Accessed January 8, 2026

- SQ Magazine. Coinbase Users Statistics 2026: Why It’s Surging Again. Accessed January 8, 2025

- The Block. Goldman upgrades Coinbase stock to Buy, flags execution risks and growing competition. Accessed January 6, 2026

- Companiesmarketcap