Signal Trading Summary:

- GMT (GMT)

- Entry: Rp325 ($0.01932)

- Cut Loss [CL]: Rp285 ($0.01692)

- Take Profit [TP]:

- TP1 = Rp366-Rp383 ($0.02172-$0.02274)

- TP2 = IDR407-Rp448 ($0.02416-$0.02662)

- Sui (SUI)

- Entry: IDR31,371 ($1.8605)

- Cut Loss [CL]: IDR28,113 ($1.6673)

- Take Profit [TP]:

- TP1 = IDR34,134-Rp35,063 ($2.0244-$2.0795)

- TP2 = IDR37,819-Rp40,210 ($2.2429-$2.3847)

- Zilliqa (ZIL)

- Entry: IDR96 ($0.00573)

- Cut Loss [CL]: IDR83 ($0.00496)

- Take Profit [TP]:

- TP1 = IDR107 ($0.00635)

- TP2 = Rp119-Rp123 ($0.00709-$0.00732)

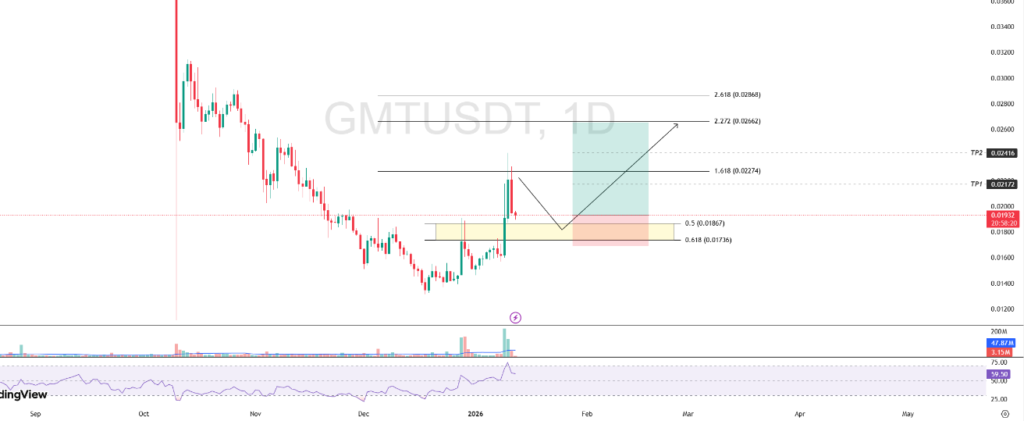

1. GMT (GMT)

Tags: Move-to-Earn

GMT’s bullish movement experienced a significant rejection after touching the harmonic resistance at the level of IDR383 ($0.02274). Rejection in the area triggered short-term selling pressure that pushed the price down.

Currently, GMT price is seen correcting towards a strong support area, which coincides with the golden pocket Fibonacci retracement in the range of Rp292-Rp314 ($0.01736-$0.01867). This area is the next direction-determining zone, where the price reaction will determine whether the bullish trend can continue or potentially weaken further.

If the price is able to show a valid rebound from the golden pocket area, then the upside opportunity remains open with a potential retest of the previous high at IDR383 ($0.02274) as the main target.

Notes: Make sure there is a clear bounce with confirmation of a bullish candle (such as bullish engulfing) supported by increased volume, to minimize the risk of false signals.

Notes: Make sure there is a clear bounce with confirmation of a bullish candle (such as bullish engulfing) supported by increased volume, to minimize the risk of false signals.

GMT Potential Buy Setup:

- Entry: Rp325 ($0.01932)

- Cut Loss [CL]: Rp285 ($0.01692)

- Take Profit [TP]:

- TP1 = Rp366-Rp383 ($0.02172-$0.02274)

- TP2 = IDR407-Rp448 ($0.02416-$0.02662)

Important Notes:

Always apply risk management and capital management with discipline. For trading, especially those using leverage, we recommend using a risk per transaction of: 1% of total capital.

2. Sui (SUI)

Tags: Layer-1

SUI’s price movement failed to continue its upward trend after printing a peak on January 6 at Rp34,134 ($2.0244). This condition triggered a short-term correction that brought the price down to touch the RBS (Resistance Become Support) area in the range of IDR28,497-Rp30,200 ($1.6901-$1.7911).

In the period of January 8-11, SUI prices were seen moving sideways (consolidation) in the support area. Although trading volume in the last two days was relatively low, the price structure still shows the potential to resume the uptrend, as long as the RBS area remains able to withstand selling pressure.

The bullish scenario will be more valid if the January 12 daily candle closure forms a strong bullish candle (such as marubozu) and is supported by increased volume, which has the potential to trigger the re-entry of positive sentiment from market participants.

SUI Potential Buy Setup:

- Entry: IDR31,371 ($1.8605)

- Cut Loss [CL]: IDR28,113 ($1.6673)

- Take Profit [TP]:

- TP1 = IDR34,134-Rp35,063 ($2.0244-$2.0795)

- TP2 = IDR37,819-Rp40,210 ($2.2429-$2.3847)

Important Notes:

Always apply risk management and capital management with discipline. For trading, especially those using leverage, we recommend using a risk per transaction of: 1% of total capital.

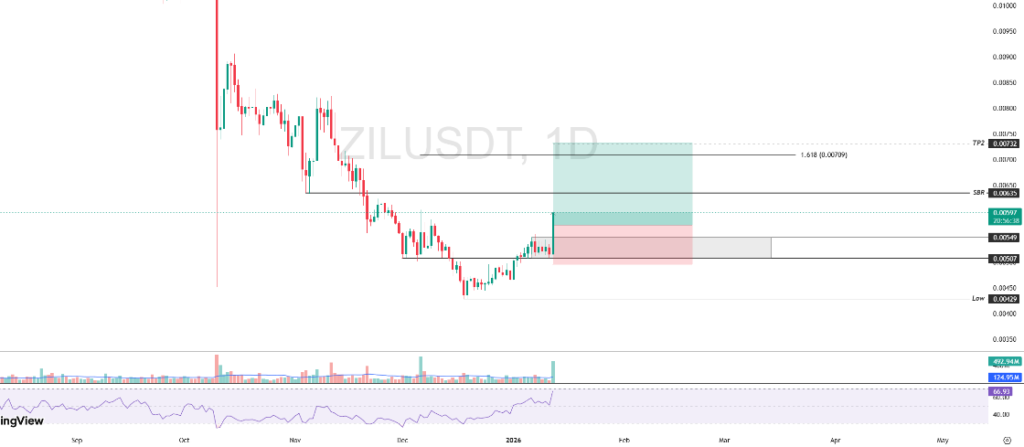

3. Zilliqa (ZIL)

Tags: Layer-1

ZIL’s price movement caught the market’s attention after the January 12 daily candle close recorded a significant gain of ±17%. This price surge came after a consolidation phase in the January 6-11 period, which was confirmed by an increase in trading volume, thus reinforcing the positive sentiment towards the continuation of the uptrend.

Technically, the current ZIL price movement has the potential to test the SBR (Support Become Resistance) area around IDR 107 ($0.00635), which is the key resistance in the short term. If the price is able to break and hold above this level, then the opportunity for a continuation of the bullish rate is increasingly open.

The next upside target is at the IDR119 ($0.00709) area, with a potential extension towards the continued resistance area if buying momentum is maintained.

ZIL Potential Buy Setup:

- Entry: IDR96 ($0.00573)

- Cut Loss [CL]: IDR83 ($0.00496)

- Take Profit [TP]:

- TP1 = IDR107 ($0.00635)

- TP2 = Rp119-Rp123 ($0.00709-$0.00732)

Important Notes:

Always apply risk management and capital management with discipline. For trading, especially those using leverage, we recommend using a risk per transaction of: 1% of total capital.