Liquidation generally occurs due to trader error in managing positions in perpetual futures. These mistakes are often experienced by traders who still have limited experience and understanding of perpetual futures risk management. Therefore, this article will discuss five common mistakes in perpetual futures trading that beginners can avoid, so that the risk of liquidation can be avoided and potential losses can be minimized.

Article Summary

- ❌ Five Common Mistakes in Perpetual Futures Trading: neglecting risk management, not knowing market conditions, overconfidence, overtrading, and not keeping a trading journal.

- 🏋️ These mistakes can be avoided through the application of good and disciplined risk management, a thorough understanding of market conditions, control of trading psychology, and continuous evaluation through a trading journal.

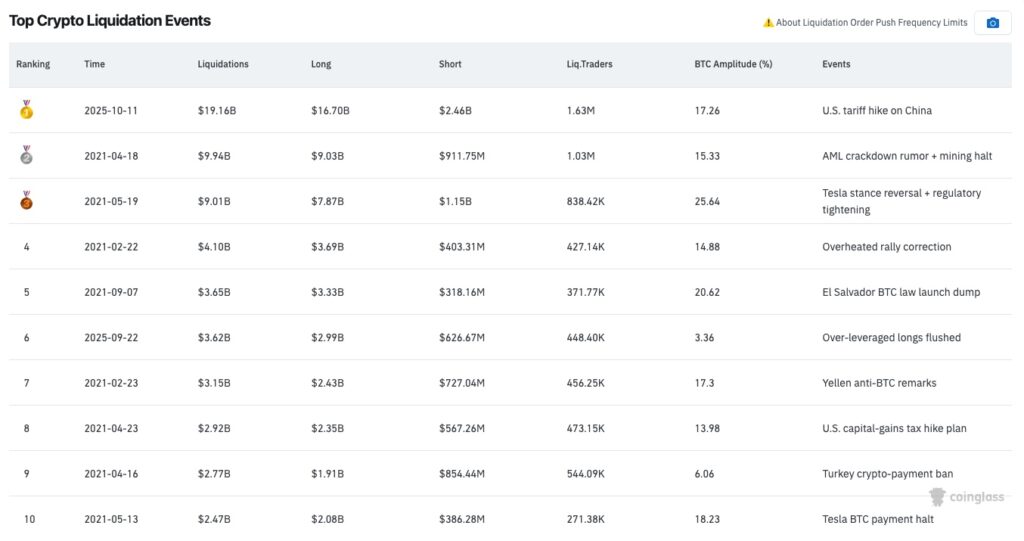

Perpetual futures is a type of derivatives market that allows traders to open positions with a value much greater than their capital through the leverage mechanism. Although the use of leverage provides high profit potential, the risks faced are also comparable, ranging from large losses to liquidation of positions if traders fail to manage positions and risks properly.

Unlike the spot market, the risk faced by traders is generally limited to a decrease in the value of the assets held, rather than a complete loss of assets such as a rugpull. Based on these differences, the spot market and perpetual futures each have advantages and disadvantages that can be tailored to a trader’s risk profile.

Therefore, position management strategies in these two markets are also different. It is important to know how to reduce the risk of liquidation in perpetual futures trading through risk management. For example, determining the maximum loss limit is a fundamental aspect that futures traders must master.

Learn more: Managing Risk in Futures Trading With 25x Leverage

By understanding the common mistakes in futures trading, traders can build awareness from the start that futures trading is a high-risk activity that demands discipline. Here are the common mistakes in perpetual futures trading.

1. Ignoring Risk Management

Neglecting risk management is one of the most common mistakes in futures trading. In the perpetual futures market, traders are not only focused on seeking potential profits, but also on managing risk in a disciplined manner in order to survive volatile market conditions. Without adequate risk management, traders risk incurring huge losses and losing margin due to liquidation.

There are different types of traders who neglect risk management. One of them is the trader who focuses too much on the potential for big profits and makes speculative decisions without adequate risk calculation.

Risk Management Tips in Perpetual Futures Trading

- Determine the Risk Limit per Trade: In perpetual futures trading, every decision to open a position must be accompanied by a careful risk calculation. Traders need to determine from the outset the maximum amount of loss that can be accepted if the price moves against the position. To control this risk, traders can use the stop loss feature as a tool to ensure that losses remain within the predetermined risk limit per trade.

- Calculating Position Size: Determining the exact position size helps traders calculate how big a percentage of the price movement from the entry point to the stop loss. The larger the position size, the greater the risk.

- Have a Target: By having a clear and reasonable profit target, traders can close positions in a disciplined manner without being tempted to over-hold positions.

2. Not Aware of Market Conditions

Opening positions without understanding market conditions increases loss risk, especially when price movements go against the position. For example, traders may open long positions during bearish, high-volatility markets, assuming price declines present buying opportunities. However, instead of making a profit, the position could lead to losses and liquidation if the selling pressure persists.

The popular expression “never catch a falling knife” becomes relevant in this context. Traders who enter the market without considering the right conditions and momentum should be prepared to face the consequences of such decisions.

Tips for Understanding Market Conditions in Perpetual Futures Trading

- Fundamental Analysis: By understanding the macroeconomic factors and project catalysts that affect prices, traders can build an analytical framework to assess market direction and conditions. The results of this analysis help traders determine position strategies such as going long or short, including choosing to wait when market conditions are unclear.

- Technical Analysis: Technical analysis helps traders understand the market structure more objectively in both bullish and bearish conditions. By identifying price movement patterns and trend structures, traders can assess market direction and conditions and adjust their positioning strategies accordingly. Various technical patterns can be analyzed to confirm market conditions before making trading decisions.

Read: List of 5 Downtrend Chart Patterns for Short Positions in Futures

3. Overconfidence

Overconfidence is a psychological bias occurring when traders believe they understand market conditions without sufficient analysis. It often develops through frequent trading, especially after short-term profits are mistakenly interpreted as consistent success.

Overconfidence is a psychological bias occurring when traders believe they understand market conditions without sufficient analysis. It often develops through frequent trading, especially after short-term profits are mistakenly interpreted as consistent success.

Tips to Avoid Overconfidence in Perpetual Futures Trading

- Be Adaptive: Relying on one strategy for all market conditions can increase the risk of decision bias. Traders need to evaluate and adjust trading methods to stay relevant to changes in market structure.

- Be open to different analyses: Traders need to be open to different data sources and analytical approaches to enrich market research. An analysis-based approach encourages more objective, rather than emotional, decision-making.

4. Overtrading

Overtrading in futures refers to opening excessive positions, either through high trading frequency or oversized position sizes. It is commonly driven by emotional behavior, such as chasing losses or overconfidence, which significantly increases the risk of further losses.

This can also happen when traders lack discipline and a clear strategy before opening a position. As a result, risk limits are often breached as traders focus solely on profit without considering worst-case scenarios.

Tips to Avoid Overtrading in Perpetual Futures Trading

- Develop a Trading Plan: A trading plan serves as a guideline that helps traders determine when positions can be opened and when to stop trading. Therefore, the trading plan must be consistently executed and not violated in order to maintain discipline and risk management.

- Accepting Losses: It is important to realize that trading in perpetual futures is an activity with a high level of risk. When incurring losses, traders have the potential to make decisions based on emotions that can trigger overtrading behavior. Under these conditions, traders need to evaluate, stop trading activities temporarily, and reorganize their plans and next steps rationally.

5. Not Having a Trading Journal

A trading journal helps traders record activities to evaluate decisions and assess the effectiveness of trading strategies. Through the trading journal, traders can identify mistakes and areas that require continuous improvement.

However, many traders neglect this record-keeping, making it difficult to understand the causes of mistakes that lead to repeated losses. A trading journal can contain important information needed to improve the quality of your trading.

Here is an example of elements that should be recorded in the trading journal:

- Pair assets.

- Date of transaction.

- Reasons and factors for interest in the asset.

- The market session in which the entry is made.

- The type or style of trading used (e.g. swing trading, day trading, scalping, etc.).

- The result of the position taken.

- Evaluation and improvements that need to be applied to the next transaction.

Trading Futures on Pintu Pro Web

After learning about the common mistakes in perpetual futures trading, you can open long and short positions such as BTC, SOL, and more directly through Pintu Pro Web. On Pintu Pro Web, you can trade Futures and spot right away!

How to trade Crypto Futures on Pintu Pro Web:

- Go to https://pintu.co.id/

- Click the Open Pro on Desktop button at the top center.

- Register or log in to Pintu Pro Web.

- Go to the Futures section.

- Trade BTC and other cryptocurrencies.

In addition to trading, Pintu also lets you learn more about crypto through various articles on Pintu Academy, updated weekly!

Conclusion

Basically, risk management is the main factor to avoid the five common mistakes in perpetual futures trading. By applying disciplined risk management, traders can control losses, maintain consistency, and reduce emotional influence in trading decisions. Market understanding, trading psychology management, and continuous evaluation through a trading journal form the foundation for long-term survival.

Disclaimer: All articles from Pintu Academy are intended for educational purposes and do not constitute financial advice.