In 2025, the United States officially passed the GENIUS Act, a groundbreaking piece of legislation that became the first federal regulation to govern stablecoins-digital assets whose value is pegged to fiat currency and used for payments. With a vote of 308-122 in the House of Representatives and 68-30 in the Senate, the GENIUS Act brings the legal clarity that the crypto industry has been waiting for.

For the first time, federal rules define who can issue stablecoins, how they must be secured, and which regulators are responsible for overseeing them. More than just regulation, the GENIUS Act sends a strong signal that stablecoins are now recognized as legitimate financial products, while paving the way for more secure and structured innovation in the digital asset ecosystem.

Article Summary:

🗽 The GENIUS Act is the first regulation in the United States to govern stablecoins backed by the US dollar.

🗓️ The GENIUS Act will come into effect on January 18, 2027, or 120 days after US regulators publish the final regulations.

🔎 Under the GENIUS Act, if the issuance of stablecoins exceeds $10 billion, they will be directly supervised by federal regulators.

🇺🇸 Policymakers in the US are debating plans to cap stablecoin yields.

What is the GENIUS Act?

The GENIUS Act (Guiding and Establishing National Innovation for US Stablecoins) is the first regulatory guideline in the United States to specifically govern stablecoins. Officially passed on July 18, 2025, this is a long-awaited milestone that is expected to be the first step towards broader regulation for the entire crypto industry.

Broadly speaking, the GENIUS Act serves to establish comprehensive oversight rules for stablecoins and their issuers. The main goal of this regulation is to provide clear rules for the issuance of stablecoins and their asset reserves, while protecting consumers and maintaining financial system stability.

So, when did the GENIUS Act come into effect in America?

According to reports, the GENIUS Act will take effect on January 18, 2027, or 120 days after regulators issue the final regulations, whichever comes first. Although it has not yet been officially enacted, many companies are expected to have already started adjusting their business models and services to be ready when this regulation is actually implemented.

What are Stablecoins?

Before we get into the GENIUS Act, we’ll talk a bit about stablecoins and their growth over the years.

Definition of Stablecoins

Stablecoins are a type of digital asset designed to have a stable value, usually by being pegged to a reserve asset such as a fiat currency, such as the US dollar. The goal is for stablecoins to be used as a fast, cheap, and secure medium of exchange around the world through blockchain technology.

So, what is a payment stablecoin according to the GENIUS Act? Under the GENIUS Act, a payment stablecoin is defined as a digital asset designed specifically for payment purposes, and issued by an entity that guarantees the value of the asset will remain stable against a certain amount of currency.

Why are stablecoins interesting?

Some of the main reasons why stablecoins are in demand, both in the traditional financial system and in the crypto world:

- Crypto can be very volatile. Many crypto assets have dramatically fluctuating prices, so using them as a means of payment can be risky for both sellers and buyers.

- Asset conversion. Stablecoins have the advantage of being the stable value asset of choice for crypto asset conversion.

- Money transfers can be slow and expensive. Cross-border money transfers are often time-consuming, costly and lack transparency.

- Distrust of the local currency. In countries with high inflation and unstable currencies, people often struggle to access more stable currencies like the US dollar. Stablecoins can be an alternative.

This is where stablecoins play an important role, as a substitute for digital cash that is fixed in value and easily accessible. Apart from global payments, stablecoins are also widely used in smart contracts and the decentralized finance(DeFi) sector because they can be programmed for various purposes.

Stablecoin Growth

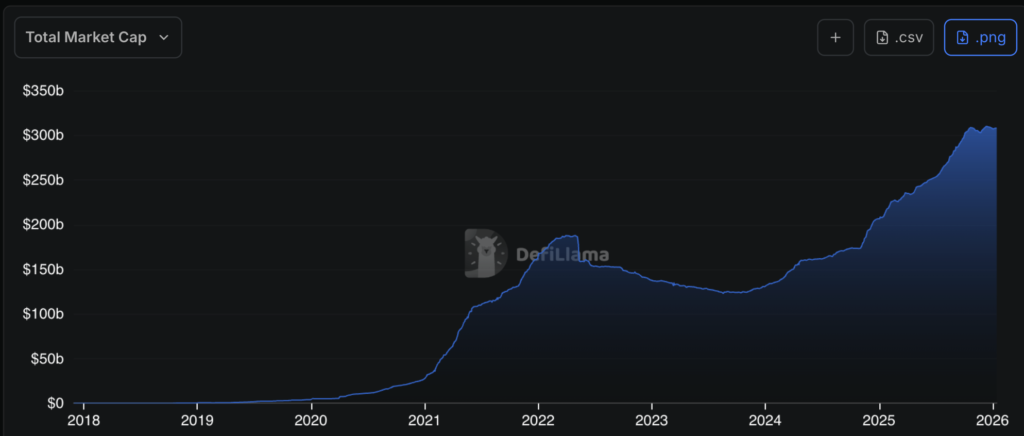

In recent years, the stablecoin market has seen tremendous growth. A chart from DeFiLlama shows that since 2020, the market capitalization of stablecoins began to rise sharply, marking the start of massive adoption of these digital assets.

The initial peak occurred in 2022, when the market cap reached over $180 billion, but then experienced a significant decline throughout 2022 to mid-2023. However, the stablecoin market bounced back starting in late 2023 and continued to show a consistent upward trend.

The most significant increase occurred from 2024 to mid-2025, where the market capitalization of stablecoins soared to $300 billion by early 2026.

How does the GENIUS Act Work?

The GENIUS Act includes very detailed rules, but here are some of the most important key provisions:

Licensing and Oversight of Stablecoin Issuers

Companies intending to issue stablecoins must register with federal authorities.

- If the total issuance exceeds $10 billion, the issuer will be subject to direct supervision by federal regulators.

- Smaller-scale issuers may choose to be regulated at the state level instead.

Collateral and Redemption Standards

Stablecoins must be backed 100% by reserve assets such as cash, U.S. Treasury securities, or other high-quality liquid assets.

- This means that for every $100 worth of stablecoins in circulation, the issuer is required to hold $100 in real, tangible assets as collateral.

Auditing and Transparency

Stablecoin issuers are required to:

- Conduct regular audits of their reserves;

- Provide periodic reports and public disclosures.

Consumer Protection

In the event of a stablecoin issuer’s bankruptcy, stablecoin holders will be given priority in reclaiming their funds—above other creditors, including banks or bondholders.

- This provision overrides traditional bankruptcy rules, applying a special framework to ensure user protection.

How does the GENIUS Act Protect Consumers?

At the heart of the GENIUS Act is consumer protection. As mentioned above, payment stablecoins are already circulating in the US with little regulatory oversight. The GENIUS Act is therefore the first federal regulation to provide a regulatory framework for payment stablecoins, including strict reserve requirements and transparency over the assets backing the value of those stablecoins.

According to the document, the GENIUS Act establishes federal protections for stablecoin holders and increases consumer confidence in the market for permitted payment stablecoins, by requiring:

- 100% reserves in US dollars, short-term government securities, or similar liquid assets as determined by the primary regulator.

- Monthly public disclosure of reserve composition.

- Audited annual financial statements for issuers with a market capitalization of more than $50 billion.

The GENIUS Act sets strict standards in the marketing of payment stablecoins:

- Prohibits statements that stablecoins are fully supported by the US government, guaranteed by the government, or insured by the FDIC, so issuers may not mislead consumers about government support or protection of stablecoins.

- Ensure stablecoins should not be marketed in such a way that the average person thinks they are legal tender or government-guaranteed.

- States that digital assets should not be marketed as payment stablecoins unless they are fully compliant with the GENIUS Act.

The GENIUS Act prevents the risk of a destabilizing rush (massive withdrawals) by establishing a regulatory framework that includes:

- Reserve asset diversification requirements.

- Interest rate risk management standard.

- Capital, liquidity and other risk management requirements.

- Prohibit the use of high-risk reserve assets such as corporate debt or stocks.

In the case of bankruptcy, the GENIUS Act provides that:

- The claims of legitimate stablecoin holders will be prioritized over other creditors if the stablecoin issuer goes bankrupt.

- The legal process for court review and distribution of reserve assets to stablecoin holders will be expedited.

GENIUS Act is here, how will it affect crypto investors?

If the GENIUS Act truly drives widespread adoption of stablecoins, it could lead to increased usage of the blockchain networks that support those stablecoins. This surge in activity may also enhance the credibility of the underlying blockchains, positioning them as trusted networks and potentially bringing greater exposure to their ecosystems. However, this should not be viewed as a basis for investment decisions, as many factors must be considered.

Investors should also be aware that failures related to stablecoins—such as insolvency or depegging from their underlying value—can negatively impact the prices of associated cryptocurrencies. While regulations like the GENIUS Act may help reduce risks of fraud and misuse, they cannot fully protect portfolios from negative market sentiment.

Overall, the passage of the GENIUS Act is seen as a significant milestone for the crypto industry. It represents the first crypto-related law to pass at the federal level and signals a growing openness among lawmakers to regulations that support the future development of digital assets.

That said, in the short term, it’s important to remember that crypto assets remain highly volatile, and the practical effectiveness of the GENIUS Act’s protections is still uncertain.

How Does the GENIUS Act Affect USDT and USDC?

Both pegged to the US dollar in a 1:1 ratio, the two largest stablecoins today, USDT (Tether) and USDC (Circle), account for nearly 90% of the global stablecoin market. So, how will the GENIUS Act impact USDT and USDC?

Impact on USDT (Tether)

USDT is the world’s largest stablecoin with a supply of 187 billion and a record transaction volume of $13.3 trillion by 2025. However, USDT is still considered to have compliance shortcomings, especially regarding inconsistent reserve transparency.

According to The Motley Fool (16/12/25), Tether, the issuer of the USDT stablecoin, has been in the spotlight for transparency issues since 2017. An investigation by the New York Attorney General’s Office revealed that in 2017 and 2018, Tether did not fully maintain a 1-to-1 reserve for every USDT in circulation. This makes it less compliant with GENIUS Act standards, so it is likely to be restricted in the US, although globally its dominance is likely to remain strong.

Impact on USDC (Circle)

USDC is fully compliant with the requirements of the GENIUS Act, as it is backed 100% by US dollars and US Treasury securities. Furthermore, Circle regularly publishes monthly verification reports audited by Deloitte & Touche LLP, to ensure that their asset reserves equal or exceed the amount of USDC outstanding.

The reserves consist of approximately 88.8% in money market funds and 11.2% in cash held in regulated financial institutions. With its high level of transparency, USDC is increasingly attractive to financial institutions and is considered ready to compete in the US market.

Currently, USDC has a market capitalization of $75.04 billion and a daily trading volume of $20.82 billion and is expected to continue to grow as adoption increases from market participants who require regulatory certainty.

What is the Difference between GENIUS Act and STABLE Act?

In the near future, the adoption of stablecoin regulation in the United States is expected to materialize. This is driven by the Trump administration’s move to make US leadership in the digital assets sector a top priority. Currently, both the US House of Representatives and Senate are processing two similar bills:

- TheSTABLE Act (Stablecoin Transparency and Accountability for a Better Ledger Economy Act of 2025), originated in the House of Representatives.

- GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins Act of 2025), originated in the Senate.

Both bills have bipartisan support and both aim to create a new federal regulatory framework specifically for stablecoins. While the goals are similar, the content and approach differ in some important aspects.

GENIUS Act vs STABLE Act comparison

| Aspects | STABLE Act (DPR) | GENIUS Act (Senate) |

|---|---|---|

| Key Objectives | Stablecoin transparency and accountability | Innovation and clarity of national regulation for stablecoins |

| Stablecoin Issuer | Must be from a specific entity: bank subsidiary, OCC-approved, or state-regulated | Same, but with clearer federal oversight mechanisms |

| Asset Reserve (Reserve) | Must be 100% backed by US dollars or similar liquid assets | Same; additional monthly audits and disclosures required |

| Regulatory Oversight | More emphasis on OCC supervision | Combination of federal and state oversight, with a threshold of $10 billion |

| AML & BSA Standards | Explicitly emphasized | Regulated, but focus more on publishing structure and consumer protection |

| Consumer Protection | Existing, but focused on transparency | More robust, including priority of stablecoin holders’ claims in bankruptcy |

| Approach to States | Gives states a significant role | States must apply rules that are “substantially similar” to the federal ones |

| Long-term Objective | Enhance market confidence and system stability | Support innovation, efficiency, and growth of the stablecoin ecosystem |

Does the GENIUS Act Favor Banks over Users?

In a report by Coingape (10/1/26), policymakers in the US are debating plans to limit stablecoin yields, as competition between the banking sector and the crypto industry increases. The issue reflects a struggle for influence over yield control, consumer rights protection, and the direction of stablecoin regulation in the US.

According to journalist Sander Lutz, Senate Banking Committee staff have briefed crypto industry players on a number of policy options, such as:

- Yields should only be given for transactions, not for deposits.

- Yield products may only be offered by regulated financial institutions.

This raised concerns in the crypto industry, given that stablecoin yields are currently popular in DeFi, trading, and crypto savings, often with higher returns than bank deposits. This debate marks a change in the regulator’s stance compared to previous discussions.

Responses from figures in the crypto world

John E. Deaton, a lawyer well known in the crypto community, calls these yield restrictions a form of direct competition between banks and the crypto industry. He believes that yield restrictions will reduce consumer choice and limit innovation, as stablecoins offer payment alternatives and faster returns than the traditional financial system.

In addition, investor and policy analyst Alex Tapscott supports the passage of the GENIUS Act to maintain the competitiveness of the US economy, but warns that poor policy execution could undermine stablecoin regulation. He emphasized the importance of focusing on the benefits to users, not just on protecting bank profits.

Then, how will the GENIUS Act impact Indonesian crypto exchanges?

If the GENIUS Act is successful in driving the adoption of stablecoins in the US, particularly those pegged to the US dollar, then the use of stablecoins is likely to grow rapidly around the world. For crypto exchanges in Indonesia, stablecoins such as USDC are likely to be viewed as safer from a regulatory perspective as they are within the US legal framework and follow clear compliance standards.

Conclusion

The GENIUS Act is the United States’ first major step towards creating federal regulation for stablecoins, with the aim of clarifying issuance rules, asset reserves and consumer protection. While it is expected to drive global adoption and innovation, concerns have been raised thatyield restrictions driven by the banking sector could favor financial institutions and reduce benefits to users.

The debate over yield caps reflects the tug-of-war between market controls, consumer interests, and the future of stablecoin policy. The successful implementation of the GENIUS Act will largely depend on the details of its implementation and its favorability to end users.

FAQ

When does the GENIUS Act come into effect and who must comply with it?

The GENIUS Act will go into effect on January 18, 2027, or 120 days after US regulators publish the final regulations. The law is mandatory for all stablecoin issuers that wish to offer payment stablecoins to the public in the United States, including foreign entities operating in the US market.

How will the GENIUS Act affect popular stablecoins like USDT (Tether) and USDC (Circle)?

USDC is likely to benefit from being transparent and compliant with GENIUS Act standards. Meanwhile, USDT could face challenges as it lacks transparency about asset reserves. If it does not conform, its circulation in the US market could be restricted.

How does the GENIUS Act differ from stablecoin regulation in other countries (e.g. MiCA in Europe)?

In short, MiCA covers a broader spectrum of digital assets, while the GENIUS Act is more focused and in-depth on payment stablecoins, with strict oversight and consumer protection mechanisms in the US context.

Reference:

- Ade Hennis. 1 Risk Crypto Investors Should Watch With Tether. Accessed on January 14, 2026

- Anqi Dong. GENIUS Act explained: What it means for crypto and digital assets. Accessed on January 14, 2026

- Arnold & Porter. What You Need To Know About Incoming Stablecoin Legislation. Accessed on January 14, 2026

- Coingape. Genius Act: Stablecoin Yields Face Regulatory Crackdown as Banks’ Lobby Pressures Senate. Accessed on January 14, 2026

- Diraj Nallapaneni. Is USDC a Good Investment? (2026). Accessed on January 14, 2026

- Fidelity. What is the GENIUS Act? Accessed on January 14, 2026

- James Morales. The Year Stablecoins Went Mainstream: 2025’s Winners and Losers. Accessed on January 14, 2026

- KoinBX. How the GENIUS Act Reshapes Stablecoins in 2026. Accessed on January 14, 2026

- Paul Hastings. The GENIUS Act: A Comprehensive Guide to US Stablecoin Regulation. Accessed on January 14, 2026