Tesla is a pioneer in the development of long-range EVs. Over the years, the company has enjoyed high demand for its premium products that are considered innovative and prestigious. Tesla’s initial strategy used a top-down approach, by first designing and selling high-performance luxury electric cars. This approach proved very successful and created a huge positive image effect (halo effect) for the Tesla brand in the eyes of global consumers.

Article Summary:

🏢 Tesla Motors, Inc. was founded on July 1, 2003.

⛓️ TSLAX is a tokenized asset that reflects the market price of Tesla Inc. shares in real-time.

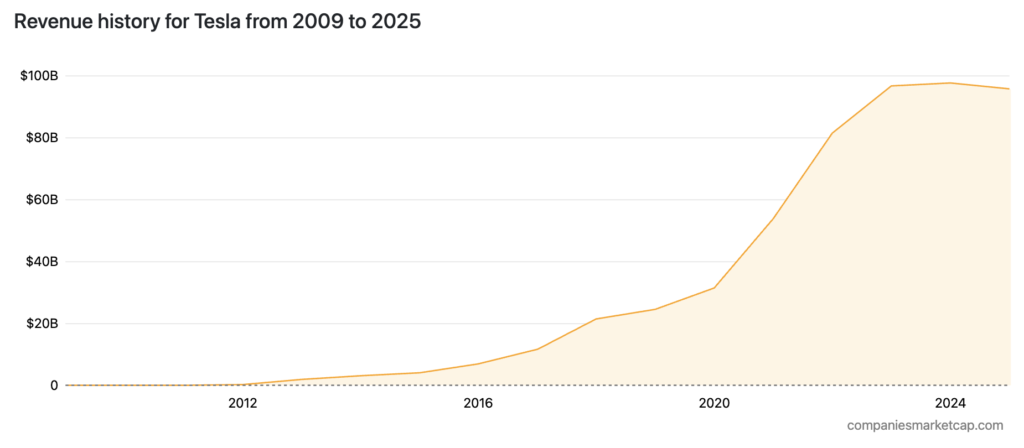

📈 In about 5 years, Tesla’s revenue jumped from about $30 billion to close to $100 billion.

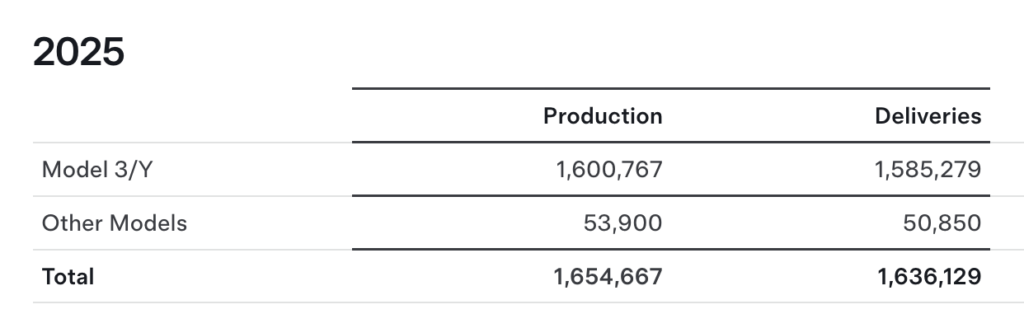

🚗 By 2025, Tesla’s total deliveries will reach 1.636 million units.

Getting to know the Tesla Company and its vision

Tesla, Inc. (NASDAQ: TSLA) is an automotive and sustainable energy technology company. Widely recognized as a pioneer of electric vehicles (EVs), Tesla brought about a major revolution in the automobile industry through technological innovation and a different business approach from traditional automotive manufacturers.

Although Tesla is best known as a manufacturer of electric vehicles, the company also develops various technology products and energy storage systems. Until 2025, Tesla’s business activities fall into three main areas:

- Automotive

Tesla’s largest segments include electric vehicle sales and leasing, as well as software features such as Full Self-Driving (FSD). By 2024, this segment generates revenue of around $77 billion, although growth is starting to slow down due to intensifying competition.

- Energy generation and storage

Tesla designs and installs solar power systems, and manufactures energy storage products such as Powerwall and Megapack. By 2024, this segment will record revenues of over $10 billion, making it one of Tesla’s growing business lines.

- Services and more

Revenues from vehicle maintenance services, insurance, charging, as well as technology licenses reached approximately $10.5 billion by 2024, demonstrating the important role of support services in Tesla’s business ecosystem.

Over the years, Tesla has also benefited greatly from the sale of regulatory carbon credits, which in 2024 alone generated $2.76 billion in revenue. However, this source of revenue is now shrinking due to changes in emissions policy-especially since the One Big Beautiful Bill Act was enacted in 2025-as well as the automotive industry’s trend toward zero-emission vehicles.

The Beginnings and Vision of Tesla’s Founders

Tesla was originally founded on July 1, 2003 under the name Tesla Motors by two engineers, Martin Eberhard and Marc Tarpenning. After successfully selling their first company, the two had a vision to bring electric cars to the global market. At the time, major automotive manufacturers had tried to develop EVs, but failed to attract widespread market interest beyond environmentalists and technologists.

When seeking funding, many investors considered the project too risky as there were no successful examples of profitable luxury electric cars. However, this approach changed when they met Elon Musk, the famous entrepreneur who founded PayPal and SpaceX. Musk was attracted to Tesla’s vision, invested heavily and joined as a board member.

In 2008, Martin Eberhard and Marc Tarpenning left the company. After their departure, Elon Musk took over the CEO position and began to lead the direction of the company. In 2010, Tesla conducted its initial public offering (IPO) and managed to raise around $226 million, marking Tesla’s important step into the public market.

Tesla Innovations Year by Year

With its differentiated business approach, aggressive technological innovations, and the ambitious vision of CEO Elon Musk, Tesla has captured the world’s attention. Here’s a look back at Tesla’s journey over the past few years, looking at the milestones that shaped the company’s image and direction:

| Year | Events / Innovation |

|---|---|

| 2014 | – Tesla released all its electric car patents to encourage the development of electric vehicles and reduce global carbon emissions. – Announced the construction of the first Gigafactory in Nevada for large-scale production of lithium-ion batteries. – Started embedding Autopilot technology with features such as autosteering and hands off the steering wheel warning. |

| 2015 | – Building a Supercharger network that enables long-distance travel (e.g. New York to Los Angeles). |

| 2016-2017 | – Announced all new cars will be equipped with hardware for fully autonomous driving (cameras, radars, etc). – Nevada Gigafactory officially opens. – Tesla begins phasing out unlimited free charging facilities at Superchargers. – Construction of the second Gigafactory in New York. |

| 2018-2020 | – Started building the third Gigafactory in China. – October 2018: Removed the “Full Self-Driving” option from the website due to consumer confusion. – Launched the Tesla Model Y, a smaller and more affordable crossover than the Model X, sharing components with the Model 3. – Sales of the Model Y quickly rivaled the Model 3 and became one of Tesla’s most popular cars. |

| 2021-2023 | – Elon Musk announced the launch of the Full Self-Driving (FSD) beta version. – Several fatal accidents have raised public doubts over the safety of FSD. – The Cybertruck launches with a futuristic and sharp design, and pre-orders are expected to reach two million units. |

| 2025 | – Tesla released cheaper variants of the Model 3 and Model Y, costing $37,000 and $40,000 respectively, with a shorter battery range and simpler features. |

What is Tesla Tokenized Stock (TSLAX)?

TSLAX is a tokenized asset that reflects the market price of Tesla Inc. (TSLA) shares in real-time. The token is issued by Backed Finance through its xStocks product line, and allows users to access Tesla’s stock price performance directly on the blockchain, without the need to open an account with a traditional securities company.

Each TSLAX token is fully backed by a single TSLA share held in a regulated and authorized custodian, so the value of the token remains transparent and verifiable. When Tesla’s stock price changes on the Nasdaq exchange, the value of TSLAX will also change directly on the blockchain network.

The Difference Between Tesla Shares and TSLAX Token

While tokenized stocks like TSLAX are designed to mirror the value of traditional stocks (TSLA), the trading experience is very different. The main differences lie in the way they are accessed, the settlement of transactions, and their integration in the investment flow.

Here’s an outline comparison between the traditional Tesla stock and the TSLAX token:

| Features | Traditional TSLA Shares | TSLAX Tokenized Shares |

|---|---|---|

| Trading Hours | Limited to stock exchange trading hours | Available for trading 24 hours a day |

| Access | Requires brokerage account and KYC verification | Accessible via crypto wallet |

| Completion Time | Usually takes two working days | Transactions complete on the blockchain in minutes |

| Minimum Investment | Usually have to buy one full share | Supports partial share ownership |

| Geographical Restrictions | Can be limited by region or country | Globally available |

| Integration | Separate from the crypto system | Can be used in crypto and DeFi platforms |

It is important to remember that tokenized stocks are not traded on traditional exchanges and may be subject to different regulations and legal rules, depending on the platform and jurisdiction used.

Advantages and Benefits of Investing in Tesla

For some investors, Tesla may only be considered an electric car manufacturer. But for Tesla CEO Elon Musk, Tesla’s role is much bigger than that.

“We are at a pivotal point for Tesla and the direction of our strategy going forward, as we begin to bring AI technology to the real world,” Musk said in the opening of the company’s third-quarter financial results call.

“I think it’s important to emphasize that Tesla is truly a leader in real-world AI.”

One manifestation of this strategy is the initial launch of the Robotaxi autonomous taxi service, which uses Tesla’s own cars. Musk believes this service will fundamentally change the way people move around.

Musk’s optimism about Robotaxi is well-founded. He believes that all Tesla cars will be able to drive themselves without human supervision. According to him, all that is needed is software enhancements that are in the works.

Once the software is ready, Tesla can send it directly to customers’ cars via an over-the-air (OTA) update. This means that in a short time, Tesla has the potential to become the world’s largest autonomous taxi company, providing both its fleet and services directly.

Risks to Watch Out For

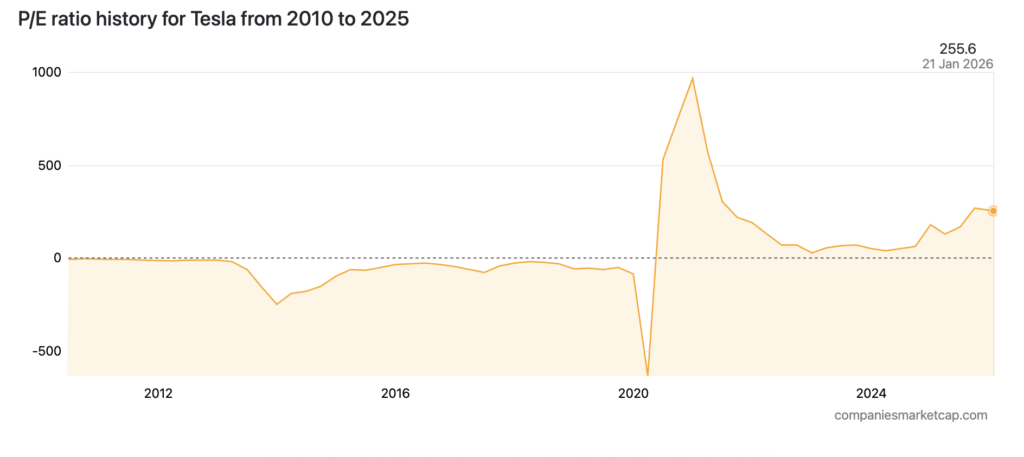

As reported by The Motley Fool (January, 20), the huge success of the Robotaxi project may have been prematurely reflected in Tesla’s stock price. Currently, the price-to-earnings ratio (P/E ratio) of Tesla shares stands at more than 300 – a very high number, especially considering that there are no real examples in the world of autonomous taxi networks that are successfully run on a large scale, let alone profitable.

Investors should truly believe in Tesla’s vision, even though there are still many uncertainties regarding technology readiness, regulatory approvals, business models, and the timing of a wide-scale launch.

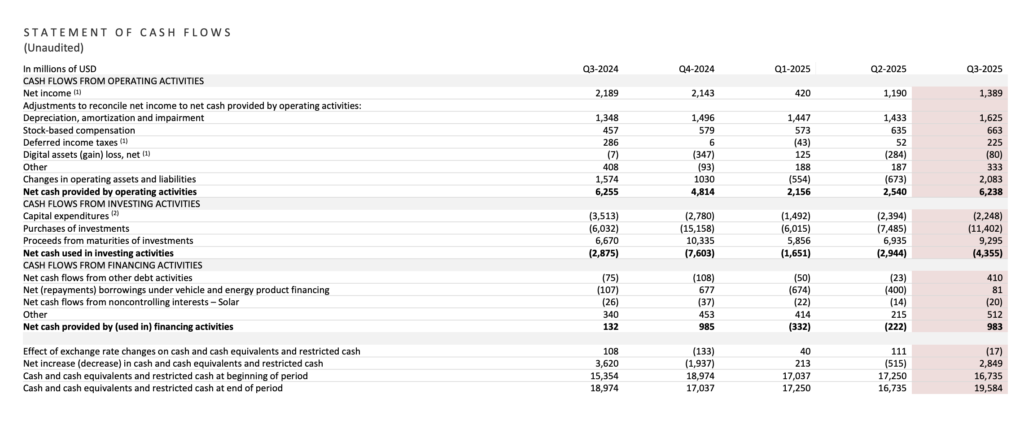

Another problem is that Tesla car deliveries are actually declining. In 2025, deliveries totaled 1.636 million units, down from 1.789 million units in 2024. Financial performance has also taken a hit-Tesla’s net profit plunged about 37% year-on-year in the most recent reported quarter.

How Has Tesla Performed Year-on-Year?

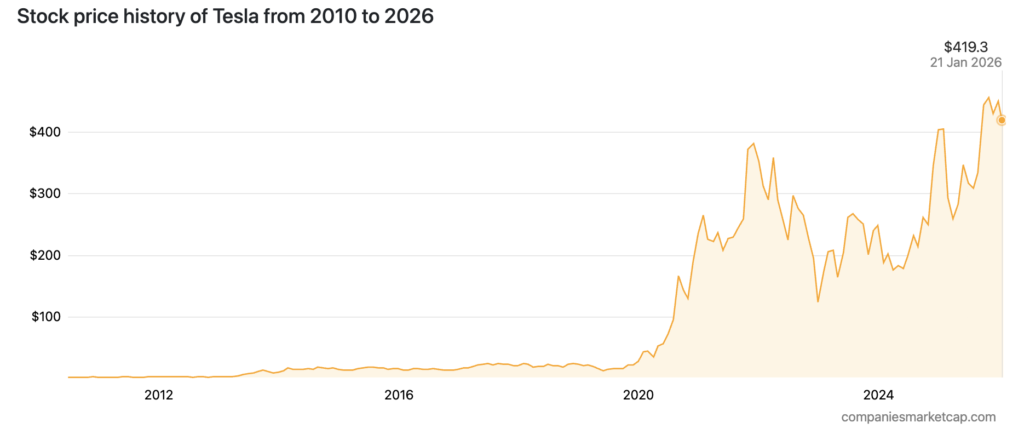

Tesla Stock Performance from 2010 – 2026

The data from Companiesmarketcap above shows the significant journey of Tesla, Inc. stock price over the past 16 years. In the early 2010s, Tesla’s stock price moved relatively flat and stabilized at a low level of around $1.

However, starting around late 2019 to 2021, there was a sharp spike that marked the company’s aggressive growth phase. After reaching the peak, Tesla stock experienced high volatility with sharp ups and downs in the period 2022-2024. Nevertheless, the long-term trend remains positive.

As of January 21, 2026, Tesla’s share price stood at $419.3, close to the all-time high it managed to record at the end of 2025 at around $456.6. This shows that, despite market challenges and performance fluctuations, investor interest in Tesla shares remains strong.

Tesla Revenue Development

The chart above shows Tesla’s very significant revenue growth over the past decade-plus. In the early period, which was between 2009 and around 2015, Tesla’s revenue grew gradually and was still below the $10 billion mark. However, after that, especially starting 2018, the revenue started to increase faster.

The sharpest spike came after 2020, where Tesla recorded tremendous revenue growth. In about five years, the company’s revenue jumped from about $30 billion to close to $100 billion in 2023 and 2024.

However, towards 2025, the graph shows a slight decline, signaling that growth is starting to slow down or even experience a mild correction.

Tesla Stock P/E Ratio Development

The journey of Tesla’s P/E (price to earnings) ratio over the past 15 years reflects how the market assesses the company’s valuation compared to its earnings. In the early period (2010-2019), Tesla’s P/E ratio was mostly below zero or very low, indicating that the company was still losing money or had yet to generate significant profits.

However, the big turning point occurred around 2020, when the P/E ratio jumped sharply, even touching a figure close to 1000, reflecting the market’s very high expectations for Tesla’s future growth.

After this peak, the P/E ratio has gradually decreased but remains at a high level compared to traditional automotive companies. As of January 21, 2026, Tesla’s P/E ratio stood at 255.6, a figure that is still very high and shows that Tesla’s stock is still valued at a premium by investors, albeit with potential risks if growth does not meet expectations.

Tesla (TSLAX) Outlook Going Forward

Technical Analysis of Tesla Stock

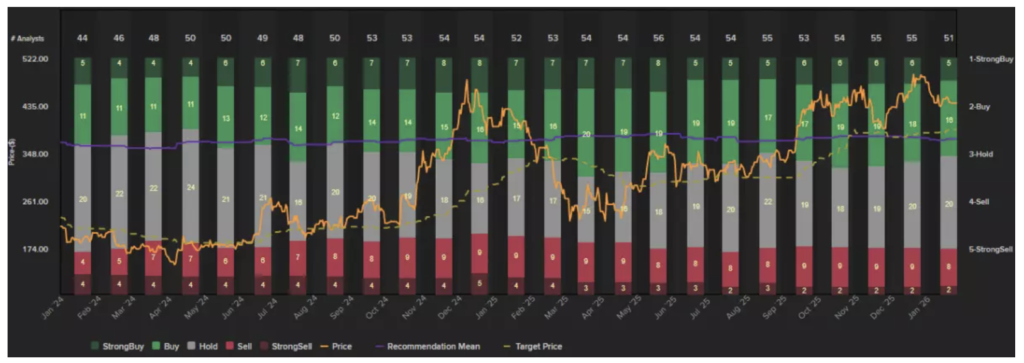

Citing market analyst Fabien Yip’s report (January, 21), currently, Tesla shares are trading at a valuation of 201 times projected forward earnings. Furthermore, Wall Street analysts give an average target price of $389, which means a potential drop of about 7% from the current price.

Concerns about valuation can also be seen in analysts’ recommendations: 30 out of 51 analysts recommend “hold” or even “sell” Tesla stock.

In addition, after a sharp drop in April 2025 and a fairly volatile price movement, Tesla stock as a whole has not shown much progress in the past year. Although the uptrend since April provided some support, the share price is now approaching a downside vulnerability point. Momentum indicators corroborate this potential downward direction:

- The RSI (Relative Strength Index) dropped to 37, indicating that selling pressure is becoming more dominant.

- The MACD (Moving Average Convergence Divergence) is also showing a negative signal, signaling the downward momentum is gaining strength.

- The stock price started to lose support from the 100-day moving average (100-day MA).

If the company’s Q4 earnings report for 2025, which will be published on January 28, 2026, is disappointing, the share price is expected to drop to the next support level around $383.

Conversely, if financial results are above expectations, prices could potentially rise towards resistance at $452, which is around the 20-day moving average (20-day MA).

Tesla Stock Analysis According to Analysts at X

Technical analyst at X, Donald Dean, observed an Inverse Head and Shoulders pattern forming on the Tesla (TSLA) stock chart as of January 20, 2026. This pattern is known as an uptrend reversal signal, which usually indicates that the previous price decline is starting to lose momentum and a potential bounce is imminent.

Although the price experienced downward pressure on the day, Donald noted that the pattern is still valid and is in the process of forming. The key level to watch is $450-if the price manages to break above this level, then the upward movement could be faster and stronger, as expected by the pattern.

The chart also shows an upward sloping support line and three price valleys that form the typical structure of an inverse head and shoulders pattern, with volume favoring consolidation. In addition, there is a “volume shelf” area around $440-$450 that indicates a zone of high trading concentration, which could act as an accumulation or breakout zone.

In addition, the @tslaming account on X shared the latest developments regarding Tesla (TSLA). According to him, several important catalysts have just emerged that have the potential to strengthen the prospects for Tesla shares in the near future:

- Re-entering the Canadian Market

Tesla got a breath of fresh air from Canada’s new trade deal that lowers import tariffs on Chinese-made electric vehicles. This reverses the 2024 import closure decision and allows Tesla to resume importing vehicles from Giga Shanghai at competitive prices. This strengthens Tesla’s global distribution network and logistics efficiency.

- Cybercab Hardware Enhancements

The latest sighting of a Cybercab prototype in Chicago shows a new rear camera system. This feature overcomes the problem of the lens being covered in snow or road dirt, which was previously a hindrance in extreme climate conditions. This update improves the reliability of Tesla’s Full Self-Driving (FSD) system-an important step towards true level 5 autonomy.

- Restart Dojo Supercomputer Project 3

Elon Musk confirmed that the Dojo 3 project has restarted, now powered by the latest generation of AI chips. This in-house supercomputer is designed to accelerate neural network training. The success of this project could transform Tesla from a mere automaker to an AI and robotics leader, and open up opportunities to decouple its stock price from conventional electric vehicle delivery cycles.

- Aggressive Pricing Strategy in South Korea

Tesla cut the price of the Model 3 Standard RWD to 41.99 million won (~$28,500). With local subsidies, the price could drop to the 30 million won range-making it highly competitive against local players like BYD, Hyundai, and Mercedes-Benz. This strategy positions Tesla as a high-value option in the Korean market.

How to Buy Tesla (TSLAX) on the Doors App

At Pintu, investing in Tesla is quite easy. TSLAX purchases can be started at a very affordable amount of Rp11,000, allowing users to gain exposure to Tesla’s valuation without a lot of capital.

In addition to TSLAX Pintu also provides various other tokenized stocks such as CRCLX, HOODX, QQQX, and other similar assets through the Market Tokenized Stocks page, allowing users to easily access various global stocks in on-chain form.

Here’s an easy way to buy TSLAX at the Door:

- Enter the Pintu homepage.

- Go to the Market page .

- Search and select the crypto asset Tesla xStocks (TSLAX).

- Enter the amount you wish to purchase, and follow the rest of the steps.

Conclusion

Overall, Tesla is not just an electric car manufacturer but also represents innovation at the intersection of automotive, energy, and artificial intelligence. With an ambitious vision to revolutionize global transportation through eco-friendly and autonomous technology, Tesla has successfully built an image as a pioneer of the future industry.

In terms of the capital market, Tesla’s share price has shown tremendous growth, jumping from around $1.59 in 2010 to over $419 as of January 2026. Despite the high volatility and often debatable valuation, investor enthusiasm for Tesla’s long-term prospects remains strong.

Disclaimer: All articles from Pintu Academy are intended for educational purposes and do not constitute financial advice.

Reference:

- Adam Hayes. Tesla: The True Untold Story. Accessed on January 21, 2026

- Barbara A. Schreiber, Erik Gregersen, Doug Ashburn. Tesla, Inc. Accessed on January 21, 2026

- Biscontini, Tyler. Tesla Inc. Accessed on January 21, 2026

- Daniel Sparks. Is Tesla a Good AI Growth Stock to Buy and Hold For the Next 10 Years? Accessed on January 21, 2026

- Fabien Yip. Tesla Q4 2025 earnings preview: Optimus and robotaxi progress amid margin pressure. Accessed on January 21, 2026

- Interactive Crypto. TSLA Warning: Key Support Level Being Tested Right Now. Accessed on January 21, 2026

- Rachel Warren. How Does Tesla Make Money? Accessed on January 21, 2026

- Tech Monitor. What is Tesla? Accessed on January 21, 2026