Signal Trading Summary:

- Bitcoin (BTC)

- Entry: Rp1,448,782,755 ($86,345)

- Cut Loss [CL]: IDR1,388,378,355 ($82,745)

- Take Profit [TP]:

- TP1 = Rp1,510,781,160 ($90,040)

- TP2 = Rp1,580,095,209 – Rp1,643,503,050 ($94,171 – $97,950)

2. Astar (ASTR)

- Entry: IDR186.58 ($0.01112)

- Cut Loss [CL]: IDR152.86 ($0.00911)

- Take Profit [TP]:

- TP1 = IDR219.80 ($0.01310)

- TP2 = IDR253.36 ($0.01510)

3. ZetaChain (ZETA)

- Entry: IDR1,290 ($0.07691)

- Cut Loss [CL]: IDR1.024 ($0.06104)

- Take Profit [TP]:

- TP1 = Rp1,592 ($0.09490)

- TP2 = Rp1,813 – Rp1,927 ($0.10810 – $0.11487)

1. Bitcoin (BTC)

Tags: Layer-1

The selling pressure on Bitcoin (BTC) managed to ease after the price touched a strong support area in the range of Rp1,406,432,559-Rp1,447,759,236 ($83,821-$86,284). This area acts as a major defense zone, where buying begins to emerge and hold the price down.

As long as the price of Bitcoin is able to survive and move above the support area, the opportunity for a short to medium-term rebound is still open. Technically, the price recovery scenario has the potential to push BTC to reverse direction and retest the previous high, which was the highest price on December 3, 2025 at Rp1,580,095,209 ($94,171).

The validity of the bullish scenario will be stronger if the upside movement is supported by increased volume and a positive candle structure on the daily timeframe.

BTC Buy Potential Setup:

- Entry: Rp1,448,782,755 ($86,345)

- Cut Loss [CL]: IDR1,388,378,355 ($82,745)

- Take Profit [TP]:

- TP1 = Rp1,510,781,160 ($90,040)

- TP2 = Rp1,580,095,209 – Rp1,643,503,050 ($94,171 – $97,950)

Important Notes:

Always apply risk management and capital management with discipline. For trading, especially those using leverage, we recommend using a risk per transaction of: 1% of total capital.

2. Astar (ASTR)

Tags: Layer-1

The price movement of Astar (ASTR) still shows a constructive structure, with the price holding above the key support area at the level of IDR159.57 ($0.00951). This area acts as a key defense zone that keeps the movement bias positive.

As long as the price is able to hold and move stably above the support level, the opportunity for an uptrend continuation is still open. Technically, the highest price on November 27, 2025 at the level of IDR253.36 ($0.01510) is the main upside target in a bullish scenario.

In terms of momentum, the Relative Strength Index (RSI) indicator has formed a higher low, which indicates a strengthening of the uptrend and supports the potential for continued bullish movement.

ASTR Potential Buy Setup:

- Entry: IDR186.58 ($0.01112)

- Cut Loss [CL]: IDR152.86 ($0.00911)

- Take Profit [TP]:

- TP1 = IDR219.80 ($0.01310)

- TP2 = IDR253.36 ($0.01510)

Important Notes:

Always apply risk management and capital management with discipline. For trading, especially those using leverage, we recommend using a risk per transaction of: 1% of total capital.

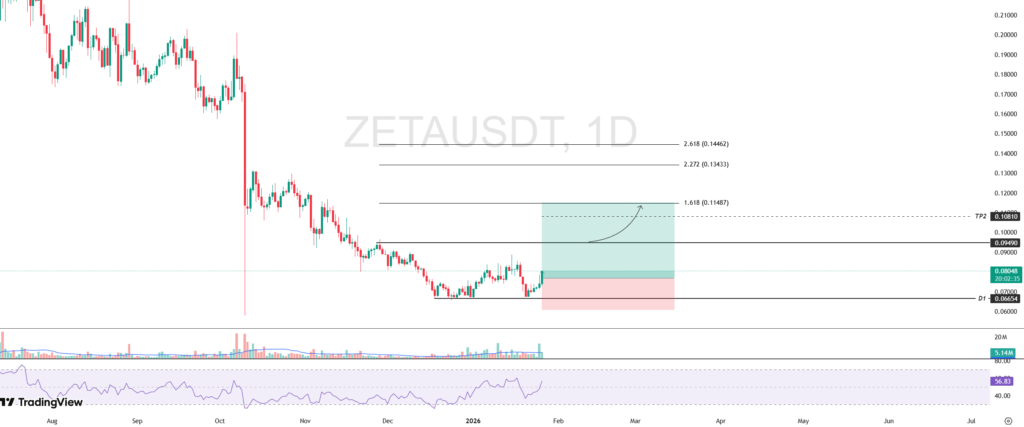

3. ZetaChain (ZETA)

Tags: Layer-1

The price movement of ZetaChain (ZETA) is still showing good resilience, with the price successfully holding above an important support area, which is the lowest price at the close of December 18, 2025 at Rp1,116 ($0.06654). This area serves as a key defense zone that keeps the price structure constructive.

As long as the price is able to stay above the support level, the opportunity to continue the upward movement is still open. Technically, the highest price on November 27, 2025 at the level of Rp1,592 ($0.09490) is the nearest upside target as well as an important resistance area to watch.

A valid breakout above this level is the main requirement for the continuation of the positive trend. If the price manages to break and stay above it, then the bullish rate has the potential to continue towards the harmonic resistance at the level of Rp1,927 ($0.11487) as a further target.

ZETA Potential Buy Setup:

- Entry: IDR1,290 ($0.07691)

- Cut Loss [CL]: IDR1.024 ($0.06104)

- Take Profit [TP]:

- TP1 = Rp1,592 ($0.09490)

- TP2 = Rp1,813 – Rp1,927 ($0.10810 – $0.11487)

Important Notes:

Always apply risk management and capital management with discipline. For trading, especially those using leverage, we recommend using a risk per transaction of: 1% of total capital.