Signal Trading Summary:

- Cosmos (ATOM)

- Entry [Buy/Long] : $2,057

- Stop Loss [SL] : $1,866

- Take Profit [TP] :

- TP1: $2,200 – $2,249

- TP2: $2,451

- Zilliqa (ZIL)

- Entry [Buy/Long] : $0,00545

- Stop Loss [SL] : $0,00491

- Take Profit [TP] :

- TP1: $0,00601

- TP2: $0,00654 – $0,00722

- Bitcoin (BTC)

- Entry [Buy/Long] : $76.212

- Stop Loss [SL] : $72.061

- Take Profit [TP] :

- TP1: $79.396 – $80.504

- TP2: $84.599

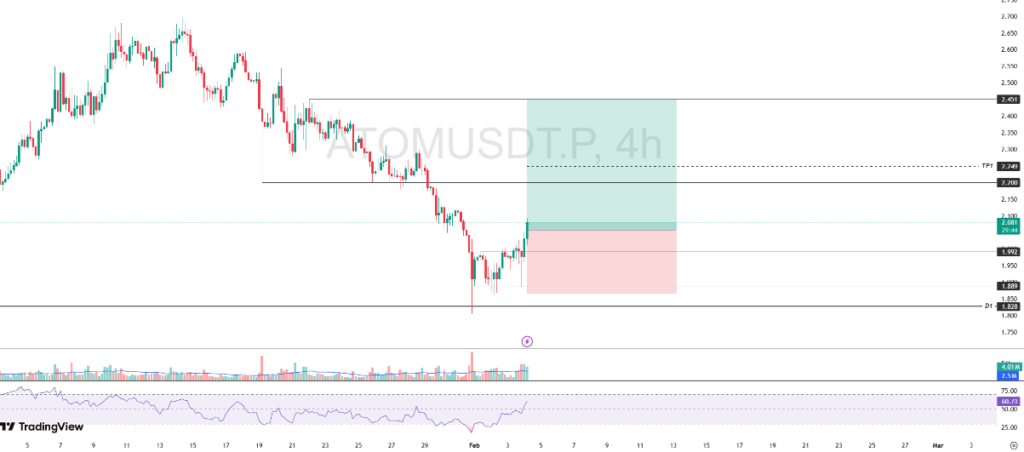

1. Cosmos (ATOM)

Selling pressure on Cosmos (ATOM) was successfully contained at the daily support area of $1,828 on January 31, which triggered increased buying pressure and prompted a price reversal from a bearish phase to an upward phase.

Currently, the pace of the rebound shows the strengthening of the technical structure after the price managed to break the local resistance on the 4-hour timeframe at the level of $1,992. This breakout opens up opportunities for the continuation of the uptrend, with the nearest upside target at the level of $2,200, as well as the main target at the level of $2,451 as the next resistance.

As long as the price is able to stay above the breakout area, ATOM’s movement bias still tends to be bullish in the short to medium term.

ATOM Potential Buy/Long Setup:

Entry [Buy/Long]: $2,057

Stop Loss [SL]: $1,866

Take Profit [TP]:

- TP1: $2,200 – $2,249

- TP2: $2,451

2. Zilliqa (ZIL)

Zilliqa (ZIL) price movement managed to record a rebound after touching harmonic support which coincided with the golden pocket Fibonacci retracement in the range of $0.00504-$0.00545. This area acts as a strong demand zone that triggers the return of buying pressure.

Technically, if the price of ZIL pulls back to the golden pocket area and is responded with a valid bounce, then this condition can be a further confirmation to buy with a more measured risk.

As long as the support area can be maintained, the potential for the continuation of the uptrend is still open with the main target of the increase being the previous high area at $0.00722.

ZIL Potential Buy/Long Setup:

Entry [Long]: $0,00545

Stop Loss [SL]: $0,00491

Take Profit [TP]:

- TP1: $0.00601

- TP2: $0.00654 – $0.00722

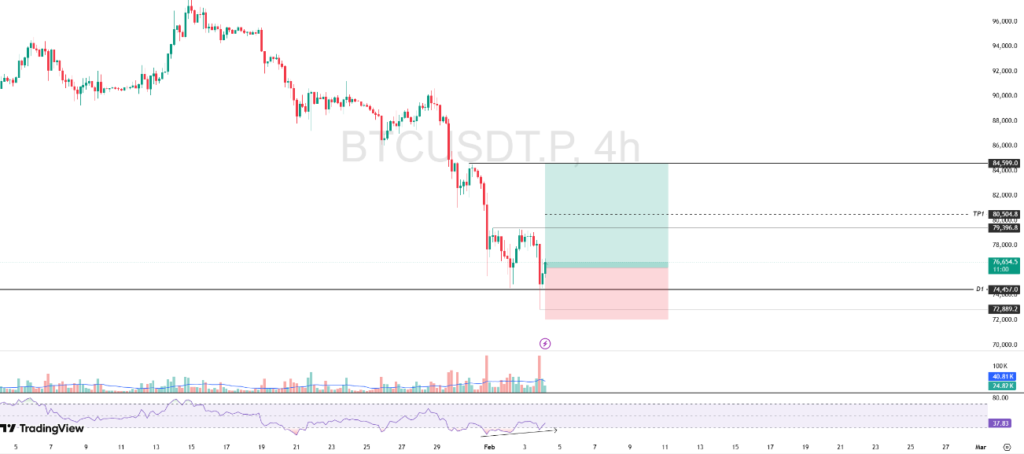

3. Bitcoin (BTC)

The Bitcoin (BTC) price drop found a strong buying response after the price touched the support area at $74,457, which was signaled by the formation of a long lower wick. The candle structure indicated a liquidity grab, where selling pressure was successfully absorbed by buyers.

As long as the price of Bitcoin is able to stay above the support area, the potential for a continuation of the rebound rate is still open. Technically, the nearest upside target is at the $79,396 level, with the main target at the $84,599 level as the next resistance area.

In terms of momentum, the formation of bullish divergence between price movements and the RSI (Relative Strength Index) indicator further strengthens the upward reversal signal, and supports a bullish scenario in the short to medium term.

BTC Buy/Long Potential Setup:

Entry [Long]: $76.212

Stop Loss [SL]: $72.061

Take Profit [TP]:

- TP1: $79,396 – $80,504

- TP2: $84,599

Important Notes:

Always apply risk management and capital management with discipline. For trading, especially those using leverage, we recommend using a risk per transaction of: 1% of total capital.

*Disclaimer: Pintu Futures activities (trading futures contracts on crypto assets) are carried out by PT Porto Komoditi Berjangka, a Futures Brokerage company licensed and supervised by Bappebti and is a member of CFX and KKI. Trading futures contracts on crypto assets has high risks, one of which is the risk that Leverage can provide greater profits or losses.