Investment portfolio management strategies are key to building sustainable wealth amid the volatility of the stock and crypto markets. By understanding how to construct a balanced investment portfolio, investors can optimize potential returns while controlling risks. A structured approach helps investors determine the asset allocation between stocks and crypto according to their financial goals and risk profile.

Stock and crypto portfolio management is not just about choosing popular assets, but rather putting together a proportionate combination of risky and safe assets. This principle is relevant for both novice and experienced investors who want to implement a disciplined long-term investment strategy. Here is the complete guide.

Article Summary

🔎 Definition of Investment Portfolio Management Strategy: An investment portfolio management strategy is a systematic approach to organizing a combination of assets such as stocks and crypto to align with financial goals, risk tolerance, and investment time horizon.

🎯 The Importance of Diversification & Asset Allocation: Diversifying stock and crypto portfolios and determining asset allocation between stocks and crypto helps to create defensive or aggressive portfolios according to the risk profile of novice and experienced investors.

⚙️ Key Strategies in Portfolio Management: Some popular approaches include the dollar cost averaging (DCA) strategy, core satellite strategy for portfolios, and rebalancing of investment portfolios to keep the asset mix balanced over the long term.

👀 Risk Management & Long Term Tips: Risk management in investment, understanding your risk profile, and the combination of risky and safe assets are key in reducing investment risk and building a stable and sustainable long-term portfolio.

What is an Investment Portfolio Management Strategy?

An investment portfolio management strategy is a systematic approach to managing different assets to align with financial goals and risk tolerance. The concept emphasizes a balance between potential returns and risk of loss.

In the modern context, portfolios often include stocks, bonds, as well as digital assets like crypto. Stock and crypto portfolio management requires understanding the correlation between assets as the volatility of cryptocurrencies tends to be higher than conventional stocks.

A portfolio management strategy is necessary to avoid concentrating risk on a single type of asset. Without a structured plan, investors risk making emotional decisions when markets fluctuate sharply. A strategic approach helps maintain investment discipline and reduce the impact of short-term volatility.

The main advantage of this strategy is return optimization with controlled risk. Through diversification and periodic evaluation, investors can adjust their asset mix according to market conditions and changing financial goals. The result is a more stable and purposeful financial foundation for the long term.

How to Build a Balanced Investment Portfolio

How to build a balanced investment portfolio starts with determining your financial goals and investment time horizon. Long-term investors can usually take higher risks than short-term investors.

The next step is to determine the asset allocation between stocks and crypto based on the risk profile. For example, conservative investors may place a larger portion on blue chip stocks or bonds, while aggressive investors may increase the portion of crypto assets.

Diversification of stock and crypto portfolios is also important to reduce dependence on a single type of asset. By spreading investments across different sectors and asset classes, potential losses due to extreme fluctuations can be minimized.

Asset Allocation between Stocks and Crypto

Asset allocation between stocks and crypto is a key element in investment portfolio management. Stocks are generally backed by company fundamentals and business performance that can be analyzed quantitatively, whereas crypto is more influenced by market sentiment, technology adoption cycles, and regulatory dynamics.

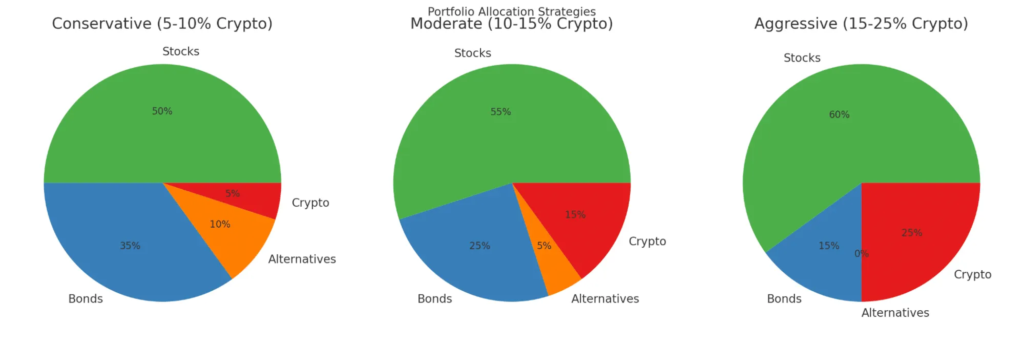

These different characteristics demand an asset composition that is tailored to each individual’s risk profile and investment objectives. Here are three portfolio models based on the allocation illustration in the figure:

1. Conservative Model (5-10% Crypto)

50% stocks +35% bonds/deposits/mutual funds +10% alternatives +5% crypto

This model places the largest portion in stocks and bonds to maintain stability. Crypto is only complementary with a small allocation to provide additional growth potential without significantly increasing risk.

2. Moderate Model (10-15% Crypto)

55% stocks + 25% bonds/mutual funds/deposits + 5% alternatives + 15% crypto

This composition increases exposure to crypto and stocks, thus providing a balance between growth and value protection. Bonds are retained as a buffer to market volatility.

3. Aggressive Model (15-25% Crypto)

60% stocks + 15% bonds/mutual funds/deposits + 25% crypto

This model is aimed at investors with a high risk tolerance. Large portions of crypto and stocks increase potential returns, but also increase fluctuations in portfolio value.

The allocation needs to consider the investment horizon and preparedness for volatility. The higher the risk tolerance, the greater the proportion of crypto that can be included. Periodic evaluation and rebalancing is necessary to keep the portfolio composition in line with market dynamics and long-term financial goals.

Diversification and Risk Management Strategy in Investment

Diversified stock and crypto portfolios help reduce systematic and non-systematic risks. The combination of risky and safe assets creates a balance between stability and growth.

Risk management in investing includes usingcut loss limits, monitoring asset correlations, and managing position sizes. It is also possible to reduce investment risk by not allocating all capital to one sector or instrument.

Defensive vs aggressive portfolios are strategic choices according to market conditions. Defensive portfolios focus more on stable assets, while aggressive portfolios pursue high growth with greater risk of fluctuation.

The Importance of Rebalancing an Investment Portfolio

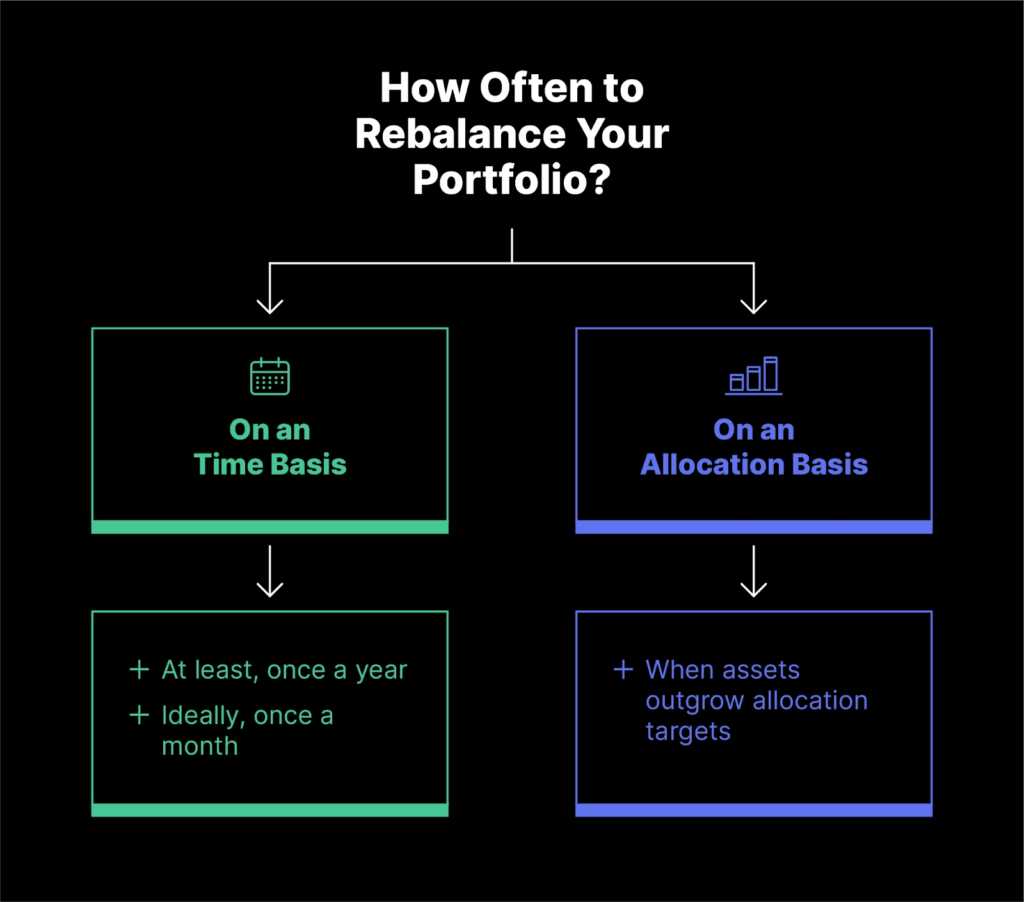

Rebalancing an investment portfolio is the process of readjusting the asset allocation to match the original planned composition. When crypto experiences a sharp rise, the proportion can become too large compared to the initial target.

Through rebalancing, investors sell some assets that have risen significantly and reallocate them to other assets. This keeps the risk balanced and helps maintain a long-term investment strategy.

Rebalancing is usually done periodically, for example every six months or a year. Discipline in rebalancing is an important part of an effective investment portfolio management strategy.

Dollar Cost Averaging Strategy and Core Satellite Strategy

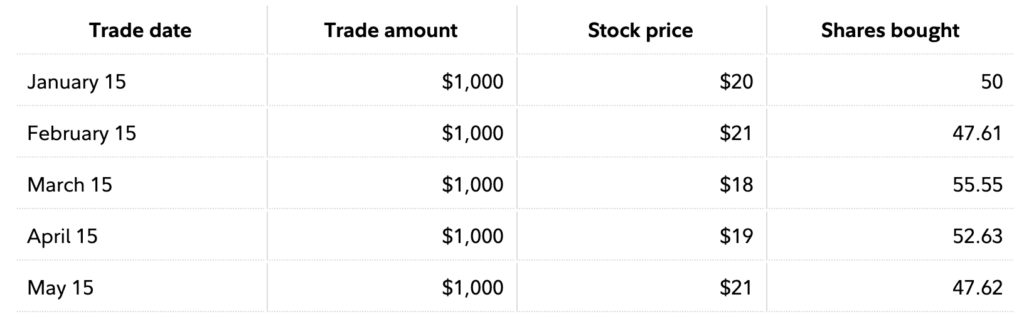

The dollar cost averaging (DCA) strategy is a method of regularly investing a fixed amount at specific time intervals. This approach helps reduce the impact of market volatility as purchases are made consistently without trying to guess the lowest price.

The core satellite strategy for portfolios is also a popular approach in modern management. It divides a portfolio into a stablecore such as index stocks or ETFs, and a more aggressive satellite such as crypto or high-growth stocks.

The combination of DCA and core satellite strategies helps investors build a more structured long-term portfolio. This approach minimizes emotional decisions while maximizing growth opportunities.

Tips for Building a Long-Term Portfolio

- Consistently invest at regular intervals to capitalize on long-term growth and reduce the impact of market fluctuations.

- Understand your personal risk profile before determining asset allocation so that investment decisions are aligned with financial goals.

- Conduct regular evaluations of asset performance to ensure the portfolio remains in line with the original strategy.

- Avoid impulsive decisions due to short-term volatility that can ruin long-term investment plans.

- Combine stocks, crypto and safe assets in equal proportions to create a balance between growth and stability.

- Apply disciplined portfolio management to optimize potential returns while keeping risks under control.

Investment Management and Passive Income Optimization

Investment portfolio management strategies focus not only on rising asset prices, but also on optimizing cash flows through yield instruments. In the crypto ecosystem, investors can now earn passive income by placing digital assets in earning features that offer annualized interest yield (APY). This approach helps balance growth potential and regular income within a single portfolio.

Through the Earn Door feature, users can hold certain cryptos and earn annual interest according to the asset and period chosen. The interest rate can be increased by raising the PTU staking level as well as choosing a locking period such as Flexi, Locked 30 days, or Locked 90 days.

How to use the Earn Door

Here are the steps to start earning interest from Pintu Earn:

- Open the Pintu app and select the “Earn” menu. Make sure the account is verified and has a balance of the crypto asset you want to place.

- Select the assets available on the Earn Door. Each asset has a different interest rate as per the terms and a maximum balance limit that counts for interest.

- Determine the Earn period. Choose between Flexi, Locked 30 days, or Locked 90 days according to your liquidity needs and target returns.

- Confirm and start Earning. Once the asset is placed, interest will be calculated according to the PTU staking period and level.

You can store crypto assets on Pintu Earn with an interest rate of up to 11.3% per year. The interest rate may vary depending on the period and PTU staking level of the user. Longer locking periods generally provide higher interest rates than flexible options.

For investors looking for a platform with clear safety standards, ease of use, and competitive APY rates, Pintu Earn is a relevant option to consider as part of a long-term portfolio management strategy.

Disclaimer: All articles from Pintu Academy are intended for educational purposes and do not constitute financial advice.

Reference

- Investopedia. Portfolio Management: Definition, Types, and Strategies. Accessed February 12, 2026.

- Investopedia. Asset Allocation: Balancing Risk and Reward. Accessed February 12, 2026.

- Fidelity. What Is Dollar-Cost Averaging? Accessed February 12, 2026.