Commodity prices, particularly gold and silver, have risen significantly in recent months. Gold, for example, has set an all-time high of $5,598/troy ounce, while silver has also rallied on the back of industrial demand. What exactly is the main cause of the rise in gold and commodity prices? In this article, we take a look at the main factors behind the rise.

Article Summary

- ⛏️ Gold Production Increases: Gold mine production each year adds about 2-3% to the total stock of gold already in circulation, so the growth in supply is relatively limited.

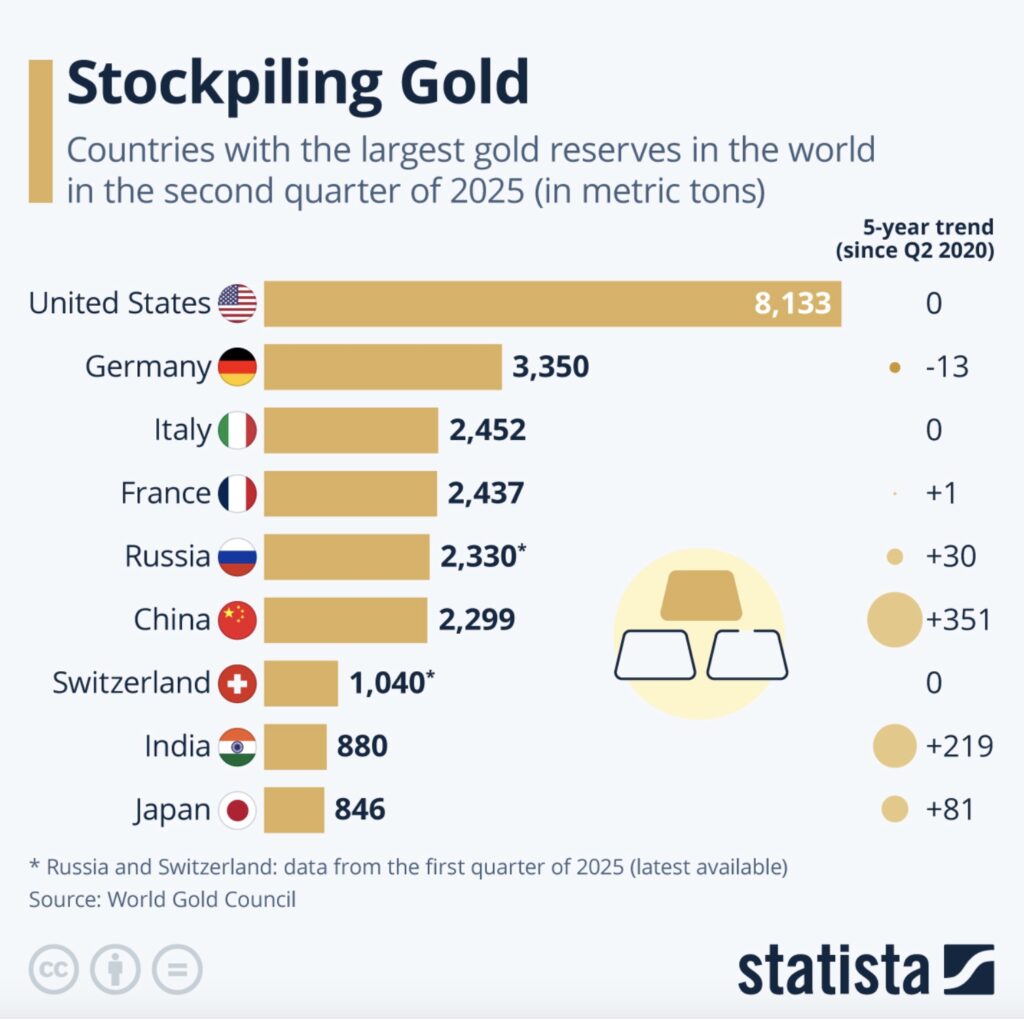

- 🌏 Demand from Central Banks and Countries: China has been one of the countries with the largest accumulation of gold in the past five years, totaling around 351 tons.

- 🧠 Multiple Factors Causing the Rise: Gold prices are influenced by various factors such as real interest rates, the value of the US dollar, geopolitical conditions, and supply and demand dynamics.

- 💽 Correlation between Gold Price Movement and Inflation: Data shows that inflation is not the main culprit driving gold prices higher.

History and Types of Gold

Gold is one of the commodities that has historically been in high demand, whether as jewelry, foreign exchange reserves or hedging instruments. In recent years, gold prices have shown a significant upward trend, reflecting a combination of factors.

One of the main characteristics of gold is its scarcity. As a finite natural resource, the supply of gold cannot be produced quickly. In fact, mine production each year adds about 2-3% to the total existing gold stock according to Investopedia.

The following are some of the most commonly traded types of gold products:

- Precious metals

- Jewelry

- ETF (Exchange Traded Fund) digital products

- Tokenization of Gold such as XAUT and PAXG

Learn more about gold comparison and tokenization and how it relates to crypto: Comparison of Physical Gold, Digital and Gold-Based Crypto for Gold Investment - Pintu Academy

Top Causes of Gold Price Rise

Gold has been one of the instruments that has had relatively stronger price movements than BTC since the beginning of 2025. From tradingview data, the price of gold has continued to rise since the beginning of 2025, while BTC has experienced a correction of around 30%. Here are some of the main reasons for the rise in gold prices:

1. Institution and Country Purchases

One factor that supports the strengthening of gold prices is central banks. Global central banks are institutions that have made massive gold purchases in the last 3 years. According to J.P. Morgan research, more than 1,000 tons of gold have been purchased by global central banks every year since 2022 and the projection is that gold demand this year will reach 755 tons.

Based on data from the World Gold Council and Statista, several countries such as China, India, Japan, and Russia have increased their gold reserves consistently ranging from 30 to 351 tons since the last 5 years. Gold accumulation can be interpreted as a diversification measure of foreign exchange reserves to maintain economic stability.

Gold is a valuable asset that has been recognized worldwide and has proven to be a hedge in various events, one of which was the 2008 global crisis.

2. Weakening US Dollar Exchange Rate

According to tradingview data, the US dollar exchange rate index has decreased by more than -10% over the past year, in the same time frame gold has increased by approximately 73%. The US dollar exchange rate and its relationship with gold price movements are quite close because gold is traded globally in US dollar denominations. This means that gold price movements can be caused by the strength or weakness of the US dollar exchange rate.

When the US dollar weakens against other currencies, gold becomes relatively cheaper for buyers outside the US, potentially increasing demand for gold and impacting its price movements.

3. Interest Rate

Real interest rates, which are nominal interest rates after deducting the inflation rate, have an inverse relationship with gold prices. When real interest rates are high, keeping money in deposits or bonds provides above-inflation returns, so investors tend to favor these instruments. Conversely, when real interest rates are low or even negative, the purchasing power of cash shrinks over time even if it is kept in a bank. Under these conditions, holding gold becomes more attractive because while gold does not earn interest or dividends, its value is not eroded by inflation like cash.

For example: if the deposit rate is 4% but inflation reaches 6%, the real interest rate is -2%. This means that while savings increase nominally, purchasing power decreases. In this situation, gold serves as an alternative store of value that is more resistant to declining purchasing power.

Based on investing.com data, when compared since 2023, the Fed’s interest rate cut from 5.5% to 3.75% this year occurred along with the increase in gold prices which has exceeded 100%. This correlation shows that easing monetary policy tends to have an impact on rising gold prices.

4. Geopolitical Uncertainty

Gold has historically been seen as a safe haven asset, especially in times of political uncertainty and geopolitical conflicts such as military tensions. Under these conditions, investors tend to shift funds from risky assets to instruments that are considered more stable and have intrinsic value, such as gold.

Geopolitical uncertainty can trigger volatility in financial markets, pressure on certain currencies and increased demand for hedging assets. In some situations, a weakening US dollar can also amplify gold price gains, as gold is traded in dollar denominations and thus becomes relatively cheaper for holders of other currencies.

Overall, these dynamics suggest that geopolitical factors, currency movements, and increased investor demand are intertwined in driving gold prices higher.

The Relationship Between Inflation and Gold Prices

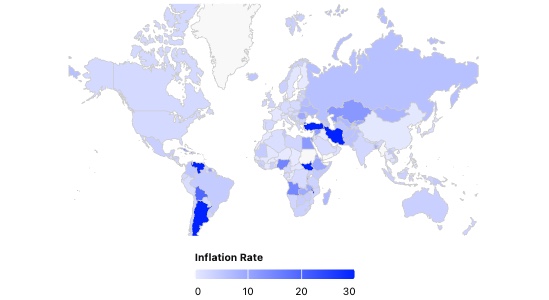

One of the most common perceptions is that gold is an inflation hedge against inflation and deflation. That is, when prices of goods and basic necessities rise due to increasing production costs, gold prices have historically risen to maintain purchasing power. This perception is not entirely wrong, but it is also not entirely correct.

Inflation and Gold Price Correlation Data

According to data from the World Gold Council, since 1971 only about 16% of gold price variations can be explained by changes in inflation (CPI). Statistically speaking, this figure suggests that inflation is not the main factor driving gold’s overall price movements.

This finding is reinforced by research from the Federal Reserve Bank of Chicago which shows that the relationship between gold and inflation was very strong in the 1970s, a period of extreme inflation in the United States, but the correlation weakened significantly in the following decades.

Analysis from the CFA Institute even found that the average correlation between changes in gold prices and inflation in the short term is close to zero. This means that over a short-term horizon, gold does not consistently move in the same direction as inflation, so its role as a hedge against inflation is contextual rather than universal.

When is Gold Effective as a Hedge Against Inflation?

Essentially, the gold option becomes effective when inflation rates can spike suddenly high, especially when the main factors causing it are triggered by supply-side shocks such as energy crises or heated geopolitical conditions such as military tensions. Gold is also effective during a currency crisis, where confidence in the monetary system has plummeted.

This drives the attractiveness of gold even stronger as the opportunity cost of owning gold becomes smaller.

But if inflation conditions are moderate and under control, for example in the range of 2-4%, when central banks manage to raise interest rates to control inflation, or when the US dollar strengthens along with inflation, gold can become less desirable.

Commodity Rise Phenomenon (Silver, Uranium, Cobalt, etc.)

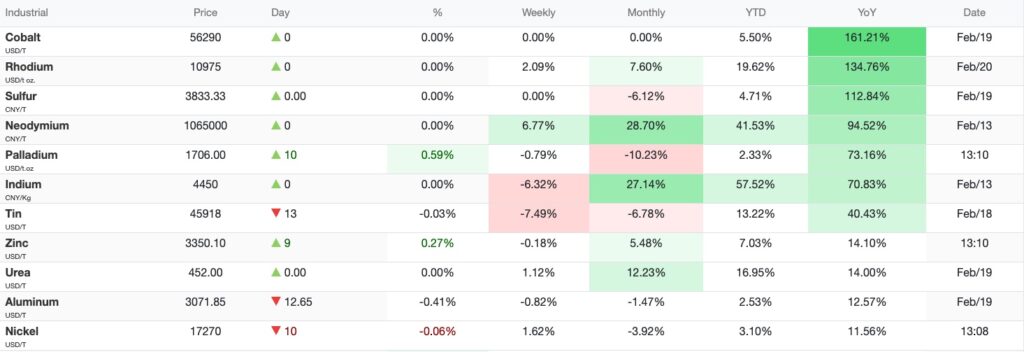

Apart from gold, a number of other commodities have also recorded significant year-on-year (YoY) gains based on Trading Economics data. Some of them even experienced a much higher surge than gold:

- Silver: +139%

- Cobalt: +161%

- Platinum: +112%

- Uranium: +37%

- Copper: +26%

This increase shows that price movements do not only occur in one particular commodity, but also in the global commodity sector. Here are the factors causing the increase.

1. Energy Transition and Electrification

The rise in cobalt and copper prices has a lot to do with the accelerating energy transition and the growth of electric vehicles (EVs). Cobalt is an important component in lithium-ion batteries, while copper is required in large quantities for power infrastructure, solar panels, wind turbines, and transmission networks. Increasing demand from the renewable energy sector is tightening the supply of these commodities.

2. Return of Interest in Nuclear Energy

Uranium prices are rising due to renewed interest in nuclear energy as a low-carbon energy source. A number of countries are extending the life of old nuclear reactors and planning the construction of new reactors to support net-zero emission targets.

On the other hand, global uranium supply was limited due to a decline in production in the previous few years, so the supply-demand imbalance pushed prices up.

3. Precious Metals Other than Gold

Silver and platinum also posted sharp gains. Silver not only serves as a precious metal, but also has industrial uses, especially in solar panels and electronic components.

Meanwhile, platinum is widely used in vehicle catalytic converters as well as the hydrogen industry. When industrial activity picks up and sentiment towards precious metals improves, both commodities are pushed up.

Gold Investment Risks

After understanding the various factors that can drive gold prices higher, it is important to look at the risk side in a balanced way. No investment instrument is completely risk-free, including gold, which is often perceived as a safe asset.

1. Potential Correction After Printing the Highest Price

Although gold is often categorized as a safe haven, its price movements are still affected by global market dynamics and can experience significant volatility. For example, in the period January 28-February 1, 2026, the price of gold experienced a correction of around 20.78% after printing its new high.

Such events show that market sentiment,profit-taking, and changes in macroeconomic expectations can trigger selling pressure in a short period of time. Investors who react emotionally and sell during a correction phase could potentially realize losses, even though prices have historically recovered in the past. Market corrections are a natural part of the price cycle, including in relatively defensive assets like gold.

2. No Yield

Unlike bonds, time deposits or dividend stocks that provide regular cash flows, physical gold does not generate passive income. An investor’s profit depends entirely on the difference between the purchase price and the selling price (capital gain).

In a high real interest rate environment, fixed income-based instruments become more attractive as they offer competitive yields. This increases the opportunity cost of holding gold, thereby suppressing its demand.

However, the development of innovations such as gold tokenization allows investors to earn additional returns through certain mechanisms, such as lending or integration with the crypto ecosystem. However, these returns do not come from the gold itself, but from the financial schemes that surround it, so they still carry additional risks.

3. Spread Risk

With physical gold investments, there are some additional costs, up to and including the difference between the buying price and selling price (spread), which is usually greater than with gold stocks or ETFs.

Large spreads mean that investors need to wait for a higher price increase in order to make a return, especially if they make large purchases. If the price doesn’t rise far enough, profits can be eroded by the spread.

In terms of liquidity, selling physical gold is also not always as quick as selling assets in the stock or crypto markets. The process can take time and depends on the place of repurchase. This is especially important if investors need funds quickly.

Buy Gold-Backed Crypto in Pintu

For investors who are interested in buying gold-backed crypto, there is no need to worry. You can buy XAUT and PAXG on Pintu. The following is how to buy gold-based crypto assets on Pintu:

- Create a Pintu account and follow the identity verification process to start trading.

- On the home page, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and search for XAUT or PAXG.

- Click buy and fill in your desired quantity.

- Now you have gold in Pintu as an asset!

You can safely and conveniently buy other cryptocurrencies such as BTC, ETH, SOL, and more safely and easily on Pintu. Pintu diligently evaluates all crypto assets, highlighting the importance of exercising caution.

Pintu is also compatible with popular wallets such as Metamask to ease your transactions. Download the Pintu app on Play Store and App Store! Pintu is a fully regulated exchange and certified by OJK and CFX.

Besides buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through Pintu Academy’s various articles.

Disclaimer: All articles from Pintu Academy are intended for educational purposes and do not constitute financial advice.

Conclusion

The rise of various commodities is widely associated with the commodity supercycle phase . In particular, gold is being looked at again as a safe haven asset as it has historically proven to hold its value over time. However, investing in commodities also comes with the unavoidable risk of price volatility caused by multiple factors.

Reference

- “Will gold prices break $5,000/oz in 2026?“, JP Morgan, accessed February 13, 2026.

- “Understanding the Dynamics Behind Gold Prices“, Investopedia, accessed February 13, 2026.

- “Understanding Gold Prices“, PIMCO, accessed February 16, 2026.

- “Investment Update – Beyond CPI: Gold as a strategic inflation hedge” World Gold Council, accessed on February 16, 2026.