In the DeFi ecosystem, you can borrow crypto assets in the same way that you would borrow money from a traditional bank. However, the main challenge faced in the crypto world is the rapid fluctuation of crypto asset prices. Maker Protocol emerges as a solution to this problem by offering loans in the form of stablecoins and crypto asset collateral. So, what is Maker, and how does it work? Let’s find out in the following article!

Article Summary

- 🏦 Maker Protocol or Maker is a crypto asset lending platform that operates on the Ethereum network. It offers loans in the form of DAI stablecoins secured by excess crypto assets locked in smart contracts.

- 🪙 Maker utilizes two token models, i.e., DAI and MKR. DAI is a decentralized stablecoin with a stable value of one US dollar. In comparison, MKR is a token used to vote on proposals and manage the risk and stability of the protocol.

- 💰 Maker implements a Multi-Collateral Dai (MCD) system, which can use different types of collateral assets, or “multi-collaterals,” as the basis for creating DAI.

- 🧑💼 All aspects of the Maker Protocol are governed by the MakerDAO. MakerDAO is a Decentralized Autonomous Organization where MKR token holders have the power to govern the Maker Protocol.

What is Maker (MKR)?

Maker Protocol or Maker is a crypto asset lending platform that operates on the Ethereum network. The platform offers loans in the form of DAI stablecoin secured by excess crypto assets and locked in smart contracts. Maker Protocol uses a two-token model, i.e., the DAI stablecoin and the protocol’s governance token, MKR.

Unlike traditional lending systems, Maker operates on the principle of a predetermined interest rate known in advance to the borrower. It helps eliminate the confusion and uncertainty often associated with crypto-asset lending.

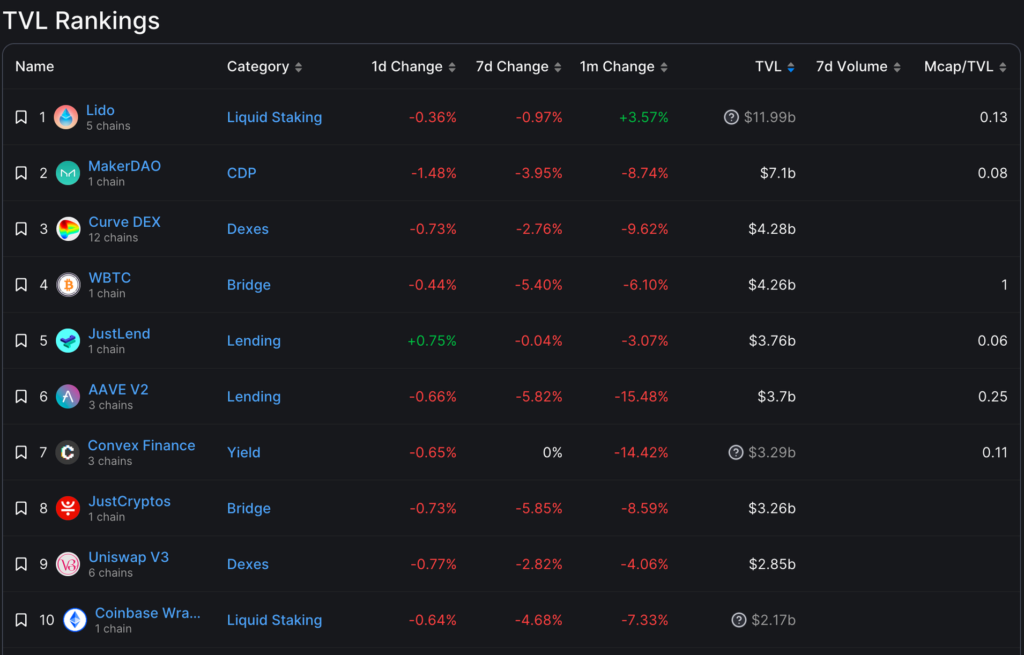

Maker is becoming one of the largest and most established dApps on the Ethereum blockchain. It has a significant market share in the DeFi ecosystem. As of May 2023, Maker is the second-largest total value-locked protocol (TVL) at 7.1 billion US dollars.

The MakerDAO governs all aspects of the Maker Protocol. MakerDAO is a Decentralized Autonomous Organization where MKR token holders have the power to govern the Maker Protocol. Through their voting rights, they play a vital role in ensuring the platform’s stability, transparency, and efficiency.

MakerDAO is fully decentralized, where all decisions are taken collectively. This system provides users greater security, stability, and control than systems controlled by a central authority.

Read also What is Decentralized Finance (DeFi)?

Who Created Maker?

Maker was created by a developer and entrepreneur, Rune Christensen. He successfully managed a business while studying at the University of Copenhagen and Copenhagen Business School. However, after exposure to Bitcoin in 2011, he stepped away from his business and invested in crypto assets. Later, he had a strong interest in stablecoins, eventually leading him to create Maker.

Rune Christensen and his team have been focusing on building Maker’s protocol organization framework since 2015. The team comprises experts in blockchain engineering, data, and software development.

DAI Stablecoin and MKR

Maker uses two token models to run its system, DAI, and MKR. DAI is a stablecoin backed by collateral assets and has a stable value of one US dollar. DAI is created in the Maker Protocol by depositing crypto assets (ERC-20) as collateral into a Vault. Once DAI is generated, it can be used as a crypto asset.

MKR is a governance and utility token on the Maker platform. MKR holders have voting rights in key decisions within the protocol. Every MKR token is worth one vote.

In addition, MKR tokens are used in Maker as a protocol stability regulator, providing a solution when, for example, the price of Ether (ETH) that collateralizes DAI drops too quickly, and existing collateral assets cannot cover the value of DAI. MKR is created and sold to the market in this scenario to raise additional collateral. In this way, MKR maintains the balance and stability of the Maker Protocol system in situations of imbalance between the value of DAI and its collateral assets.

The relation between DAI and MKR in Maker is that DAI is a stablecoin created and operates within the protocol, while MKR is a token used for voting and managing the risk and stability of the protocol.

Read also What is Stablecoin?

Maker Key Components

- Maker Vault: Vault, formerly called collateralized debt positions (CDP), is a smart contract that allows users to lock their crypto assets as collateral and create DAI. Users who want to create DAI must lock their crypto assets in Vault as collateral. The value of this collateral must exceed the value of the DAI they want to receive. In Vault, the main concept is “over-collateralization” to ensure the stability of DAI.

- Collateral Assets: Maker Protocol supports various crypto assets that can be used as collateral to create DAI. Ethereum (ETH) is the main crypto asset used in Maker Protocol. Some of the assets that can serve as collateral for DAI include Ether (ETH), Basic Attention Token (BAT), USD Coin (USDC), Wrapped Bitcoin (wBTC), Compound (COMP), and many more.

- Stability Fees: The stability fee is the interest users pay to use the DAI generated from the CDP or Vault. MakerDAO determines this fee and is subject to change according to the policies adopted by the usage and stability of the system.

How Does Maker Work?

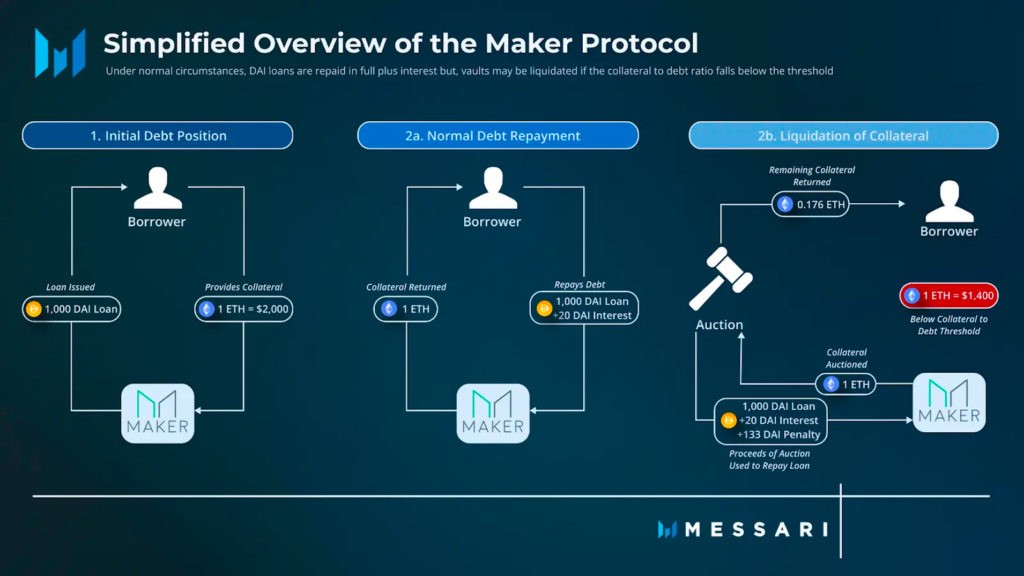

Users can access Maker and create a Vault through Oasis Borrow. The Maker protocol involves several key steps that enable the creation and management of DAI stablecoins. Here’s how the Maker Protocol works:

- Collateralization: Users must provide collateral as an acceptable crypto asset, with Ethereum (ETH) as the primary asset. This collateral serves as a value guarantee to ensure the stability of the generated DAI.

- Vault Creation: Users can open a Vault (Collateralized Debt Position/CDP) by locking their collateral in a smart contract. This Vault allows users to generate DAI loans using their crypto assets as collateral.

The minimum DAI required to open a Vault is 3,500. Therefore, you need to put up more collateral to generate 3,500 DAI

- DAI Creation: Once the Vault is opened, users can generate DAI by depositing their collateral. The amount of DAI generated depends on the collateral value and the collateral ratio set by the Maker Protocol.

- Stability Fee: Users who generate DAI from the Vault will be charged a stability fee. MakerDAO determines the level of stability fee and may be adjusted based on policy.

- Governance: Maker Protocol involves MKR token holders in the decision-making and management of the protocol. MKR holders have voting rights in determining policies and risk mechanisms in the system. Through the voting mechanism, they can influence changes in interest rates, risk parameters, and other important decisions.

- Liquidation: If the collateral value (ETH) drops below a set threshold (usually to avoid default risk), the Vault may be liquidated. In this situation, Maker will liquidate the collateral and the resulting DAI will be used to repay the loan. It ensures that sufficient collateral value is always available to guarantee the value of the DAI.

In other words, users lock their crypto assets in a CDP or Vault as collateral. Then, based on the value of the collateral assets, Maker Protocol generates DAI equivalent to the amount requested by the user. The user can use the generated DAI to utilize or invest in other dApps.

DAI Saving Rates (DSR)

Besides borrowing crypto assets, users can also save through the DAI Saving Rates (DSR) feature. This savings feature can be accessed through the Oasis Earn portal or various gateways within Maker Protocol. Users do not need to deposit a minimum amount to earn DAI rewards. Users can withdraw some or all of their DAI from the DSR contract at anytime.

What Makes Maker Different?

Maker Protocol has several advantages compared to other DeFi dApps. First, Maker has a DAI stablecoin that is fully decentralized because a central authority does not control DAI issuance. Unlike USDT, for example, whose issuance and burning are regulated by Tether.

Second, Maker implements a Multi-Collateral Dai (MCD) system, where Maker uses different types of collateral assets, or “multi-collaterals,” as the basis for creating DAI. DAI differs from most stablecoins collateralized by a single fiat currency or a single type of crypto asset.

Third, Maker is one of the largest and earliest DeFi applications operating on the Ethereum network. It has a significant market share in the number of TVLs, which is the second largest network after Lido.

All these advantages make Maker a robust and trusted protocol in the DeFi ecosystem, which solves the problem of stability and liquidity in the crypto market.

Conclusion

MakerDAO continues to strive to be the first decentralized bank in the DeFi world. It provides earning and lending features that allow users to make profits.

In addition, MakerDAO continues to make long-term innovations, including connecting real-world collateral with the Ethereum DeFi ecosystem in the form of property, invoices, commercial mortgages, and others. MakerDAO also entered into a large-scale collaboration with Huntington Valley Bank (HVB). It is the first significant partnership to connect traditional US finance with DeFi.

How to Buy MKR Token on Pintu?

You can start investing in MKR by buying it in the Pintu app. Here’s how to buy crypto on the Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for MKR.

- Click buy and fill in the amount you want.

- Now you have ID as an asset!

In addition, the Pintu application is compatible with various popular digital wallets such as Metamask to facilitate your transactions. Go and download the Pintu cryptocurrency app on Play Store and App Store! Pintu is regulated and supervised by Bappebti and Kominfo.

You can also learn more crypto through the various Pintu Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice.

References

- MakerDAO Team, The Maker Protocol: MakerDAO’s Multi-Collateral Dai (MCD) System, MakerDAO, accessed 11 Mei 2023.

- Blockchain Council Team, What Is MakerDAO And How It Works? Blockchain Council, accessed 11 Mei 2023.

- MakerDAO Team, A Guide to Dai Stats, MakerDAO, accessed 11 Mei 2023.

- Filippo Bertocchi, MakerDAO: 1st Unbiased Currency and Decentralized Stablecoin, Coin Bureau, accessed 11 Mei 2023.

- Melanie Kramer, What is Maker (MKR)? Decrypt, accessed 11 Mei 2023.

- Cryptopedia Staff, DAI: A Systematically Sustainable Stablecoin, Cryptopedia, accessed 11 Mei 2023.