Ethereum is the 2nd largest crypto project in the world after Bitcoin. It is arguably the heart of the crypto industry as it is the center of financial activity for cryptocurrencies. In addition, Ethereum’s market capitalization is even larger than the five crypto assets below it combined. Ethereum, along with Bitcoin, is the dominant force driving the crypto market. Furthermore, ETH price movements can affect hundreds of other altcoins. Therefore, many traders and crypto users pay attention to every update of the Ethereum network. Shapella is Ethereum’s latest update that focuses on the staking feature. This update was successfully implemented in April 2023. So, what is the impact of Ethereum Shapella? What is the current situation of Ethereum? This article will explain it in detail.

Article Summary

- 💻 Ethereum, the world’s second-largest crypto project after Bitcoin, successfully performed a network update called Shapella on April 12, 2023. This update introduced an “unstaking” feature that allows users to withdraw ETH from staking.

- 🧠 While there was mixed sentiment about the impact of the Shapella update, post-Shapella data shows that it actually triggered an increase in the amount of staking on Ethereum, with deposits outpacing withdrawals.

- ⚙️ Shapella positively impacts the Liquid Staking Derivatives (LSD) sector, with Lido Finance dominating the sector with a Total Value Locked (TVL) of more than $12 billion.

- 📈 The increase in ETH staking is expected to continue as more people look to earn passive income. The Shapella update removes a major risk that users were previously concerned about, which was the inability to withdraw ETH from staking.

- ⚖️ Along with the growth of the Liquid Staking sector comes the Liquid Staking Derivatives Finance (LSDFI) protocol which allows the use of liquid staking tokens (LSTs) in DeFi activities. Although the sector is still in its infancy, several protocols such as Unsheth, Lybra Finance, Parallax Finance, 0xAcidDAO, and Agility LSD have received attention from the crypto community.

Post Shapella Upgrade

The Ethereum Shapella upgrade was finally successful on April 12, 2023. The Ethereum development team successfully implemented Shapella without any problems. This update brings new features and some small developments that make it easier for developers in the Ethereum ecosystem. However, the main highlight of the Shapella update is unstaking for ETH.

With Shapella, everyone can start withdrawing their ETH. Now, Ethereum users can stake and withdraw their ETH at any time with a relatively short withdrawal time. This makes Ethereum’s staking system similar to various other L1s such as Solana. However, Ethereum developers enforced a queue system to prevent attacks and network instability.

Ethereum also divides the withdrawal system into two groups: partial and full withdrawals. Partial is those who withdraw their ETH rewards but remain validators while full is the withdrawal of all their ETH. You can watch the video below that explains how the ETH withdrawal system works.

You can read in more detail about what is the Ethereum Shapella Upgrade on Pintu Academy.

Prior to the Shapella upgrade, the crypto community on Twitter was divided between potentially bullish and bearish sentiments about Shapella. Those who were bullish saw Shapella as an update that would encourage many people to keep their ETH in staking. On the other hand, bearish people think that Shapella will be a sell-the-news event, as many long-term stakers will withdraw their ETH (staking has been possible since December 2020).

Below we will discuss the impact and look at the data post-Shapella.

What are the impacts of Shapella?

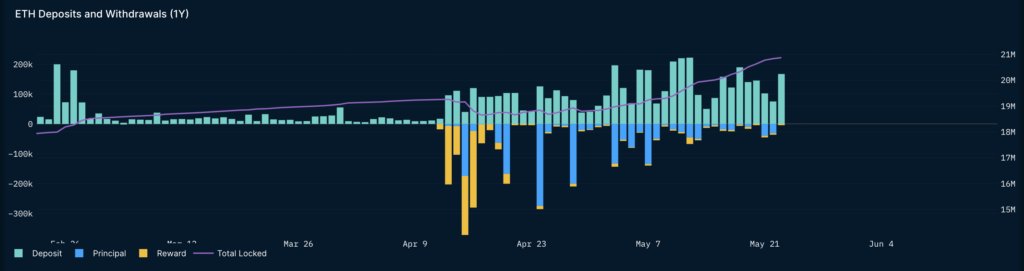

The data above shows a graph of ETH deposits and withdrawals in the past year. The leftmost yellow bar indicates the first time ETH can be withdrawn (April 12, 2023). Meanwhile, the purple line represents the total ETH locked in staking. The largest staking withdrawal occurred from April 15-17, 2023 where approximately 738,067 ETH was withdrawn. Other large ETH withdrawals occurred on April 20, 24, and 28, 2023. The number of ETH locked has been steadily increasing since April 25 and we actually saw the number of deposits exceed the number of ETH withdrawals in May. This is a surprise since Lido V2 allows Lido users to withdraw their ETH since May 15, 2023.

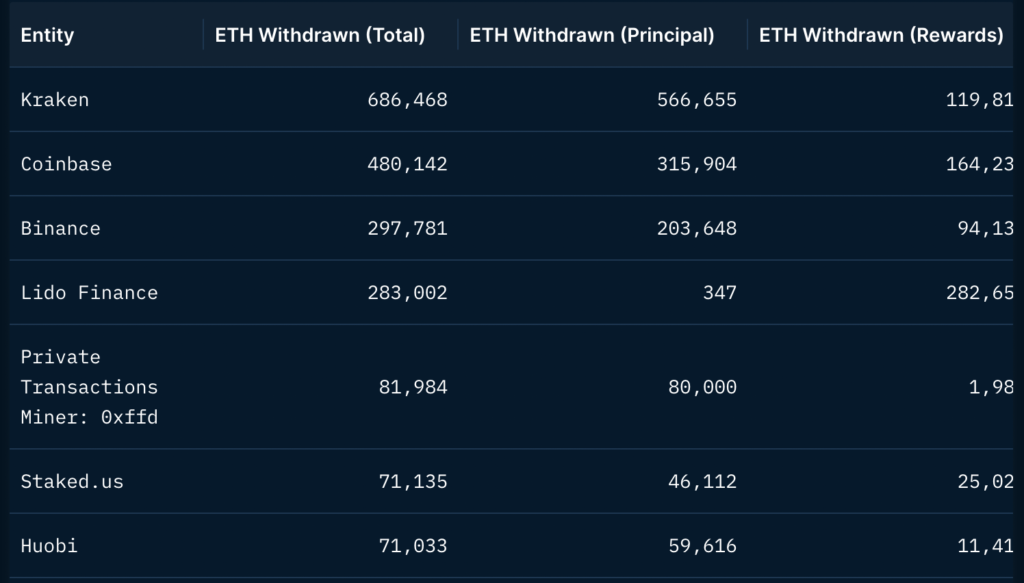

The image above is a list of the largest entities withdrawing ETH. The average time taken to withdraw ETH is currently around 5 days. As we can see, the list is dominated by centralized exchanges (CEXs) such as Kraken, Coinbase, and Binance. Although the amount withdrawn looks enormous, the total ETH locked up currently is 21.1 million ETH, or 17.7% of the total ETH supply.

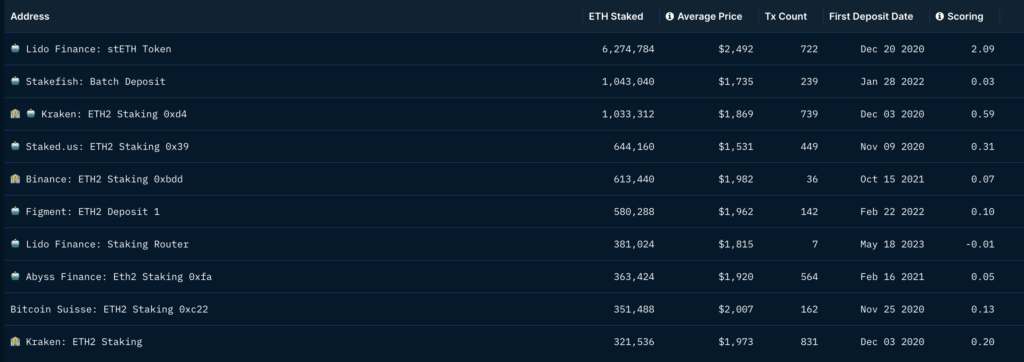

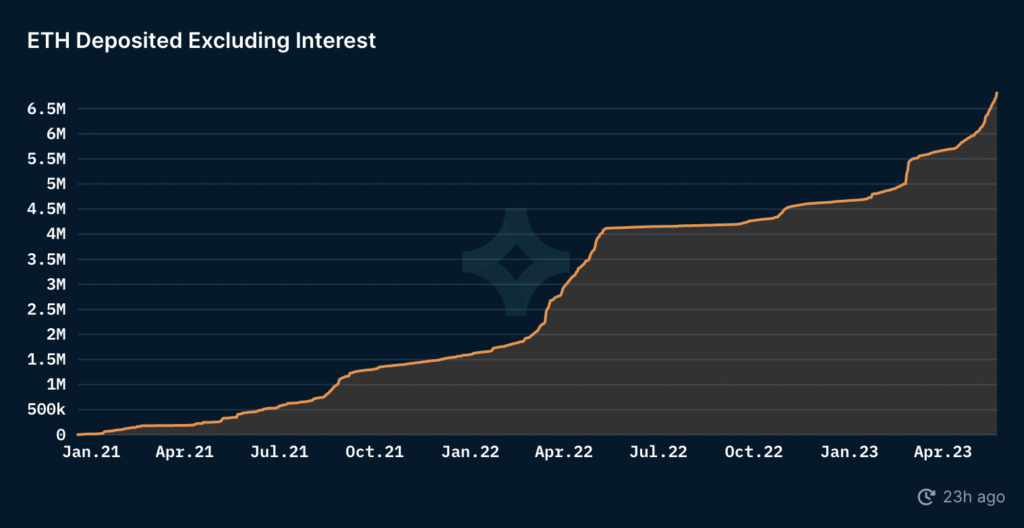

On the other hand, the amount of ETH deposited by various entities is equally if not larger. As shown in the image below, the total ETH deposited through Lido alone reached more than 6.2 million ETH, which is much larger than the withdrawal figure in the image above. This data disproves the bearish notion of Shapella. Shapella didn’t trigger a sell-off. Instead, it was a bullish catalyst that drove people to stake in Ethereum.

What About LSD Protocols?

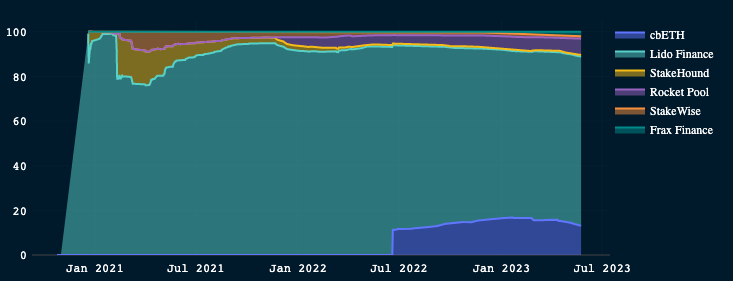

The LSD sector was one of the big winners of the Shapella update. As shown in the data above, Lido Finance dominates the Ethereum liquid staking sector. Lido’s closest competitor right now is CoinBase which doesn’t even make up 20% of the liquid staking market. The amount of staking on Lido even reaches 31.6% of the total ETH locked. Furthermore, Lido Finance managed to raise TVL of $12 billion dollars. This is the largest TVL figure in the crypto world. Since Shapella, Lido’s TVL has increased by about $600 million dollars and its deposit figure has exceeded 6.5 million ETH.

Lido V2 was successfully launched on May 15, 2023, and enabled the unstaking feature for all Lido users. This Lido update also seeks to improve the decentralization of Lido with router staking. With this, Lido can now support a wide variety of Ethereum node operators ranging from individuals to organizations. Lido's decentralization is crucial to reducing the risk of attacks because Lido dominates Ethereum’s staking sector.

The figure below shows how ETH on Lido has steadily increased, indicating increasing interest from Ethereum users. This figure continued to increase even after Lido enables the unstaking feature with Lido V2. Some analysts explain that the trend of increasing ETH staking numbers will continue as more people look to earn passive income. Shapella removes a big risk that users were previously worried about (not being able to withdraw ETH from staking). Not only Lido, but other liquid staking platforms such as Frax Finance, Rocketpool, and StakeWise have also seen an increase in ETH deposits since Shapella.

The Advent of LSDFI Protocols

Ethereum’s liquid staking sector is currently worth $18.3 billion dollars. This is the highest TVL value in the DeFi industry. With such a large market value, we are just waiting for protocol innovations that can take the majority of the market share. The latest trend that wants to capitalize on the LSD sector is LSDFI (LSD Finance). LSDFI is an application ecosystem that wants to utilize LSD tokens (called LST or liquid staking tokens) for DeFi. Basically, LSDFI allows you to use LSD tokens such as stETH Lido, ankrETH Ankr, and rETH Rocket Pool in DeFi activities such as yield farming and stablecoins.

Some LSDFI protocols that are already gaining attention from the crypto community on Twitter are Unsheth, Lybra Finance, Parallax Finance, 0xAcidDAO, and Agility LSD. The LSDFI sector seems to be going through an early growth stage where many protocols are emerging and the crypto community is just getting to know about them. Look out for an upcoming article about LSDFI on Pintu Academy!

Conclusion

Ethereum, the second largest crypto project after Bitcoin, underwent a major update called Shapella in April 2023. This update introduced an ‘unstaking’ feature that allows users to withdraw their staked Ethereum (ETH) assets whenever they want. This feature brings convenience and flexibility to Ethereum users and parallels other blockchains like Solana. Despite fears that this update would have a “sell the news” effect, data shows an increase in the number of ETH deposits exceeding the number of withdrawals. This indicates that the Shapella update was not a ‘sell-off’ trigger and is actually bullish for Ethereum.

The ‘liquid staking’ sector was one of the big winners from the update, with Lido Finance being the market leader, collecting $12 billion in TVL. The increase in ETH staking is expected to continue as more users look to earn passive income. Meanwhile, with the increase in staking activity, the LSDFI (LSD Finance) sector is beginning to emerge, utilizing LSD tokens (liquid staking tokens) for various DeFi activities. Protocols such as Unsheth, Lybra Finance, Parallax Finance, 0xAcidDAO, and Agility LSD are starting to gain attention, indicating an early growth stage in the sector.

References

- Nansen, “Shapella enabled ETH withdrawals for the first time Bears argued it would”, Twitter, accessed on 24 May 2023.

- The Ethereum Shanghai (Shapella) Upgrade Dashboard, Nansen, accessed on 24 May 2023.

- Kennan Mell, What’s Next For Ethereum After Its Shapella Upgrade? (ETH-USD), Seeking Alpha, accessed on 25 May 2023.

- Omkar Godbole, Number of Ether Staked Has Surged By 4.4 Million Since Shapella Upgrade, Coin Desk, accessed on 25 May 2023.

- Maheen Hernandez, Ethereum’s Silent Rise: Gaining Momentum after the Shapella Upgrade, The Currency Analytics, accessed on 25 May 2023.

- 0xJeff, “𝗟𝗶𝗾𝘂𝗶𝗱 𝗦𝘁𝗮𝗸𝗶𝗻𝗴 𝗗𝗲𝗿𝗶𝘃𝗮𝘁𝗶𝘃𝗲𝘀 (LSD) has proven itself to be the 𝗟𝗮𝗿𝗴𝗲𝘀𝘁 Crypto Sector w/ $𝟭𝟳.𝟴𝟳𝗯 TVL”, Twitter, accessed on 26 May 2023.

- Swellm, From Shanghai to LSDfi: A Twitter Space with Pendle Finance, Swell Network, accessed on 26 May 2023.