Equity investors have different characteristics, goals and analysis methods. Understanding the types of equity investors is important for both beginners and experienced investors, especially when constructing a portfolio according to risk profile and investment style.

Based on data from Investopedia as well as various global investment style studies, investors can be categorized according to strategy, activity and risk profile.

Article Summary:

📊 Ca tegories of Stock Investors: Investors can be categorized based on strategy(value, growth, dividend, momentum), activity (active or passive), and risk profile (conservative, moderate, aggressive). These classifications help in determining an investment approach that suits your goals and risk tolerance.

🔍 F undamental & Technical Analysis Approach: Value and growth investors generally use fundamental analysis such as P/E, PBV, ROE, and EPS, while momentum investors rely more on technical analysis that focuses on price trends, volume, and market indicators.

💰 Different Investment Styles: Value investors look for undervalued stocks, growth investors pursue fast growth, dividend investors focus on regular income, and momentum investors capitalize on short-term price movements. Each style offers different risks and potential returns.

⚖️ The Importance of Understanding Risk Profile: Knowing whether an investor is conservative, moderate or aggressive is critical to maintaining a consistent strategy. Risk profile affects stock selection, portfolio management and the ability to deal with market volatility.

Based on Investment Strategy

Equity investors can be categorized according to the strategic approach they use in selecting and managing portfolios. This approach is also often associated with the great figures in the investment world that modern investors look up to.

For example, value investing is synonymous with Warren Buffett and Benjamin Graham; growth investing is widely applied by figures such as Peter Lynch; income investing is popular among large fund managers such as John Templeton; while momentum investing is known through the academic work and practice of quantitative investors such as Cliff Asness and Richard Driehaus.

Some examples of investor types based on investor strategies include:

1. Value Investor

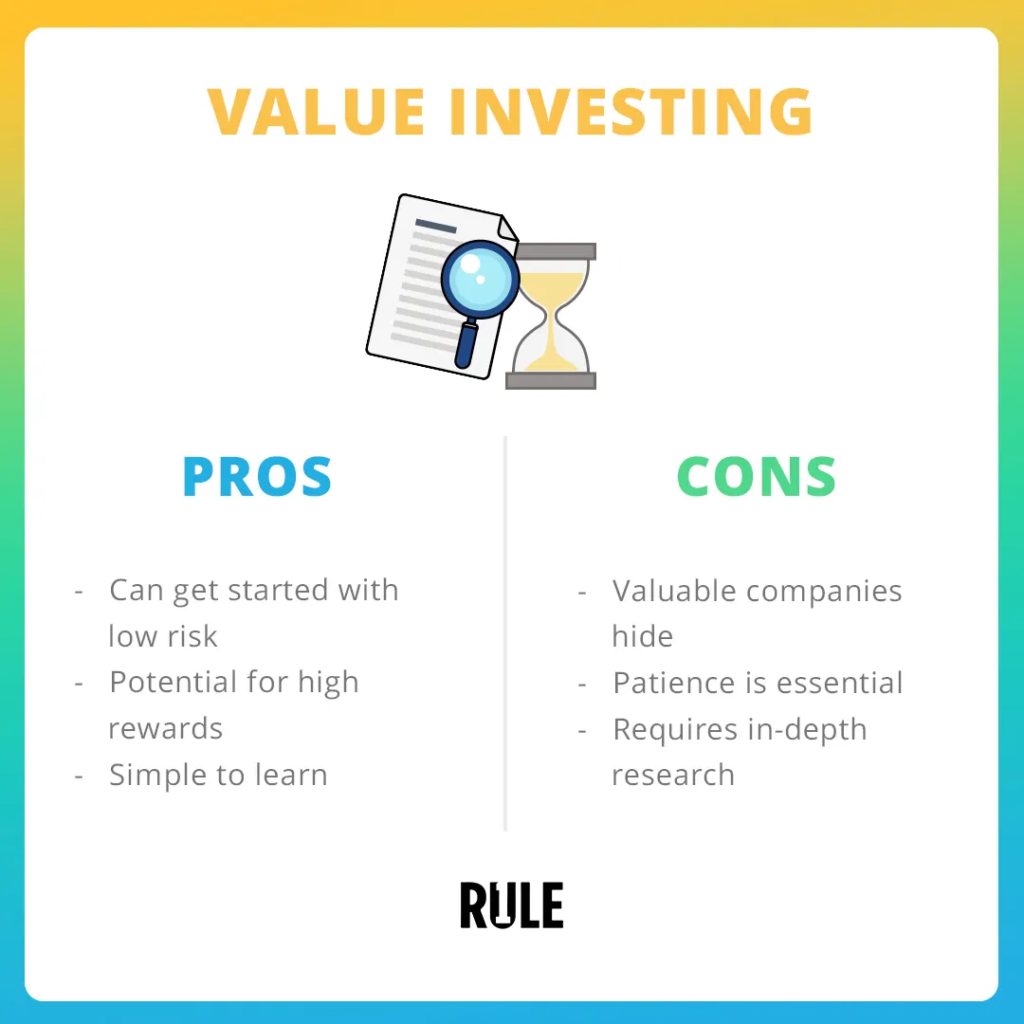

Value investing is an approach that focuses on stocks that are considered “cheaper” than their intrinsic value. Data from Investopedia explains that value investing is heavily influenced by the theories of Benjamin Graham and Warren Buffett, using the P/E (Price-to-Earnings) and PBV (Price-to-Book Value) metrics to identify undervalued stocks.

Value Investor traits:

- Select stocks with low P/E and low PBV compared to the industry average.

- Focus on long-term fundamentals, unaffected by short-term volatility.

- More conservative, pursuing a margin of safety.

Value Stock Example:

- Well-established utility, banking or industrial companies that have stable growth.

Value and growth stock investor types are often compared due to their different focus on fundamentals and growth potential.

2. Growth Investor

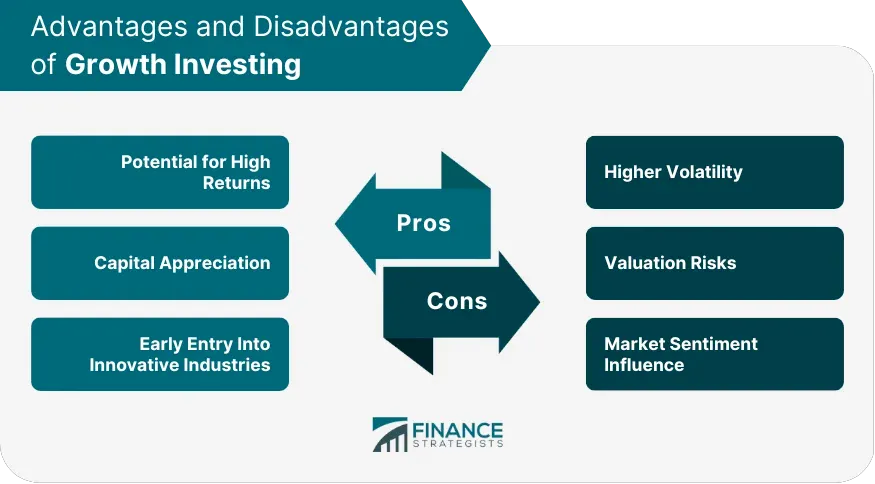

Growth investing focuses on companies that have high revenue and profit growth prospects. According to AngelOne, growth stocks usually have high valuations because the market expects strong business expansion.

Characteristics of Growth Investors:

- Focus on companies with high earnings and EPS growth.

- Doesn’t really mind a high P/E as it prioritizes future potential.

- Be more aggressive and ready to accept large price volatility.

Growth Stock Example:

- Tech companies, e-commerce, digital health, and other innovation sectors.

The difference between value investing and growth investing:

Value → search for “low price”.

Growth → pursuit of “high growth”.

3. Income Investor(Dividend Investor)

Income investors are the type of investors who prioritize regular passive income from dividends. They usually invest in large, stable companies that have a long track record of paying dividends, making them suitable for conservative investors, retirees, or large capital holders who need regular cash flow.

Characteristics of Dividend Investors:

- Select stocks with consistently highdividend yield.

- Focus on stable sectors such as telecommunications, consumer goods, energy, and banking.

- Prioritize regular cash flow over share price growth.

Within the spectrum of investment styles – value, growth, dividend – income investors focus on the stability of profit distribution, not the potential for aggressive appreciation.

4. Momentum Investor

Momentum investing capitalizes on price movements based on market trends. The Joyful Investors mentions that momentum investors buy stocks when prices are rising and sell when the trend is weakening.

Momentum Investor Characteristics:

- Rely on technical analysis and trend indicators.

- High-risk, high-reward; suitable for aggressive profiles.

- Focus on the short term – following breakout patterns or high volume.

By Activity

Grouping equity investors by activity reflects how frequently they execute transactions and the level of involvement in portfolio management. Some of them are:

5. Active Investor

Active investors are the type of investors who are directly involved in analyzing the market and execute transactions with a higher frequency than the traditional approach. They usually apply strategies such as market timing, technical analysis, and regular portfolio rebalancing to pursue short-term opportunities.

The primary goal of active investors is to earn alpha, i.e. returns that outperform the market, although this strategy requires time, in-depth research, and higher transaction costs.

6. Passive Investors

Passive investors choose to follow market performance without engaging in aggressive buying and selling activities. This approach generally focuses on a long-term strategy or buy and hold, utilizing instruments such as ETFs or stock indices that reflect overall market movements.

Because it is more stable and does not require intensive analysis, this type of investor is suitable for beginners as well as those with a conservative to moderate risk profile.

By Risk Profile of Equity Investors

The classification of investors based on risk profiles aims to understand the extent to which individuals are able to accept potential losses in the investment process. Some of them are:

7. Conservative Investor

Conservative investors place capital safety as a top priority, thus preferring low-risk instruments such as bluechip stocks, dividend stocks, and bonds. This approach aims to maintain portfolio stability from excessive market volatility. Therefore, conservative investors tend to avoid cyclical stocks or assets that have high volatility.

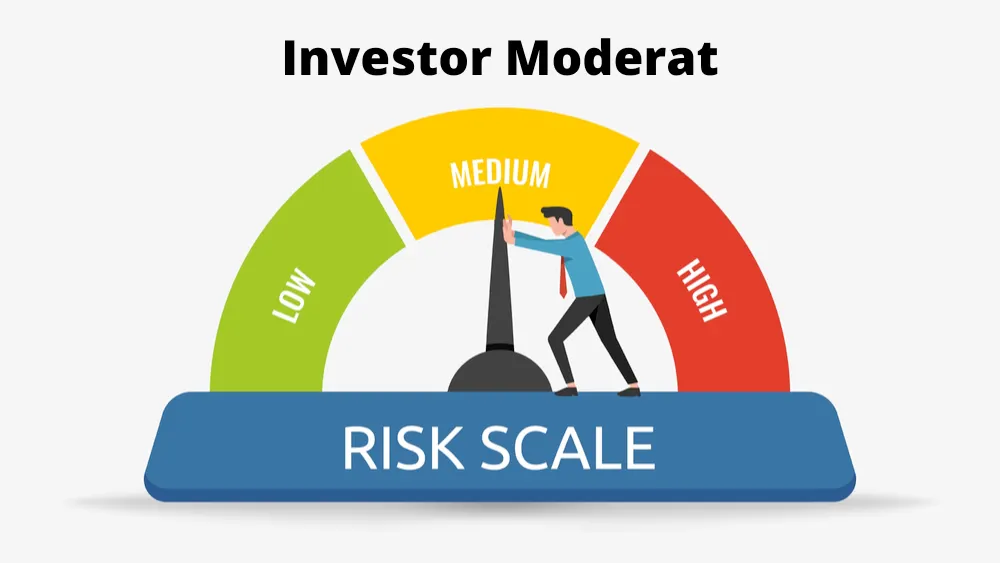

8. Moderate Investor

Moderate investors usually take a middle ground position, combining growth stocks and value stocks in their portfolios. They are willing to accept a moderate level of risk for the opportunity to earn higher returns than conservative investors. This profile is common among beginner investors who have understood the basics of the market and are starting to explore growth potential without taking extreme risks.

9. Aggressive Investor

Aggressive investors focus on fast growth opportunities by investing in high-risk stocks such as growth stocks, technology stocks, and small-caps. They pursue the potential for large gains through momentum trends and rapid price movements.

However, this approach also demands being prepared for significant fluctuations and potential short-term losses as part of a high-risk investment strategy.

Based on Analysis Objective and Approach

Classifying investors based on analytical approaches serves to understand the methods used in valuing stocks as well as determining a strategy that suits investment objectives. Some of them are:

10. Fundamental vs Technical Investor

Fundamental investors select stocks based on an in-depth analysis of the company’s financial condition, using metrics such as P/E, PBV, ROE, EPS, and earnings growth to identify undervalued or growth potential stocks. This approach is commonly used by value and growth investors who focus on long-term performance.

In contrast, technical investors assess stocks through price patterns, volume, and market indicators. They utilize trends and momentum movements to determine when to buy or sell, making it a popular approach among momentum investors and active traders.

Why is it important to know the types of stock investors?

Understanding the different types of stock investment styles allows investors to build a more disciplined and objective strategy. Some of the reasons include:

- Help determine strategies that fit the risk profile.

- Make it easy to choose the instrument and investment style (value, growth, dividend).

- Avoid impulsive decisions when the market is volatile.

- Assist in more consistent long-term portfolio management.

How to Buy Tokenized US Stocks on the Pintu App

The Pintu app now features Pintu tokenized US stocks investment, allowing local investors to buy global tech stocks such as Apple (AAPLX), Tesla (TSLAX), or NVIDIA (NVDAX) in the form of crypto tokens. These tokens represent fractional ownership of the actual shares, and can be transacted 24/7 on the blockchain.

To purchase, users simply need to download the Pintu app, complete KYC verification, and deposit funds in Rupiah. After that, open the menu to select the desired stock, and make a direct purchase in the form of crypto assets. The price follows the real-time stock market value and can be monitored through the app.

Conclusion

Understanding the types of equity investors is a fundamental step in building a targeted investment strategy that meets financial goals. By categorizing them based on investment strategy, activity, and risk profile, each investor can identify the tendencies, preferences, and analytical approaches that best align with their character and needs.

By recognizing where they fall on the spectrum of investment styles, investors can construct a more disciplined, rational and sustainable portfolio, increasing their chances of achieving optimal returns over the long term.

Reference

- Investopedia. Investor Definition. Accessed December 10, 2025.

- Investopedia. Institutional Investor. Accessed December 10, 2025.

- AngelOne. Types of Investors in the Stock Market. Accessed December 10, 2025.

- The Joyful Investors. The 4 Types of Investors in the Stock Market. Accessed December 10, 2025.