Trends or narratives are an important part of crypto market dynamics. Trends in the crypto world usually come from specific sectors or externally from technology trends. We saw this in early 2023 with the AI trend started by ChatGPT and the Liquid Staking Derivatives (LSD) platform before Ethereum’s Shapella update. Crypto trends change quickly and can happen simultaneously. Assets related to these trends usually experience a dramatic rise. In addition, there is always a winner from each trend that beats other assets within the sector. So, what will be the next crypto trend in 2023? How can you invest to follow this trend? This article will explain.

Article Summary

- 📈 The crypto market in 2023 is showing signs of recovery, with Bitcoin successfully climbing back to $30K and other sectors showing rapid growth.

- ⚖️ Three potential crypto trends for late 2023 are Ethereum’s L2 war, LSDFI platform competition, and Bitcoin ETFs. All three have the potential to trend in the final months of 2023 and into 2024.

- ⚙️ The Merge upgrade was a massive catalyst for the Ethereum ecosystem, driving the altcoin sector and giving a boost to L2 networks like Optimism and Arbitrum. The abundance of new L2 networks sparked a fierce war to become the dominant network in the sector.

- 💎 A new trend in the DeFi sector is LSDFI, a financial ecosystem that utilizes liquid staking infrastructure like Lido. Post Shapella, the number of ETH in staking increases dramatically and attracted investors to the liquid staking sector. The LSDFI ecosystem is experiencing rapid growth as many protocols look to dominate the sector.

- 🥇 BlackRock’s Bitcoin ETF proposal is a sign of massive institutional adoption. Despite strong criticism of the crypto industry from the US government, various other investment firms followed BlackRock’s lead and filed Bitcoin ETFs with the SEC.

Crypto Market Conditions

2023 has been an important year for the crypto industry. After a bear market of more than a full year, the crypto industry is showing signs of recovery. Bitcoin climbs back to pre-FTX crash price (>$20,000). As shown in the chart above, Bitcoin has climbed above the 200-day EMA line after staying below it for 2022. If we look at the history of price movements, Bitcoin is in a transition period between a bear market and a bull market.

In other sectors, rapid growth is taking place. Ethereum’s The Merge upgrade was a massive catalyst for the Ethereum ecosystem. The Merge is a strong driver for altcoin sectors on Ethereum such as layer-2, NFTs, and the LSD platform. In addition, narratives about AI and Hong Kong revitalized the crypto market in early 2023. The crypto industry is starting to show signs of life.

Three Potential Crypto Trends for Late 2023

Ethereum L2 Sector

Ethereum’s layer 2 sector is already a huge ecosystem in the crypto industry. All major crypto applications such as Curve and OpenSea have extended their applications to L2 networks such as Polygon. In this sector, Polygon (MATIC) is considered the leading network. Polygon’s partnerships with major brands such as Starbucks and Reddit mean that Polygon’s network processes 2.5 million transactions every day However, Polygon’s position as the L2 leader is starting to be threatened by some strong competitors.

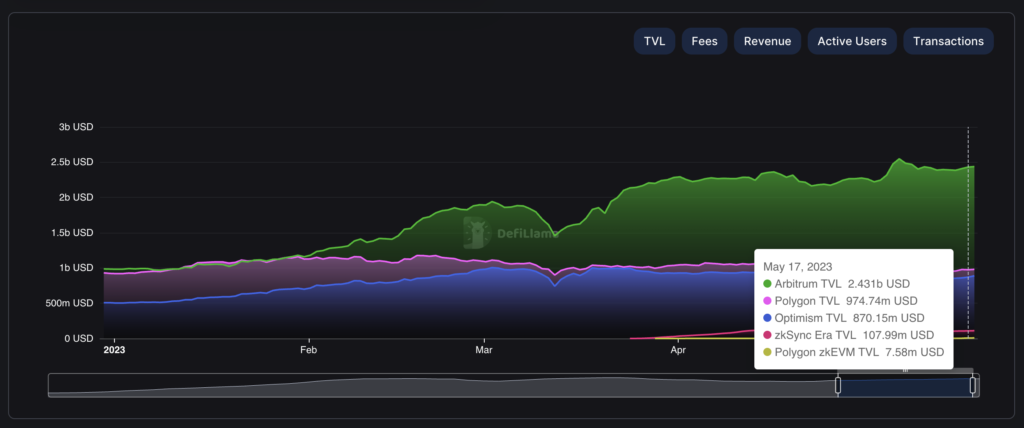

The competition for various protocols in Ethereum’s layer 2 sectors is very fierce. As shown in the figure above, the Total Funds Locked (TVL) figure shows that Arbitrum has overtaken Polygon and become the largest network in the L2 sector. Optimism also has a TVL value that is almost equal to Polygon. In fact, Polygon’s TVL had reached $10 billion dollars at the peak of the 2021 bull market. These two relatively new L2 networks are able to compete with Polygon.

Several new L2 networks are coming to this already crowded sector. Here are some L2 projects that will be released this year or early next year: Mantle Network (a project of BitDAO) and Fuel Network. In addition, several ZK (Zero-Knowledge) based L2 networks such as Scroll, zkSync, and STARKnet are in beta testing with a target mainnet in 2024.

The competition in this sector will be even more fierce near the end of 2023 with the Ethereum Dencun (Deneb-Cancun) upgrade. Within Dencun, there is EIP-4844 or Proto-Danksharding. Proto-Danksharding will reduce the transaction fees of all transactions from L2 rollup. So, the transaction fees of Optimism and Arbitrum are about to go even cheaper (estimation around 100-900%).

EIP-4844 could be the catalyst for the L2 crypto trend that will get stronger towards the end of 2023 and into 2024. EIP-4844 also introduces a way of validating ZKP transactions to the Ethereum network. In the near future, Polygon PoS will also move to Validium’s zkEVM technology with a target implementation of Q1 2024. If you’re a trader or investor, keep an eye on the prices of L2 assets and trends in the sector heading into Q4 2023.

LSDFI Protocol

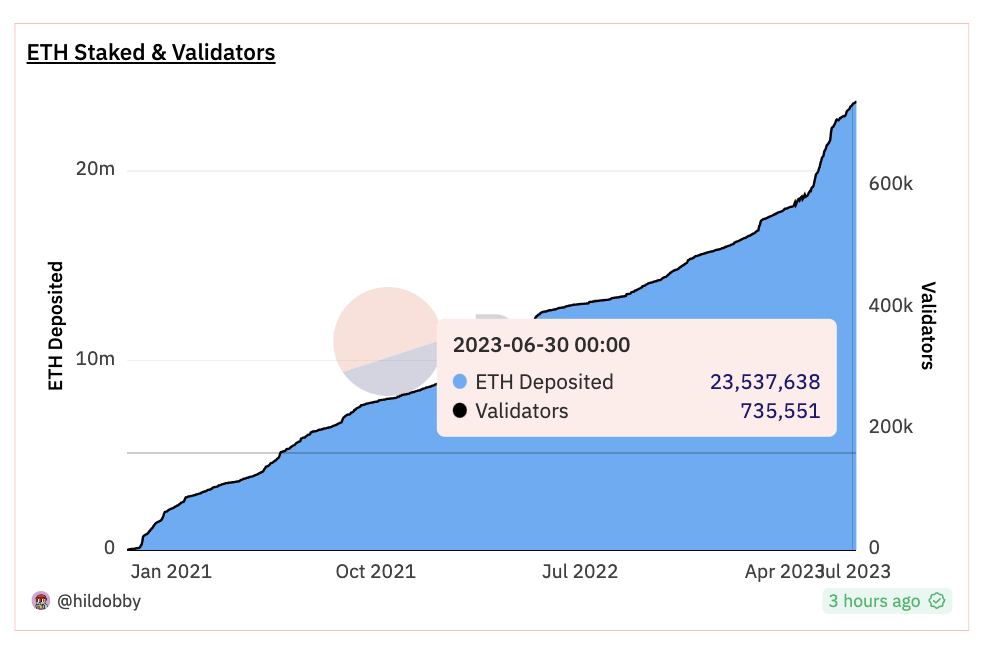

The Ethereum Shapella update was initially considered a bearish update for the Ethereum ecosystem. Shapella allows Ethereum users to withdraw ETH in staking. As shown in the image above, Shapella actually became a bullish moment for ETH. The number of staking assets increased dramatically. Currently, there are 23.6 million ETH stored in staking, about 19.87% of the total ETH supply.

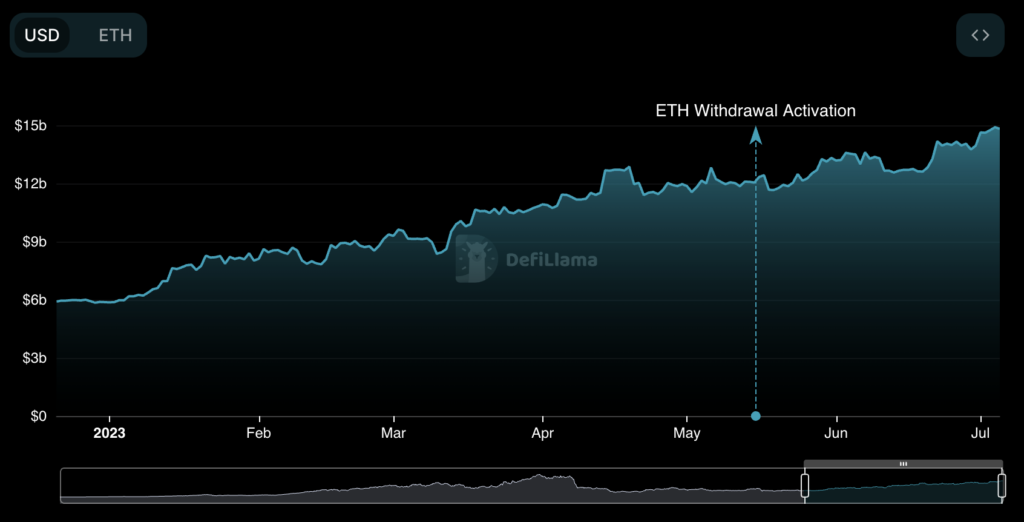

Shapella was a significant moment that gave birth to a new DeFi sector, LSDFI, a financial ecosystem that utilizes liquid staking infrastructure such as Lido. The advent of the LSDFI ecosystem is closely tied to the sector’s largest LSD platform, Lido Finance. As shown in the figure above, Lido’s TVL numbers have been steadily increasing since early 2023. In fact, Lido is currently the platform with the largest TVL in the crypto industry. The success of Lido shows the high interest of crypto investors in the liquid staking sector.

The LSD sector alone has reached $19.87 billion dollars. So, LSDFi platforms are trying to create a new ecosystem on top of the massive LSD infrastructure. The ecosystem has grown very rapidly in the months since Shapella.

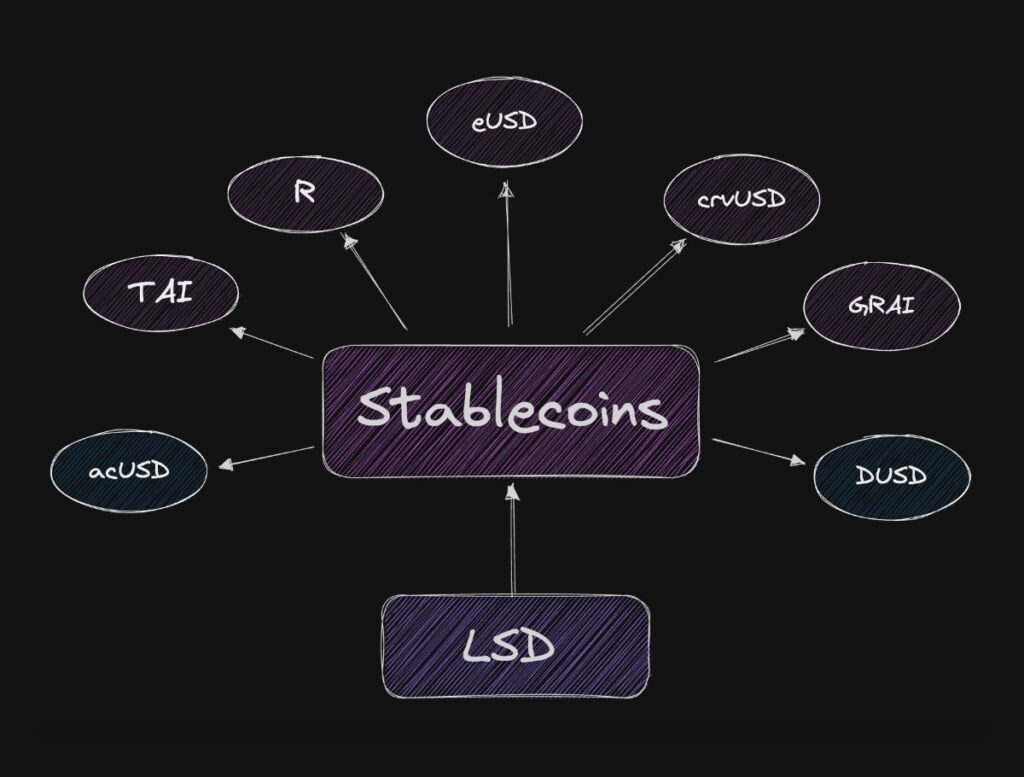

Currently, the LSDFi sector has a TVL of $688 million dollars with Lybra Finance taking a 47% market share. The majority of LSDFi platforms focus on utilizing LST (LSD token) to create stablecoins that can provide additional yield. This creates competition from multiple platforms with stablecoins. This triggers each protocol to innovate and create added value compared to other LSDFi platforms.

The LSDFi ecosystem itself doesn’t have a big catalyst like the L2 sector. However, new ecosystems usually have high growth potential in the crypto world, especially in the context of the Ethereum ecosystem. The LSDFi sector also doesn’t have a leader yet. Most of the potential catalysts of the LSDFi ecosystem currently come from protocols that are planning to launch major updates such as Pendle Finance V2.

BlackRock Bitcoin ETF

On June 15, 2023, BlackRock, the world’s largest asset management company, filed for a Bitcoin ETF (Exchange-Traded Fund) with the US Securities and Exchange Commission (SEC). In response to this news, Bitcoin rose more than 10% within a week. The ETF filing from BlackRock (which manages about $9 trillion dollars in funds) is a sign of massive interest from institutions.

Following Blackrock, Fidelity, WisdomTree, BitWise, and Valkyrie also files for BTC ETFs. Furthermore, these firms copy-paste Blackrock’s form. These investment firms believe in BlackRock’s track record of filing 576 ETFs with the SEC (only one failed).

What is ETF? An Exchange-Traded Fund or ETF is a type of index fund that trades like a stock on an exchange. The mechanism of an ETF is similar to an index fund in that it is a collective investment contract managed by an entity but officially listed on a stock exchange. With Bitcoin ETF, traditional financial institutions can buy BTC on a stock exchange platform.

The circumstance of ETF BlackRock’s ETF filing is unusual as it comes during a time of legal crackdown from the US government (especially the SEC). Furthermore, BlackRock and other investment firms have recently named Coinbase as an ETF partner. Coinbase was recently sued by the SEC on June 6 on the basis of operating an unregistered securities exchange. Therefore, the momentum of BlackRock’s filing and Coinbase’s writing as a partner is quite confusing to many.

However, one thing that is clear is that the news about BlackRock’s Bitcoin ETF had a huge influence on the price action of BTC. On June 30, 2023, Bitcoin fell as much as $1,000 dollars due to the news of BlackRock’s document rejection by the SEC. Apparently, this rejection was based on BlackRock not including the name of the exchange partner (which has now been specified as Coinbase).

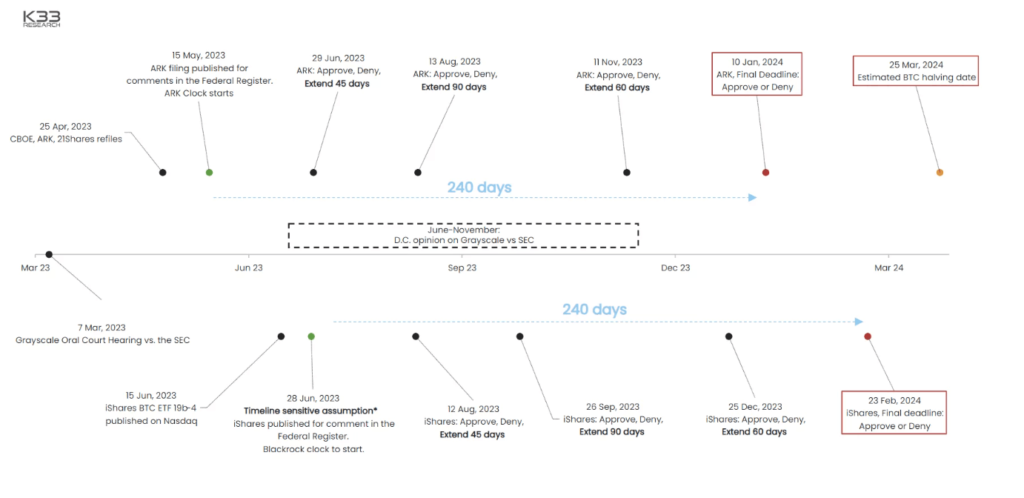

One interesting dynamic of this series of ETF filings is that they are all intertwined. The SEC will have to approve or reject all of them because the content of all the filings is the same (based on BlackRock documents). So, the ETF decision will be a catalyst for BTC prices. As in the image above, basically, the initial timeframe of ETF determination from the SEC is 45 days with an option to extend it.

BlackRock CEO Larry Fink recently issued a statement that "Bitcoin revolutionalizes finance and is an international asset."

The image above also shows that the final deadline for Bitcoin ETF is likely to be close to the Bitcoin halving (April 2024). The Bitcoin ETF decision has a 240-day timeframe. So, the decision to accept or reject BTC ETF is February 23, 2024. Bitcoin ETFs could potentially be a crypto trend throughout the end of 2023 until the announcement of acceptance or rejection by the SEC.

Conclusion

The AI trend triggered by ChatGPT and the Liquid Staking Derivatives (LSD) platform before Ethereum’s Shapella upgrade has been an important narrative in early 2023. The crypto market is showing signs of recovery with Bitcoin price climbing back to important levels. Additionally, sectors such as layer-2, NFTs, and LSD platforms are experiencing rapid growth.

Three potential crypto trends at the end of 2023 are the Ethereum L2 Sector War, LSDFI Protocol Competition, and Bitcoin ETF. Ethereum’s layer 2 sectors have become a huge ecosystem in the crypto industry, while the LSDFI sector has grown rapidly since the Shapella update. Lastly, the filing of the Bitcoin ETF by BlackRock and other firms will probably bring about a huge institutional adoption for BTC.

However, it should be noted that trends in the crypto world can change quickly, and investors should always keep an eye on market movements to maximize their returns. The trends mentioned above can give an idea of the future direction of the crypto market.

References

- The DeFi Saint, “The Present State of L2s, Edition #5”, Substack, accessed on 4 July 2023.

- @Moomsxxx, “LSDfi is where the next money will flow. #Binance has just released their LSDfi Report. 10 Insights you need to know”, Twitter, accessed on 5 July 2023.

- @UtilityChad, “Staked $ETH is going parabolic LSDfi projects are riding this wave, and you can too! Learn which protocols are capturing this growth 🧵”, Twitter, accessed on 5 July 2023.

- @evanpark99, ” 👀Blackrock and Fidelity filing for BTC spot ETFs ✍️UK writing crypto into law 💸 BTC price up There have been lots of positive headlines of global crypto adoption and regulatory progress in the last few weeks”, accessed on 6 July 2023.