The crypto market started poorly since the turn of the year. Bitcoin had a short rally to $107k from $93k but experienced a huge -15% drawdown in the second week of January. Trump’s inauguration, subsequent memecoin launch, and sudden ruthless tariffs policy contributed to extreme volatility. What was thought to be the most bullish quarter for crypto disappointed many people, especially altcoin investors.

Key Takeaways

- Bitcoin’s Resilience in Q1: Despite early-year volatility and a significant drawdown, historical trends show that Q1 is a bullish period for Bitcoin in a bull market, often setting the stage for positive returns.

- Altcoin Consolidation: After aggressive selling, altcoins are finding stability with many assets consolidating around previous lows, indicating potential for a rebound as market conditions improve.

- Catalyst from Project Launches and Updates: Q1 2025 is packed with major events, including token launches, mainnet releases, testnet rollouts, and crucial network upgrades (e.g., Ethereum’s Pectra), which are expected to drive market interest.

- Sustained Growth in the AI Sector: The AI and AI agent sectors continue to perform strongly, with innovative projects and significant updates—like Bittensor’s dTAO upgrade—adding new momentum to the sector.

4 Reasons Q1 2025 is Still Bullish for Crypto

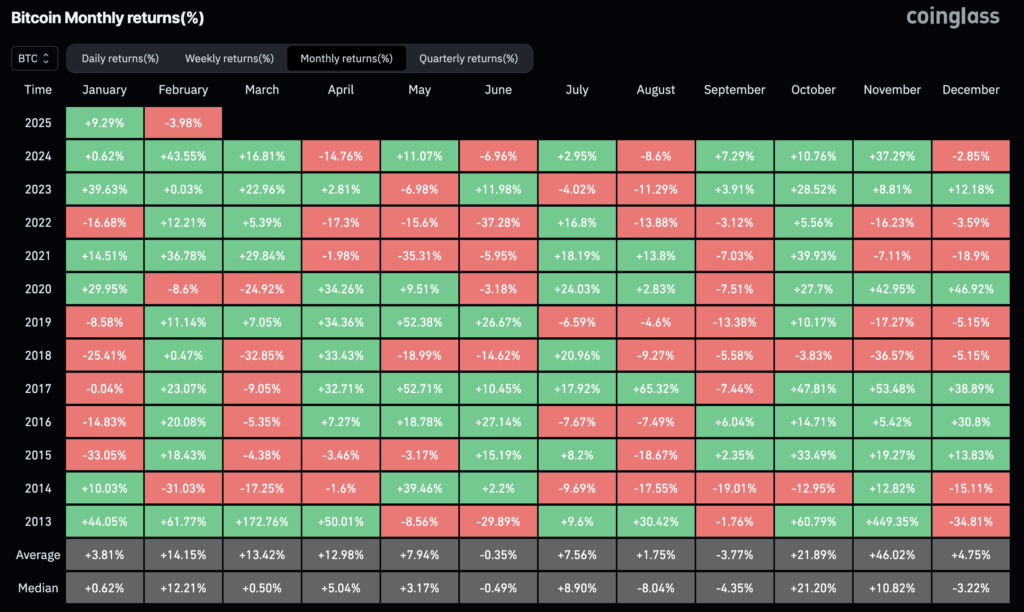

1. Bitcoin Always Gives Positive Returns in a Bull Market Q1

Q1 has always been a bullish quarter for Bitcoin alongside Q4. This is especially true in a bull market. This is why many people are surprised by the current price action of Bitcoin and altcoins. Since the start of the year, Bitcoin has been very volatile, with swings between $106k and $94k. In the altcoin land, most assets are bleeding heavily as attention returns to BTC.

The nuke in altcoins can be explained by the Bitcoin Dominance chart rising by 10% since the start of 2025. Unlike the thousands of new altcoin launches, there is only one BTC and that helps with liquidity going into one asset. It also helps that more and more countries and states are looking into Bitcoin as a reserve asset (such as Czech).

Lastly, the chart above shows how February is a good month for BTC. In all previous bull markets, February is always green, similar to October. This trader argues that we will see the same seasonality as in October last year. Last October, Bitcoin suffered a drawdown when people called for “Uptober”. However, it pumped into the 2nd week of October and into the end of Q4 2024.

2. Breathing Room for Altcoins

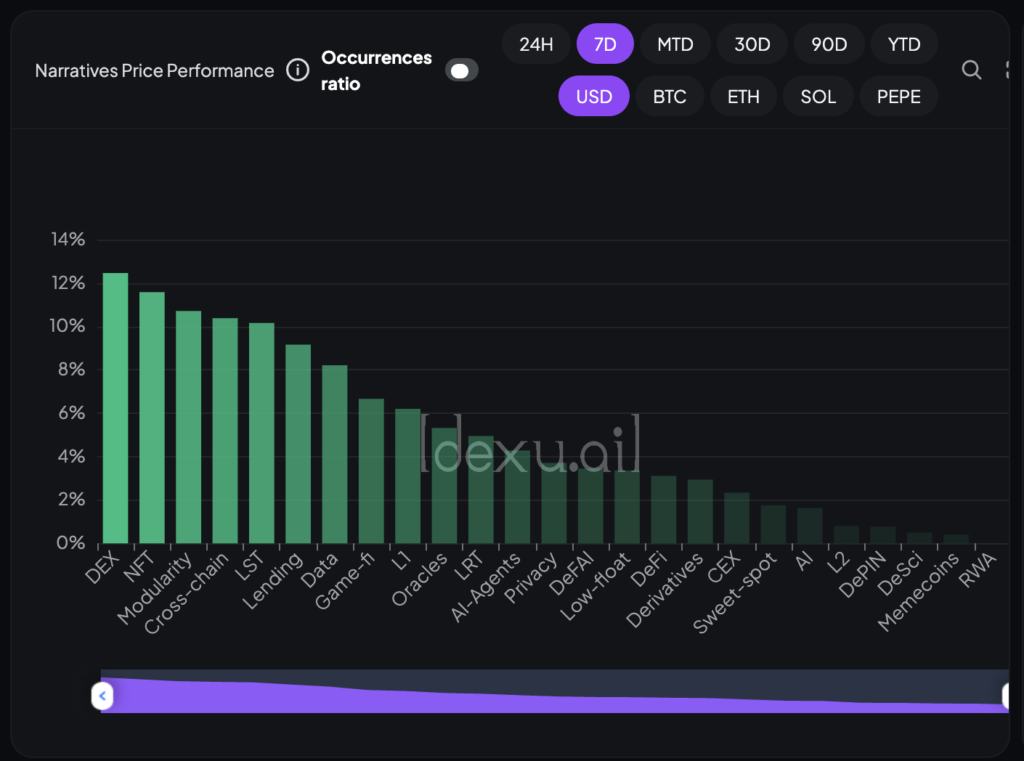

After a very aggressive selling phase since mid-January 2025, the altcoin sector finally has breathing room. Most altcoins no longer nuke every day and they are consolidating around their previous lows (such as SOL above). Altcoin no longer nukes -30% on every bearish news. Furthermore, some sectors are recovering faster than others.

As seen above, most sectors have been in the green for the past week (February 10-14). Surprisingly, DEX narratives lead the pack with CAKE pumping by 118% from the Binance Chain narrative. Other things to note are that the new launches such as LAYER and BERA also stopped dumping after instantly nuking on launch.

Furthermore, the OTHERS/BTC chart and Bitcoin dominance chart are moving in each other’s opposite direction—Others/BTC are charts showing the movement of altcoins outside of the top 10 against Bitcoin. The dominance chart has been falling to around 60% while the OTHERS/BTC chart has risen 12% in the past week. This is a good sign for a relief move in most altcoins.

3. Project Launches and Updates

Q1 2025 is set to be a big quarter for many crypto projects launching their mainnet and tokens. As seen below, many projects are looking for their TGE (Token Generation Event) in this quarter. In February alone, Story Protocol, Solayer, and Berachain already launched their tokens. We also have upcoming launches from hyped-up projects such as Kaito, Nillion, Karak, MilkyWay, Linea, and Initia.

Besides projects launching their tokens, we also have the long-awaited public testnet of MegaETH and Monad. Both of these projects have a strong community of users waiting to test the ecosystem. Along with the Pudgy-backed Abstract chain, all three are almost guaranteed to do an airdrop to their users.

Lastly, Ethereum plans to implement the Pectra (Prague-Electra) upgrade in Q1 2025. Pectra will implement an Account Abstraction mechanism by upgrading every EOA account in Ethereum to smart wallets. Besides Ethereum, big projects such as Jupiter, UniSwap, and Bittensor also have important catalysts in Q1 2025.

4. The AI Sector Will Continue to Perform

The AI sector has shown its staying power. With the birth of AI agents and DeFAI, it is more alive than ever. The spotlight in the last 2 months has been on AI agents and DeFAI while older AI projects such as GRASS, FET, and TAO take the backseat. AI16Z, ARC, and AVA once again take the lead in AI sector performance. However, DEAI, GRASS, and TAO also have recovered from their downtrend.

However, one project that can shift attention back to the AI sector is Bittensor. On February 14, Tao will implement the biggest update to its tokenomics with the dTAO upgrade. The dTAO upgrade revamps TAO staking mechanism and introduces a subnet-level staking with the dTAO token. Furthermore, the dTAO value will fluctuate according to each subnet’s performance and popularity, introducing a speculative aspect to TAO.

In the AI agent sector, Virtuals’ competitor, Arc Rig, also launched an AI agent launchpad similar to Virtuals. This makes Arc one of Virtual’s main competitors. Additionally, Virtuals has only recently expanded into the Solana ecosystem a few weeks ago–albeit with lower volumes than on Base.

Conclusion

While the early part of the year has been challenging, the underlying fundamentals and upcoming developments point to a promising Q1 2025 for the crypto market. Bitcoin’s historical performance in Q1, combined with a consolidation phase in altcoins, a surge in innovative project launches, and robust activity in the AI sector, suggest that the market is positioning itself for a bullish Q1 turnaround. Investors should keep an eye on these key areas as indicators of a broader market recovery.

Read More

- What Are AI Agents in Crypto?

- Crypto Narratives and Catalysts for 2025

- AI Agent Analysis: A Guide Based on Market Trends and Data

References

- “Grayscale Research Insights: Crypto Sectors in Q1 2025”, Grayscale, accessed on 11 February 2025.

- Grant, “The blocmates 2025 Thesis”, Blocmates, accessed on 11 February 2025.

- S4mmyeth, “The Agentic Future: AI Agent Weekly Analysis”, Substack, accessed on 13 February 2025.

- “dTAO Introduction”, Taostats, accessed on 14 February 2025.