The crypto bull market is a period where cryptocurrencies are in high demand and undergo exponential growth. This short-lived market phenomenon can be a life-changing opportunity for traders and investors. However, most market participants will leave the bull market with marginal gains or even a loss. It is important for you to utilize the best strategies that suit your strengths and weaknesses as an investor. Here are 5 recipes for success in the bull market.

Article Summary

- 💵 Timing the Crypto Bull Market: The crypto bull market is a brief period, lasting about 1 to 2 years. Entering early can significantly boost your profits, making the difference between moderate returns and exponential growth.

- ⚖️ Portfolio Diversification: Organize your portfolio into categories to balance long-term investments and trend-based trades. This approach helps manage risk and reduces the impact of FOMO, allowing you to take calculated risks.

- 📈 Focus on Winning Sectors: Prioritize sectors with strong performance, such as memecoins, AI, and L1 blockchains. Avoid frequently switching between sectors to prevent unnecessary losses.

- ⚠️ Manage Risk and Position Sizes: Use effective risk management strategies like stop-losses and appropriate position sizing based on your conviction. This helps safeguard your portfolio from significant losses and ensures smart capital allocation.

The Crypto Bull Market is Short

The crypto bull market is a highly anticipated period in which most cryptocurrencies significantly reprice higher. On average, the crypto bull market only lasts around 1 to 2 years. This is why it is important to choose the best strategy to take advantage of this short period. Additionally, the bull market only happens every 4 years, following Bitcoin’s halving cycle.

Additionally, the first and second years of the bull market played out very differently. For example, if you enter SOL in early 2023 by now you will be up more than 2,000%. If you enter in early 2024, that profit turns into ‘only’ 100%. This shows how being early in crypto can be the difference between a 2X and a 20x.

This diminishing return in the bull market also applies to sectors, not just individual assets. When a new sector formed, the risk/return ratio in the early days would have been skewed towards more gain. However, as the trend solidified itself in the market, the risk started to become bigger.

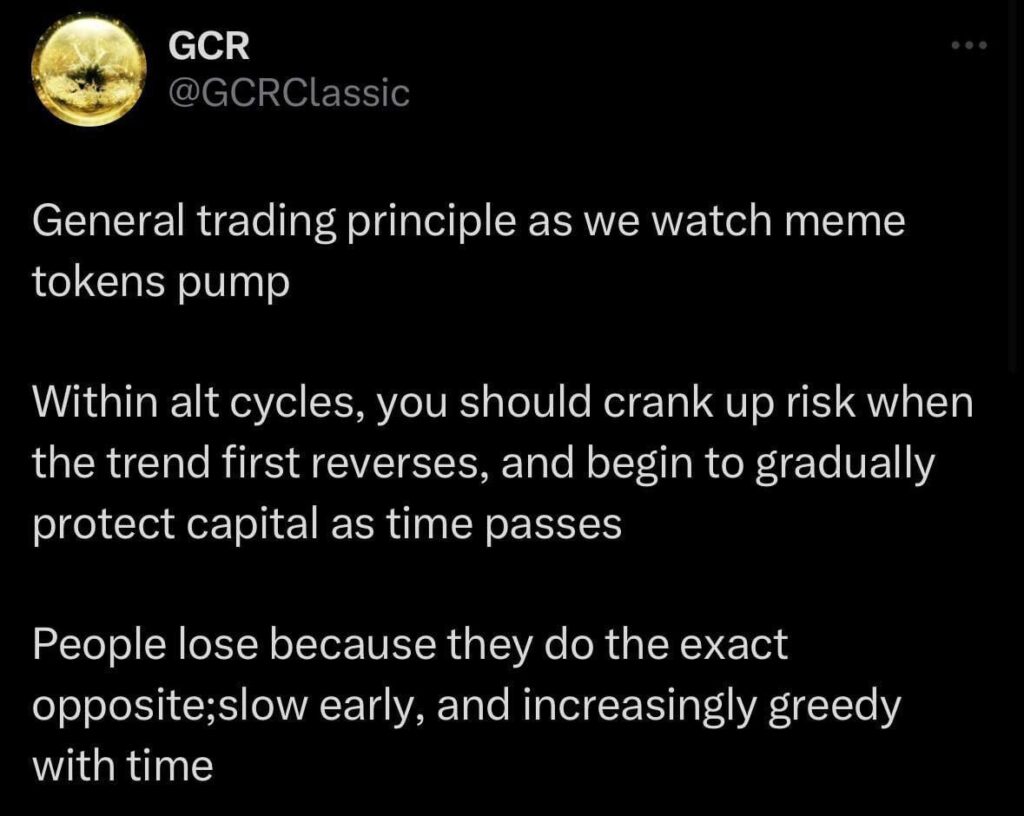

The general rule of thumb with trends is to increase your risk early on and gradually reduce it. This also applies to the general crypto market. If we go back to historical data, the top of the cycle will happen in 2025. As we move closer to the top, we should be very cautious when picking altcoins and opening positions.

5 Recipes For the Bull Market

1. Categorizing Your Portofolio

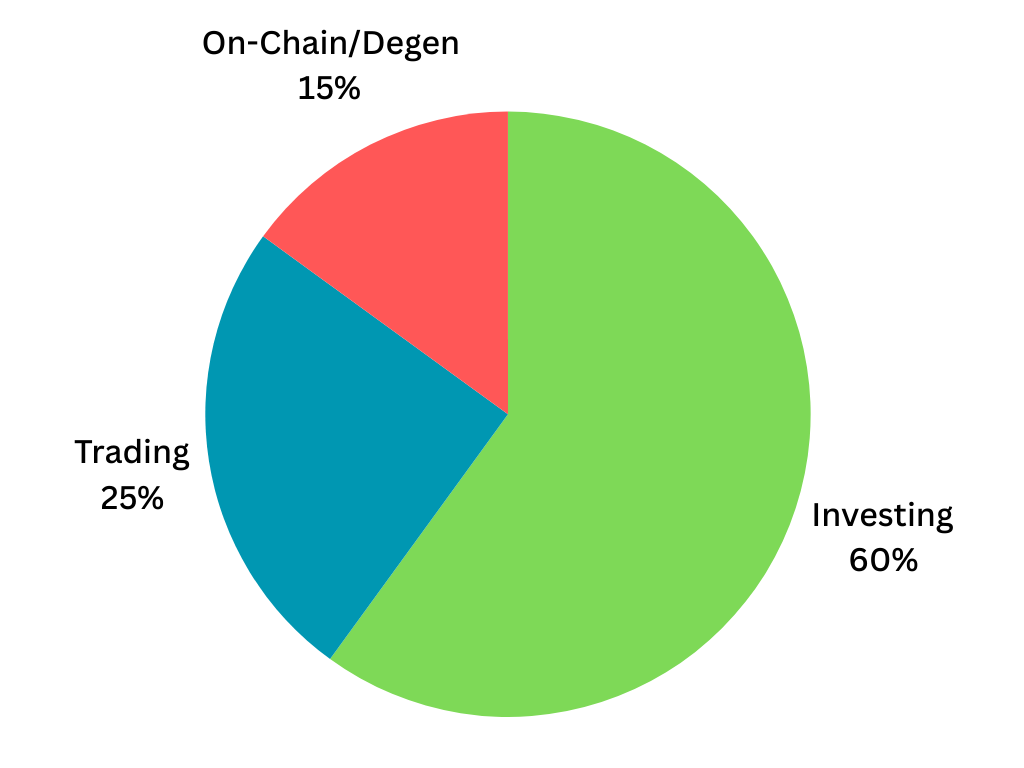

Dividing up your portfolio into 3 distinct categories is one of the best strategies for beginners. This will help with people constantly feeling FOMO. By categorizing our portfolio, we are also creating different mindsets for each category.

For example, BTC and SOL are in your investing portfolio, which means we are buying for the long term (1 to 3 years). This will be the do-not-touch and buy-only part of our assets. Later on, we will need to have a proper profit-taking strategy to sell our investment assets slowly—you can also leave it as a permanent part of your investment portfolio.

In the strategy above, we leave 40% of our portfolio for chasing trends and ‘satiating’ our FOMO. You can also reduce it to 25 or 30% if you think it is too risky. However, if you are confident with your trading on and off-chain, this 40% will probably outperform other parts of your portfolio.

Onchain trading is filled with many high-risk, high-return assets, such as ZEREBRO, MOODENG, GOAT, and VIRTUAL. These are low to mid-cap cryptocurrencies with a high potential return that comes with equally high volatility.

2. Choosing the Right Sector

Every year, thousands of projects and cryptocurrencies are created. This leads to the dilution of value and attention for the community. If you only need to pay attention to around 5-10 assets and 3 narratives last cycle, now you need to watch double that amount.

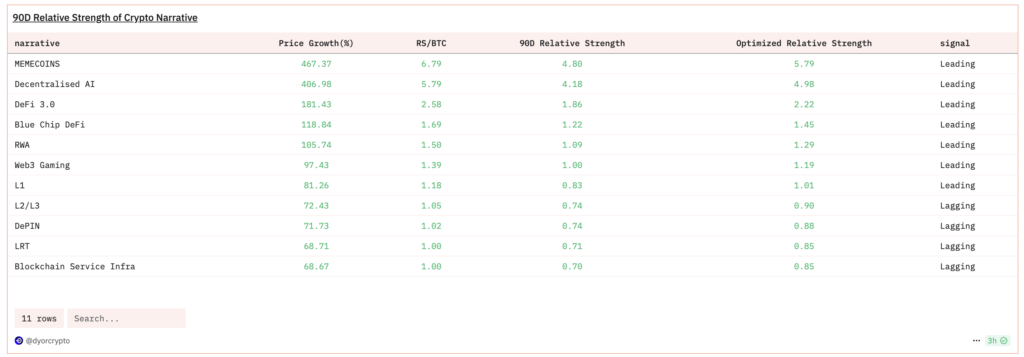

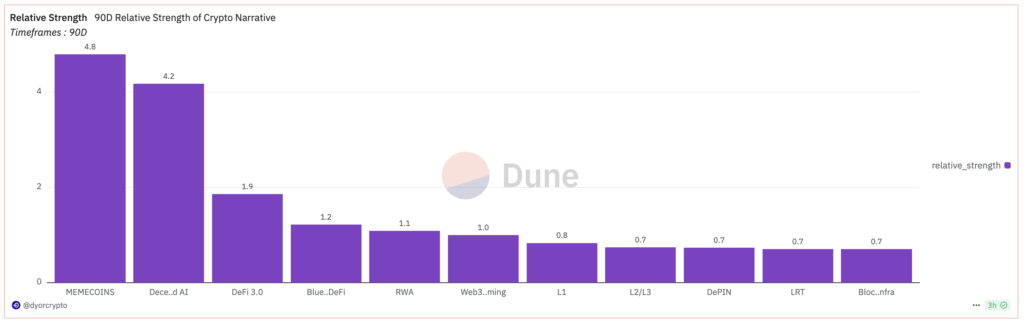

Trends and narratives move very quickly. Attention and mindshare have become precious resources. As can be seen above, for the past 90 days, memecoin has been at the top for price growth and relative strength. Memecoin is the undisputed top sector in this bull market cycle.

Do not rotate too often between various sectors. You will be punished if you rotate too late to a narrative.

Although every sector will get its time somewhere in the bull market, it is better to pick outperformers. Memecoins aren’t always at the top and will always need a cool-off period. However, as has been shown time and time again, it will always outperform other assets when the market is green.

Several outperforming sectors in the past year: Memecoins, AI, RWA, and L1 blockchains.

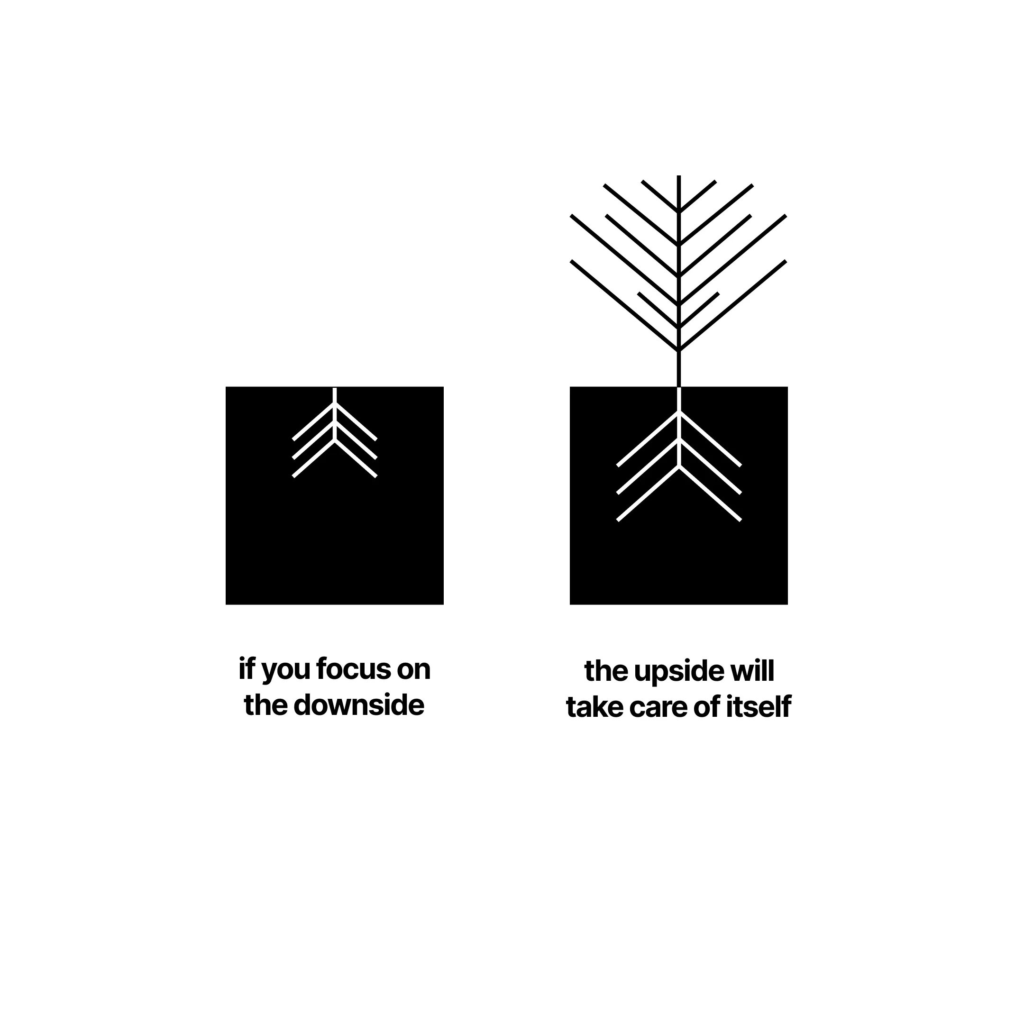

3. Minimizing Downside Risk

The bull market doesn’t mean that everything goes up in a straight line. For example, more than $1.5 billion were liquidated on 9 December as BTC stumbled to around $94k. These events are very common as the market usually resets itself by punishing late entries during a big move.

So, minimizing downside risk is the most important thing to do. Do not touch futures if you are not confident with your trading skills. If you do, always use a stop loss above your liquidation price.

For spot trades, set a maximum loss tolerance based on your conviction. For example:

- Low conviction – Max Loss = 10%

- Normal Conviction – Max Loss = 15%

- High Conviction – Max Loss = 30%

- Ultra High Conviction – Max Loss = 50%

Minimizing risk and potential loss on each trade ensures you are never caught with a 60% loss on a low-conviction trade. Lastly, as the bull market progresses, you should slowly switch to high-quality assets to prevent a huge drawdown from Bitcoin reaching its cycle top.

Zhu Su, one of 3AC’s founders, ironically said this: “Those who do not manage their risk will have the market manage it for them.” He eventually experienced this firsthand.

4. Sizing Correctly

Sizing refers to the size of your positions on an asset. Most people on crypto have experienced the pain of only entering $50 into an asset that goes 10x. Then, when you do size in on an asset, it only moves 20%. So, the problem with portfolio sizing is a pain many crypto participants know very well.

Similar to downside risk, sizing your position should go hand in hand with your conviction. Taking a 60% loss on a $50 trade is better than tolerating a 20% loss from a $1k low-conviction position.

Most people make a mistake in that they size in big on low-conviction/gambling assets based on trends. On the flip side, they enter a small position on the leaders because “the market cap is too big”. This often happens when people FOMO into a new trend thinking that smaller cap assets always run big.

The golden rule on how to play a narrative (according to the legendary trader GCR): Size in early when narratives shift, reduce as it gains mainstream adoption in the crypto community.

5. Profit Taking Strategy

Most people go into the crypto market without a profit-taking strategy. As a result, they became ‘bagholders’ of assets and went with their profit to the bear market. These people become exit liquidity for more experienced traders and investors. In this scenario, unrealized profit eventually turns into unrealized losses.

As the bull market rages on, undisciplined traders will be disciplined by the market. Many people will roundtrip their thousands of dollars in profit. So, a proper profit-taking strategy is important if you want to survive in the bull market.

For example, you buy a coin at a 5 million market cap and it goes to 10 million, you sell 10%, at 20m you sell another 10%, and so on. A more aggressive profit-taking strategy would be to immediately sell your initial capital at 100% profit and let the rest run. However, if you sell your high-conviction asset too early, you will miss the potential upside if it keeps going up.

You can also periodically take profit on certain market caps. For example, you will sell half of your position when your asset reaches 1 billion and will periodically sell the rest every 1 billion market cap.

The most important thing about a profit-taking strategy is that you stick to it. As previously said, if you don’t manage your risks, the market will manage them for you. Setting unrealistic targets is a sure way to become bagholders and roundtrip all your profit.

Conclusion

Navigating a crypto bull market requires strategic planning, disciplined execution, and risk management. By understanding the short-lived nature of the bull cycle, diversifying portfolios, focusing on strong sectors, and applying sound risk and profit-taking strategies, investors can maximize their gains while minimizing potential losses. Combining all of these and consistency in implementing them can make the difference between a marginal gain and a life-changing profit.

Buy Cryptocurrencies on Pintu

Looking to invest in cryptocurrencies? No worries, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily at Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Don’t forget to read Pintu Academy articles. All Pintu Academy articles are made for educational purposes, not financial advice.

References

- @0xENAS, “Crypto For Dummies (2024 Edition)”, X, accessed on 9 December 2024.

- @D_gilz, “David’s short guide to making money in bull markets and not blowing yourself up”, X, accessed on 10 December 2024.

- @nobrainflip, “Strategy for Bullrun”, X, accessed on 10 December 2024.

- @damskotrades, “5 Tips to scale in”, X, accessed on 11 December 2024.

- @0xtexashedge, “24 Months into the bull market,” X, accessed on 11 December 2024.

- @ahboyash, “Final innings of the cycle,” X, accessed on 12 December 2024.