The crypto market entered a bull market phase at the end of 2023 and the beginning of 2024. Bitcoin and the majority of altcoins experienced significant price increases. However, market conditions reversed in the second quarter of 2024, especially for the altcoin sector. Bull and bear markets are natural cycles in the crypto industry. They are natural processes where the flow of funds shifts from long-term to short-term investors and vice versa.

The rapid cycle forces crypto investors and traders to adapt to rapidly changing market conditions. Investors who invest with a bull market strategy in a beal market will fail to make the best of the market and vice versa. Therefore, you need to adjust your strategy and prepare for the current market conditions. So, what do you need to prepare for the next crypto bull market? This article will give you a guide for the upcoming crypto bull market.

Article Summary

- 🐂 🐻 Bull and bear markets are natural cycles in the crypto industry. In the crypto world, these cycles happen faster than in traditional asset markets. Investors and traders need to adapt quickly to these changes.

- ⚙️ In the fourth quarter of 2023 and the first quarter of 2024, the crypto market showed a significant recovery, as seen in the growing prices of Bitcoin and altcoins.

- 🧠 Important things to prepare for a bull market include preparing capital, making a list of cryptocurrencies to buy, having the right mindset, determining investment strategies, and risk management.

- ⚠️ In addition to strategy, risk management is very important in the crypto market. Every investor should know their risk tolerance and plan the right steps if market conditions change.

Why We Should Prepare for the Bull Market

The crypto market demonstrated an exceptional recovery in the fourth quarter of 2024 and the first quarter of 2024. In October 2023, Bitcoin rallied from $27,500 to a new all-time high of $73,738 in mid-March 2024. This means BTC experienced a 168% increase. Various assets in the altcoin sector also experienced increases of over 100% during the same period.

However, after this period, altcoin prices plummeted. Many altcoins corrected by 50-75% from their peak prices. This condition raised concerns that the bull market was over and the market had entered a bear market phase. At the same time, although Bitcoin was also corrected, it was still able to maintain a range of $57,000 to $65,000. Bitcoin’s condition provided optimism that the market had not yet shifted to a bear market.

Moreover, the following four charts show that the bull market's peak has not yet occurred. Thus, the possibility of the crypto market entering a bull market phase is still wide open.

So what if there is a possibility of a bull market in the near future? How should we prepare for it?

Most investors who haven’t experienced a full cycle of bear and bull markets usually underestimate the adaptation required to be successful in two different market conditions. It is common to be bearish at the beginning of a bull market phase due to the fear of a bear market while still feeling bullish at the beginning of a bear market phase due to the euphoria of a bull market. If this happens, we will likely incur losses.

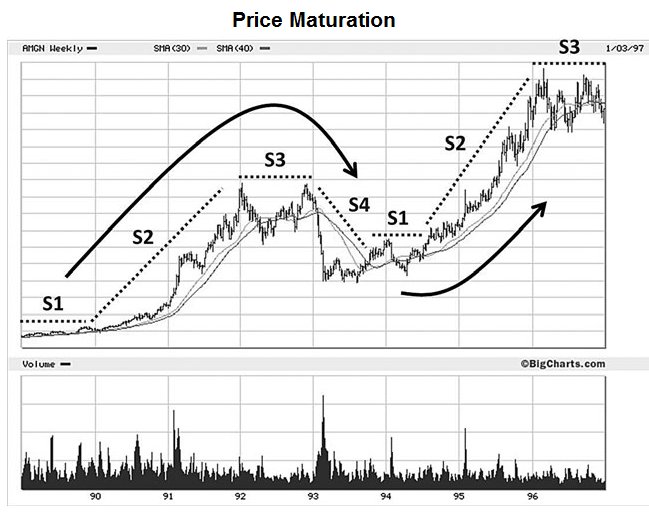

Therefore, experienced investors usually have a long-term plan in place, just like in the picture above. This long-term strategy will be useful so that we have our own timeframe and a set of tactics to execute our strategy.

Also, bull markets usually occur within a short time span so you need to have a plan in place in order to benefit. Investors and traders who don’t prepare for bull runs usually run the risk of buying the top. So, here are five things you should prepare for the next bull market.

5 Things You Should Prepare for a Bull Market

1. Prepare and Collect Capital

One of the most important things to prepare for a bull market is capital or money. Imagine if, in the middle of a bull market, you run out of money to buy the assets you want to buy. Many experienced traders argue that bear markets are not the right time to trade because your potential for loss is very high. Beginner investors and traders are better off preparing and saving capital to use when the bull market starts.

Look for altcoins that are in the "S1" stage from the picture above because this is the accumulation phase before the price goes up dramatically.

If you are already familiar with and confident in the crypto world, you can save capital by staking crypto assets. For example, you are a long-term ETH investor so you keep the majority of your assets in ETH staking. Another alternative is to use the earn Pintu feature to compound assets.

Basically, you should prepare your money for a bull market because this market condition will open up a lot of profit potential for prepared investors. The current market phase, which is still in a transition period, is the perfect time to accumulate capital.

2. Create a wishlist of Assets you want to buy

In a bull market, trends and narratives usually come and go. This can be seen from what happened in the 2021 bull market. At the time, alternative L1 trends such as Solana and Fantom saw SOL and FTM rise by over 1000%. The Metaverse trend also led to a drastic appreciation for assets like SAND, AXIE, and MANA. Both trends did not come out of the blue. Experienced investors saw their potential before they reached mainstream levels.

You can also read Pintu Academy’s article on 3 potential trends for the second half of 2023.

The trends that will be popular in the next bull market may already exist now, it’s just that they’re not that popular yet. So, the best thing you can do now is to put together a basket of assets that you want to buy for each category. Make sure you separate the leading assets (e.g. LDO for the LSD category) and others with great potential.

Also, creating a wishlist here is closely related to doing research for fundamentals, potential trends, and a better understanding of market dynamics. Investors who will succeed in a bull market are those who understand the dynamics of the crypto market or understand how to do technical analysis to find good price charts.

3. Bull Market Mindset

One of the biggest mistakes crypto investors and traders make is not adapting quickly enough to market conditions. This problem is usually faced by investors who have experienced bear market trauma where they suffered huge losses from the bear market.

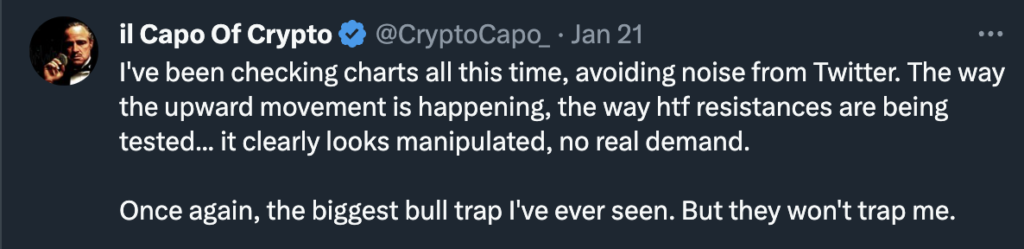

In the early phase of a bull market, this problem will be apparent as some investors will have a negative perspective on every price increase. The tweet above is often discussed by the crypto community as an example of negative bias that doesn’t match market sentiment. While the price of Bitcoin continued to rise, the account above held on to its negative sentiment and believed the price would fall again. Two months after the tweet, Bitcoin has risen 100% from a low of $15,500.

Therefore, a good investor will have a bias that matches the market sentiment. Bull markets and bear markets require different mindsets and principles. Some important bull market principles to remember:

- Buy the dip: In a bear market, the buy-the-dip strategy is very risky as you could be buying an asset that continues to decline. However, this strategy is very useful in a bull market as the price decline is usually temporary.

- Follow the trend: There is a saying that the trend is your friend and never invest against the trend. In a bull market, invest in assets you strongly believe in and sell at the point the market starts to turn bearish.

- Pay attention to the popular narrative: The narrative and trends in a bull market can bring you profits many times over. In a bull market, everyone is bullish and new market participants are coming in so this can boost the price trending assets.

4. Formulate A Strategy

In a bull market, you need to have a clear strategy of what to buy, when to buy it, and what percentage you will allocate. This is extremely useful to plan so when the bull market starts you know what to do.

For example, you can decide to DCA some blue chip assets like ETH and BTC from now on. If you are still unsure, you may decide to execute your plan when Bitcoin reaches a certain level (e.g. $40k). You can also have an aggressive plan to invest in small altcoins that you think have the potential to return profits above 1000%.

Basically, bull markets require specific strategies that can increase potential profits. Determine the price level where you are comfortable buying in bulk as a medium or long-term position. Of course, never forget risk management.

5. Risk Management

Finally, risk management in a bull market is very important. Although bull market conditions are usually very favorable, fraud and hacking are at their highest in this market period. This has to do with market participants experiencing the euphoria of ever-increasing prices and not paying attention to scams. Remember to avoid common ways fraud occurs and avoid investing in meme coins without standard security practices.

Don’t forget to read Pintu Academy’s article on 7 things you need to prepare before investing in crypto.

Beyond security concerns, important risk management relates to asset allocation between blue chips like Bitcoin and altcoins with small market capitalizations. In general, the smaller the market capitalization of an asset, the greater the risk of loss. Therefore, you should adjust the percentage allocation of altcoins and BTC according to the risk you are willing to take. Assets like BTC and ETH are suitable for conservative investors.

Read Pintu Academy’s article on the categorization of crypto assets based on market capitalization.

Conclusion

Bull markets and bear markets are natural cycles in the crypto industry. The crypto market has shown a remarkable recovery in the first and second quarters of 2023, with Bitcoin up 100% and various altcoin assets up more than 100% since the beginning of the year.

Before entering the bull market, investors need to prepare a few things in order to gain maximum profits. Some of these things are preparing and accumulating capital, creating a wishlist of crypto assets to buy, forming the right mindset, designing a clear strategy, and good risk management.

In a bull market phase, buying the dip, following the price trend, and paying attention to popular narratives are important principles to adhere to. Investors also need to be vigilant in investing and understand that every investment decision carries its own risks. For this reason, proper risk management is essential to prevent losses.

How to Buy Crypto at Pintu

You can start investing in cryptocurrencies by buying them on the Pintu app. Here is how to buy crypto on Pintu:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for your favorite crypto (like BTC).

- Click buy and fill in the amount you want.

- Now you are a crypto investor!

In addition, the Pintu application is compatible with various popular digital wallets such as Metamask to facilitate your transactions. Go and download the Pintu cryptocurrency app on Play Store and App Store! Pintu is regulated and supervised by Bappebti and Kominfo.

You can also learn crypto through the various Pintu Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice

References

- @SuverSteveFrams, “I’m starting to see the usual moon tweets that are part of bull markets, and I’d like to suggest a system”, Twitter, accessed on 13 July 2023.

- @intuitio_, “FOCUS. Look man You need to understand this You made money the past year? nice You lost money the past year?”, Twitter, accessed on 13 July 2023.

- Zaveria, “Bull Run Crypto | The Ultimate Guide to Preparing for the Next Crypto Bull Run”, Analytics Insight, accessed on 14 July 2023.

- “Prepare for the Next Crypto Bull Run: 2024 + 2025 Outlook”, De.Fi, accessed on 14 July 2023.

- @crypto_linn, “View Risk for what it is and you open the door to Profit: My belief is that because the system is now more stable”, Twitter, accessed on 14 July 2023.