DeFi is one of the most active sectors in the crypto industry and has become increasingly recognized, especially with the entry of institutions and easier access to global financial services that drive broader adoption. Today, anyone can earn passive income through various available protocols, one of which is Aave. In this article, we’ll take a comprehensive look at Aave, from its definition and key metrics to the growth catalysts and long term potential it holds.

Article Summary

🔎 What is Aave: A DeFi protocol that allows users to borrow, lend, and earn interest on crypto assets.

⚙️ Features & Catalysts: Aave V3 introduces features like Isolation Mode, Siloed Borrowing, and E-Mode. Its cumulative revenue has surpassed $173 million, supported by token buybacks and cross-chain growth.

🚀 Future Potential: Aave 2030 and Aave V4 present a modular and efficient vision, with deeper integration of the GHO stablecoin and Real World Assets.

What is Aave 2.0?

Aave is a decentralized finance (DeFi) protocol that has now entered its third generation. It allows users to borrow, lend, and earn interest on crypto assets, while also enabling participation as liquidity providers. Initially built on the Ethereum network, Aave has since expanded to support multiple blockchain networks.

Currently, Aave supports around 17 blockchain networks, including Base, Arbitrum, Optimism, and others. This broad integration allows users across various ecosystems to access Aave’s services more easily.

Read more in the article: What is Aave (AAVE)?

In its latest version, Aave V3 introduces several new features such as Isolation Mode, Efficiency Mode, and Siloed Borrowing. These upgrades are designed to improve the protocol’s efficiency and flexibility.

1. Isolation Mode

Isolation Mode is a feature in Aave V3 that allows new assets to be added in a limited capacity. If a borrower uses such an asset as collateral, they can only borrow specific stablecoins that have been approved through Aave’s governance process. Additionally, they cannot use other assets as additional collateral, although they can still supply other assets to earn interest.

2. Efficiency Mode (E-Mode)

Efficiency Mode (E-Mode) is a mechanism in Aave that allows users to maximize the efficiency of their collateral. This is useful for certain assets with highly correlated prices, such as ETH and wstETH or BTC and wBTC. For users with this type of asset, E-Mode enables access to significantly higher borrowing power.

3. Siloed Borrowing

Siloed Borrowing is a feature in Aave designed to limit the risk associated with highly volatile or low-liquidity assets. If a user supplies this type of asset as collateral, they can only borrow specific stablecoins designated by Aave Governance, and only up to a strict borrowing limit.

Aave V3 Data and Metrics in 2025

According to data from Artemis, Aave is the largest DeFi protocol in the lending sector based on total lending deposits, which have reached $55.7 billion, making it the leader in this category.

This is largely due to Aave offering a wide range of assets with varying interest rates. Another advantage is its user-friendly interface, which is easy to understand and doesn’t require a complicated process to start using the platform.

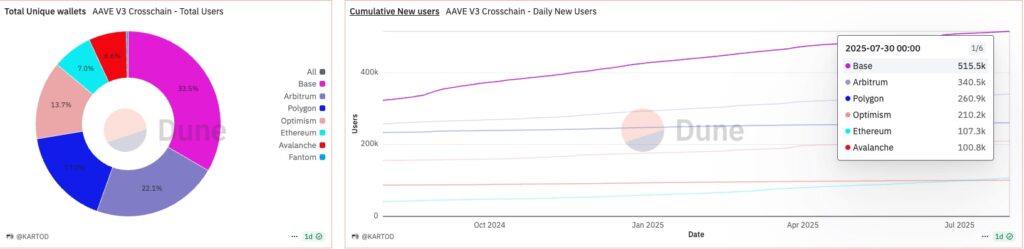

Data from Dune shows that the Base network has become the largest contributor to Aave V3’s cross-chain user growth, with over 515,000 users as of the end of July 2025. Arbitrum and Polygon follow in the next positions, contributing 340,000 and 260,000 users respectively. This indicates that Aave’s adoption is no longer dominated by Ethereum alone but is shifting toward Layer-2 networks that offer lower transaction fees and a faster user experience. This growth reflects how Aave’s multichain strategy has successfully reached new users across various blockchain ecosystems.

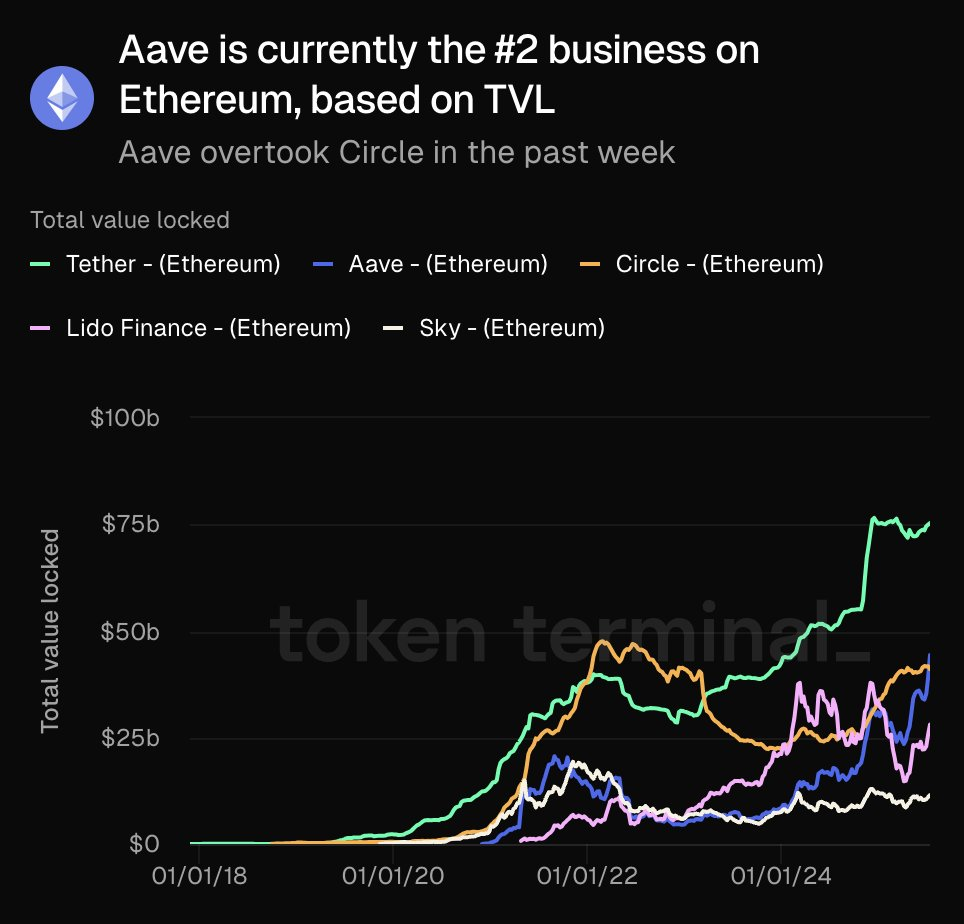

Data from Token Terminal as of July 16, 2025, shows that Aave briefly held the position of the second-largest DeFi protocol on Ethereum based on Total Value Locked (TVL), sitting just below Tether and surpassing Circle in the past week. This achievement reinforces Aave’s reputation as a leading lending protocol that consistently records growth in user-deposited assets. Although the DeFi market often experiences fluctuations, Aave’s increasing TVL reflects growing confidence in the protocol’s services and security over the long term.

Aave vs Bank

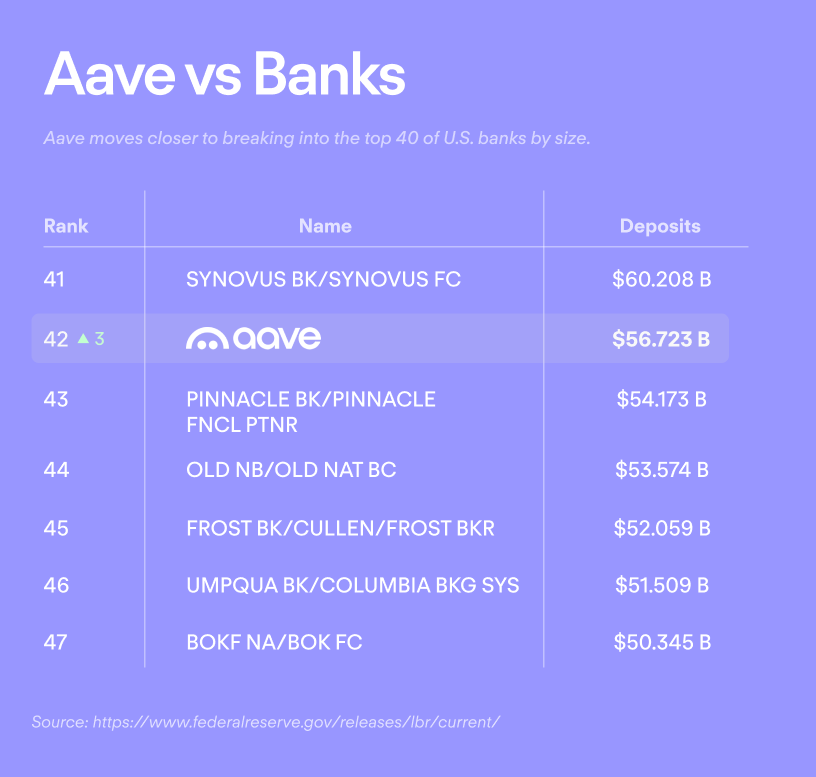

At the institutional level, Aave has positioned itself as one of the few DeFi protocols that have surpassed several US banks in terms of total deposits, reaching a value of $56.7 billion. This places Aave at the 42nd position, ahead of traditional banking institutions such as Pinnacle and Old National Bank. This surge reflects the growing adoption of DeFi protocols and signals a shift in public trust from traditional financial systems toward more open, efficient, and decentralized blockchain-based financial services.

Aave Stablecoin: GHO

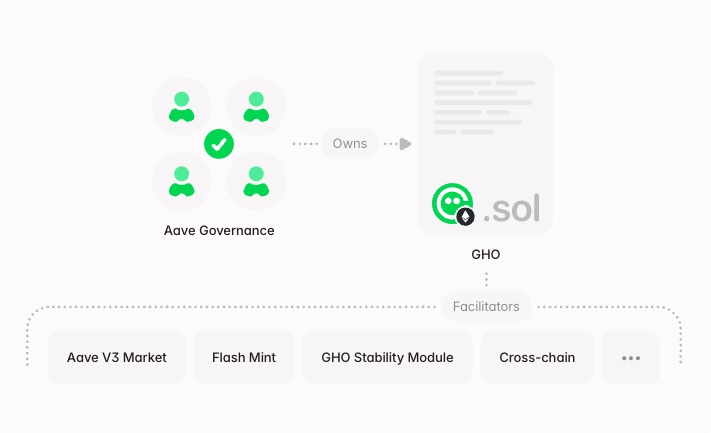

GHO is Aave’s native stablecoin, pegged to the US dollar. To obtain GHO, users can mint it by depositing selected crypto assets as collateral within the protocol. Additionally, staked GHO can earn up to 9% interest, making it an attractive option for generating passive income within the Aave ecosystem.

Aave Governance has the authority to mint and burn GHO tokens through smart contracts, with limits set via governance to ensure the GHO supply remains controlled. In this system, the Aave V3 Market, Flash Mint, GHO Stability Module, and Cross-chain facilitators act as approved smart contracts designated by governance to execute these functions.

Growth Catalysts of Aave

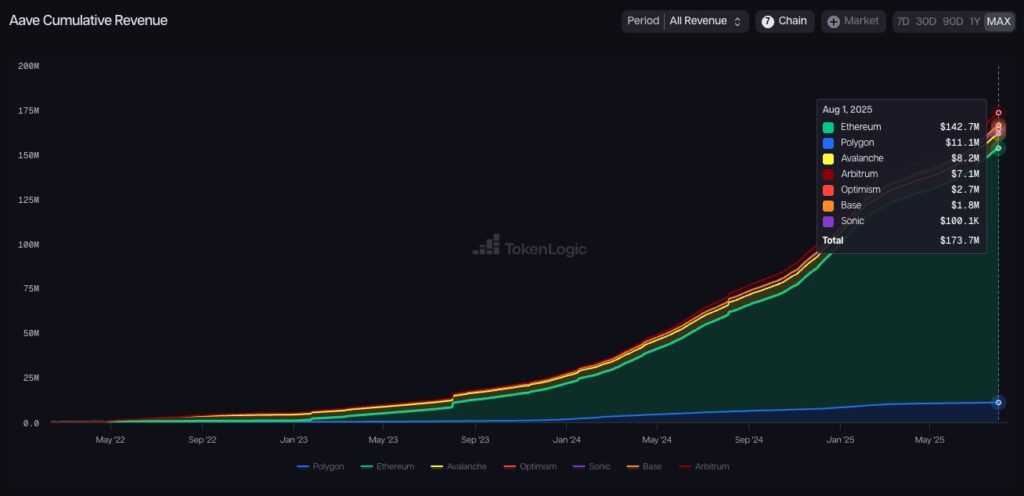

One of the main growth catalysts for Aave is its consistently increasing revenue performance. According to data from TokenLogic as of August 1, 2025, Aave has recorded a cumulative revenue of $173.7 million. This figure reflects significant growth, especially over the past two years, with revenue accelerating sharply since early 2024.

Of the total revenue, Ethereum contributes the largest share by far, approximately $142.7 million. This reinforces Ethereum’s role not only as Aave’s first supported chain but also as the primary liquidity hub across all supported networks. Outside of Ethereum, Polygon ranks second with $11.1 million in revenue, followed by Avalanche ($8.2 million), Arbitrum ($7.1 million), and Optimism ($2.7 million).

Overall, this revenue growth proves that Aave remains one of the most productive and economically sustainable DeFi protocols. With its expanding cross-chain support and new innovations such as GHO and Aave Arc, Aave’s potential for future revenue growth remains wide open.

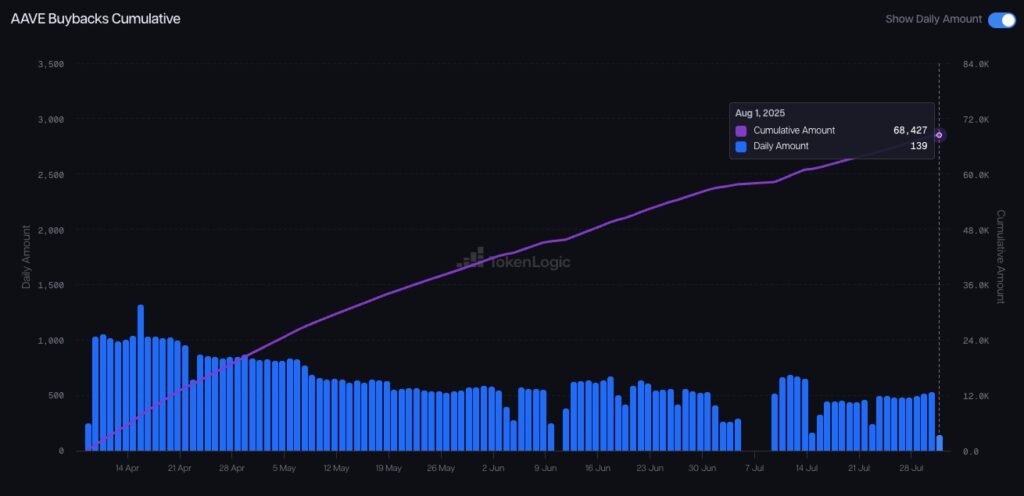

One of the most interesting developments of Aave in 2025 is the token buyback scheme that the protocol has been executing regularly. According to data from TokenLogic, as of August 1st, 2025, the protocol has bought back more than 68,000 AAVE tokens, with daily purchases remaining steady over the past few months.

The period between April and early August showed a consistent accumulation trend. In the earlier months, like April and May, daily buyback volumes remained relatively high and stable, ranging between 500 and 1,000 AAVE per day. Entering June and July, despite slight fluctuations, the buyback rhythm continued, reflecting Aave’s commitment to its value redistribution strategy for token holders and to maintaining the protocol’s economic stability.

Interestingly, the buyback scheme is not permanent. As a fully community-governed protocol, Aave gives AAVE token holders the authority to decide on key policies through governance voting. This means the structure and objectives of the buyback program can be adjusted, discontinued, or redirected at any time based on the outcome of community votes. This highlights Aave’s commitment not only to transparency but also to flexibility in collectively managing its economic framework.

Aave’s Long-Term Potential

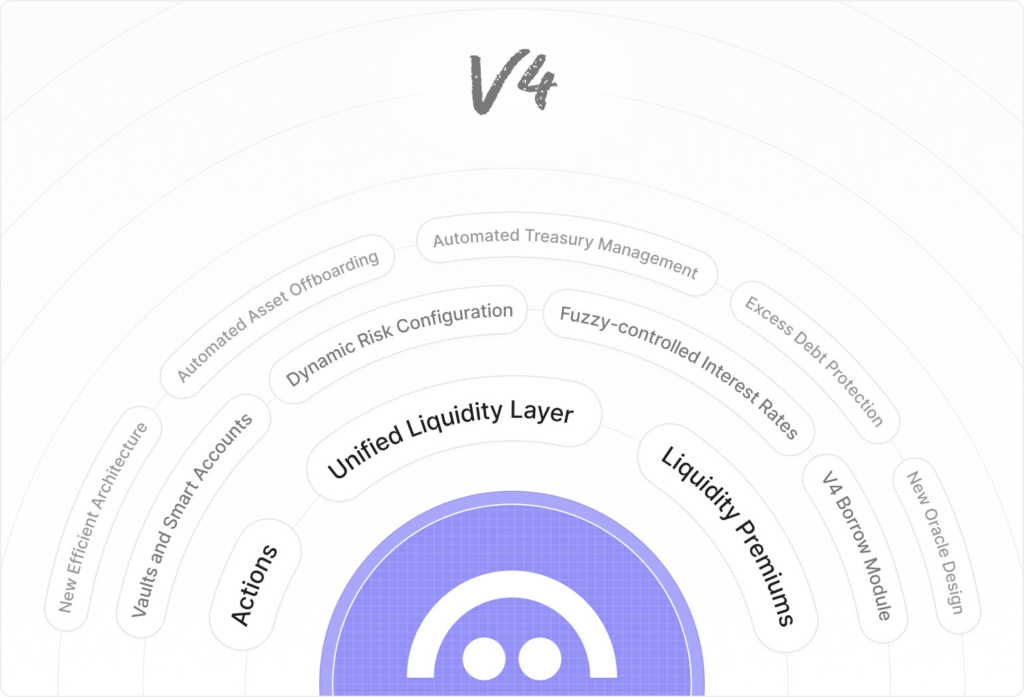

One of Aave’s biggest long-term potentials lies in the recently introduced “Aave 2030” roadmap, proposed through the project’s official governance forum. This proposal outlines a strategic plan to evolve Aave into the most modular, scalable, and integrated lending protocol in the DeFi space. At the heart of this roadmap is the upcoming launch of Aave V4, the latest version of the protocol that promises significant upgrades over V3.

Aave V4 is designed to introduce a Unified Liquidity Layer across chains, enabling efficient liquidity integration and movement between various blockchains. In addition, V4 will simplify the interest rate infrastructure, optimize efficiency, strengthen the integration of the GHO stablecoin, and pave the way for Real World Assets (RWAs) through collaboration with Chainlink. All of these advancements are built on a modular architecture that supports continuous and flexible development.

With its ambitious and forward-thinking approach, Aave is not only solidifying its position as a leader in the DeFi space but also laying the foundation to sustain and grow in the long term amid increasingly fierce competition.

Additionally, with regulatory discussions around DeFi becoming more open in the U.S. and growing institutional interest in Ethereum-based protocols, Aave stands to benefit from potential new liquidity flows, especially given its position as the largest lending protocol and its readiness to offer regulation-friendly solutions like Aave Arc.

Conclusion

With its ongoing achievements and evolving innovations, Aave has proven itself not only as a pioneer in the DeFi sector but also as a protocol capable of adapting and growing alongside the ever-changing ecosystem. From the new features introduced in Aave V3, the launch of the GHO stablecoin, to the decentralized buyback scheme, all of these highlight Aave’s commitment to maintaining relevance and delivering value to its users.

Looking ahead, the Aave 2030 roadmap and the upcoming launch of Aave V4 mark significant milestones in strengthening Aave’s position as a flexible, modular, and sustainable digital financial infrastructure. With its cross-chain strategy, strong community support, and focus on efficiency and openness, Aave is on the right path to remain a vital part of the blockchain-based financial future.

Disclaimer: All articles from Pintu Academy are intended for educational purposes only and do not constitute financial advice.

References

- Aave Documentation – Aave V3: https://aave.com/docs/developers/aave-v3#features-siloed-borrowing

- Aave Documentation – GHO: https://aave.com/docs/developers/gho

- Aave Documentation – Aave 2030: https://governance.aave.com/t/temp-check-aave-2030/17539

- Data dan Metric – Lending Deposits: Artemis

- Data dan Metric – New Users: dune.com/KARTOD

- Data dan Metric – TvL: X/@tokenterminal

- Data dan Metric – Revenue: tokenlogic.xyz

- Data dan Metric – Buyback: tokenlogic.xyz